|

市場調查報告書

商品編碼

1836637

汽車氣動致動器:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Automotive Pneumatic Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

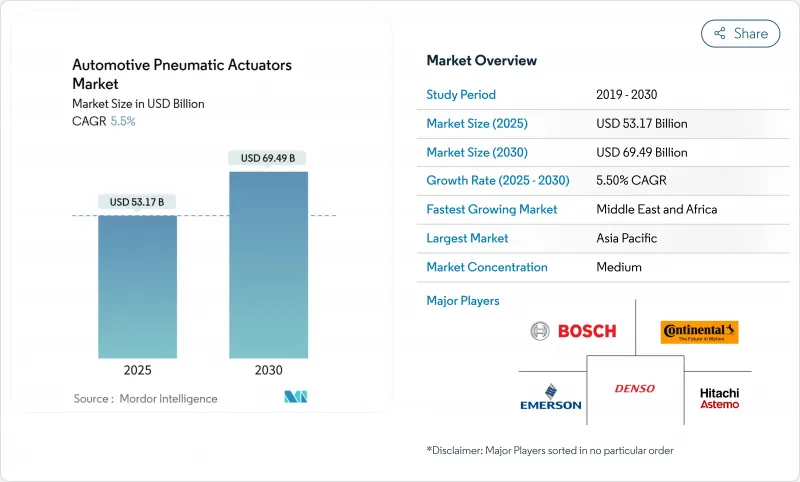

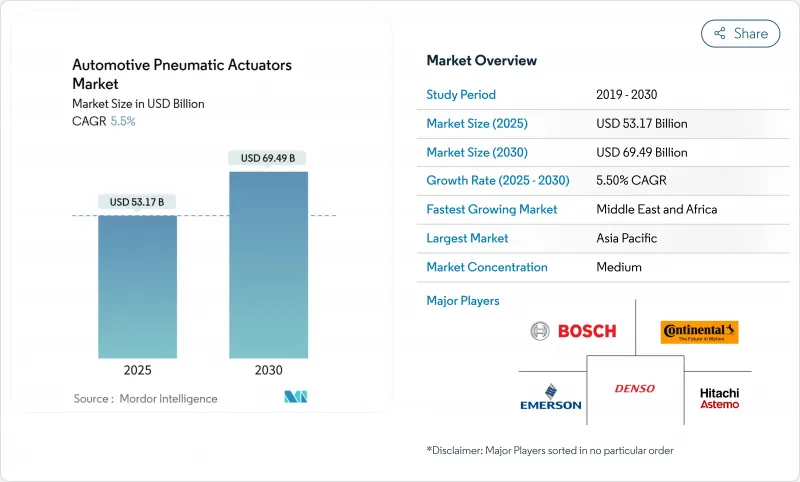

預計 2025 年汽車氣動致動器市場規模為 531.7 億美元,到 2030 年將達到 694.9 億美元,預測期內(2025-2030 年)的複合年成長率為 5.50%。

儘管面臨節能電動致動器的競爭,汽車製造商仍依賴氣動元件來實現安全、動力傳動系統和底盤功能。更嚴格的排放法規和日益普及的ADAS(高級駕駛輔助系統)正在推動氣動元件的需求,亞太地區憑藉其強大的供應鏈引領市場。同時,由於本地組裝專案的擴張,中東、非洲和南美洲也正在經歷快速成長。

全球汽車氣動致動器市場趨勢與洞察

更嚴格的排放法規鼓勵精確的空燃比控制

美國環保署 (EPA) 第三階段重型車輛法規將於 2024 年生效,該法規將收緊氮氧化物基準值,迫使柴油機製造商改進依賴高解析度氣動閥門的廢氣再循環 (EGR) 和計量策略。在歐洲,類似的歐 7 草案將引發需求高峰。實驗室測試將被現場檢驗測試取代,致動器必須在實際振動和溫度變化下保持精確度。擁有可閉合數位回饋迴路的電動氣動套件的供應商將在競標中享有明顯優勢。監管時間表將加快中標決策,並確保整個預測期內的收益可見度。

全球汽車產量增加

隨著輕型和重型車輛產量的增加,每個組裝單元都將配備多個致動器點,從而推高所有氣壓應用的基準需求。日本汽車工業協會 (JAMA) 已確認,2025 年原始設備製造商 (OEM) 的時間表包括在煞車、油門和 EGR 迴路中整合氣動解決方案,以確保燃油效率和合規性。平台共用將進一步擴大產量,因為現在可以在同級車型中安裝單一致動器系列,從而提高供應商的規模經濟效益。西方製造商正在將組裝轉移到東南亞,促使致動器製造商將模組化生產線設在同一地點。因此,即使競爭對手的電動致動器提高了成本提案,產量的復甦也確保了汽車氣動致動器市場的短期成長。

轉向節能電動致動器

機電系統將電池電能轉換為運動,效率高達 80%。這種差異在電動車中更為明顯,每節省一瓦電,就意味著續航里程的增加。生產線製造商也將焊接機器人和物料輸送臂遷移到電動缸,以提高路徑精度。然而,在壓縮空氣已整合到汽車平臺的重載節點(例如重型卡車的氣壓煞車)中,氣動技術仍然佔據主導地位。因此,供應商正在致力於開發混合技術致動器,該執行器結合了低能耗位置控制,同時保留了基於壓力的力道。

報告中分析的其他促進因素和限制因素

- ADAS 的普及需要精確的驅動

- 減輕重量以提高燃油效率的趨勢

- 氣動複雜性與高維修成本

細分分析

2024年,煞車氣室和停車煞車卡鉗單元將佔汽車氣動致動器市場的31.50%。所有乘用車和商用車都必須配備這些零件,這鞏固了基準基線。儘管電子機械停車煞車正在豪華轎車領域取得進展,但重型卡車的鼓式煞車仍然依賴氣室來實現高扣夾力和低單位成本。渦輪增壓器排氣泄壓閥致動器將是成長最快的領域,複合年成長率為6.70%。油門、暖通空調混合門和廢氣再循環蝶閥將保持中等個位數成長,這主要受監管或舒適性需求的驅動。

氣動燃油噴射軌道調節器在巴西流行的靈活燃料佈局中依然存在,門鎖柱塞在成本敏感的掀背車中仍然很常見。供應商正在嘗試將智慧壓力感測器嵌入致動器主體,以便將健康數據輸入車輛控制網路。即使在直接電動馬達驅動縮小競爭差距的情況下,此增強功能仍能延長氣動設備的使用壽命。總體而言,由於多種應用,汽車氣動致動器市場仍維持著數十億美元的收入。

2024年,乘用車將佔汽車銷售量的56.70%,反映了全球工廠的高產量。然而,重型商用車預計將以5.90%的複合年成長率推動汽車氣動致動器市場規模的擴張。車隊營運商重視空氣煞車和空氣懸吊迴路在高強度工作循環下的耐用性,而更嚴格的二氧化碳排放法規要求最佳化壓縮機管理,而非全面更換技術。輕型商用廂型車將實現強勁的複合年成長率,這主要得益於電商小包裹需求和城市物流的成長。施工機械和採礦設備主要需要耐高溫排氣閥控制設備和堅固的轉向穩定器。

雖然摩托車仍然是一個集中在部分亞洲經濟體的微型細分市場,但Scooter原始設備製造商正在試驗低壓氣動伺服系統,用於自動離合器執行。郊區乘用車因其NVH優勢而傾向於緊湊型電動驅動,而重型車輛則因其力密度和久經考驗的耐用性而保留氣壓驅動。這種脫節將影響一級供應商未來的平台策略,迫使他們建立模組化系列,從微型到重型,而無需重新編寫其認證通訊協定。

區域分析

受中國多品牌乘用車生產和日本高精度閥門產能的推動,亞太地區將在2024年佔據全球銷售量的45.50%。該地區的複合年成長率預計將達到7.10%,因為越南、泰國和印度的供應基地正在提升價值曲線,使區域內採購對全球製造商更具吸引力。韓國的電動氣動研發中心利用該國先進的半導體生態系統,將壓力MEMS感測器整合到致動器PCB上,增強了其競爭地位。儘管電動車正在興起,但成本最佳化的微型車市場仍採用氣動暖通空調和渦輪增壓排氣泄壓閥閥裝置,為供應商提供了產量。

中東和非洲是成長最快的叢集,複合年成長率為7.80%。沙烏地阿拉伯的「2030願景」產業政策正在吸引CKD組裝,企業也需要商用卡車致動器組件的在地化,以支持其建築業的繁榮發展。阿拉伯聯合大公國(UAE)正在利用自由區物流,將零件套件轉口到非洲市場。土耳其加入歐洲關稅同盟的便利性正在促進零件出口,迫使氣動設備供應商擴大其在伊茲密爾和布爾薩的工廠。這些動態正在將採購從跨洲運輸轉向更靠近市場的生產,從而縮短了前置作業時間並減少了貨運排放。

在南美,該地區獨特的靈活燃料引擎架構正在刺激對廢氣再循環 (EGR) 和燃油軌致動器的需求,因為燃燒化學計量會根據乙醇混合物的變化而每日變化。跨國供應商正在推動在地採購法規,以便在米納斯吉拉斯安裝彈性體硫化機,而不是進口密封件。阿根廷的重型卡車組裝廠在貨幣穩定措施後正在復甦,這增加了對大容量煞車室的需求。外匯波動和政治風險抑制了前景,但裝置量的慣性使整個西半球的汽車氣動致動器市場保持韌性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 更嚴格的排放法規鼓勵精確的空燃比控制

- 全球汽車產量增加

- 需要精確操作的ADAS的普及

- 減輕重量以提高燃油效率

- 採用氫內燃機的氣門正時

- 透過支援 OTA 的致動器軟體收益

- 市場限制

- 轉向節能電動致動器

- 氣動致動器的複雜性和高維護成本

- 密封用高級彈性體短缺

- Tier-1脫碳,抑制氣動設備研發

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模與成長預測:價值(美元)與數量(單位)

- 按應用程式類型

- 節氣門致動器

- 燃油噴射致動器

- 致動器

- 廢氣再循環致動器

- 渦輪增壓器廢氣旁通致動器

- HVAC致動器

- 門鎖致動器

- 其他

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 非公路用車

- 摩托車

- 按致動器機構

- 單膜片氣壓

- 真空增壓氣壓

- 電動氣動(EP)

- 伺服氣壓

- 齒條和小齒輪

- 轉葉

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 埃及

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Emerson(ASCO Valve)

- Hitachi Astemo Ltd

- CTS Corporation

- Schrader Duncan Ltd

- Rotex Automation

- Nucon Industries Pvt Ltd

- Magneti Marelli SpA

- Mitsubishi Electric Corp

- Del-Tron Precision Inc

- Procon Engineering

- Valeo SA

- Aisin Corporation

- Mahle GmbH

- BorgWarner Inc

第7章 市場機會與未來展望

The Automotive Pneumatic Actuators Market size is estimated at USD 53.17 billion in 2025, and is expected to reach USD 69.49 billion by 2030, at a CAGR of 5.50% during the forecast period (2025-2030).

Despite competition from energy-efficient electric actuators, vehicle makers continue to rely on pneumatic devices for safety, powertrain, and chassis functions. Stricter emission regulations and the growing adoption of ADAS drive demand, with Asia-Pacific leading due to strong supply chains. At the same time, the Middle East and Africa, as well as South America, see rapid growth from expanding local assembly programs.

Global Automotive Pneumatic Actuators Market Trends and Insights

Stricter emission norms driving precise air-fuel control

The US EPA's Phase 3 heavy-duty standards enacted in 2024 tighten NOx thresholds, compelling diesel makers to refine EGR and dosing strategies that rely on high-resolution pneumatic valves. Similar Euro 7 drafts trigger demand peaks in Europe. Field-valid testing replaces laboratory cycles, forcing actuators to sustain precision under real-world vibration and temperature excursions. Suppliers with electro-pneumatic packages that close the digital feedback loop enjoy distinct bidding advantages. The regulatory timetable accelerates award decisions, locking in revenue visibility for the forecast period.

Increasing global vehicle production

Rising light-duty and heavy-duty volumes lift baseline demand across all pneumatic applications because every unit assembled carries multiple actuator points. The Japan Automobile Manufacturers Association confirmed that OEM schedules for 2025 still embed pneumatic solutions in brake, throttle, and EGR circuits to assure fuel efficiency and compliance. Platform sharing further magnifies volumes because a single actuator family can now be fitted across sibling models, raising economies of scale for suppliers. Western manufacturers are repositioning final-assembly footprints toward Southeast Asia, which encourages actuator makers to co-locate module lines. The production rebound therefore secures near-term growth in the automotive pneumatic actuators market even as electric rivals sharpen their cost proposition.

Shift toward energy-efficient electric actuators

Electromechanical systems convert battery power into motion with up to 80% efficiency, dwarfing the 20% ceiling of air-driven counterparts. The delta becomes more pronounced in electric cars, where every watt saved extends range. Line-builders are also migrating their welding robots and material-handling arms to electric cylinders for tighter path accuracy. Yet pneumatics still dominates the highest-force nodes, such as heavy truck drum brakes, where compressed air is already integral to the vehicle platform. Consequently suppliers are channeling R&D toward mixed-technology actuators that preserve pressure-based force while embedding low-energy position control.

Other drivers and restraints analyzed in the detailed report include:

- ADAS proliferation demanding accurate actuation

- Lightweighting trend for fuel economy

- Complexity & high maintenance cost of pneumatics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Brake chambers and parking brake caliper units commanded 31.50% share of the automotive pneumatic actuators market in 2024. Their presence is mandated across every passenger and commercial vehicle variant, cementing baseline volume. Electromechanical parking brakes are penetrating luxury sedans, but heavy truck drum brakes still rely on air chambers that deliver high clamping force at low unit cost. Turbocharger wastegate actuators follow as the fastest riser, posting a 6.70% CAGR because downsized gasoline engines depend on accurate boost management to meet power and emission targets. Throttle valves, HVAC blend doors, and EGR butterflies retain mid-single-digit growth, each backed by regulatory or comfort imperatives.

Pneumatic fuel-injection rail regulators survive in certain flex-fuel layouts popular in Brazil, while door-lock plungers remain common in cost-sensitive hatchbacks. Across the board, suppliers experiment with smart pressure sensors embedded in actuator bodies to supply health data back to the vehicle control network. The enhancements prolong relevance of pneumatically powered devices even as direct electric motor drives tighten competitive gaps. Overall, the application mix underscores why the automotive pneumatic actuators market maintains double-digit billion-dollar revenues: it spans mandatory safety, emissions, and comfort functions that every vehicle must carry.

Passenger cars generated 56.70% of 2024 revenue, reflecting sheer production volume across global plants. Yet heavy commercial vehicles are projected to pace the automotive pneumatic actuators market size expansion with a 5.90% CAGR. Fleet operators prize the durability of air-brake and air-suspension circuits under intense duty cycles, while stricter CO2 quotas push for optimized compressor management rather than wholesale technology swaps. Light commercial vans track e-commerce parcel demand and achieve a robust CAGR on the back of city-logistics growth. Construction and mining equipment are, chiefly for high-temperature exhaust-flap controllers and robust steering stabilizers.

Two-wheelers remain a micro-segment concentrated in select Asian economies, yet scooter OEMs are trialing low-pressure air servos for automatic clutch actuation. The diversity highlights a bifurcation: suburban passenger cars gravitate toward compact electric drives for NVH advantages, whereas high-payload vehicles sustain pneumatics for force density and proven maintainability. That divergence shapes future platform strategies of tier-1 suppliers, compelling them to produce modular families that scale from micro to heavy-duty ratings without rewriting qualification protocols.

The Automotive Pneumatic Actuator Market is Segmented by Application Type (Throttle Actuators, Fuel Injection Actuators, Brake Actuators, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Actuator Mechanism (Single-Diaphragm Pneumatic and More), Sales Channel (OEM and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific generated 45.50% of global revenue in 2024, underpinned by China's multi-brand passenger car output and Japan's high-precision valve competence. The region is forecast to post a 7.10% CAGR as supply bases in Vietnam, Thailand, and India climb the value curve, making in-region sourcing attractive for global nameplates. Electro-pneumatic R&D centers in South Korea exploit the country's advanced semiconductor ecosystem to integrate pressure MEMS sensors onto actuator PCBs, heightening competitive edge. Notwithstanding electric-vehicle penetration, cost-optimized sub-compact segments still install pneumatically driven HVAC and turbo wastegate units, securing volume for suppliers.

Middle East & Africa stands out as the fastest-growing cluster at a robust CAGR of 7.80%. Saudi Vision 2030 industrial policy lures CKD assembly lines, each demanding localized actuator content for commercial trucks that service construction booms. The UAE leverages free-zone logistics to re-export spare parts kits deeper into African markets. Turkey's customs-union access to Europe boosts its component exports, compelling pneumatic suppliers to expand Izmir and Bursa facilities. These dynamics re-orient procurement away from trans-continental shipping toward near-market production, shortening lead times and cutting freight emissions.

In South America, flex-fuel engine architectures unique to the region stimulate EGR and fuel-rail actuator demand because ethanol blends alter combustion stoichiometry daily. Local content rules push multinational suppliers to site elastomer curing presses in Minas Gerais rather than import seal stacks. Argentine heavy-truck assembly rebounds after currency stabilization measures, adding lift for high-capacity brake chambers. Currency volatility and political risk temper the outlook, yet installed base inertia keeps the automotive pneumatic actuators market resilient in the hemisphere.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Emerson (ASCO Valve)

- Hitachi Astemo Ltd

- CTS Corporation

- Schrader Duncan Ltd

- Rotex Automation

- Nucon Industries Pvt Ltd

- Magneti Marelli SpA

- Mitsubishi Electric Corp

- Del-Tron Precision Inc

- Procon Engineering

- Valeo SA

- Aisin Corporation

- Mahle GmbH

- BorgWarner Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter emission norms driving precise air-fuel control

- 4.2.2 Increasing global vehicle production

- 4.2.3 ADAS proliferation demanding accurate actuation

- 4.2.4 Lightweighting trend for fuel economy

- 4.2.5 Hydrogen ICE valve-timing adoption

- 4.2.6 OTA-enabled actuator software monetisation

- 4.3 Market Restraints

- 4.3.1 Shift toward energy-efficient electric actuators

- 4.3.2 Complexity & high maintenance cost of pneumatics

- 4.3.3 Shortage of high-grade elastomers for seals

- 4.3.4 Tier-1 decarbonisation curbing pneumatic R&D

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Application Type

- 5.1.1 Throttle Actuators

- 5.1.2 Fuel Injection Actuators

- 5.1.3 Brake Actuators

- 5.1.4 Exhaust Gas Recirculation Actuators

- 5.1.5 Turbocharger Wastegate Actuators

- 5.1.6 HVAC Actuators

- 5.1.7 Door Lock Actuators

- 5.1.8 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Off-Highway Vehicles

- 5.2.5 Two-Wheelers

- 5.3 By Actuator Mechanism

- 5.3.1 Single-Diaphragm Pneumatic

- 5.3.2 Vacuum-Boost Pneumatic

- 5.3.3 Electro-pneumatic (EP)

- 5.3.4 Servo-pneumatic

- 5.3.5 Rack-and-Pinion

- 5.3.6 Rotary-Vane

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Denso Corporation

- 6.4.4 Emerson (ASCO Valve)

- 6.4.5 Hitachi Astemo Ltd

- 6.4.6 CTS Corporation

- 6.4.7 Schrader Duncan Ltd

- 6.4.8 Rotex Automation

- 6.4.9 Nucon Industries Pvt Ltd

- 6.4.10 Magneti Marelli SpA

- 6.4.11 Mitsubishi Electric Corp

- 6.4.12 Del-Tron Precision Inc

- 6.4.13 Procon Engineering

- 6.4.14 Valeo SA

- 6.4.15 Aisin Corporation

- 6.4.16 Mahle GmbH

- 6.4.17 BorgWarner Inc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment