|

市場調查報告書

商品編碼

1842498

丁烷:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Butane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

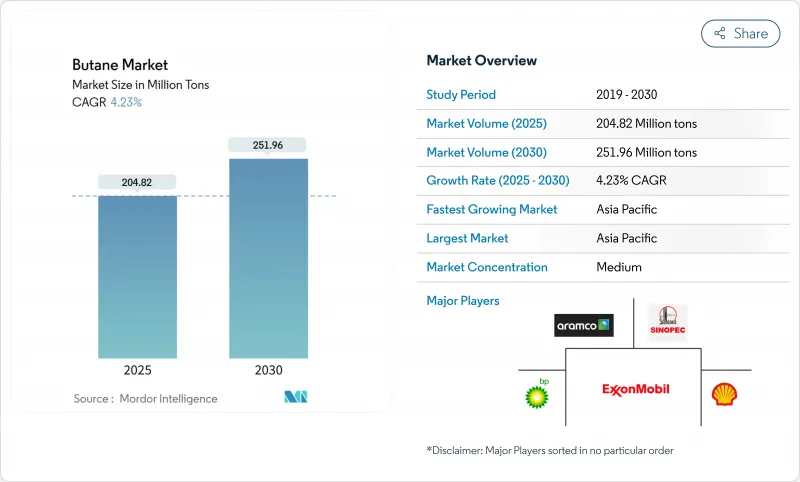

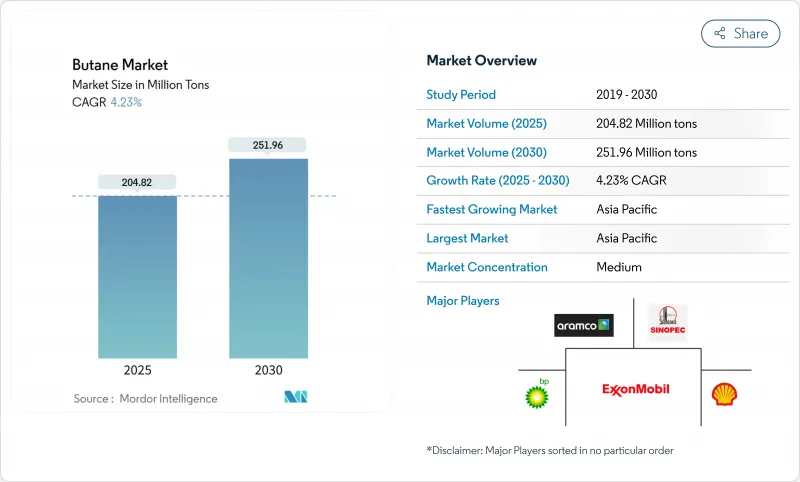

預計 2025 年丁烷市場規模為 2.0482 億噸,到 2030 年將達到 2.5196 億噸,預測期內(2025-2030 年)的複合年成長率為 4.23%。

這種碳氫化合物是民用液化石油氣和石化原料的關鍵成分,特別是乙烯和丙烯鏈,亞太地區的營運商正在建造更多世界一流的裂解裝置。

正丁烷支持冬季汽油調和,而異丁烷則增強高辛烷值烷基化油的流動性。正如達拉斯聯邦儲備銀行指出的那樣,北美頁岩油生產促進了液態天然氣的回收,抑制了價格飆升,並解決了區域供應緊張的問題。儲存終端的數位孿生技術減少了處理損失,並最佳化了運輸窗口。這些因素緩解了與原油相關的價格波動,並推動了對生產、物流和下游轉化資產的投資。

全球丁烷市場趨勢與洞察

石化產業需求不斷成長

裂解裝置產能擴張正在推動丁烷的結構性需求成長,預計2019年至2024年期間中國液化石油氣(LPG)原料的消耗量將增加210萬桶/日,到2030年還將進一步增加。國際能源總署(IEA)預測,2025年超過一半的液體燃料需求成長將來自丁烷等NGL原料。隨著新建工廠稀釋價差,下游利潤率將收窄,迫使營運商簽訂長期承購協議並採取增效措施。

金屬加工和建設產業的需求增加

丁烷燃燒式焊槍因其火焰溫度穩定、煙塵減少、焊接品質和切割精度高等特點,深受工業用戶的青睞。使用液化石油氣(LPG)鋼瓶的可攜式加熱器,可在寒冷氣候下電力供應不穩定的現場作業。儘管高所得國家的電氣化程度正在提高,但新興市場的承包商仍然青睞經濟高效的液化石油氣解決方案,這推動了亞洲新建工程和非洲基礎設施維修的成長。液化石油氣的應用也依賴於能夠縮短物流「最後一哩路」的鋼瓶發行網路,為中游企業創造機會。

原物料價格波動

丁烷與原油和天然氣指數的密切相關性,使用戶面臨價格突然波動的風險,並使採購預算更加複雜。原油價格下跌會導致天然氣液體(NGL)價格下跌,而乙烷價格的突然下跌則會增強丁烷與丁烷的相關性,從而增加對沖的複雜性。美國生產者物價指數(PPI)從2025年1月的210.934點下跌至4月的144.296點,跌幅達32%,這給庫存規劃帶來了不確定性。價格風險抑制了資金匱乏地區的新增產能,並推動了對靈活物流的投資,以套利區域價差。

報告中分析的其他促進因素和限制因素

- 丁烷是汽油和柴油的更清潔的替代品,在汽車燃氣。

- 液化石油氣倉儲物流數位雙胞胎最佳化

- 替代燃料的可用性

細分分析

至2024年,正丁烷將佔丁烷市場規模的56.19%,並以4.94%的最快複合年成長率成長至2030年。冬季級汽油需要更高的正丁烷混合比才能滿足雷德蒸氣壓限值,從而確保煉油廠的穩定供應。石化製造商將正丁烷整合到蒸汽裂解裝置中,引導C4抽提物流,從而實現丁二烯和抽餘油生產之間的靈活切換。

丁烷市場報告按產品類型(正丁烷和異丁烷)、終端用戶行業(住宅/商業、工業(包括化學原料)、引擎燃料、煉油廠和其他終端用戶行業)、供應商(天然氣和煉油廠)以及地區(亞太地區、北美、歐洲、南美、中東和非洲)對南美丁烷市場進行了細分。市場預測以產量(噸)為單位。

區域分析

2024年,亞太地區將佔據丁烷市場的54.18%,維持5.28%的最快複合年成長率。中國蒸汽裂解裝置的興起將繼續吸引美國NGL貨物,到2024年,其將佔中國液化石油氣(LPG)進口量的56%。

北美仍然是主要的丁烷供應地區,充足的頁岩油產量推動了出口成長。 2024年,美國丁烷出口量約50萬桶/日,其中41%銷往亞洲,36%銷往非洲。歐洲市場呈現均衡態勢。積極的氣候政策正在抑制需求成長,但傳統的石化資產正在穩定基準需求。

在中東,透過利用有利的原料,石化產品的擴張將得以維持;而在非洲和南美洲,在哥倫比亞和奈及利亞補貼框架的支持下,氣瓶滲透率將會增加。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 石化產業需求不斷成長

- 金屬加工和建設產業的需求增加

- 擴大丁烷在汽車燃氣中的使用,作為汽油和柴油的更清潔的替代品

- 全球烹飪和取暖用液化石油氣(LPG)消費量不斷增加

- 液化石油氣倉儲物流數位雙胞胎最佳化

- 市場限制

- 原物料價格波動

- 替代燃料的可用性

- 新興市場的基礎設施有限

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測(數量)

- 依產品類型

- 正丁烷

- 異丁烷

- 按來源

- 天然氣

- 純化

- 按最終用戶產業

- 住宅/商業

- 工業(含化工原料)

- 引擎燃料

- 純化

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- Bharat Petroleum Corporation Limited

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- ConocoPhillips

- Dow

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom

- Linde PLC

- Petroliam Nasional Berhad(PETRONAS)

- Petron Corporation

- Reliance Industries Limited

- Saudi Arabian Oil Co.

- Shell

- TotalEnergies

- Valero Energy Corporation

第7章 市場機會與未來展望

The Butane Market size is estimated at 204.82 Million tons in 2025, and is expected to reach 251.96 Million tons by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).Hydrocarbons serve as key components for residential LPG and petrochemical feedstocks, particularly in ethylene and propylene chains, with Asia-Pacific operators adding world-scale crackers.

Normal butane supports winter gasoline blending, while isobutane enhances high-octane alkylate streams. North American shale output boosts natural gas liquids recovery, curbing price spikes and addressing regional tightness, as noted by the Dallas Fed. Digital twins at storage terminals reduce handling losses and optimize ship-loading windows. These factors mitigate crude-linked pricing volatility and drive investments in production, logistics, and downstream conversion assets.

Global Butane Market Trends and Insights

Growing Demand from the Petrochemical Industry

Expanding cracker capacity spurs structural butane uptake, with China's LPG feedstock pull rising 2.1 million b/d between 2019 and 2024 and more additions scheduled to 2030. The International Energy Agency projects that over half of the 2025 liquids-demand increase will come from NGL feedstocks such as butane. Downstream margins tighten as new plants dilute spreads, pushing operators toward long-term offtake contracts and efficiency measures.

Increasing Demand from the Metalworking and Construction Industry

Industrial users favour butane-fired torches for consistent flame temperatures and lower soot formation, enhancing weld quality and cutting precision. Portable heaters using LPG cylinders support site work in cold climates where the electric supply is unreliable. While electrification gains traction in high-income economies, emerging-market contractors still prefer cost-effective LPG solutions. Growth, therefore, tracks new-build activity in Asia and infrastructure upgrades in Africa. Adoption also hinges on cylinder distribution networks that shorten last-mile logistics, signalling opportunity for midstream players.

Volatility in Raw Material Prices

Butane's close linkage to crude and natural gas indices exposes users to rapid swings that complicate procurement budgets. Lower crude leads to softer NGL pricing, but sudden ethane weakness heightens co-movement with butane, increasing hedge complexity. The US producer-price index dropped from 210.934 in January 2025 to 144.296 in April 2025, a 32% slide that unsettled inventory planning. Price risk discourages greenfield capacity in capital-scarce zones and channels investment into flexible logistics that arbitrage regional spreads.

Other drivers and restraints analyzed in the detailed report include:

- Growing Usage of Butane in Autogas, a Cleaner Alternative to Gasoline and Diesel

- Digital Twin Optimisation of LPG Storage Logistics

- Availability of Fuel Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

n-Butane held 56.19% of the butane market size in 2024 and posts the fastest 4.94% CAGR to 2030. Winter-grade gasoline necessitates higher normal-butane blend ratios to meet Reid-vapor-pressure limits, securing consistent off-take from refiners. Petrochemical players integrate normal butane into steam crackers oriented toward C4 extraction streams that switch flexibly between butadiene and raffinate production.

The Butane Market Report Segments the Industry by Product Type (n-Butane and Iso-Butane), End-User Industry (Residential/Commercial, Industrial (Including Chemical Feed Stock), Engine Fuel, Refinery, and Other End-User Industries), by Source (Natural Gas and Refining), and by Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Ton).

Geography Analysis

Asia-Pacific commanded 54.18% butane market share in 2024 and sustained the fastest 5.28% CAGR. China's steam-cracker wave continues to pull US NGL cargoes, accounting for 56% of Chinese LPG imports in 2024.

North America remains the supply powerhouse, with ample shale-derived output feeding rising export volumes. The US shipped roughly 500 thousand b/d of butane in 2024, routing 41% to Asia and 36% to Africa. Europe presents a balanced picture: forward-looking climate policy checks demand growth, but legacy petrochemical assets keep baseline offtake steady.

The Middle East leverages advantaged feedstock to sustain petrochemical expansions, while Africa and South America see incremental cylinder penetration supported by subsidy frameworks in Colombia and Nigeria.

- Bharat Petroleum Corporation Limited

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- ConocoPhillips

- Dow

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom

- Linde PLC

- Petroliam Nasional Berhad (PETRONAS)

- Petron Corporation

- Reliance Industries Limited

- Saudi Arabian Oil Co.

- Shell

- TotalEnergies

- Valero Energy Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from the Petrochemcial Industry

- 4.2.2 Increasing Demand from the Metalworking and Construction Industry

- 4.2.3 Growing Usage of Butane in Autogas, a Cleaner Alternative to Gasoline and Diesel

- 4.2.4 Increasing global consumption of liquefied petroleum gas (LPG) for cooking and heating

- 4.2.5 Digital twin optimisation of LPG storage logistics

- 4.3 Market Restraints

- 4.3.1 Volatility in Raw Material Prices

- 4.3.2 Availability of Fuel Alternatives

- 4.3.3 Limited Infrastructure in Emerging Markets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 n-Butane

- 5.1.2 Iso-butane

- 5.2 By Source

- 5.2.1 Natural Gas

- 5.2.2 Refining

- 5.3 By End-user Industry

- 5.3.1 Residential/Commercial

- 5.3.2 Industrial (Including Chemical Feedstock)

- 5.3.3 Engine Fuel

- 5.3.4 Refinery

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments}

- 6.4.1 Bharat Petroleum Corporation Limited

- 6.4.2 BP plc

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation

- 6.4.5 ConocoPhillips

- 6.4.6 Dow

- 6.4.7 Equinor ASA

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 Gazprom

- 6.4.10 Linde PLC

- 6.4.11 Petroliam Nasional Berhad (PETRONAS)

- 6.4.12 Petron Corporation

- 6.4.13 Reliance Industries Limited

- 6.4.14 Saudi Arabian Oil Co.

- 6.4.15 Shell

- 6.4.16 TotalEnergies

- 6.4.17 Valero Energy Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment