|

市場調查報告書

商品編碼

1842483

汽車自動輪胎充氣系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Automatic Tire Inflation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

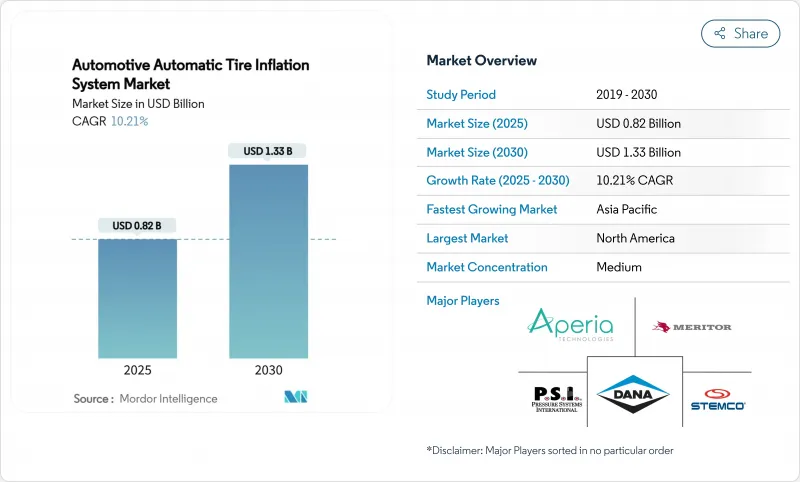

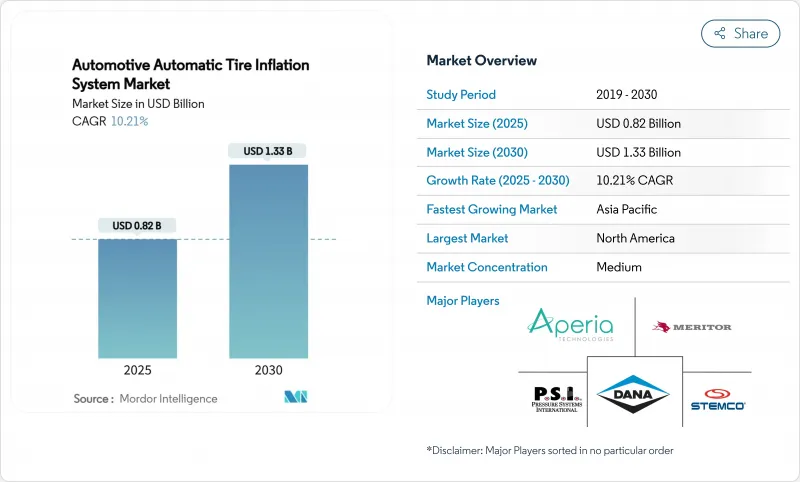

預計 2025 年汽車自動輪胎充氣系統市場價值將達到 8.2 億美元,到 2030 年將達到 13.3 億美元,複合年成長率為 10.21%。

成長反映了協調的安全法規、降低車輛成本的需求以及與聯網汽車架構更緊密的整合。北美車輛必須符合 49 CFR 393.75 的冷充氣規則,歐盟的通用安全法規 II 要求所有新車必須監測輪胎壓力,這間接推動了對全自動輪胎充氣功能的需求。商用車輛透過保持適當的輪胎充氣可節省高達 1.4% 的燃油,從而提高自動化系統的投資收益。同時,農業和施工機械製造商正在採用中央輪胎壓力控制來滿足土壤保護要求和精密農業需求,例如 Fendt 的 Variogrip,它可以在行駛過程中將輪胎壓力從 8.7 變為 36.3 PSI。投資動能受到創投的支持,例如 Aperia Technologies 的 4,500 萬美元資金籌措轂安裝、自供電充氣機。

全球汽車自動輪胎充氣系統市場趨勢與洞察

越來越多的汽車製造商致力於降低燃料和輪胎磨損成本

輪胎支出佔重型卡車營運預算的15-20%,而輪胎充氣不足是導致道路輪胎故障的95%的原因。 Pressure Systems International公司表示,安裝自動充氣系統後,燃油經濟性平均可提高1.4%,輪胎壽命可延長10%。此資料豐富的平台提供即時壓力、溫度和負載訊息,使負責人能夠最佳化速度曲線和維護時段。遠距運輸業者看到了最大的絕對收益,因為一旦牽引車年行駛里程超過12萬英里,增量成本就會累積。因此,採購團隊正在納入總擁有成本模型,優先考慮在牽引車和拖車更換週期內安裝自動充氣系統。

全球嚴格的輪胎安全法規

全球立法正在加強輪胎維護紀律。歐盟通用安全法規 II 將於 2024 年 7 月生效,要求對 M1 以外的所有新認證車輛類別進行輪胎壓力監測,從而創建通用基準以鼓勵自動壓力升級。互補的歐 7 法規設定了輪胎磨損的上限,並規定了 2032 年的合規期限。在美國,聯邦汽車運輸安全管理局的檢查員在路邊檢查期間強制執行最低輪胎壓力限制,促使大型車隊安裝自動系統以避免受到打擊。隨著出口導向原始設備製造商尋求與歐盟標準協調一致,類似的法規正在蔓延到南美洲和東南亞。因此,車隊經理認知到市場引入自動汽車輪胎充氣系統既是合規的必要條件,也是節省營運成本的途徑。

前期成本高且整合複雜

每輛車的系統套件價格在 1,500 美元到 5,000 美元之間。改裝計劃會增加人工時間和潛在的停機時間,而許多小型卡車運輸公司難以負擔。商用輪胎經銷商指出,預算有限的業者會將升級推遲到資本支出週期到位,儘管盈虧平衡分析通常顯示投資回收期為 18 個月或更短。技術人員培訓、感測器校準以及與傳統電控系統的軟體整合,進一步阻礙了價格敏感地區的採用。

細分分析

到2024年,中型和重型商用車將佔汽車自動輪胎充氣系統市場收入的66.82%,這表明該細分市場將對汽車自動輪胎充氣系統市場產生重大影響。年行駛里程的增加、多軸配置以及對油耗的高靈敏度,為自動輪胎充氣系統帶來了極具吸引力的投資案例。遠距離診斷和壓力校準使負責人能夠最大限度地減少路邊服務呼叫,並保證交付進度。隨著原始設備製造商在其車型系列中標準化充氣端口和數據通訊協定,其應用範圍正在擴展到區域卡車和最後一英里卡車。

非公路設備將呈現最迅猛的成長軌跡,到2030年,複合年成長率將達到11.84%。精密農業需要輕柔的土壤負荷以保障產量,而建築和軍用車輛則需要在瀝青、礫石和泥漿之間快速調整。芬特的駕駛室內VarioGrip系統可在幾秒鐘內切換壓力,從而提高牽引效率並減少壓實。約翰迪爾和凱斯紐荷蘭工業集團也提供類似的產品,這標誌著產業正在轉向壓力控制。雖然輕型商用廂型車和乘用車的銷售量不高,但歐盟安全法規和消費者對高階駕駛輔助功能的偏好,正促使原始設備製造商(OEM)採用小型自動化氣動模組。

2024年,公路輪胎將佔汽車自動輪胎充氣系統市場收入的72.41%,主要受跨洲卡車運輸的推動,在這種運輸中,每行駛一英里,輪胎充氣不足都會降低燃油經濟性。自動充氣系統會持續調整冷態充氣水平,不受環境波動的影響,而傳統的每週例行檢查可能會導致輪胎長期充氣不足。車隊遠端資訊處理儀錶板整合了輪胎充氣壓力KPI和運行時間顯示,使管理人員能夠根據與柴油消費量直接相關的遵從率對各倉庫進行基準測試。

非公路輪胎的複合年成長率為12.29%,這反映了對採石、林業和農業智慧機械的投資。米其林的中央系統可根據土壤類型調整輪胎壓力,從而將生產率提高高達4%,並節省10%的燃油。研究表明,適當的胎壓可以將土壤壓實深度減少高達三分之一,從而保護農田並減少耕作能耗。同樣,輪式裝載機操作員報告稱,在實施閉合迴路壓力系統後,與輪胎相關的停機時間有所減少,該系統可在側壁夾傷發生前發出警告。儘管領先定價仍然是小型承包商的障礙,但這些優勢鞏固了未來的需求。

區域分析

由於清晰的法規結構和成熟的遠端資訊處理技術,北美將在2024年佔據汽車自動胎壓系統市場的39.81%。聯邦胎壓法規正推動卡車運輸公司採用自動化解決方案,以規避路邊罰款。大型租賃車隊表示,這些解決方案可節省1-3%的柴油,並延長15-20%的輪胎壽命,這些成果強化了董事會層面的永續性承諾。該地區還在大規模初步試驗無人駕駛貨運路線,自動駕駛開發商需要冗餘的輪胎健康系統,使駕駛員免於維護。

亞太地區將迎來最快的成長速度,到2030年複合年成長率將達到12.19%。電子商務出貨量的爆炸性成長、大規模的高速公路建設以及電動動力傳動系統的推動,使汽車價格上漲的經濟理由顯而易見。印度的物流改革旨在減少與運輸成本相關的12-14%的GDP損失,而胎壓校正是一個顯而易見的槓桿。一汽和中國重汽等中國主機廠正在將胎壓閥整合到新能源卡車中,以延長電池續航里程,將汽車自動胎壓系統市場定位為標準的效率衡量標準。

歐洲遵循並遵循歐盟的安全和環境指令。歐盟法規II強制所有新車安裝胎壓監測系統(TPMS),而歐7引入了磨損限制,該限制很大程度上取決於最佳胎壓。德國和法國的業者正在將通膨數據與碳排放報告結合,以滿足客戶範圍3的取證要求。儘管中東和非洲的整體採用率落後,但石油出口國正在投入大量基礎設施資金升級專業車輛,即使服務中心密度落後,潛在需求也在成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 越來越多的車隊注重降低燃料和輪胎磨損成本

- 全球輪胎安全法規更加嚴格

- 擴大車輛和貨運活動

- 先進 TPMS 與互聯平台的 OEM 整合

- 預測輪胎健康狀況的自動駕駛卡車的需求

- 農業土壤保護轉向氣壓管理

- 市場限制

- 前期成本高且整合複雜

- 嚴苛工作循環下的可靠性與維護問題

- 全球售後生態系統有限

- 聯網 ATIS 中的網路安全漏洞

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 非公路用車(農業、建築、軍用)

- 按用途

- 公路車

- 越野輪胎

- 按銷售管道

- OEM

- 售後市場

- 依產品類型

- 中央輪胎充氣系統 (CTIS)

- 常規/輪端充氣機

- 自供電輪轂充氣機

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Aperia Technologies, Inc.

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Meritor, Inc.

- STEMCO Products Inc.

- CODA Development

- Denso Corporation

- Pressure Systems International, Inc.

- Dana Incorporated

- Michelin Group

- Hendrickson International

- ti.systems GmbH

- FTL Technology

- Parker Hannifin Corporation

- Haltec Corporation

- Trelleborg AB

- SKF Group

- Haldex AB

第7章 市場機會與未來展望

The automotive automatic tire inflation system market size registers a valuation of USD 0.82 billion in 2025 and is forecast to reach USD 1.33 billion by 2030, advancing at a 10.21% CAGR.

Growth reflects coordinated safety regulations, fleet cost-reduction imperatives, and tighter integration with connected-vehicle architectures. North American fleets must comply with 49 CFR 393.75 cold-inflation rules, while the European Union's General Safety Regulation II requires tire-pressure monitoring across all new vehicles, indirectly cementing demand for fully automatic inflation capabilities. Commercial fleets realize up to 1.4% fuel savings when tires remain at correct pressure, sharpening return on investment for automatic systems . In parallel, agricultural and construction equipment makers embed central pressure control to meet soil-conservation mandates and precision-farming needs, as seen in Fendt's VarioGrip that varies pressure from 8.7 to 36.3 PSI while in motion. Investment momentum is buoyed by venture funding, illustrated by Aperia Technologies' USD 45 million raise that targets hub-mounted self-powered inflators.

Global Automotive Automatic Tire Inflation System Market Trends and Insights

Rising Fleet Focus on Fuel and Tire-Wear Cost Reduction

Tire expenditures represent 15-20% of heavy-truck operating budgets, and under-inflation generates up to 95% of roadside tire failures. Pressure Systems International quantifies 1.4% mean fuel gains and 10% tire-life extension when automatic inflation is installed . Data-rich platforms deliver live pressure, temperature, and load information, letting dispatchers optimize speed profiles and maintenance windows. Long-haul carriers accrue the greatest absolute benefit because incremental savings compound across annual mileages that exceed 120,000 miles per tractor. Consequently, procurement teams embed total cost-of-ownership models that prioritize automatic inflation during tractor and trailer replacement cycles.

Stringent Global Tire-Safety Regulations

Worldwide statutes are elevating tire-maintenance discipline. The EU General Safety Regulation II, effective July 2024, mandates tire-pressure monitoring on every newly homologated vehicle category except M1, creating a universal baseline that encourages automatic inflation upgrades. Complementary Euro 7 rules set tire-abrasion caps with 2032 compliance deadlines . In the United States, Federal Motor Carrier Safety Administration inspectors enforce cold-inflation minimums during roadside checks, prompting large fleets to deploy automated systems to avoid citations. Similar provisions are cascading into South America and Southeast Asia as export-oriented OEMs harmonize with EU standards. As a result, fleet managers perceive automotive automatic tire inflation system market adoption as a compliance necessity that also unlocks operational savings.

High Upfront Cost and Integration Complexity

System packages range from USD 1,500 to USD 5,000 per vehicle. Retrofit projects add labor hours and potential downtime that many small carriers cannot absorb. Commercial tire dealers note budget-constrained operators delaying upgrades until capex cycles align, even though break-even analysis often shows payback inside 18 months. Training technicians, calibrating sensors, and harmonizing software with legacy electronic control units further slow adoption in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Commercial-Vehicle Parc and Freight Activity

- OEM Integration with Advanced TPMS and Connected Platforms

- Reliability and Maintenance Issues in Harsh Duty Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium and heavy commercial vehicles accounted for 66.82% of the automotive automatic tire inflation system market revenue in 2024, underscoring the sector's outsized influence on the automotive automatic tire inflation system market. Elevated annual mileage, multi-axle configurations, and fuel-spend sensitivity combine to produce compelling investment cases for automatic inflation. Remote diagnostics and over-the-air pressure calibration let dispatchers minimize roadside service calls and preserve delivery schedules. Adoption is now filtering into regional haul and final-mile trucks as OEMs standardize inflation ports and data protocols across model lines.

Off-highway equipment exhibits the sharpest trajectory at an 11.84% CAGR through 2030. Precision agriculture mandates gentle soil loading to protect yield, while construction and military vehicles require fast adjustments between asphalt, gravel, and mud. Fendt's in-cab VarioGrip toggles pressure inside seconds, boosting tractive efficiency and cutting compaction, and similar offerings from John Deere and CNH Industrial signal an industry shift toward embedded pressure control. Light commercial vans and passenger cars participate more modestly, yet EU safety rules and consumer preference for advanced driver-assistance features are nudging OEMs to incorporate scaled-down automatic inflation modules.

On-road tires secured 72.41% of the automotive automatic tire inflation system market revenue in 2024, anchored by cross-continental trucking, where under-inflation steals fuel economy on every highway mile. Automated systems continuously regulate cold-inflation levels regardless of ambient swings that might lead to chronic under-pressure in conventional weekly-check routines. Fleet telematics dashboards integrate pressure KPIs alongside hours-of-service readouts, and managers benchmark depots on compliance percentages that correlate directly with diesel spend.

Off-road tires are climbing at a 12.29% CAGR, reflecting investment in smart machinery for quarrying, forestry, and agriculture. Michelin's central system posts up to 4% productivity lifts and 10% fuel savings by tailoring pressure to soil type. Studies show that correct pressure can trim soil compaction depth by one-third, preserving arable land and reducing tillage energy. Similarly, wheel-loader operators report lower tire-related downtime after installing closed-loop inflation that alerts them before sidewall pinch damage occurs. These benefits cement future demand even as upfront pricing remains a barrier for smaller contractors.

The Automotive Automatic Tire Inflation System Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application (On-The-Road Tires and Off-The-Road Tires), Sales Channel (OEM and Aftermarket), Product Type (Central Tire Inflation Systems (CTIS), Continuous/Wheel-End Inflators, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 39.81% revenue of the automotive automatic tire inflation system market in 2024, buoyed by well-defined regulatory frameworks and mature telematics penetration. Federal enforcement of tire-pressure rules prompts carriers to adopt automatic solutions as insurance against roadside fines. Large for-hire fleets cite 1-3% diesel savings and 15-20% tire-life gains, outcomes that reinforce board-level sustainability pledges. The region also hosts expansive pilots for driverless freight corridors, and autonomous developers require redundant tire-health systems that remove the driver from the maintenance loop.

Asia-Pacific posts the quickest ascent at 12.19% CAGR through 2030. Explosive e-commerce shipping volumes, extensive highway build-outs, and the push for electrified powertrains sharpen the economic rationale for automatic inflation. India's logistics overhaul seeks to trim the 12-14% GDP drain tied to freight costs, and correcting tire pressure is a visible lever. Chinese OEMs such as FAW and Sinotruk integrate inflation valves on new energy trucks to extend battery range, positioning the automotive automatic tire inflation system market as a standard efficiency measure.

Europe remains consistent, guided by Union-wide safety and environmental directives. Regulation II obliges TPMS on every new vehicle, and Euro 7 introduces abrasion limits that depend heavily on optimum pressure. Operators in Germany and France combine inflation data with carbon reporting to satisfy customer Scope 3 disclosure requests. The Middle East and Africa trail in overall penetration, yet oil-exporting economies funnel infrastructure funds into vocational fleet upgrades, which lifts baseline demand even if service-center density lags.

- Aperia Technologies, Inc.

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Meritor, Inc.

- STEMCO Products Inc.

- CODA Development

- Denso Corporation

- Pressure Systems International, Inc.

- Dana Incorporated

- Michelin Group

- Hendrickson International

- ti.systems GmbH

- FTL Technology

- Parker Hannifin Corporation

- Haltec Corporation

- Trelleborg AB

- SKF Group

- Haldex AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising fleet focus on fuel and tire-wear cost reduction

- 4.2.2 Stringent global tire-safety regulations

- 4.2.3 Expanding commercial?vehicle parc and freight activity

- 4.2.4 OEM integration with advanced TPMS and connected platforms

- 4.2.5 Autonomous-trucking demand for predictive tire health

- 4.2.6 Agricultural shift to on-the-go soil-conserving pressure control

- 4.3 Market Restraints

- 4.3.1 High upfront cost and integration complexity

- 4.3.2 Reliability and maintenance issues in harsh duty cycles

- 4.3.3 Limited global aftermarket service ecosystem

- 4.3.4 Cyber-security vulnerabilities in connected ATIS

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.1.4 Off-Highway Vehicles (Agricultural, Construction, Military)

- 5.2 By Application

- 5.2.1 On-the-Road Tires

- 5.2.2 Off-the-Road Tires

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Product Type

- 5.4.1 Central Tire Inflation Systems (CTIS)

- 5.4.2 Continuous/Wheel-End Inflators

- 5.4.3 Self-Powered Hub Inflators

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Aperia Technologies, Inc.

- 6.4.2 Bridgestone Corporation

- 6.4.3 Continental AG

- 6.4.4 Goodyear Tire & Rubber Company

- 6.4.5 Meritor, Inc.

- 6.4.6 STEMCO Products Inc.

- 6.4.7 CODA Development

- 6.4.8 Denso Corporation

- 6.4.9 Pressure Systems International, Inc.

- 6.4.10 Dana Incorporated

- 6.4.11 Michelin Group

- 6.4.12 Hendrickson International

- 6.4.13 ti.systems GmbH

- 6.4.14 FTL Technology

- 6.4.15 Parker Hannifin Corporation

- 6.4.16 Haltec Corporation

- 6.4.17 Trelleborg AB

- 6.4.18 SKF Group

- 6.4.19 Haldex AB

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment