|

市場調查報告書

商品編碼

1842418

工業微生物學:全球市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Global Industrial Microbiology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

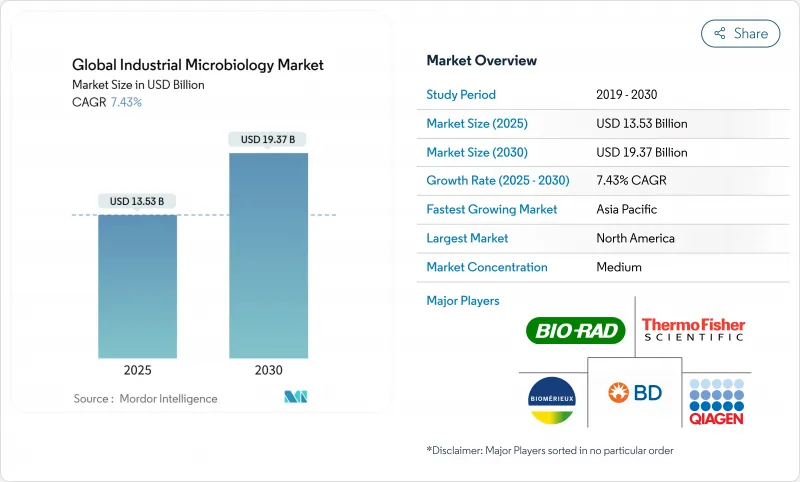

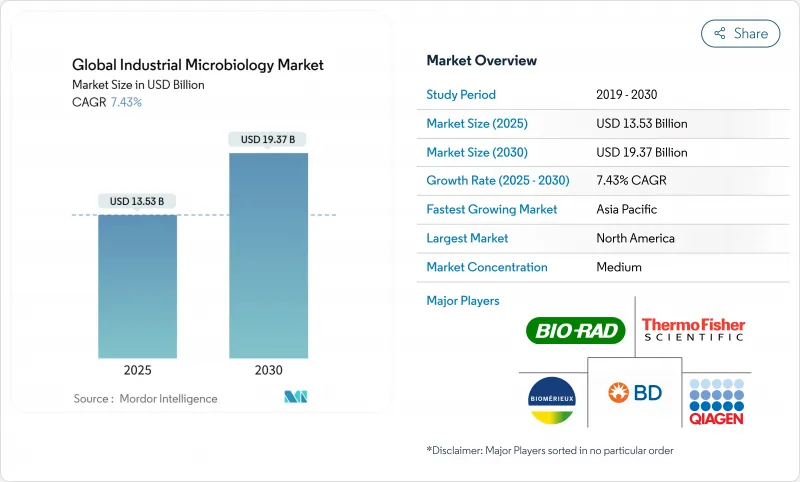

預計 2025 年工業微生物市場價值將達到 135.3 億美元,到 2030 年預計將成長至 193.7 億美元,複合年成長率為 7.43%。

隨著生物加工、精準發酵和 ESG主導的廢棄物生物修復計劃為服務提供者創造新的收益來源,需求正在超越傳統的品管測試。來自培養肉類設施的快速無菌和內毒素篩檢要求,以及多個司法管轄區對基因改造作物的審查力度加大,正在再形成全球供應鏈的驗證通訊協定。供應商中斷,尤其是 BD 2024 年 BACTEC 血培養管瓶短缺,正在推動人們對多源採購籌資策略和自動庫存追蹤的興趣,以確保實驗室的運作。隨著領先供應商尋求收購、一次性生物反應器創新和人工智慧驅動的污染檢測軟體,以在速度、數據完整性和網路安全彈性方面脫穎而出,競爭正在加劇。

全球工業微生物學市場趨勢與見解

對營養補充品和發酵產品的需求不斷成長

亞洲益生菌消費量激增,尤以 Zuellig Pharma 與印尼、菲律賓和台灣地區長達十年的合作夥伴關係分銷 OMNi-BiOTiC 菌株為標誌,促使實驗室提供以區域為重點的菌株表徵服務以及代謝物分析。因此,工業微生物學市場正將其重點從病原體檢測轉向更深入的功能分析,以量化生物活性和區域口味偏好。製造商也在定製配方以滿足當地的監管要求,這加速了新興經濟體對快速微生物品質檢測基礎設施的需求。從鮮味調味料到生物基甜味劑,發酵衍生成分的範圍不斷擴大,為污染物和脫靶代謝物增加了新的品質查核點。總的來說,這種轉變正在維持正常的消費量並鞏固與主要供應商的長期試劑合約。

人們對食品安全的興趣日益濃厚,監管也更加嚴格

最近因李斯特菌而引發的補充奶昔召回事件促使監管機構收緊污染確認的周轉目標,從而刺激了高通量 PCR 和全基因組測序工作流程的採用。 FDA 更新的《藥物微生物學手冊》要求統一的內毒素和抗菌功效檢測與符合 21 CFR 11 的資料擷取系統無縫整合。生物梅里埃等供應商已推出其 3P ENTERPRISE 平台,將數位環境監控與審核的電子記錄相結合。區塊鏈支援的供應鏈透明度增加了另一層文檔,並迫使 QC 實驗室產生防篡改的微生物測試報告。這種壓力推動了對自動培養箱、快速閱讀器和中間件的支出增加,這些設備可以縮短結果週期,同時滿足不斷發展的全球基準。

食品中基因改造作物的監管衝突

由於 CRISPR 編輯作物的框架多種多樣,合規性變得複雜,歐盟提案對新興基因組技術採取雙重監管途徑,而美國則傾向於透過 ICH 進行協調。因此,服務全球客戶的實驗室必須維護平行的通訊協定、認證和報告格式,這會增加營運成本並擴大技術純熟勞工的能力。中國加強的生物安全監管也要求出口商證明基因改造微生物從譜係到最終產品的可追溯性。由於有超過 1,900 項 CRISPR作物專利且沒有統一的治療方法,工業微生物學市場的品質控制提供者在規劃針對基因改造作物的分析平台的資本投資時面臨不確定性。這些不一致性正在減緩跨境採用針對基因改造生物的快速微生物檢測方法。

報告中分析的其他促進因素和限制因素

- 研發費用不斷增加,生物製藥產品線不斷擴大

- 擴大生質燃料和酵素的工業發酵

- 專業培養基投入的供應鏈不確定性

細分分析

至2024年,耗材將佔全球總營收的52.38%,凸顯其在日常營運中的關鍵角色。隨著每個自動化週期的推進,試劑用量也不斷增加,預計到2030年,與耗材相關的工業微生物學市場規模將以9.28%的複合年成長率成長,因為高通量設備需要更大、更高品質的批次。製藥無塵室環境監測準則的日益嚴格推動了培養基和培養物製備的擴展。支援RFID的管瓶和培養皿提高了庫存準確性,並支援遠端批次放行檢驗,加深了實驗室對品牌耗材的依賴。

儀器與系統部門將受益於一次性技術,該技術可將清潔驗證步驟減少50%,但由於資本預算遵循多年週期,其佔有率成長將放緩。過濾和離心技術的創新有利於封閉式系統配置,從而阻止可疑微生物進入上游。自動菌落計數器系統減少了分析人員的時間,從而提高了供應商的通量並改善了試劑回收率。這些協同效應有助於供應商在日益激烈的競爭中保持淨利率。

在全球HACCP標準的推動下,預計到2024年,食品飲料產業將佔據工業微生物學市場佔有率的32.42%。然而,預計到2030年,製藥和生物技術產業將以10.22%的複合年成長率成長,推動內毒素、黴漿菌和無菌檢測套組等工業微生物學市場規模的成長。細胞和基因治療製造領域的成長將最為強勁,因為快速放行檢測可以將產品前置作業時間縮短數週。

隨著 ESG主導的清潔基金贊助工業場所的石油、重金屬和 PFAS 的微生物修復,環境檢測正日益受到關注。農業擴大利用根瘤菌來促進植物生長,以分析土壤健康狀況;而化妝品品牌則投資於微生物友善配方,並要求進行活菌培養穩定性評估。這種用例的多樣化分散了服務供應商的風險,並鼓勵各行各業廣泛採用這些設備。

區域分析

北美的領先地位歸功於成熟的GMP執行和持續的資本投資,例如賽默飛世爾科技在美國投資20億美元升級項目。加拿大生技叢集正在利用優惠的研發稅額扣抵,開發植物來源食品的微生物聯盟,而墨西哥生產商則專注於跨境協調,以滿足USMCA食品安全審核的要求。涵蓋自動化資料系統的網路安全框架進一步區分了區域供應商,並結合了基於角色的存取控制和加密備份。

亞太地區兩位數的成長軌跡得益於中國國營生技藥品製藥廠尋求全球cGMP認證、印度疫苗和生物相似藥出口商,以及日本機能性食品企業對先進菌株穩定性分析的需求。韓國和澳洲政府對mRNA設施的支持也加速了對快速品質控制解決方案的需求。區域供應商實現消費品在地化生產將縮短前置作業時間,避免進口關稅,並從老牌跨國公司手中搶佔市場佔有率。

歐洲正在平衡嚴格的監管與綠色轉型的獎勵。歐盟推動ISCC Plus認證將鼓勵廣泛採用可再生塑膠耗材,賽多利斯公司實現化石塑膠減量50%的里程碑就證明了這一點。德國和法國正率先使用預測性微生物分析技術建立生物製程4.0試點工廠,英國則在公共領域資助噬菌體療法的研發。然而,由於各國在基因改造作物方面的監管規定存在差異,跨國實驗室必須實施重複的通訊協定,這在一定程度上限制了跨境效率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 對營養補充品和發酵產品的需求不斷成長

- 對食品安全的日益關注和更嚴格的監管

- 研發費用不斷增加,生物製藥產品線不斷擴大

- 擴大生質燃料和酵素的工業發酵

- 培養肉生產中的快速品質控制需求

- ESG資助的微生物組廢棄物生物修復計劃

- 市場限制

- 食品中基因改造作物的監管衝突

- 產品召回增加導致審查力道加大

- 專業媒體投入的供應鏈不確定性

- 自動化微生物資料系統的網路安全風險

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模及成長預測(金額)

- 依產品類型

- 設備和系統

- 發酵系統

- 生物反應器和發酵罐

- 過濾和離心分離系統

- 其他

- 耗材

- 培養基/培養液

- 培養皿和管瓶

- 其他耗材

- 試劑

- 酵素和緩衝液

- 其他

- 設備和系統

- 按應用領域

- 食品和飲料業

- 製藥和生物技術

- 農業

- 環保產業

- 化妝品和個人護理行業

- 其他應用領域

- 依微生物類型

- 細菌

- 酵母和黴菌

- 病毒和噬菌體

- 按測試類型

- 無菌測試

- 生物負載測試

- 內毒素檢測

- 其他

- 按地區(金額)

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第6章 競爭態勢

- 市場集中度

- 市佔率分析

- 公司簡介

- 3M Company

- Agilent Technologies

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher Corporation

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- Becton, Dickinson & Company

- Sartorius AG

- Eppendorf AG

- QIAGEN NV

- Novozymes A/S

- Lonza Group AG

- Charles River Laboratories

- Pall Corporation(Danaher)

- Shimadzu Corporation

- Waters Corporation

- Asiagel Corporation

- Bio-Techne Corporation

- Grant Instruments

- BD Diagnostic Systems

第7章 市場機會與未來展望

The industrial microbiology market is valued at USD 13.53 billion in 2025 and is forecast to climb to USD 19.37 billion by 2030, reflecting a 7.43% CAGR over the period.

Demand is widening beyond traditional quality-control testing as bioprocessing, precision fermentation, and ESG-driven waste-bioremediation projects create fresh revenue pools for service providers. Rapid sterility and endotoxin screening requirements originating from cultivated-meat facilities, together with stricter GMO oversight in multiple jurisdictions, are reshaping validation protocols across the global supply chain. Supplier disruptions-in particular BD's shortage of BACTEC blood-culture vials in 2024-have amplified interest in multisource procurement strategies and automated inventory tracking to secure laboratory uptime. Competitive intensity is accelerating as leading vendors pursue acquisitions, single-use bioreactor innovations, and AI-driven contamination-detection software to differentiate on speed, data integrity, and cybersecurity resilience.

Global Industrial Microbiology Market Trends and Insights

Growing Demand for Nutraceuticals & Fermented Products

Surging probiotic consumption across Asia, highlighted by Zuellig Pharma's decade-long alliance to distribute OMNi-BiOTiC strains in Indonesia, Philippines, and Taiwan, is pushing laboratories to offer localized strain-characterization services alongside metabolite profiling. The industrial microbiology market is therefore pivoting from pathogen detection toward deeper functional analytics that quantify bioactivity and regional taste preferences. Manufacturers are also tailoring formulations to match local regulatory requirements, which accelerates demand for rapid microbial-quality testing infrastructure in emerging economies. The widening palette of fermentation-derived ingredients-ranging from umami seasonings to bio-based sweeteners-is adding new QC checkpoints for contaminants and off-target metabolites. These shifts collectively sustain recurring consumable uptake and cement long-term reagent contracts for leading suppliers.

Rising Concern for Food Safety & Stringent Regulations

Recent Listeria-linked recalls involving supplement shakes prompted regulators to enforce tighter turnaround targets for contamination confirmation, spurring adoption of high-throughput PCR and whole-genome-sequencing workflows. The FDA's updated Pharmaceutical Microbiology Manual demands harmonized endotoxin and antimicrobial-effectiveness assays that integrate seamlessly with 21 CFR 11-compliant data-capture systems. Vendors such as bioMerieux responded with the 3P ENTERPRISE platform, pairing digital environmental monitoring with audit-ready electronic records. Blockchain-supported supply-chain transparency adds another documentation layer, compelling QC labs to generate tamper-proof microbial test reports. Collectively, these pressures increase spending on automated incubators, rapid readers, and middleware that can cut result cycles while meeting evolving global benchmarks.

Regulatory Conflicts Over GMOs in Food Sources

Divergent frameworks for CRISPR-edited crops create compliance complexity as the EU proposes dual regulatory pathways for new genomic techniques, while the U.S. leans on harmonization through the ICH. Testing laboratories servicing global clients must therefore maintain parallel protocols, certifications, and reporting formats, increasing operating costs and stretching skilled-labor capacity. China's heightened biosafety oversight further obliges exporters to demonstrate traceability of genetically modified microorganisms from strain lineage to final product. As patent volumes for CRISPR crops exceed 1,900 yet lack uniform treatment, QC providers in the industrial microbiology market face uncertainty when planning capital investments in GMO-specific analytical platforms. These discrepancies slow cross-border adoption of rapid microbial assays tailored to engineered organisms.

Other drivers and restraints analyzed in the detailed report include:

- Increasing R&D Spend & Biopharma Pipeline Expansion

- Expansion of Industrial Fermentation for Biofuels & Enzymes

- Supply-Chain Volatility in Specialty Culture Media Inputs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables represented 52.38% of global revenue in 2024, underscoring their vital role in day-to-day operations. Reagent volumes rise with each automation cycle, and the industrial microbiology market size attached to consumables is projected to grow at 9.28% CAGR to 2030 as high-throughput instruments demand larger lot-qualified batches. Media & culture preparations expand in tandem with stricter environmental-monitoring guidelines for pharmaceutical clean rooms. RFID-enabled vials and plates improve inventory accuracy and support remote batch-release verification, deepening laboratory reliance on branded disposables.

The equipment & systems segment benefits from single-use technologies that cut cleaning validation steps by 50%, yet its share grows more gradually because capital budgets follow multi-year cycles. Filtration and centrifugation innovations favor closed-system configurations that block adventitious microbes upstream. Automated colony-counters reduce analyst hours, which translates into higher throughput and greater reagent pull-through for suppliers. Such synergies help vendors defend margins even as competition intensifies.

The food & beverage sector held 32.42% of industrial microbiology market share in 2024 on the back of global HACCP standards. However, the pharmaceutical & biotechnology segment is forecast to deliver a 10.22% CAGR through 2030, expanding the industrial microbiology market size for endotoxin, mycoplasma, and sterility testing kits. Growth is strongest in cell- and gene-therapy manufacturing, where rapid release testing can shave weeks off product lead-times.

Environmental testing is gaining traction as ESG-directed remediation funds sponsor microbiome-based clean-up of oil, heavy metals, and PFAS at industrial sites. Agricultural applications increasingly involve soil-health profiling using plant-growth-promoting rhizobacteria, while cosmetic brands invest in microbiome-friendly formulations that require live-culture stability assessments. These diversified use-cases spread risk for service providers and underpin broader instrument penetration across verticals.

The Industrial Microbiology Market is Segmented by Product Type (Equipment & Systems [Fermentation Systems, and More], Consumables [Media & Culture Preparations, and More], Reagents), by Application Area (Food & Beverage Industry, Pharmaceutical & Biotechnology Industry, and More), by Microbial Type (Bacteria, and More), by Test Type (Sterility Testing, and More), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America's leadership stems from mature GMP enforcement and ongoing capital investment such as Thermo Fisher's USD 2 billion U.S. upgrade program, which expands local single-use media output and strengthens supply resilience. Canadian biotech clusters leverage favorable R&D tax credits to develop microbial consortia for plant-based foods, whereas Mexican producers focus on cross-border harmonization to meet USMCA food-safety audits. Cybersecurity frameworks targeting automated data systems further differentiate regional vendors that embed role-based access controls and encrypted backups.

Asia-Pacific's double-digit trajectory arises from China's state-backed biologics plants seeking global cGMP accreditation, India's vaccine and biosimilar exporters, and Japan's functional-food incumbents requiring advanced strain-stability analytics. Government support for mRNA facilities in South Korea and Australia also accelerates demand for rapid QC solutions. Regional suppliers that localize consumable production reduce lead times and skirt import duties, capturing share from established multinationals.

Europe balances regulatory rigor with green-transition incentives. The EU's push for ISCC Plus certification drives uptake of renewable-plastic consumables, as demonstrated by Sartorius' 50% fossil-plastic reduction milestone. Germany and France spearhead bioprocess-4.0 pilot plants deploying predictive microbial analytics, while the UK channels public funding into phage-therapy R&D. Divergent GMO rules, however, oblige multi-national labs to run dual protocols, mildly constraining cross-border efficiencies.

- 3M

- Agilent Technologies

- Thermo Fisher Scientific

- Merck

- Danaher

- bioMerieux

- Bio-Rad Laboratories

- Beckton Dickinson

- Sartorius

- Eppendorf

- QIAGEN

- Novozymes A/S

- Lonza Group

- Charles River

- Pall Corporation (Danaher)

- Shimadzu

- Waters Corporation

- Asiagel

- Bio-Techne

- Grant Instruments

- BD Diagnostic Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for nutraceuticals & fermented products

- 4.2.2 Rising concern for food safety & stringent regulations

- 4.2.3 Increasing R&D spend & biopharma pipeline expansion

- 4.2.4 Expansion of industrial fermentation for biofuels & enzymes

- 4.2.5 Rapid QC needs in cultivated-meat manufacturing

- 4.2.6 ESG-funded microbiome waste-bioremediation projects

- 4.3 Market Restraints

- 4.3.1 Regulatory conflicts over GMOs in food sources

- 4.3.2 Escalating product recalls heightening scrutiny

- 4.3.3 Supply-chain volatility in specialty culture media inputs

- 4.3.4 Cyber-security risks to automated microbiology data systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Equipment & Systems

- 5.1.1.1 Fermentation Systems

- 5.1.1.2 Bioreactors & Fermenters

- 5.1.1.3 Filtration & Centrifugation Systems

- 5.1.1.4 Others

- 5.1.2 Consumables

- 5.1.2.1 Media & Culture Preparations

- 5.1.2.2 Petri Dishes & Vials

- 5.1.2.3 Other Consumables

- 5.1.3 Reagents

- 5.1.3.1 Enzymes & Buffers

- 5.1.3.2 Others

- 5.1.1 Equipment & Systems

- 5.2 By Application Area

- 5.2.1 Food & Beverage Industry

- 5.2.2 Pharmaceutical & Biotechnology Industry

- 5.2.3 Agricultural Industry

- 5.2.4 Environmental Industry

- 5.2.5 Cosmetic / Personal-Care Industry

- 5.2.6 Other Application Areas

- 5.3 By Microbial Type

- 5.3.1 Bacteria

- 5.3.2 Yeasts & Molds

- 5.3.3 Viruses & Phages

- 5.4 By Test Type

- 5.4.1 Sterility Testing

- 5.4.2 Bioburden Testing

- 5.4.3 Endotoxin Testing

- 5.4.4 Others

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Agilent Technologies

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 Merck KGaA

- 6.3.5 Danaher Corporation

- 6.3.6 bioMerieux SA

- 6.3.7 Bio-Rad Laboratories Inc.

- 6.3.8 Becton, Dickinson & Company

- 6.3.9 Sartorius AG

- 6.3.10 Eppendorf AG

- 6.3.11 QIAGEN NV

- 6.3.12 Novozymes A/S

- 6.3.13 Lonza Group AG

- 6.3.14 Charles River Laboratories

- 6.3.15 Pall Corporation (Danaher)

- 6.3.16 Shimadzu Corporation

- 6.3.17 Waters Corporation

- 6.3.18 Asiagel Corporation

- 6.3.19 Bio-Techne Corporation

- 6.3.20 Grant Instruments

- 6.3.21 BD Diagnostic Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment