|

市場調查報告書

商品編碼

1836643

印尼紡織製造業:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Indonesia Textile Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

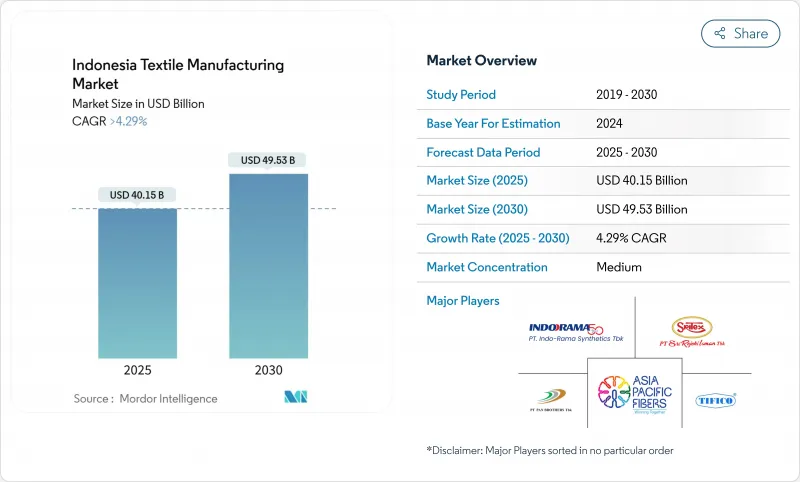

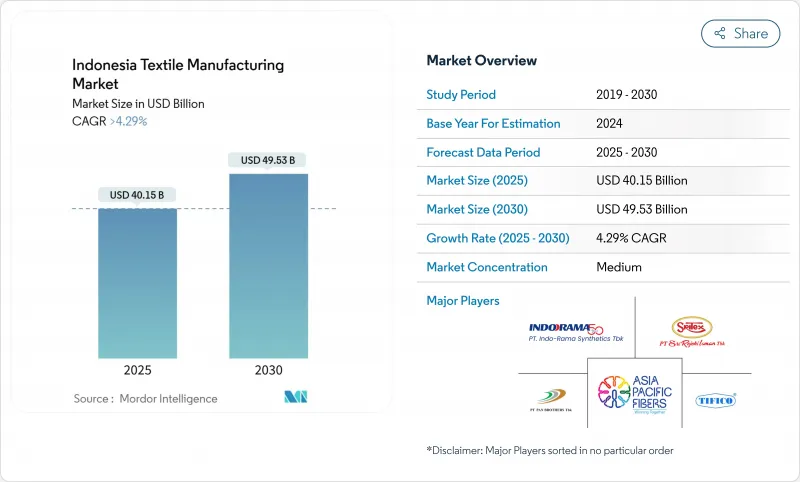

預計到 2025 年,印尼紡織製造市場價值將達到 401.5 億美元,到 2030 年將達到 495.3 億美元,複合年成長率為 4.29%。

「打造印尼4.0」藍圖帶來的強大政策支持、豐富的技術純熟勞工資源以及國際訂單的復甦,使印尼成為尋求在亞洲實現供應鏈多元化的品牌的重要採購中心。爪哇島成熟的工業生態系統,加上日益提升的工廠自動化和石化一體化水平,在工資壓力不斷上升的背景下仍保持著成本競爭力。適度穿著和技術紡織品的需求不斷成長,持續提升生產質量,而向再生纖維的轉變則表明其與全球永續性標準的接軌程度不斷提高。儘管存在物流瓶頸和進口主導的價格競爭,但積極的稅收優惠政策、綠色產業認證和區域發展計畫仍為中期成長前景提供支持。

印尼紡織製造市場趨勢與洞察

越來越多的美國和歐盟品牌將運動服訂單轉移到爪哇叢集

亞洲傳統樞紐的人事費用不斷上漲,以及對更快補貨的需求,正促使西方品牌在爪哇島擴張至更大的工廠。年產能達1.17億件的Pan Brothers公司已獲得更多高性能針織品契約,凸顯了其向印尼的戰略重心。爪哇工業內紗線、布料和服裝工廠的緊密聯繫縮短了前置作業時間,並降低了處理成本。即便如此,美國可能上調關稅的不確定性仍是生產商觀點。

穆斯林時尚出口繁榮推動增值服飾生產

印尼正利用其文化親和性和設計人才,為不斷擴張的全球時尚產業提供產品。據估計,到2023年,全球時尚產業的產值將達到3,610億美元。在紐約時裝週的展示提升了本土品牌的國際知名度,並使其能夠獲得更高的價格分佈。高附加價值的產品線能夠加強客戶關係,並需要先進的裝飾技術,這促使工廠投資於專用機械和熟練的工匠。

非法低成本進口侵蝕中小企業紡織利潤

由於非法進口導致當地價格下跌,工廠倒閉和裁員,政府正在收緊進口許可證並加強檢查。即使徵收200%的保障性關稅,執法不力也導致假冒仿冒品紡織品順利通過港口,導致社區紡織叢集無法收回管理成本。新的Permenperin 5/2024法規旨在透過明確文件要求和同步海關資料庫來彌補漏洞。

報告中分析的其他促進因素和限制因素

- 政府的「印尼4.0」激勵措施加速紡織自動化

- 電商主導國內服飾需求在天才消費者中激增

- 長期的港口和鐵路瓶頸導致島際物流成本膨脹

細分分析

至2024年,機織布料將在印尼紡織品製造市場中保持37.3%的佔有率,西爪哇省叢集已建成梭子織布機和劍桿織布機產能。生產將主要面向襯衫和丹寧布料,出口量將保持穩定。同時,受高性能服飾和休閒系列激增的推動,到2030年,針織品的複合年成長率將達到5.08%。生產商將採用圓針織機,這種機器可以實現小批量生產並採用功能性混紡紗線,以適應在線零售商青睞的短版生產模式。

針織品的成長也反映了運動服飾品牌尋求東南亞快速補貨的訂單增加。爪哇的製造商透過整合染色和印花設施,提供全套服飾,從而比僅提供布料的供應商獲得更高的價值。從中期來看,無縫結構等先進的針織技術預計將提高生產力並減少後期生產浪費,從而增強印尼在舒適服裝領域的競爭地位。

到2024年,服飾將佔印尼紡織品製造市場佔有率的59.5%,這反映了該國深厚的縫紉專業知識和充足的勞動力。生產商正在從單一的裁剪、製衣和修剪服務轉向全包裝服務,為品牌客戶提供設計意見、商品行銷和合規文件。技術和工業紡織品將成為成長最快的細分市場,複合年成長率為5.04%,這反映了汽車原始設備製造商的基礎設施投資和本地化進程。

服飾持續主導,也得益於印尼時裝的利基市場。該市場將傳統圖案與現代輪廓融合,瞄準出口市場。控制上游布料和染色製程的綜合性公司提高了利潤率,並確保了與品牌審核的品質一致性。同時,僅生產布料的生產商正在將更多生產轉向防護衣、過濾和汽車零件,從而減少對時尚週期的依賴。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 政府的「印尼製造4.0」獎勵措施加速紡織自動化

- 越來越多的美國和歐盟品牌將運動服近岸外包至爪哇叢集

- 穆斯林時尚出口繁榮推動高附加價值服飾生產

- 電子商務主導Z世代消費者國內服飾需求激增

- 棉花依賴度高,人造纖維進口替代正在推進

- 中爪哇綠色染料廠升級專案投資者稅收減免

- 市場限制

- 非法低成本進口損害中小企業紡織利潤

- 長期的港口和鐵路瓶頸增加了島嶼間的物流成本

- 不穩定的印尼國家電力收費系統對能源密集型紡織業帶來壓力

- 西爪哇的勞動力短缺和工資上漲

- 價值鏈/供應鏈分析

- 監管和政府主導的前景

- 技術展望-為工業4.0和數位轉型做好準備

- 產業吸引力—五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 近期全球動盪對印尼紡織製造業的影響

- 永續性和循環經濟的趨勢

第5章市場規模及成長預測

- 依流程類型

- 紡紗

- 織物

- 針織

- 精加工

- 其他工藝(不織布)

- 依紡織品類型

- 纖維

- 線

- 織物

- 衣服

- 其他紡織品

- 按材質

- 天然纖維(棉、絲等)

- 合成纖維(聚酯、尼龍等)

- 其他(再生及再循環纖維、特殊纖維)

- 按用途

- 服飾

- 家用紡織品

- 工業紡織品

- 其他用途

- 按地區(印尼)

- Java

- 蘇門答臘

- 其他(加里曼丹、蘇拉威西、峇裡島等)

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介{ }(英文)

- PT Asia Pacific Fibres Tbk

- Indo-Rama Synthetics Tbk

- PT Sri Rejeki Isman Tbk(Sritex)

- PT Tifico Fiber Indonesia Tbk

- PT Pan Brothers Tbk

- PT Ever Shine Tex Tbk

- PT Trisula Textile Industries Tbk

- PT Century Textile Industry Tbk(Toray)

- PT Polychem Indonesia Tbk

- PT Argo Pantes Tbk

- Duniatex Group

- PT Kahatex

- PT Apac Inti Corpora

- PT Eratex Djaja Tbk

- PT Ateja Tritunggal

- PT Sinar Para Taruna

- PT Kewalram Indonesia

- PT Pura Group(Textile Div.)

- PT Multi Garmenjaya

- PT Delami Garment Industries

第7章 市場機會與未來展望

The Indonesia Textile Manufacturing Market is valued at USD 40.15 billion in 2025 and is projected to reach USD 49.53 billion by 2030, expanding at a 4.29% CAGR.

Robust policy backing through the Making Indonesia 4.0 roadmap, a large pool of skilled labor, and resurging foreign orders position the country as a vital sourcing hub for brands looking to diversify Asian supply chains. Java's mature industrial ecosystem, together with rising factory automation and petrochemical integration, sustains cost competitiveness even as wage pressures inch up. Expanding demand for modest wear and technical textiles continues to lift output quality, while the shift toward recycled fibers signals growing alignment with global sustainability standards. Despite logistics bottlenecks and import-led price competition, proactive tax incentives, green-industry certifications, and regional development programs underpin medium-term growth prospects.

Indonesia Textile Manufacturing Market Trends and Insights

Rising Near-Shoring of Activewear Orders from US & EU Brands to Java Clusters

Labor cost escalation in legacy Asian hubs and the need for faster replenishment bring Western labels to Java's large-scale plants. Pan Brothers, with annual capacity of 117 million pieces, has secured incremental contracts for performance knitwear, underscoring the pivot toward Indonesia. Close proximity among yarn, fabric, and garment units inside the island's industrial estates compresses lead times and lowers handling expenses. Nevertheless, uncertainty over potential US tariff hikes remains a watchpoint for producers.

Boom in Muslim Fashion Exports Driving Value-Added Garment Production

Indonesia leverages cultural affinity and design talent to supply the expanding global modest-fashion segment, estimated at USD 361 billion in 2023. Showcases at New York Fashion Week have raised international visibility, allowing local brands to command higher price points. Value-added lines create stickier customer relationships and require advanced embellishment techniques, prompting mills to invest in specialty machinery and skilled artisans.

Illegal Low-Priced Imports Eroding SME Weaving Margins

Unlawful inflows undercut local price points and have triggered factory closures and layoffs, pushing the government to tighten import permits and step up inspections. Even with 200% safeguard tariffs, weak enforcement lets counterfeit and sub-standard fabrics slip through ports, leaving community-based weaving clusters unable to recover overheads. The new Permenperin 5/2024 regulation aims to close loopholes by clarifying documentation requirements and synchronizing customs databases.

Other drivers and restraints analyzed in the detailed report include:

- Government "Making Indonesia 4.0" Incentives Accelerating Textile Automation

- Surge in E-Commerce-Led Domestic Apparel Demand Among Gen-Z Consumers

- Chronic Port & Rail Bottlenecks Inflating Inter-Island Logistics Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Weaving retained a 37.3% share of the Indonesia textile manufacturing market in 2024, anchored by entrenched shuttle and rapier loom capacity across West Java clusters. Output caters mainly to shirtings and denim, segments that still support steady export volumes. Knitting, however, posts a 5.08% CAGR through 2030 as performance apparel and athleisure lines surge. Producers deploy circular knitting machines capable of smaller lot sizes and functional yarn blends, aligning with the short-run model favored by online retailers.

Knitting's growth also reflects rising orders from sportswear labels seeking quick replenishment out of Southeast Asia. Java-based makers leverage co-located dye-houses and print shops to deliver fully packaged garments, capturing greater value than fabric-only suppliers. In the medium term, advanced knitting techniques such as seamless construction are expected to lift productivity and reduce post-production waste, reinforcing Indonesia's competitiveness in comfort apparel.

Garments represented 59.5% of the Indonesia textile manufacturing market share in 2024, testifying to the country's deep sewing expertise and abundant workforce. Producers have moved beyond cut-make-trim to full-package services, offering design input, merchandising, and compliance documentation to brand customers. The fastest expansion occurs in technical and industrial textiles at 5.04% CAGR, reflecting infrastructure spending and automotive OEM localization.

Continued garment leadership also stems from Indonesia's modest-wear niche, where brands merge traditional motifs with modern silhouettes for export markets. Integrated players that control upstream fabric and dyeing steps capture improved margins and ensure quality alignment with brand audits. Meanwhile, fabric-only producers channel more output into protective wear, filtration, and automotive components, reducing reliance on fashion cycles.

The Indonesia Textile Manufacturing Market Report is Segmented by Process Type (Weaving, Knitting, Spinning, and More), by Textile Type (Fabric, Yarn, Fiber, and More), by Material Type (Natural Fibers (Cotton, Silk Etc. ), and More), by Application (Apparel, Home Textiles, and More), and by Region (Java, Sumatra and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- PT Asia Pacific Fibres Tbk

- Indo-Rama Synthetics Tbk

- PT Sri Rejeki Isman Tbk (Sritex)

- PT Tifico Fiber Indonesia Tbk

- PT Pan Brothers Tbk

- PT Ever Shine Tex Tbk

- PT Trisula Textile Industries Tbk

- PT Century Textile Industry Tbk (Toray)

- PT Polychem Indonesia Tbk

- PT Argo Pantes Tbk

- Duniatex Group

- PT Kahatex

- PT Apac Inti Corpora

- PT Eratex Djaja Tbk

- PT Ateja Tritunggal

- PT Sinar Para Taruna

- PT Kewalram Indonesia

- PT Pura Group (Textile Div.)

- PT Multi Garmenjaya

- PT Delami Garment Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government "Making Indonesia 4.0" incentives accelerating textile automation

- 4.2.2 Rising near-shoring of activewear orders from US & EU brands to Java clusters

- 4.2.3 Boom in Muslim fashion exports driving value-added garment production

- 4.2.4 Surge in e-commerce-led domestic apparel demand among Gen-Z consumers

- 4.2.5 Import-substitution push for man-made fibers amid high cotton dependency

- 4.2.6 Investor tax breaks for green dye-house upgrades in Central Java

- 4.3 Market Restraints

- 4.3.1 Illegal low-priced imports eroding SME weaving margins

- 4.3.2 Chronic port & rail bottlenecks inflating inter-island logistics cost

- 4.3.3 Volatile PLN electricity tariffs squeezing energy-intensive spinning

- 4.3.4 Tight labour pool in West Java driving wage inflation vs. Vietnam

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Government-Initiative Outlook

- 4.6 Technological Outlook - Industry 4.0 & Digital Transformation Readiness

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Recent Global Disruptions on the Indonesia Textile Manufacturing Industry

- 4.9 Sustainability & Circular Economy Trends

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Process Type

- 5.1.1 Spinning

- 5.1.2 Weaving

- 5.1.3 Knitting

- 5.1.4 Finishing

- 5.1.5 Other Processes (non-woven)

- 5.2 By Textile Type

- 5.2.1 Fiber

- 5.2.2 Yarn

- 5.2.3 Fabric

- 5.2.4 Garments

- 5.2.5 Other Textiles

- 5.3 By Material Type

- 5.3.1 Natural Fibers (Cotton, Silk etc.)

- 5.3.2 Synthetic Fibers (Polyester, Nylon etc.)

- 5.3.3 Others (Regenerated & Recycled Fibers, Speciality Fibers)

- 5.4 By Application

- 5.4.1 Apparel

- 5.4.2 Home Textiles

- 5.4.3 Technical/Industrial Textiles

- 5.4.4 Other Applications

- 5.5 By Region (Indonesia)

- 5.5.1 Java

- 5.5.2 Sumatra

- 5.5.3 Others (Kalimantan, Sulawesi, Bali, etc.)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 PT Asia Pacific Fibres Tbk

- 6.4.2 Indo-Rama Synthetics Tbk

- 6.4.3 PT Sri Rejeki Isman Tbk (Sritex)

- 6.4.4 PT Tifico Fiber Indonesia Tbk

- 6.4.5 PT Pan Brothers Tbk

- 6.4.6 PT Ever Shine Tex Tbk

- 6.4.7 PT Trisula Textile Industries Tbk

- 6.4.8 PT Century Textile Industry Tbk (Toray)

- 6.4.9 PT Polychem Indonesia Tbk

- 6.4.10 PT Argo Pantes Tbk

- 6.4.11 Duniatex Group

- 6.4.12 PT Kahatex

- 6.4.13 PT Apac Inti Corpora

- 6.4.14 PT Eratex Djaja Tbk

- 6.4.15 PT Ateja Tritunggal

- 6.4.16 PT Sinar Para Taruna

- 6.4.17 PT Kewalram Indonesia

- 6.4.18 PT Pura Group (Textile Div.)

- 6.4.19 PT Multi Garmenjaya

- 6.4.20 PT Delami Garment Industries

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment