|

市場調查報告書

商品編碼

1842454

葡萄糖二酸:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Glucaric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

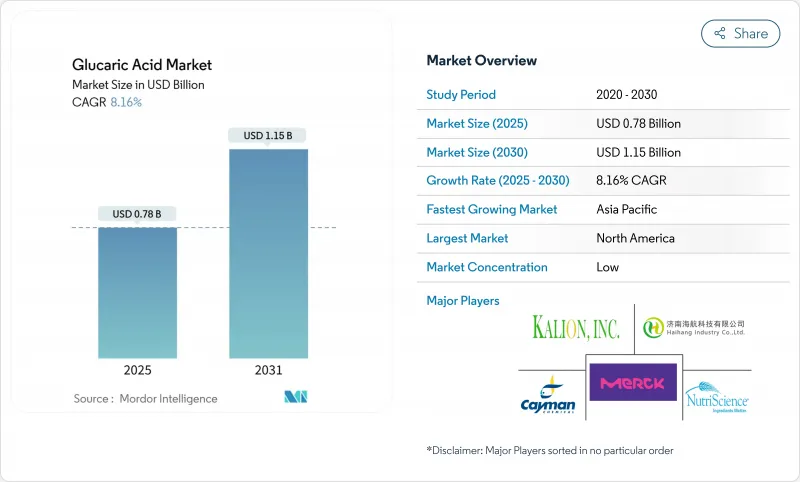

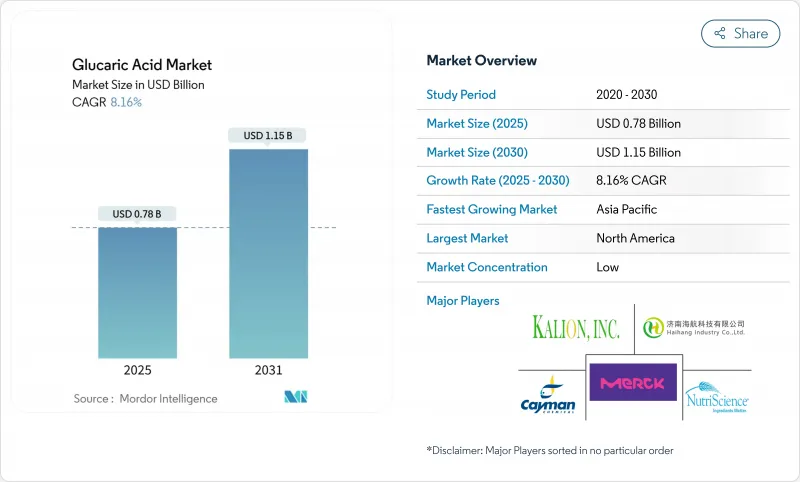

預計 2025 年全球葡萄糖酸市場價值將達到 7.8 億美元,到 2030 年預計將達到 11.5 億美元,預測期內複合年成長率為 8.16%。

在嚴格的環境法規和全球對永續化學替代方案的需求推動下,葡萄糖二酸市場正獲得顯著發展。這一上升趨勢的主要驅動力包括生物技術的進步以及在製藥和食品加工領域日益廣泛的應用。人們日益關注減少對石化產品的依賴,這進一步推動了市場擴張。目前,純化形式佔據市場主導地位,展現了其商業性成熟度和廣泛應用。然而,膳食補充劑領域的衍生物正在興起,預計在不久的將來會得到更快的普及。消費者對健康和保健意識的不斷提高正在推動這一領域的成長。雖然清潔劑佔據了主要應用領域,但受潔淨標示和功能性成分需求不斷成長的推動,食品應用也經歷了顯著的成長。這一趨勢與食品生產向透明度和永續性轉變的趨勢相吻合。在成熟的工業基礎設施和配套法規的支持下,成熟經濟體繼續佔據最大的市場佔有率。然而,在快速工業化和強大的環境永續性政策舉措的推動下,亞太地區作為一個快速成長的地區正在掀起波動。該地區不斷壯大的中階人口和不斷成長的可支配收入進一步推動了市場的成長。在技術創新引領和區域動態的推動下,市場即將迎來一場變革性的變革。

全球葡萄糖酸市場趨勢與見解

各產業消費者對無害、無過敏原添加劑的偏好

隨著對無毒、無過敏原添加劑(例如葡萄糖酸)的需求日益成長,各行各業的化學品籌資策略也發生了變化,葡萄糖酸已成為傳統螯合劑的替代品。美國環保署 (EPA) 的「更安全選擇」標準修正案將於2024年8月生效,該修正案將要求提高產品認證的成分透明度和生命週期分析,從而支持採用生物基替代品。這與歐盟 (EU) 指令 2024/825 一致,該指令要求對永續性標籤上的環境聲明檢驗和第三方認證,並取消未經證實的「環保」行銷聲明。這些監管變化為能夠證明可量化環境效益的葡萄糖酸製造商提供了優勢。為了最大限度地降低責任風險並實現企業永續性目標,工業負責人正在優先考慮無毒添加劑,並將其評估標準擴展到成本之外。製藥業在代謝健康產品中使用葡萄糖酸鈣,並有臨床研究證實其在血糖管理方面的有效性,這表明安全考慮因素如何影響定價策略。

消費者越來越關注排毒和METABOLIC INC.健康

代謝性疾病的日益普遍,催生了對葡萄糖酸衍生物(尤其是葡萄糖酸鈣)的龐大市場需求。這一成長主要源於消費者對代謝健康管理意識的不斷提升,以及對經科學檢驗的傳統藥物干預天然替代品的探索。葡萄糖酸化合物在調節GLP-1通路方面展現出巨大潛力,使其成為不斷擴張的體重管理市場中處方藥的可靠替代品。醫療保健機構正在加速將這些化合物納入治療方案,作為治療各種代謝疾病的經濟有效的干涉措施。人口老化和糖尿病盛行率上升等同步發生的人口結構變化,為基於葡萄糖酸的健康解決方案,尤其是在預防保健和代謝支持應用領域,奠定了堅實的市場基礎。例如,根據世界銀行的數據,到2023年,日本65歲及以上人口的比例將達到30%,位居世界首位,其次是義大利,將達到24%。

複雜且耗能的精煉工藝

醫藥級和食品級葡萄糖二酸的嚴格純化要求限制了市場成長,尤其對小型生物技術公司影響尤為嚴重。傳統的純化方法需要多個結晶步驟和嚴格的雜質控制措施。高昂的能源成本限制了某些地區的純化工藝,只有能夠獲得負擔得起的清潔能源的生產商才能從中受益。雖然電滲析和膜分離等先進技術提供了可行的替代方案,但這些方法需要大量的資本支出和專門的技術專長。在不同的原料和發酵參數中保持標準化的產品品質的複雜性為老牌製造商創造了競爭優勢。此外,食品藥物管理局(FDA) 和歐洲藥品管理局 (EMA) 建立的法律規範要求提供全面的文檔和驗證通訊協定,這給小型製造商設置了巨大的營運障礙。這些因素綜合起來對葡萄糖二酸產業的市場成長軌跡和業務動態產生了重大影響。

其他促進因素和限制因素分析

- 對無磷清潔劑的監管更加嚴格

- 對生物基化學品作為永續替代品的需求不斷成長

- 大眾市場的價格敏感度

細分分析

純 D-葡萄糖酸的市佔率將在 2024 年達到 30.88%,這得益於其在製藥、工業和研究領域的重要作用,而這些領域的純度至關重要。這一領域的擴張得益於成熟的生產技術和法規遵從性,尤其是在水處理領域。其根據《有毒物質控制法》(TSCA)的核准提供了競爭優勢,尤其是在水處理領域。純 D-葡萄糖酸的廣泛應用進一步支持了對純 D-葡萄糖酸的需求,從化學中間體到環保解決方案。此外,生產技術的進步有望提高效率並降低成本,進一步促進其在各個領域的應用。同時,預計到 2030 年,D-葡萄糖酸鈣的複合年成長率將達到 9.37%,這得益於針對其藥物應用和代謝健康的臨床研究。與遊離酸形式相比,其鈣鹽形式具有優異的生物利用度和穩定性,使其成為膳食補充劑的熱門選擇。消費者對健康和保健意識的不斷提高也促進了膳食補充劑中對 D-葡萄糖酸鈣的需求不斷成長。

D-葡萄糖酸鉀和D-葡萄糖酸鈉的變體在工業應用中得到了廣泛的應用,尤其是在溶解度和pH穩定性至關重要的清潔劑配方中。這些變體也因其在增強清潔劑性能方面的作用而日益普及,尤其是在硬水條件下。 D-葡萄糖酸-1,4-內酯在聚合物化學和合成反應中開闢了一個特殊的領域。其獨特的化學性質使其成為高性能材料和先進製造流程的重要組成部分。 「其他」類別包括各種針對特定工業應用的新型衍生物和配方。這種市場區隔標誌著從基礎化學應用向高階藥品和特種產品的轉變。生技公司處於領先地位,生產的衍生物不僅能提高性能,價格也更高。衍生物開發的持續創新預計將為市場成長開闢新的途徑,尤其是在藥物輸送系統和先進工業製程等高價值應用領域。

區域分析

截至2024年,北美佔據31.34%的主導市場佔有率,這得益於其強大的生物技術基礎設施、嚴格的環境法規以及對永續化學的廣泛接受。該地區的主要企業正在開拓基於發酵的生產技術,並獲得水處理的監管核准。 《更安全選擇》標準的修訂和日益嚴格的環境合規要求,正在刺激人們對生物基替代品的穩定需求。同時,該地區成熟的製藥和特種化學品領域提供了豐厚的市場機會。此外,先進的研究設施和對技術創新的高度重視進一步鞏固了北美的市場地位。該地區適應不斷變化的監管環境的能力及其對永續性的關注,使其成為推動生物基解決方案應用的關鍵參與者。

亞太地區可望迎來最高的成長軌跡,到2030年,複合年成長率將達到9.74%。這一快速成長的動力源於對研發設施的大量投資、生物基化學品的日益普及以及製藥業日益成長的需求。政府支持永續化學品生產的舉措、製造商日益增強的環保意識以及從食品保鮮到個人護理等廣泛的應用,進一步推動了該地區的成長。該地區龐大且快速成長的人口也推動了各行各業對永續產品的需求。此外,跨國公司日益增多以及它們與本地製造商的合作也加速了亞太地區生物基技術的開發和應用。

歐洲市場正在經歷生物基化學品的激增,這得益於在嚴格的 REACH 法規和循環經濟舉措下消費者對永續性的偏好日益增加。該地區強力的法規結構確保了一致的品質和安全標準,進一步支持了生物基替代品的採用。此外,歐洲致力於減少碳排放和實現氣候變遷目標,這也與對永續產品日益成長的需求相吻合。同時,南美洲和中東及非洲正處於採用的早期階段,這得益於蓬勃發展的農業部門、對生物煉油廠的投資不斷增加以及減少化學生產對石油依賴的共同努力。這些地區也正在探索利用其豐富的自然資源開發生物基化學品的機會,有可能成為全球市場的新興參與者。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 各產業消費者對無毒、無過敏性添加劑的偏好

- 消費者對排毒和METABOLIC INC.健康的興趣日益濃厚

- 日益嚴格的無磷清潔劑法規

- 對生物基化學品作為永續替代品的需求不斷成長

- 產業轉向更安全、無腐蝕性的酸替代品

- 葡萄糖二酸在清潔劑和清潔產品的用途廣泛

- 市場限制

- 複雜且耗能的精煉工藝

- 大眾市場的價格敏感度

- 在有機溶劑中溶解度低

- 關鍵合成技術的專利限制

- 供應鏈分析

- 監理展望

- 五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 依產品類型

- 純D-葡萄糖酸

- D-葡萄糖酸鈣

- D-葡萄糖酸鉀/鈉

- D-葡萄糖二酸-1,4-內酯

- 其他

- 按用途

- 食品配料

- 清潔劑

- 製藥

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 荷蘭

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 其他南美

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市場排名分析

- 公司簡介

- Merck KGaA

- Kalion Inc.

- Haihang Group

- Cayman Chemical Company

- NutriScience Innovations, LLC

- Rivertop Renewables

- Johnson Matthey plc

- Anmol Chemicals Pvt.Ltd

- Alfa Chemistry

- AK Scientific Inc.

- Jungbunzlauer Suisse AG

- Shanpar Industries Private Limited

- Jiaan Biotech

- Tokyo Chemicals Industry Pvt Ltd

- Geocon Products

- Spectrum Chemical Mfg. Corp.

- Hindustan Bec Tech India Pvt. Ltd.

- Santa Cruz Biotechnology, Inc.

- Surfachem Group Ltd

- Kanto Chemical Co., Inc.

第7章 市場機會與未來展望

The global glucaric acid market, valued at USD 0.78 billion in 2025, is expected to reach USD 1.15 billion by 2030, growing at a CAGR of 8.16% during the forecast period.

Driven by stringent environmental regulations and a global push for sustainable chemical alternatives, the glucaric acid market is gaining significant momentum. Key drivers of this upward trend include advancements in biotechnology and an increasing application in pharmaceuticals and food processing. The growing focus on reducing dependency on petrochemical-based products further supports the market's expansion. Purified forms currently lead the market, showcasing their commercial maturity and widespread application. Yet, derivatives aimed at the health supplement segments are on the rise, with expectations of a faster adoption rate in the near future. The increasing consumer awareness regarding health and wellness is driving this segment's growth. While detergents hold the top spot in applications, there's a notable surge in food-grade uses, driven by a growing demand for clean-label and functional ingredients. This trend aligns with the broader shift toward transparency and sustainability in food production. Mature economies, bolstered by established industrial infrastructures and supportive regulations, still command the largest market share. However, the Asia-Pacific region is making waves as the fastest-growing area, propelled by swift industrialization and robust policy initiatives championing environmental sustainability. The region's expanding middle-class population and rising disposable incomes further contribute to the market's growth. With innovation at the forefront and regional dynamics in play, the market is poised for a transformative evolution.

Global Glucaric Acid Market Trends and Insights

Consumer Preference for Non-Toxic, Allergen Free Additives Across Industries

The increasing demand for non-toxic, allergen-free additives is transforming chemical procurement strategies across industries, with glucaric acid emerging as an alternative to conventional chelating agents. The Environmental Protection Agency (EPA)'s Safer Choice Standard amendments, taking effect in August 2024, mandate improved ingredient transparency and lifecycle analysis for product certification, supporting the adoption of bio-based alternatives . This aligns with the European Union's Directive 2024/825, which requires verification of environmental claims and third-party certification for sustainability labels, eliminating unsubstantiated "eco-friendly" marketing claims. These regulatory changes provide advantages to glucaric acid manufacturers who can demonstrate quantifiable environmental benefits. Industrial purchasers prioritize non-toxic additives to minimize liability risks and meet corporate sustainability goals, expanding their evaluation criteria beyond cost factors. The pharmaceutical industry's use of calcium glucarate in metabolic health products illustrates how safety considerations influence pricing strategies, as supported by clinical studies that confirm its effectiveness in glucose management.

Surging Consumer Focus on Detox and Metabolic Health

The increasing prevalence of metabolic health conditions has generated substantial market demand for glucaric acid derivatives, particularly calcium glucarate. This growth is primarily attributed to consumers' heightened awareness of metabolic health management and their pursuit of scientifically validated natural alternatives to conventional pharmaceutical interventions. Glucaric acid compounds have demonstrated significant potential in modulating GLP-1 response pathways, positioning them as credible alternatives to prescription medications within the expanding weight management market. Healthcare institutions are increasingly integrating these compounds into their treatment protocols as cost-effective interventions for various metabolic disorders. The concurrent demographic shifts toward aging populations and the rising incidence of diabetes create a strong market foundation for glucaric acid-based health solutions, particularly in preventive healthcare and metabolic support applications. For instance, according to World Bank data, in 2023, Japan reported the highest proportion of individuals aged 65 or older at 30% of its population, with Italy following at 24% .

Complex and Energy-Intensive Purification Process

Stringent purification requirements for pharmaceutical and food-grade glucaric acid restrain market growth, particularly affecting smaller biotechnology companies. Traditional purification methods demand multiple crystallization steps and strict impurity control measures. High energy costs in certain regions limit purification processes, benefiting only producers with access to affordable clean energy. Although advanced technologies such as electrodialysis and membrane separation present viable alternatives, these methodologies necessitate considerable capital expenditure and specialized technical expertise. The inherent complexity of maintaining standardized product quality across diverse feedstock materials and fermentation parameters creates a competitive advantage for established manufacturing entities. Furthermore, the regulatory framework established by the Food and Drug Administration (FDA) and European Medicines Agency (EMA) mandates comprehensive documentation and validation protocols, presenting substantial operational barriers for smaller-scale producers. These combined factors significantly influence the market's growth trajectory and operational dynamics within the glucaric acid industry.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Regulatory Push for Phosphate-Free Detergents

- Rising Demand for Bio-Based Chemicals as Sustainable Alternatives

- Price Sensitivity in Mass-Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, pure D-glucaric acid commands a 30.88% share of the market, driven by its critical role in pharmaceuticals, industry, and research, where purity is paramount. This segment's expansion is bolstered by established production techniques and adherence to regulations, especially in water treatment. Here, approvals under the Toxic Substances Control Act (TSCA) confer a competitive edge. The demand for pure D-lucaric acid is further supported by its versatility in applications, ranging from chemical intermediates to environmentally friendly solutions, which align with the growing emphasis on sustainability. Additionally, advancements in production technologies are expected to enhance efficiency and reduce costs, further driving their adoption across various segments. Meanwhile, calcium D-glucarate is on track to expand at a 9.37% CAGR through 2030, fueled by its pharmaceutical uses and clinical research focus on metabolic health. Its calcium salt form boasts superior bioavailability and stability over its free acid counterpart, making it a prime choice for dietary supplements. The increasing consumer awareness regarding health and wellness is also contributing to the rising demand for calcium-D-glucarate in dietary formulations.

Potassium and sodium-D-glucarate variants find their primary application in the industrial segments, notably in detergent formulations where both solubility and pH stability are paramount. These variants are also gaining traction due to their role in enhancing the performance of cleaning agents, particularly in hard water conditions. D-glucaric acid-1,4-lactone carves out a specialized niche in polymer chemistry and synthesis reactions. Its unique chemical properties make it an essential component in high-performance materials and advanced manufacturing processes. The 'other' category encompasses a range of emerging derivatives and tailored formulations for distinct industrial applications. This market segmentation indicates a transition from fundamental chemical uses to premium pharmaceutical and specialty products. Biotechnology firms are at the forefront, crafting derivatives that not only enhance performance but also fetch premium prices. The ongoing innovation in derivative development is expected to open new avenues for market growth, particularly in high-value applications such as drug delivery systems and advanced industrial processes.

The Global Glucaric Acid Market is Segmented by Product Type (Pure D-Glucaric Acid, Calcium-D-Glucarate, Potassium/Sodium-D-Glucarate, D-Glucaric Acid-1, 4-Lactone, and Others), by Application (Food Ingredients, Detergents, Pharmaceuticals, and Others), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a dominant 31.34% market share, bolstered by its robust biotechnology infrastructure, stringent environmental regulations, and a broad embrace of sustainable chemistry. Major companies in the region are pioneering fermentation-based production technologies and obtaining regulatory nods for water treatment. Modifications to the Safer Choice Standard and heightened environmental compliance demands fuel a steady appetite for bio-based alternatives. Meanwhile, the region's well-established pharmaceutical and specialty chemical segments present lucrative market opportunities. Additionally, the presence of advanced research facilities and a strong focus on innovation further strengthens North America's position in the market. The region's ability to adapt to evolving regulatory landscapes and its emphasis on sustainability make it a key player in driving the adoption of bio-based solutions.

Asia-Pacific is on track to achieve the highest growth trajectory, boasting a 9.74% CAGR through 2030. This surge is fueled by significant investments in research and development facilities, a rising embrace of bio-based chemicals, and an escalating demand from the pharmaceutical sector. Government-backed initiatives championing sustainable chemical production, heightened environmental awareness among manufacturers, and a broadened scope of applications from food preservation to personal care further bolster the region's growth. The region also benefits from its large and rapidly growing population, which drives demand for sustainable products across various industries. Furthermore, the increasing presence of global players and collaborations with local manufacturers are accelerating the development and adoption of bio-based technologies in Asia-Pacific.

European markets, navigating under stringent REACH regulations and circular economy initiatives, are witnessing a surge in bio-based chemicals, spurred by a growing consumer inclination towards sustainability. The region's strong regulatory framework ensures consistent quality and safety standards, which further encourage the adoption of bio-based alternatives. Additionally, Europe's focus on reducing carbon emissions and achieving climate goals aligns with the increasing demand for sustainable products. Meanwhile, South America and the Middle East and Africa are in the nascent stages of adoption, driven by their burgeoning agricultural sectors, escalating investments in bio-refineries, and a concerted effort to diminish reliance on petroleum for chemical production. These regions are also exploring opportunities to leverage their abundant natural resources to develop bio-based chemicals, which could position them as emerging players in the global market.

- Merck KGaA

- Kalion Inc.

- Haihang Group

- Cayman Chemical Company

- NutriScience Innovations, LLC

- Rivertop Renewables

- Johnson Matthey plc

- Anmol Chemicals Pvt.Ltd

- Alfa Chemistry

- AK Scientific Inc.

- Jungbunzlauer Suisse AG

- Shanpar Industries Private Limited

- Jiaan Biotech

- Tokyo Chemicals Industry Pvt Ltd

- Geocon Products

- Spectrum Chemical Mfg. Corp.

- Hindustan Bec Tech India Pvt. Ltd.

- Santa Cruz Biotechnology, Inc.

- Surfachem Group Ltd

- Kanto Chemical Co., Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consumer Preference for Non-Toxic, Allergien Free Additives Across Industries

- 4.2.2 Surging Consumer Focus on Detox and Metabolic Health

- 4.2.3 Increasing Regulatory Push for Phosphate-Free Detergents

- 4.2.4 Rising Demand for Bio-Based Chemical as Sustinable Alternatives

- 4.2.5 Industrial Shift Towards Safer and Non-Corrosive Acid Alternatives

- 4.2.6 Wide Application of Glucaric Acid in Detergent and Cleaning Products

- 4.3 Market Restraints

- 4.3.1 Complex and Energy-Intensive Purification Process

- 4.3.2 Price Sensitivity in Mass-Market

- 4.3.3 Low Solubility in Organic Solvents

- 4.3.4 Patent Constraints in Key Synthesis Technologies

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Pure D-Glucaric Acid

- 5.1.2 Calcium-D-Glucarate

- 5.1.3 Potassium/Sodium-D-Glucarate

- 5.1.4 D-Glucaric Acid-1,4-Lactone

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Food Ingredients

- 5.2.2 Detergents

- 5.2.3 Pharmaceuticals

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Spain

- 5.3.2.6 Netherlands

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Merck KGaA

- 6.4.2 Kalion Inc.

- 6.4.3 Haihang Group

- 6.4.4 Cayman Chemical Company

- 6.4.5 NutriScience Innovations, LLC

- 6.4.6 Rivertop Renewables

- 6.4.7 Johnson Matthey plc

- 6.4.8 Anmol Chemicals Pvt.Ltd

- 6.4.9 Alfa Chemistry

- 6.4.10 AK Scientific Inc.

- 6.4.11 Jungbunzlauer Suisse AG

- 6.4.12 Shanpar Industries Private Limited

- 6.4.13 Jiaan Biotech

- 6.4.14 Tokyo Chemicals Industry Pvt Ltd

- 6.4.15 Geocon Products

- 6.4.16 Spectrum Chemical Mfg. Corp.

- 6.4.17 Hindustan Bec Tech India Pvt. Ltd.

- 6.4.18 Santa Cruz Biotechnology, Inc.

- 6.4.19 Surfachem Group Ltd

- 6.4.20 Kanto Chemical Co., Inc.