|

市場調查報告書

商品編碼

1842432

可攝取感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Ingestible Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

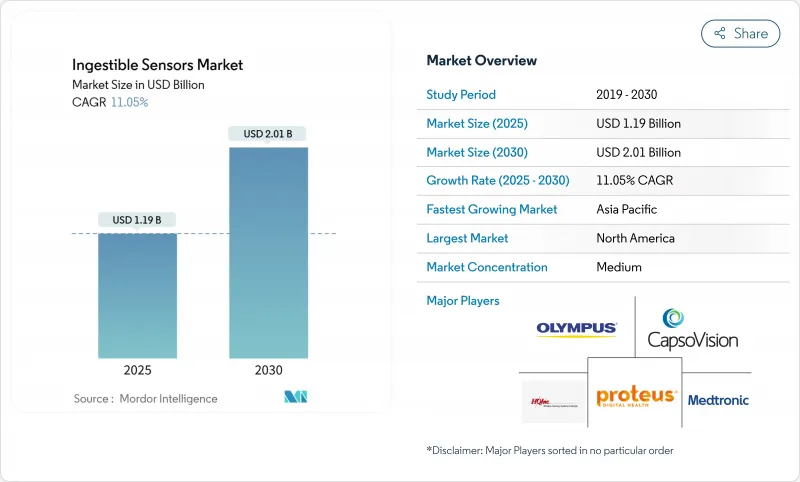

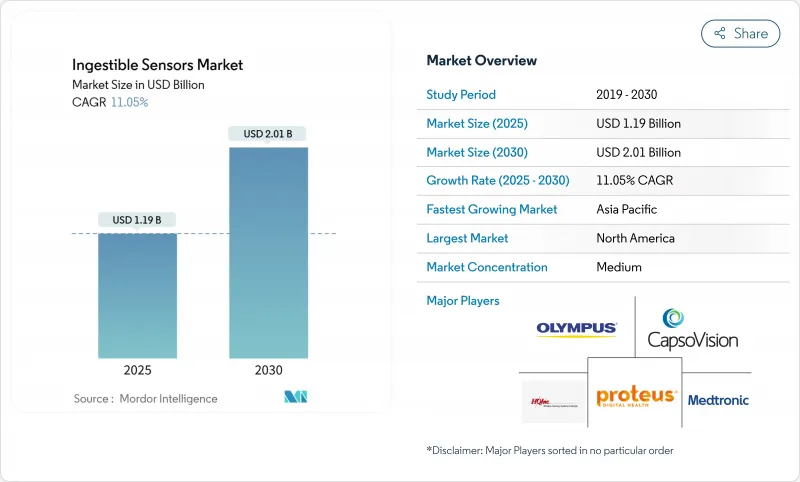

可攝取感測器市場規模預計在 2025 年達到 11.9 億美元,到 2030 年將增加至 20.1 億美元,複合年成長率為 11.05%。

這一強勁勢頭得益於微型電子技術的進步、感測模式的擴展以及醫療保健行業向預防性、數據主導護理的轉變。人工智慧與膠囊生成數據的整合,正在拓展即時監測胃腸道疾病(這些疾病曾經需要侵入性診斷)的選擇。數位藥丸的法規核准正在降低市場准入門檻,而基於價值的報銷模式的廣泛採用則推動了北美和歐洲的需求。預計到2024年,生物感測新興企業的創業投資資金將達到創紀錄水平,這將鼓勵瞄準功率效率和多參數感測的新參與企業。然而,電池容量限制和網路安全的加強正在減緩產品推出的步伐。

全球可攝入感測器市場趨勢與洞察

擴大經合組織國家對數位平板電腦的報銷範圍

經合組織 (OECD) 國家主要醫療保健系統的報銷範圍不斷擴大,增強了可攝取監測解決方案的可預測收益來源。付款方將保險範圍與慢性疾病患者持續治療後將實現的長期成本節省掛鉤,鼓勵將數位藥丸納入處方箋的標準選項 [ema.europa.eu]。歐洲的臨床試驗已驗證依從性感測器是有效的生物標記物,這進一步加速了其應用。醫院目前正在將基於膠囊的服藥依從性指標納入基於結果的契約,從而支持早期技術採用者以外的需求。因此,可攝取感測器市場預計將保持兩位數成長。

在北美推廣製藥公司主導的藥物依從性平台

製藥公司正在將可攝取標籤嵌入傳統藥物中,以收集真實世界證據、保護定價並延長專利期限。 Abilify MySite 為 FDA 鋪平了道路,使藥物-器械組合合法化,並鼓勵其他公司大力投資類似計畫。數位Abilify攝取數據支持差異化標籤,獲得保費報銷,並抵消每年 1000 億至 3000 億美元的不依從性負擔。此類產業措施鞏固了商業性終端市場,為早期感測器供應商提供支持,並在資金籌措週期性波動的情況下維持可攝取感測器市場。

FDA網路安全指南設定資料安全障礙

2024年,更嚴格的網路安全法規將要求可攝取感測器在整個生態系統中納入多層加密和即時威脅監控[irp.nih.gov]。滿足這些標準將帶來更嚴格的功耗和更長的檢驗週期。規模較小的創新企業將面臨更長的設計凍結期和更高的認證成本,使現有企業獲得競爭優勢。雖然這些措施可以提高患者資料的完整性,但可能會暫時減緩市場進入速度,從而抑制近期可攝取感測器市場的成長預期。

報告中分析的其他促進因素和限制因素

- 小型化 ASIC 的進步降低了膠囊的電力需求

- 內部遠端檢測模組 CE 標誌在歐盟範圍內激增

- 膠囊電池壽命有限,限制了多參數感測

細分分析

到2024年,溫度感測器將佔據可吞嚥感測器市場的42%,憑藉其高效的精度和低功耗優勢佔據主導地位[sciencedirect.com]。運動醫學、軍事戰備和手術全期護理都依賴這些膠囊來避免熱壓力並監測體溫趨勢。預計可吞嚥體溫感測器的市場規模將穩步擴大,這得益於體育聯盟在訓練期間強制要求持續監測體溫的通訊協定。儘管成像膠囊的基數較小,但其將受益於微型光學元件和膠囊內視鏡報銷範圍的擴大,到2030年將以13.8%的複合年成長率快速成長。

影像驅動的裝置正吸引胃腸病學家,他們希望透過非侵入性檢測出血、息肉和克隆氏症來避免鎮靜和內視鏡併發症。Medtronic的PillCam Genius SB已證明,基於人工智慧的影像選擇可以減少醫生的閱片時間,同時捕捉數萬張黏膜影像[news.medtronic.com]。最近的原型產品,例如PressureCap,整合了多個應變計,而無需增加膠囊的直徑[cell.com]。如果電池創新能夠緩解功耗限制,那麼融合所有三種感測器的跨模態設計或許能夠獲得更高的價格。

到2024年,醫療機構將佔據可攝取感測器市場收益的86%,其膠囊感測器將用於遵守用藥審核、出血定位和發炎性腸道疾病評估。隨著臨床指引將內視鏡檢查範圍轉向侵入性較小的膠囊途徑,與醫院部署相關的可攝入感測器市場規模預計將持續擴大。 FDA批准的抗精神病藥物和抗病毒藥物的服藥依從性模組顯示,遵從率接近99%,這將推動支付方採用基於價值的基本契約。

精英運動隊伍和軍事組織雖然數量不多,但卻構成了成長最快的基本客群,複合年成長率高達14.2%。耐力運動員在奧運等賽事中穿戴的保溫膠囊可以保護參與者免於運動性中暑,並最佳化補水方案。與穿戴式心率帶和雲分析的整合,可以創建全面的訓練儀表板,吸引高績效教練團隊。隨著時間的推移,隨著消費者健身計畫採用簡化版本,可攝取感測器市場可能會擴展到專業人群以外的領域。

區域分析

到2024年,北美將佔據可攝取感測器市場收益的40%,這得益於數位藥丸的付費報銷、強勁的創業投資資金以及FDA支持性的從頭核准途徑[accessdata.fda.gov]。醫院系統正在引入依從性膠囊,以降低昂貴的再入院率,製藥公司則利用真實世界的攝取數據來處方箋處方。區域學術中心也正在進行早期可行性試驗,檢驗下一代感測模式。

預計亞太地區在2025年至2030年間的複合年成長率將達到14.5%,是全球最快的地區。日本的人口老化和中國沉重的胃腸道疾病負擔構成了龐大的市場基數。國內製造商正在推出成本最佳化的膠囊產品,以適應當地的購買力,國家數位健康策略也在推動遠端監控的普及。在韓國等市場,政府保險開始考慮將膠囊內視鏡檢查納入報銷範圍,這進一步刺激了市場需求。

歐洲在可吞嚥感測器市場佔有顯著佔有率,得益於CE標誌體系,創新遠端檢測膠囊的早期應用成為可能。公共部門計畫強調預防性護理,並與非侵入性診斷相結合。德國和斯堪的納維亞半島的風險投資正在增加,支持新興企業研發自供電感測器和可生物分解外殼。波灣合作理事會和巴西的私人醫院是膠囊內視鏡的早期採用者,尤其是在高階護理套餐方面。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 擴大經合組織國家對數位藥丸的報銷範圍

- 在北美推廣製藥公司主導的藥物依從性平台

- 隨著 ASIC 變得越來越小,膠囊的功率需求也隨之降低。

- 歐盟內部遠端檢測模組CE標誌獲取量激增

- 亞太地區胃腸疾病患者數量龐大,推動需求成長

- 生物感測新興企業的創投(2023-24 年將創歷史新高)

- 市場限制

- FDA網路安全指南提高資料安全門檻

- 膠囊電池壽命有限,限制了多參數感測

- 關於付款人結果益處的混合臨床證據

- 新興國家的一次性手術費用高昂

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 專利情勢分析

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測(金額)

- 按組件

- 感應器

- 穿戴式貼片/資料記錄器

- 軟體和分析平台

- 依感測器類型

- 溫度感測器

- 壓力感測器

- pH感測器

- 影像感測器

- 按功能

- 影像學

- 監測/遵守

- 藥物輸送觸發器

- 按行業

- 醫療保健/醫療

- 運動/健身

- 按行業

- 按最終用戶

- 醫院和 ASC

- 家庭醫療保健

- 研究所

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Medtronic PLC(Given Imaging)

- Proteus Digital Health, Inc.

- CapsoVision, Inc.

- IntroMedic Co., Ltd.

- Jinshan Science and Technology

- Olympus Corporation

- HQ, Inc.

- MC10, Inc.

- etectRx, Inc.

- Otsuka Holdings Co., Ltd.

- Atmo Biosciences

- STMicroelectronics

- Philips Healthcare

- Check-Cap Ltd.

- PENTAX Medical

- RF Wireless Systems

- Karl Storz SE and Co. KG

- Boston Scientific Corporation

- CapsuleTech(a Lantronix company)

- Dassiet BioTelemetry

第7章 市場機會與未來展望

The ingestible sensors market size reached USD 1.19 billion in 2025 and is forecast to climb to USD 2.01 billion by 2030, reflecting an 11.05% CAGR.

Strong momentum stems from advances in miniaturized electronics, expanded sensing modalities, and the healthcare sector's pivot toward preventive, data-driven care. Integration of artificial intelligence with capsule-generated data is broadening real-time monitoring options for gastrointestinal disorders that once required invasive diagnostics. Regulatory clearances for digital pills are reducing market-entry barriers, while the spread of value-based reimbursement is pulling demand forward in North America and Europe. Venture funding for biosensing start-ups hit record levels in 2024, encouraging new entrants that target power efficiency and multi-parameter sensing. Nonetheless, battery capacity limits and heightened cybersecurity mandates are moderating the pace of product launches.

Global Ingestible Sensors Market Trends and Insights

Reimbursement Expansion for Digital Pills across OECD

Broader reimbursement in major OECD health systems is reinforcing predictable revenue streams for ingestible monitoring solutions. Payers link coverage to the long-term cost savings that accrue when chronic-disease patients adhere to therapy, prompting formularies to incorporate digital pills as standard options [ema.europa.eu]. Qualification of adherence sensors as valid biomarkers in European clinical trials further accelerates uptake. Hospitals now embed capsule-based adherence metrics in outcome-based contracts, anchoring demand that goes beyond early technology adopters. The resulting pull-through is expected to keep the ingestible sensors market on its double-digit growth path.

Pharma-led Push for Dose Adherence Platforms in North America

Pharmaceutical firms are embedding ingestible tags into legacy drugs to collect real-world evidence, defend pricing, and extend patent life. The FDA pathway opened by Abilify MyCite legitimized drug-device combinations, prompting others to invest heavily in similar programs. Digital ingestion data support differentiated labelling, which commands premium reimbursements and offsets the USD 100-300 billion annual burden of non-adherence. These industry moves solidify a commercial end-market that anchors early-stage sensor suppliers, sustaining the ingestible sensors market despite cyclical funding swings.

FDA Cyber-device Guidance Creating Data-Security Hurdles

Stricter 2024 cybersecurity rules obligate ingestible sensors to embed multi-layer encryption and real-time threat monitoring across their entire ecosystem [irp.nih.gov]. Meeting these standards strains power budgets and prolongs verification cycles. Smaller innovators face longer design-freeze periods and higher certification costs, tilting competitive advantage toward established firms. While the measures improve patient data integrity, they can momentarily decelerate market arrivals, dampening near-term ingestible sensors market growth projections.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturized ASIC Advances Lowering Capsule Power Demand

- CE-mark Surge for In-body Telemetry Modules in EU

- Limited Capsule Battery Life Restricts Multi-Parameter Sensing.

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Temperature sensors contributed 42% of the ingestible sensors market in 2024, a position earned through validated accuracy and low power demand [sciencedirect.com]. Sports medicine, military readiness, and perioperative care rely on these capsules to avert heat stress and monitor core temperature trends. The ingestible sensors market size for temperature devices is projected to expand steadily on the back of sports league protocols that mandate continuous thermal monitoring during training blocks. Imaging capsules, despite a smaller base, are set to grow fastest at 13.8% CAGR through 2030, benefitting from miniaturized optics and expanding reimbursement for capsule endoscopy.

Image-enabled devices elevate non-invasive detection of bleeding, polyps, and Crohn's lesions, thus attracting gastroenterologists who seek to avoid sedation and endoscopic complications. Medtronic's PillCam Genius SB demonstrates how AI-assisted image sorting can reduce physician reading time while capturing tens of thousands of mucosal pictures [news.medtronic.com]. Pressure and pH modules address motility disorders and acid reflux; recent prototypes such as PressureCap integrate multiple strain gauges without inflating capsule diameter [cell.com]. Cross-modality designs that embed all three sensor types may unlock premium pricing once battery innovations alleviate power constraints.

Healthcare facilities accounted for 86% of the ingestible sensors market revenue in 2024, using capsules for medication adherence audits, bleeding localization, and inflammatory bowel disease assessment. The ingestible sensors market size tied to hospital deployment is forecast to keep growing as clinical guidelines shift endoscopy volumes toward less invasive capsule pathways. Adherence modules, cleared by the FDA for antipsychotics and antivirals, show compliance rates approaching 99%, supporting payer adoption in value-based contracts.

Elite sports teams and military organizations, though a smaller slice, form the fastest-growing customer base at a 14.2% CAGR. Thermal capsules worn by endurance athletes during events like the Olympics safeguard participants from exertional heat stroke and optimize hydration regimens. Integration with wearable heart-rate straps and cloud analytics produces a holistic training dashboard, enticing high-performance coaching staffs. Over time, consumer fitness programs may adopt simplified versions, extending the ingestible sensors market beyond professional cohorts.

Ingestible Sensors Market Segmented by Component (Sensors, Wearable Patch / Data Recorder and More), Sensor Type (Temperature Sensor, Pressure Sensor and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40% of ingestible sensors market revenue in 2024, underpinned by payer reimbursement for digital pills, strong venture funding, and a supportive FDA De Novo pathway [accessdata.fda.gov]. Hospital systems deploy adherence capsules to curb costly readmissions, while pharmaceutical companies leverage real-world ingestion data to negotiate formulary placements. Regional academic centers also run early-feasibility trials that validate next-generation sensing modalities.

Asia-Pacific is forecast to chart a 14.5% CAGR from 2025 to 2030, the fastest worldwide. Japan's aging population and China's large burden of gastrointestinal disorders create a sizable addressable base. Domestic manufacturers introduce cost-optimized capsules that align with regional purchasing power, while national digital-health strategies encourage remote monitoring adoption. Government insurance in markets such as South Korea has begun considering capsule endoscopy reimbursement, further stimulating demand.

Europe retains a notable share of the ingestible sensors market, leveraging its CE-mark system, which grants earlier access to innovative telemetry capsules. Public-sector programs emphasize preventive care, aligning with non-invasive diagnostics. Increased venture funding in Germany and the Nordics supports start-ups pursuing self-powered sensors and biodegradable housings. Meanwhile, Middle East and Africa and South America together represent a small but rising opportunity; private hospitals in the Gulf Cooperation Council and Brazil are early adopters, especially for capsule endoscopy in premium care packages.

- Medtronic PLC (Given Imaging)

- Proteus Digital Health, Inc.

- CapsoVision, Inc.

- IntroMedic Co., Ltd.

- Jinshan Science and Technology

- Olympus Corporation

- HQ, Inc.

- MC10, Inc.

- etectRx, Inc.

- Otsuka Holdings Co., Ltd.

- Atmo Biosciences

- STMicroelectronics

- Philips Healthcare

- Check-Cap Ltd.

- PENTAX Medical

- RF Wireless Systems

- Karl Storz SE and Co. KG

- Boston Scientific Corporation

- CapsuleTech (a Lantronix company)

- Dassiet BioTelemetry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Reimbursement Expansion for Digital Pills across OECD

- 4.2.2 Pharma-led Push for Dose Adherence Platforms in North America

- 4.2.3 Miniaturised ASIC Advances Lowering Capsule Power Demand

- 4.2.4 CE-mark Surge for In-body Telemetry Modules in EU

- 4.2.5 Large GI Disorder Patient Pools in APAC Driving Demand

- 4.2.6 Venture Investments in Biosensing Start-ups (2023-24 record high)

- 4.3 Market Restraints

- 4.3.1 FDA Cyber-device Guidance Creating Data-Security Hurdles

- 4.3.2 Limited Capsule Battery Life Restricts Multi-parameter Sensing

- 4.3.3 Mixed Clinical Evidence on Outcome Benefits for Payors

- 4.3.4 High One-time Procedure Costs in Emerging Countries

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Patent Landscape Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Sensors

- 5.1.2 Wearable Patch / Data Recorder

- 5.1.3 Software and Analytics Platform

- 5.2 By Sensor Type

- 5.2.1 Temperature Sensor

- 5.2.2 Pressure Sensor

- 5.2.3 pH Sensor

- 5.2.4 Image Sensor

- 5.3 By Function

- 5.3.1 Imaging

- 5.3.2 Monitoring / Adherence

- 5.3.3 Drug Delivery Trigger

- 5.4 By Industry Vertical

- 5.4.1 Healthcare / Medical

- 5.4.2 Sport and Fitness

- 5.4.3 Other Verticals

- 5.5 By End-user

- 5.5.1 Hospitals and ASCs

- 5.5.2 Home Healthcare

- 5.5.3 Research Institutes

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Medtronic PLC (Given Imaging)

- 6.4.2 Proteus Digital Health, Inc.

- 6.4.3 CapsoVision, Inc.

- 6.4.4 IntroMedic Co., Ltd.

- 6.4.5 Jinshan Science and Technology

- 6.4.6 Olympus Corporation

- 6.4.7 HQ, Inc.

- 6.4.8 MC10, Inc.

- 6.4.9 etectRx, Inc.

- 6.4.10 Otsuka Holdings Co., Ltd.

- 6.4.11 Atmo Biosciences

- 6.4.12 STMicroelectronics

- 6.4.13 Philips Healthcare

- 6.4.14 Check-Cap Ltd.

- 6.4.15 PENTAX Medical

- 6.4.16 RF Wireless Systems

- 6.4.17 Karl Storz SE and Co. KG

- 6.4.18 Boston Scientific Corporation

- 6.4.19 CapsuleTech (a Lantronix company)

- 6.4.20 Dassiet BioTelemetry

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment