|

市場調查報告書

商品編碼

1836653

汽車燃油濾清器:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Fuel Filter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

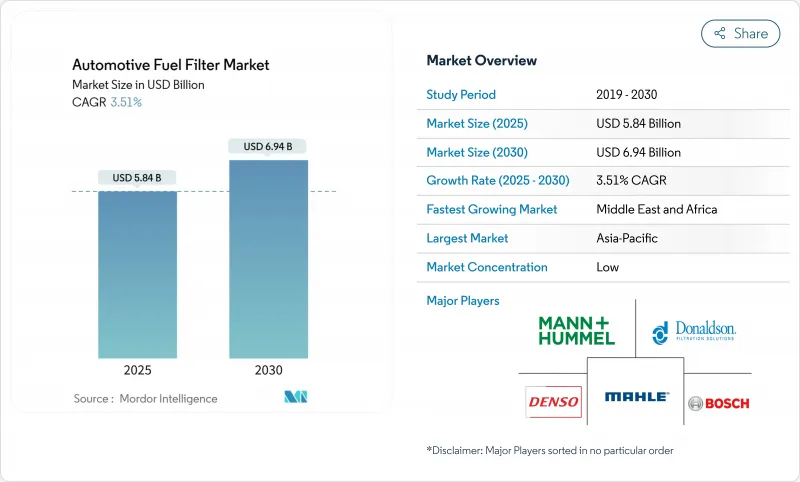

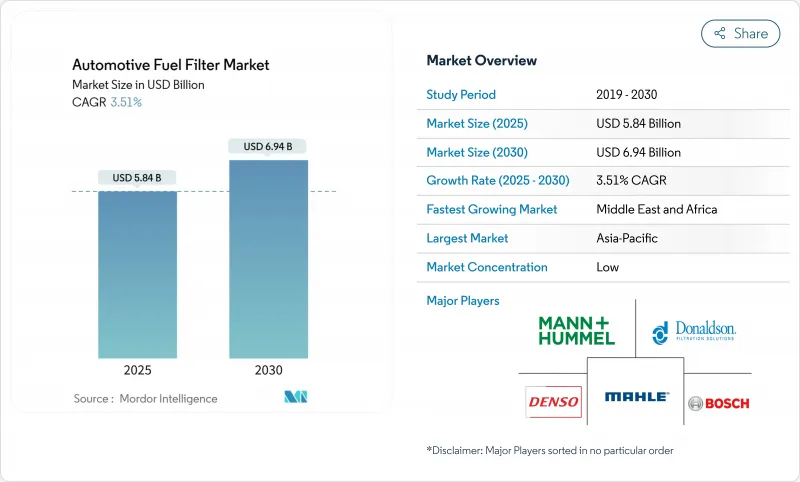

預計汽車燃油濾清器市場規模到 2025 年將達到 58.4 億美元,到 2030 年將達到 69.4 億美元,年複合成長率為 3.51%。

由於車輛老化、排放法規趨嚴以及新興市場內燃機汽車產量持續成長,抵銷了電氣化帶來的結構性阻力,全球需求仍保持韌性。由於超低硫燃料法規要求採用先進的水分離器設計,柴油應用仍然是重要的收益來源,而生質燃料混合物和壓縮天然氣則構成了特種濾清器的平行成長通道。亞太和非洲汽車產量的快速成長支撐了對原廠配件的需求,而北美和歐洲則強調更換週期。數位零售、仿冒品風險和密封的「終身」模組正在重塑汽車燃油濾清器市場各個環節的競爭策略。

全球汽車燃油濾清器市場趨勢與洞察

全球汽車老化將增加對替換車輛的需求

隨著家庭預算收緊和新車庫存波動,全球汽車保有量正在成長。主要經合組織 (OECD) 市場的車齡已超過 13 年,導致車輛維護週期延長,濾清器更換頻率也更高,以保護敏感的噴油器。配備複雜高壓燃油輸送系統的輕型卡車和 SUV 正在推動零件周轉率。經銷商、獨立維修店和電器平台正在利用售後市場的這一利好,擴大其在汽車燃油濾清器市場的客戶群。零件經銷商擴大將燃油濾清器與其他維修套件捆綁銷售,以在價格敏感的市場中獲取整體價值並保住市場佔有率。

更嚴格的廢氣排放法規推動先進過濾的發展

歐6e法規將於2023年9月對新型內燃機車型生效,而歐7法規草案則提案了更低的顆粒物閾值,要求濾材在不犧牲納污能力的前提下達到亞5微米的過濾效率。與之類似的國六和巴拉特六指令則要求多級過濾和強大的水分離功能。供應商正在與引擎原始設備製造商密切合作,以使濾清器規格與後處理系統保持一致,同時測試通訊協定也在不斷收緊,以檢驗在各種含硫量下的耐久性。低階製造商面臨著不斷上升的認證成本,這可能會加速汽車燃油濾清器市場的整合。

電動車的加速普及將減少內燃機濾清器的數量

純電動車將取代燃油濾清器,預計到2030年,其在全球汽車銷售中的比例將達到50%。隨著製造商改造組裝以及政府實施零排放法規,成熟地區的燃油濾清器可維修市場將會萎縮。曾經依賴高利潤替換零件的維修店現在正將重點轉向電池診斷和軟體更新。因此,在電氣化進程較慢且輔助燃油模組仍整合到混合動力傳動系統中的地區,汽車燃油濾清器市場將迎來顯著成長。

報告中分析的其他促進因素和限制因素

- 亞太和非洲新車產量增加

- 生質燃料混合物的激增需要相容性升級

- 鋼鐵和聚合物投入價格波動對淨利率帶來壓力

細分分析

到 2024 年,柴油應用將成為最大的收益,佔汽車燃油濾清器市場佔有率的 48.37%,因為卡車、非公路用車和許多 SUV 都需要強大的水分離技術。超低硫法規使油箱內部暴露於冷凝和微生物污染之中,這也支持了柴油濾清器的成長。車隊營運商正在尋找能夠捕獲小至 2 微米顆粒並同時回收遊離水的過濾器。工程師正在開發能夠抵抗酯膨脹和甲烷特定污染物的彈性體和密封劑。替代燃料是成長最快的部分,到 2030 年的複合年成長率為 9.38%。印度的 CNG 公車和巴西的市政車隊正在支撐早期的銷售量,但這一部分的技術要求與柴油有很大不同,因此需要專門的 SKU 來控制溢價。

儘管汽油動力汽車市場面臨電動車普及的壓力,但在北美和歐洲部分地區,由於平均行駛里程數居高不下且停車場老化,汽油動力汽車市場仍保持著重要的地位。高壓缸內噴油系統需要亞5微米的過濾和對乙醇的耐化學性。供應商收到獨立維修店的穩定補貨訂單,這些維修店將濾清器更換與定期換油同步進行,增強了售後市場的韌性。柴油機製造商也在選擇性催化還原方面進行創新,並加入了可在壓差超出規定範圍時向操作員發出警報的感測器。這些診斷趨勢確保了替換零件的穩定供應,從而為整個汽車燃油濾清器市場帶來了穩定的收益。

纖維素仍將是使用最廣泛的介質,由於其生產成本低廉且原料豐富,到 2024 年將佔銷售額的 44.19%。然而,其固有的親水性和有限的耐溫性使其難以用於生質燃料混合物。因此,生產商在纖維素纖維上塗覆疏水劑,同時增加褶皺數以增強納污能力。合成複合材料、聚酯、聚丙烯和多層奈米纖維是成長最快的類別,複合年成長率為 5.72%。這些介質提供更長的維護間隔、更低的壓力差,並且與腐蝕性燃料化學品相容。水分離器濾芯擴大採用雙區設計,將褶皺合成纖維層與聚結絨相結合,可在排出之前將微滴壓成更大的珠子。

處理公司正在投資等離子處理和表面接枝技術,以調整纖維的極性。廣泛採用的方法是將氟化矽烷連接到聚酯上,使水接觸角超過150°,並能抵抗富含界面活性劑的柴油。在高階市場,熔噴奈米纖維層可增強基體介質,阻擋亞微米顆粒,這對於超高壓共軌柴油泵至關重要。擁有內部熔噴資產的製造商可以獲得規模優勢,從而從垂直整合的薄膜生產中獲得更多價值。

區域分析

亞太地區以中國、印度、泰國和印尼的汽車生產為主,到2024年,該地區將維持41.85%的汽車燃油濾清器市場佔有率。印度與生產連結獎勵計畫的舉措計畫已調動了數兆盧比的資本投資承諾,政策制定者預計零件出口也將呈現類似的成長軌跡。本地供應商正在與汽車製造商叢集相鄰,以降低物流成本並利用熟練勞動力。儘管中國加大了對新能源汽車的推廣力度,但傳統的汽油和柴油平台仍然在郊區和農村地區佔據主導地位,形成了穩定的更換週期。本土零件品牌正在加強對中東、東歐和南美的出口,其性價比在這些地區頗具吸引力。

中東和非洲是成長最快的地區,預計到2030年複合年成長率將達到5.11% 。波灣合作理事會國家正在利用碳氫化合物來實現道路建設、貨運走廊和公共交通的現代化,並擴大其公車和商用卡車車隊。環境濕度低往往會加劇燃料箱凝結,因此可靠的水分離能力尤其重要。進口商從歐洲和亞洲採購濾清器,但擴大考慮在岸組裝,以促進就業並縮短前置作業時間。在撒哈拉以南非洲地區,由於機動車保有量低,加上排放氣體法規寬鬆,導致傳統柴油繼續盛行,從而保護了汽車燃油濾清器市場免受電器產品的侵占。

由於電氣化獎勵和密封模組銷售萎縮,北美和歐洲市場呈現溫和成長。然而,更嚴格的顆粒物法規和缸內噴油的普及,迫使高階汽車升級,從而維持了平均售價。研討會正在推廣配套服務套餐,以抵消車輛需求的下降。再生濾清器方案在注重環保的駕駛中越來越受歡迎,他們希望在不影響保固的情況下減少對環境的影響。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 全球汽車保有量老化導致更換需求增加

- 更嚴格的廢氣排放法規推動先進過濾的發展

- 亞太和非洲新車產量增加

- 生質燃料混合物的激增需要相容性升級

- 超低硫柴油推動水分離過濾器需求

- 需要亞 5µm過濾的高壓 GDI 和 CRDI 系統的成長

- 市場限制

- 由於電動車普及率加快,內燃機濾清器數量減少

- 鋼鐵和聚合物投入價格波動導致利潤壓力

- OEM轉向密封「終身」燃油模組抑製售後市場

- 假冒廉價過濾器在開發中國家猖獗

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模與成長預測:價值(美元)、數量(單位)

- 按燃料類型

- 汽油

- 柴油引擎

- 替代燃料

- 按濾材

- 纖維素

- 合成材料(玻璃和聚酯)

- 多層複合材料

- 水分離器/聚結器元件

- 按車輛類型

- 搭乘用車

- 掀背車

- 轎車

- 運動型多用途車

- 多用途車輛

- 輕型商用車

- 中大型商用車

- 摩托車

- 非公路用車

- 農業機械

- 建築和採礦設備

- 搭乘用車

- 按銷售管道

- OEM

- 售後市場

- 有組織的零售商

- 獨立車庫

- 線上平台

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- MANN+HUMMEL

- Donaldson Company, Inc.

- MAHLE GmbH

- Robert Bosch GmbH

- DENSO CORPORATION

- Cummins Inc.(Fleetguard)

- Parker Hannifin Corp(Racor)

- Sogefi Group

- Hengst SE

- UFI Filters

- Baldwin Filters

- Fram Group

- K&N Engineering Inc.

- ACDelco(General Motors)

- Champion Laboratories

第7章 市場機會與未來展望

The automotive fuel filter market was worth USD 5.84 billion in 2025 and is forecast to reach USD 6.94 billion by 2030, reflecting a moderate 3.51% CAGR.

Global demand remains resilient as ageing vehicle fleets, stricter emission rules, and sustained production of internal-combustion vehicles in emerging economies offset the structural headwinds of electrification. Diesel applications preserve a sizeable revenue base because ultra-low-sulphur fuel legislation compels advanced water-separator designs, while bio-fuel blends and compressed natural gas create a parallel growth corridor for specialised filters. Rapid vehicle output in Asia-Pacific and Africa underpins original-equipment demand, whereas North America and Europe shift focus toward the replacement cycle. Digital retail, counterfeit risks, and sealed "lifetime" modules are reshaping competitive strategies across all tiers of the automotive fuel filter market.

Global Automotive Fuel Filter Market Trends and Insights

Ageing Global Vehicle Parc Expanding Replacement Demand

Global fleets are staying on the road for longer as household budgets tighten and new-car inventories fluctuate. Average passenger-car age in major OECD markets now exceeds 13 years, and extended maintenance schedules drive more frequent filter replacement to protect sensitive injectors. Light trucks and SUVs, which contain complex high-pressure fuel delivery systems, add to parts turnover. Dealers, independent garages, and e-commerce platforms leverage this aftermarket tailwind, enlarging the customer pool for the automotive fuel filter market. Parts distributors increasingly bundle fuel filters with other service kits to capture basket value and defend share in a price-sensitive environment.

Tighter Tail-Pipe Emission Norms Driving Advanced Filtration

Euro 6e rules took effect for new internal-combustion models in September 2023, and draft Euro 7 standards propose even lower particulate thresholds, forcing filter media to achieve sub-5-micron efficiency without sacrificing dirt-holding capacity. Comparable China VI and Bharat VI mandates require multi-stage filtration and robust water separation. Suppliers collaborate closely with engine OEMs to align filter specifications with after-treatment systems, while testing protocols have become stricter to validate durability across varying sulfur levels. Down-tier manufacturers face rising certification costs that may accelerate consolidation inside the automotive fuel filter market.

Accelerating EV Penetration Cannibalizing ICE Filter Volumes

Battery-electric vehicles eliminate the need for fuel filtration, and their share of world car sales is projected to reach 50% by 2030. As manufacturers convert assembly lines and governments introduce zero-emission mandates, the serviceable market for fuel filters in mature regions declines. Workshops that once relied on high-margin replacement parts now pivot toward battery diagnostics and software updates. The automotive fuel filter market, therefore, grows largely where electrification rollouts are slower or where hybrid powertrains still incorporate auxiliary fuel modules.

Other drivers and restraints analyzed in the detailed report include:

- Rising New-Vehicle Output in Asia-Pacific and Africa

- Surge in Bio-Fuel Blends Requiring Compatibility Upgrades

- Volatile Steel and Polymer Input Prices Squeezing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diesel applications generated the highest revenue in 2024, holding 48.37% of the automotive fuel filter market share because trucks, off-highway machinery, and many SUVs require robust water-separator technology. Growth is sustained by ultra-low-sulfur mandates that expose tanks to condensation and microbial contamination. Fleet operators prize filters that trap particles down to 2 microns while collecting free water. Engineers are adapting elastomers and sealants to resist ester-induced swelling and methane-specific contaminants. Alternative fuels represent the fastest-growing segment at 9.38% CAGR through 2030. CNG buses in India and municipal fleets in Brazil underpin early volume, yet the segment's technical requirements differ sharply from diesel, leading to specialised SKUs that command premium pricing.

The gasoline category, although pressured by electric-vehicle uptake, retains importance in ageing car parks across North America and parts of Europe where average mileage remains high. High-pressure gasoline direct injection systems demand sub-5-micron filtration and chemical resistance to ethanol. Suppliers see steady replenishment orders from independent workshops that align filter swaps with scheduled oil changes, reinforcing aftermarket stickiness. Diesel manufacturers also innovate around selective catalytic reduction, embedding sensors to alert operators when differential pressure rises beyond specification. This diagnostic trend ensures consistent pull-through for replacement parts and supports overall revenue stability in the automotive fuel filter market.

Cellulose remained the most widely used medium, contributing 44.19% of 2024 revenue thanks to low production cost and abundant feedstock. Yet its innate hydrophilicity and limited temperature resistance challenge its suitability for bio-fuel blends. Producers therefore coat cellulose fibres with hydrophobic agents while boosting pleat counts to raise dirt-holding capacity. Synthetic composites, polyester, polypropylene, and multi-layer nanofibers form the fastest-growing cohort at a 5.72% CAGR. These media achieve longer service intervals, lower differential pressure, and compatibility with aggressive fuel chemistries. Water-separator cartridges increasingly incorporate dual-zone designs, pairing a pleated synthetic layer with a coalescing fleece that forces micro-droplets to form larger beads before drainage.

Suppliers invest in plasma treatment and surface grafting to tailor fibre polarity. One widely adopted method bonds fluorinated silanes onto polyester, achieving water contact angles above 150° and resisting surfactant-rich diesel. In premium segments, melt-blown nanofibre layers augment base media to block particles below 1 micron, essential for ultra-high-pressure common-rail diesel pumps. Fabricators with in-house melt-blown assets gain scale advantages because they capture more value from vertically integrated membrane production.

The Automotive Fuel Filters Market Report is Segmented by Fuel Type (Gasoline, Diesel, and Alternative Fuels), Filter Media (Cellulose, Synthetic (Glass and Polyester), and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific retained a commanding 41.85% share of the automotive fuel filter market in 2024, driven by prolific vehicle production across China, India, Thailand, and Indonesia. India's Production Linked Incentive initiative has mobilized trillions of rupees in capex commitments, and policy planners expect component exports to follow similar trajectories. Local suppliers co-locate near OEM clusters to lower logistics costs and tap skilled labour pools. Even as China intensifies its new-energy-vehicle push, legacy gasoline and diesel platforms still dominate suburban and rural fleets, creating a steady replacement cycle. Domestic component brands strengthen export footprints into the Middle East, Eastern Europe, and South America, where their cost-to-performance ratio resonates.

The Middle East and Africa region is the fastest-growing territory, forecast at 5.11% CAGR through 2030. Gulf Cooperation Council states allocate hydrocarbons windfalls to road construction, freight corridors, and public-transport modernisation, which enlarges the rolling stock of buses and commercial trucks. Low ambient humidity often accelerates fuel tank condensation, elevating the importance of reliable water-separation features. Importers source filters from Europe and Asia but increasingly explore onshore assembly to stimulate jobs and shorten lead times. Sub-Saharan Africa's young vehicle parc, coupled with lenient emission schedules, allows conventional diesel to remain prevalent, cushioning the automotive fuel filter market against electric encroachment.

North America and Europe exhibit modest growth as electrification incentives and sealed modules shrink volumes. Nevertheless, stringent particulate regulations and widespread adoption of gasoline direct injection force premium media upgrades, preserving average selling prices. Workshops promote bundled service packages to offset declining unit demand. Remanufactured filter programs gain popularity among eco-conscious drivers who seek lower environmental footprints without compromising warranty.

- MANN+HUMMEL

- Donaldson Company, Inc.

- MAHLE GmbH

- Robert Bosch GmbH

- DENSO CORPORATION

- Cummins Inc. (Fleetguard)

- Parker Hannifin Corp (Racor)

- Sogefi Group

- Hengst SE

- UFI Filters

- Baldwin Filters

- Fram Group

- K&N Engineering Inc.

- ACDelco (General Motors)

- Champion Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing global vehicle parc expanding replacement demand

- 4.2.2 Tighter Tail-Pipe Emission Norms Driving Advanced Filtration

- 4.2.3 Rising new-vehicle output in Asia-Pacific and Africa

- 4.2.4 Surge in bio-fuel blends requiring compatibility upgrades

- 4.2.5 Ultra-low-sulfur diesel boosting water-separator filter demand

- 4.2.6 Growth of high-pressure GDI and CRDI systems demanding Below 5 µm filtration

- 4.3 Market Restraints

- 4.3.1 Accelerating EV penetration cannibalizing ICE filter volumes

- 4.3.2 Volatile steel and polymer input prices squeezing margins

- 4.3.3 OEM shift toward sealed "lifetime" fuel modules curbing aftermarket

- 4.3.4 Proliferation of counterfeit low-cost filters in developing nations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Fuel Type

- 5.1.1 Gasoline

- 5.1.2 Diesel

- 5.1.3 Alternative Fuels

- 5.2 By Filter Media

- 5.2.1 Cellulose

- 5.2.2 Synthetic (Glass and Polyester)

- 5.2.3 Multi-layer Composites

- 5.2.4 Water-Separator / Coalescer Elements

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.1.1 Hatchback

- 5.3.1.2 Sedan

- 5.3.1.3 Sport Utility Vehicle

- 5.3.1.4 Multi-Purpose Vehicle

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Two-Wheelers

- 5.3.5 Off-Highway

- 5.3.5.1 Agricultural Machinery

- 5.3.5.2 Construction and Mining Machinery

- 5.3.1 Passenger Cars

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.4.2.1 Organized Retailers

- 5.4.2.2 Independent Garages

- 5.4.2.3 Online Platforms

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 MANN+HUMMEL

- 6.4.2 Donaldson Company, Inc.

- 6.4.3 MAHLE GmbH

- 6.4.4 Robert Bosch GmbH

- 6.4.5 DENSO CORPORATION

- 6.4.6 Cummins Inc. (Fleetguard)

- 6.4.7 Parker Hannifin Corp (Racor)

- 6.4.8 Sogefi Group

- 6.4.9 Hengst SE

- 6.4.10 UFI Filters

- 6.4.11 Baldwin Filters

- 6.4.12 Fram Group

- 6.4.13 K&N Engineering Inc.

- 6.4.14 ACDelco (General Motors)

- 6.4.15 Champion Laboratories

7 Market Opportunities and Future Outlook

- 7.1 White-space & Unmet-need Assessment