|

市場調查報告書

商品編碼

1836656

順丁烯二酸酐:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Maleic Anhydride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

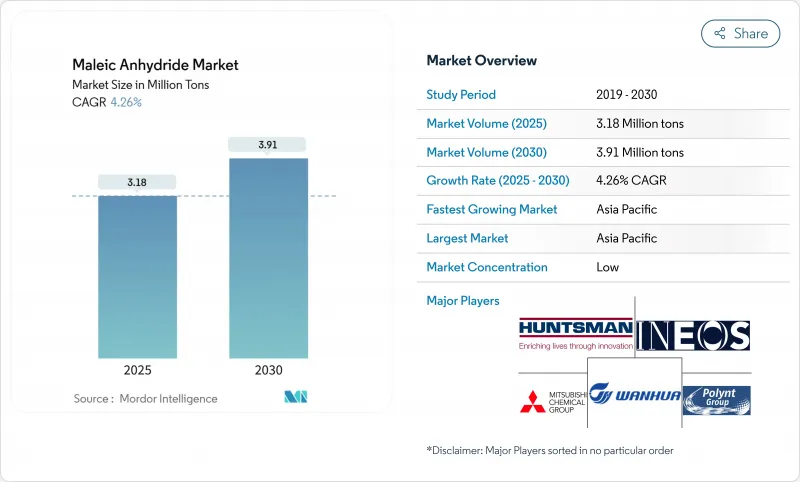

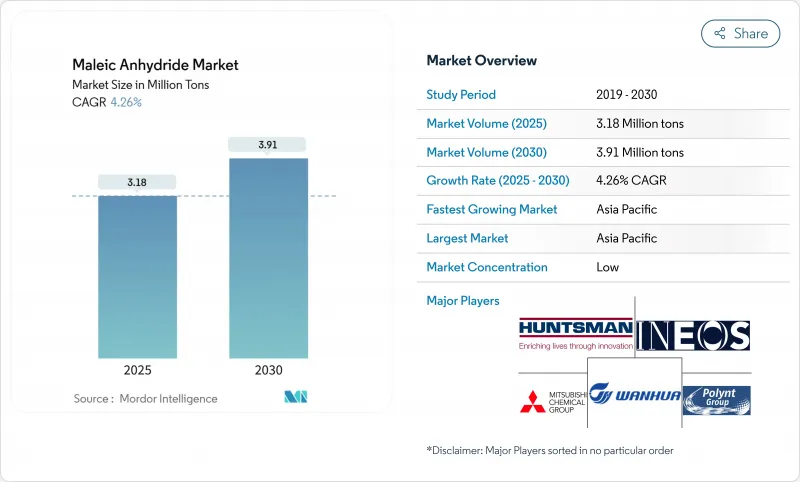

預計2025年順丁烯二酸酐市場規模將達318萬噸,2030年成長至391萬噸,複合年成長率為4.26%。

不斷擴張的基礎設施項目、對不飽和聚酯樹脂的持續需求以及正丁烷作為原料快速替代苯,是支撐順丁烯二酸酐市場成長的關鍵因素。受再生PET UPR的採用和歐洲嚴格的綠色建築法規的推動,建築業佔據了消費的大部分。北美汽車製造商正在擴大輕質SMC板材的應用,刺激了對樹脂的需求。在供應方面,亞太地區的產能仍然佔據主導地位,但中國的供應過剩正在擠壓全球利潤率,並迫使其他生產商轉向更高價值的利基市場。

全球順丁烯二酸酐市場趨勢與見解

歐洲建設產業對再生PET UPR的採用激增

隨著歐盟包裝法規於2024年強制規定廢棄物材料含量基準值,建商正轉向使用再生PET不飽和聚酯樹脂。這些配方的拉伸強度可達65-72 MPa,與原生UPR相當,同時可減少高達25%的嵌入碳含量。順丁烯二酸酐可增強聚合物基質中的界面黏合力,提升複合材料的耐久性,並支持低碳建築材料領域的順丁烯二酸酐市場。

提高正丁烷工廠產能以降低原料成本

近期的正丁烷產能波動計劃擴大了與苯的原料成本差距。BASF的三葉催化劑使順丁烯二酸酐產率提高了高達2%,並透過抑制熱點溫度降低了能耗強度。正丁烷路線的成本優勢使其在順丁烯二酸酐市場的佔有率達到70%。

經合組織收緊苯排放法規,提高合規成本

美國《有毒物質控制法》和歐盟化學品管理法規的變化將迫使苯基裝置維修或關閉,從而推高營業成本,並推動向正丁烷氧化法的轉變。這種轉變將增加資本投資需求,並抑制以老舊設備為主的地區的成長。

報告中分析的其他促進因素和限制因素

- 電動車輕質SMC面板加速北美UPR消費

- 生物基琥珀酸路線創造高利潤共聚物

- 正丁烷價格波動與原油價格掛鉤

細分分析

到2024年,不飽和聚酯樹脂將佔據順丁烯二酸酐市場佔有率的50%,到2030年,該細分市場的複合年成長率將達到4.9%。再生PET UPR牌號具有相同的機械性質,且碳足跡降低高達25%,有助於其在節能建築上的應用。同時,輕型船舶結構和電動車零件的成長也支撐了需求。因此,用於UPR應用的順丁烯二酸酐市場規模預計將保持高於行業整體平均水平。

1,4-丁二醇、共聚物和特殊界面活性劑等多元化產品正在拓寬產品組合。使用Cu-ZnO催化劑,順丁烯二酸酐連續加氫製備BDO,在190°C下產率達85%,製程效率顯著提升。以生物基琥珀酸為原料的特種共聚物為生物分解性塑膠帶來了高價,從而支撐了順丁烯二酸酐產業的利潤成長。

與苯相比,正丁烷氧化製程具有單位成本更低、有害副產品更少等特點,預計到2024年將佔順丁烯二酸酐市場的70%。亨斯邁的固定台技術與BASF的三葉催化劑結合,將在降低壓降的同時提高產量,從而增強成本領先地位。

苯法裝置主要在基礎設施較落後的地區運作。儘管規模較小,但到2030年,其複合年成長率將達到4.69%,這反映了特定市場的選擇性升級和原料價格競爭。這種雙原料格局正在影響資本配置決策,並支持順丁烯二酸酐市場的供應彈性。

區域分析

預計到2024年,亞太地區將佔據順丁烯二酸酐市場的69%,到2030年,複合年成長率將達到4.61%。中國的產能超過全球整體的三分之二,支撐著馬來酸酐的供應。印度和東南亞地區正透過基礎設施投資和不斷成長的汽車產量來滿足需求,而日本和韓國則透過日本觸媒等公司貢獻製程創新。

北美是一個技術先進且成本競爭力十足的生產基地。亨斯邁在佛羅裡達州和路易斯安那州經營大型裝置,將原料流與下游應用整合在一起。輕量化電動車面板和即將進行的正丁烷擴建項目正在提振該地區的成長,並增強順丁烯二酸酐市場的收益韌性。歐洲面臨能源成本上升和排放法規的嚴格限制,但在採用永續性方面處於領先地位,尤其是在再生PET/UPR領域。

南美特種肥料螯合物的市佔率較小,但正在成長。 YPF KIMICA正在開發生物基途徑,以配合該地區的精密農業重點。中東和非洲正在投資石化多元化,利用其豐富的原料來開發正丁烷計劃,這可能會推動未來全球順丁烯二酸酐市場的擴張。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 歐洲建設產業對再生PET基UPR的採用激增

- 透過提高正丁烷工廠的產能來降低原料成本

- 電動車輕質SMC面板正在加速北美UPR的消費

- 生物基琥珀酸路線生產高利潤共聚物

- 南美洲水溶性肥料螯合物的成長。

- 市場限制

- 經合組織苯排放法規收緊導致合規成本上升

- 中國新增產能造成全球供應過剩

- 正丁烷價格波動與原油價格相關

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價格趨勢

第5章市場規模及成長預測(數量)

- 依產品類型

- 不飽和聚酯樹脂

- 1,4-丁二醇

- 潤滑油添加劑

- 順丁烯二酸酐共聚物

- 蘋果酸

- 富馬酸

- 烷基琥珀酸酐

- 表面活性劑和塑化劑

- 其他產品類型

- 按原料

- 正丁烷

- 苯

- 按形狀

- 固體(薄片/漿體)

- 融化

- 按最終用戶產業

- 建造

- 車

- 電子產品

- 飲食

- 石油產品

- 個人護理

- 製藥

- 農業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AOC

- Arkema

- Ashland

- Bartek Ingredients Inc.

- BASF

- Borealis AG

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- IG Petrochemicals Ltd.(IGPL)

- INEOS AG

- LANXESS

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- NIPPON SHOKUBAI CO., LTD.

- PETRONAS Chemicals Group Berhad

- Polynt SpA

- Sinopec Qilu Petrochemical

- SK Functional Polymer

- Thirumalai Chemicals

- Wanhua

第7章 市場機會與未來展望

The maleic anhydride market size reached 3.18 million tons in 2025 and is forecast to climb to 3.91 million tons by 2030, translating to a 4.26% CAGR.

Expanding infrastructure programs, sustained demand for unsaturated polyester resins, and the rapid substitution of benzene with n-butane feedstock are the principal growth vectors behind the maleic anhydride market. Construction accounts for the bulk of consumption, reinforced by recycled-PET UPR adoption and stringent green-building rules in Europe. North American automakers are broadening the application scope of lightweight SMC panels, adding momentum to resin demand. On the supply side, Asia Pacific's capacity leadership remains decisive, yet Chinese oversupply is compressing global margins and pushing producers elsewhere toward high-value niches.

Global Maleic Anhydride Market Trends and Insights

Surging Adoption of Recycled-PET UPR in Europe Construction

Mandatory recycled-content thresholds under the 2024 EU Packaging and Packaging Waste Regulation are steering builders toward recycled-PET unsaturated polyester resins. These formulations deliver tensile strength of 65-72 MPa, on par with virgin UPR, and trim embedded carbon by up to 25%. Maleic anhydride enhances interfacial adhesion in the polymer matrix, reinforcing composite durability and supporting the maleic anhydride market's push into low-carbon building materials.

Capacity Additions of N-Butane Plants Lowering Feedstock Cost

Recent n-butane swing-capacity projects are widening the feedstock cost gap versus benzene. BASF's trilobe-shaped catalyst lifts maleic anhydride yield by up to 2% and curbs hot-spot temperatures, translating into lower energy intensity. The resulting cost advantage is reinforcing the n-butane route's 70% share of the maleic anhydride market.

Stricter Benzene Emission Caps in OECD Raising Compliance Cost

Revisions to the U.S. Toxic Substances Control Act and EU chemical-management rules compel retrofits or closures of benzene-based units, inflating operating costs and incentivizing the migration to n-butane oxidation. The shift increases capital-spending needs and tempers growth in regions where older assets dominate.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight SMC Panels for EVs Accelerating UPR Consumption in North America

- Bio-based Succinic Acid Routes Creating High-Margin Copolymers

- N-Butane Price Volatility Linked to Crude

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unsaturated polyester resin held 50% of the maleic anhydride market share in 2024, and the segment is set to rise at a 4.9% CAGR through 2030. Recycled-PET UPR grades, offering identical mechanical performance and up to 25% lower carbon footprints, are catalyzing adoption in energy-efficient buildings. Concurrently, growth in lightweight marine structures and electric-vehicle components sustains demand. The maleic anhydride market size for UPR applications is therefore tracking above the overall industry average.

Diversification into 1,4-butanediol, copolymers, and specialty surfactants is widening the product mix. Continuous hydrogenation of maleic anhydride to BDO, achieving 85% yield over Cu-ZnO catalysts at 190 °C, illustrates process efficiency gains. Specialty copolymers derived from bio-based succinic acid are capturing premium pricing in biodegradable plastics, supporting margin expansion within the maleic anhydride industry.

N-butane oxidation processes contributed 70% to the maleic anhydride market in 2024, driven by lower unit costs and fewer hazardous by-products compared with benzene. Huntsman's fixed-bed technology, coupled with BASF's trilobe catalyst, lifts yield while lowering pressure drop, reinforcing cost leadership.

Benzene-based units operate mainly in regions where legacy infrastructure exists. Although smaller in scale, their 4.69% CAGR to 2030 reflects selective upgrades and competitive feedstock pricing in certain markets. This dual-track raw-material scenario shapes capital-allocation decisions and underpins supply flexibility in the maleic anhydride market.

The Maleic Anhydride Market Report Segments the Industry by Product Type (Unsaturated Polyester Resin, 1, 4-Butanediol, Lubricant Additives, and More), Raw Material (N-Butane and Benzene), Physical Form (Solid (Flake/Prill) and Molten), End-User Industry (Construction, Automobile, Food and Beverage, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific held 69% of the maleic anhydride market in 2024, and the region is poised for a 4.61% CAGR through 2030. China's capacity exceeds two-thirds of the global total, underpinning supply. India and Southeast Asia sustain demand through infrastructure spending and rising automotive output, while Japan and South Korea contribute process innovations via firms such as Nippon Shokubai.

North America presents a technologically advanced yet cost-competitive production base. Huntsman operates large-scale units in Florida and Louisiana, integrating feedstock streams and downstream applications. Lightweight EV panels and forthcoming n-butane expansions reinforce regional growth, reinforcing the maleic anhydride market's revenue resilience. Europe faces higher energy costs and strict emission curbs, yet leads sustainability adoption, especially recycled-PET UPR.

South America's share is modest but rising in specialty fertilizer chelates. YPF Quimica is developing bio-based pathways to align with regional precision-agriculture priorities. The Middle East and Africa are investing in petrochemical diversification, leveraging feedstock abundance for future n-butane projects that could broaden the maleic anhydride market's global footprint.

- AOC

- Arkema

- Ashland

- Bartek Ingredients Inc.

- BASF

- Borealis AG

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- I G Petrochemicals Ltd. (IGPL)

- INEOS AG

- LANXESS

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- NIPPON SHOKUBAI CO., LTD.

- PETRONAS Chemicals Group Berhad

- Polynt S.p.A.

- Sinopec Qilu Petrochemical

- SK Functional Polymer

- Thirumalai Chemicals

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Adoption of Recycled-PET-Based UPR in Europe Construction

- 4.2.2 Capacity Additions of N-Butane Plants Lowering Feedstock Cost

- 4.2.3 Lightweight SMC Panels for EVs Accelerating UPR Consumption in North America

- 4.2.4 Bio-based Succinic Acid Routes Creating High-Margin Copolymers

- 4.2.5 Water-Soluble Fertilizer Chelates Growth in South America

- 4.3 Market Restraints

- 4.3.1 Stricter Benzene Emission Caps in OECD Raising Compliance Cost

- 4.3.2 Global Oversupply from New Chinese Capacity

- 4.3.3 N-Butane Price Volatility Linked to Crude

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Price Trend

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Unsaturated Polyester Resin

- 5.1.2 1,4-Butanediol

- 5.1.3 Lubricant Additives

- 5.1.4 Maleic Anhydride Copolymers

- 5.1.5 Malic Acid

- 5.1.6 Fumaric Acid

- 5.1.7 Alkyl Succinic Anhydrides

- 5.1.8 Surfactants and Plasticizers

- 5.1.9 Other Product Types

- 5.2 By Raw Material

- 5.2.1 N-Butane

- 5.2.2 Benzene

- 5.3 By Physical Form

- 5.3.1 Solid (Flake/Prill)

- 5.3.2 Molten

- 5.4 By End-user Industry

- 5.4.1 Construction

- 5.4.2 Automobile

- 5.4.3 Electronics

- 5.4.4 Food and Beverage

- 5.4.5 Oil Products

- 5.4.6 Personal Care

- 5.4.7 Pharmaceuticals

- 5.4.8 Agriculture

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AOC

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Bartek Ingredients Inc.

- 6.4.5 BASF

- 6.4.6 Borealis AG

- 6.4.7 Clariant

- 6.4.8 Evonik Industries AG

- 6.4.9 Huntsman International LLC

- 6.4.10 I G Petrochemicals Ltd. (IGPL)

- 6.4.11 INEOS AG

- 6.4.12 LANXESS

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 NAN YA PLASTICS CORPORATION

- 6.4.15 NIPPON SHOKUBAI CO., LTD.

- 6.4.16 PETRONAS Chemicals Group Berhad

- 6.4.17 Polynt S.p.A.

- 6.4.18 Sinopec Qilu Petrochemical

- 6.4.19 SK Functional Polymer

- 6.4.20 Thirumalai Chemicals

- 6.4.21 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Commercialization of Bio-based Maleic Anhydride