|

市場調查報告書

商品編碼

1836568

汽車燃料供應系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Fuel Delivery System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

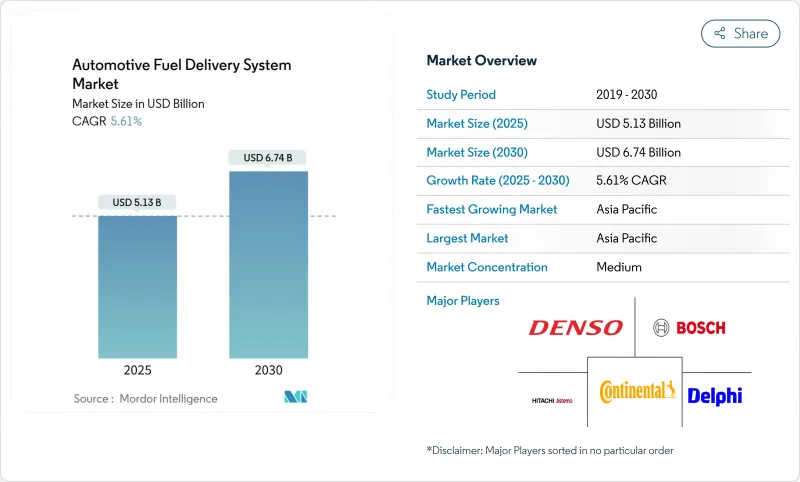

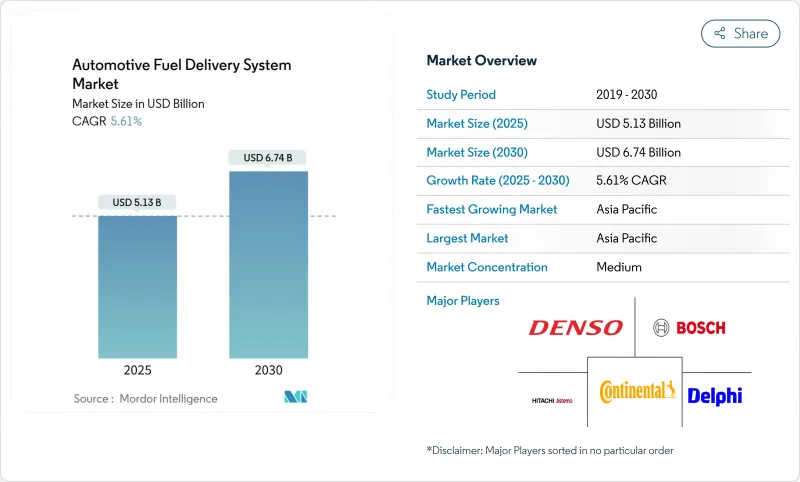

預計2025年汽車燃料供應系統市場規模將達51.3億美元,2030年將達67.4億美元,複合年成長率為5.61%。

這一成長軌跡反映了該行業適應日益嚴格的排放法規的能力,同時在電氣化日益發展的時代保持了其重要性。將於2025年7月生效的歐7法規和將於2027年生效的美國環保署第三階段標準,正推動汽車製造商向高精度噴射模組和耐腐蝕生產線邁進,從而維持對現代內燃機 (ICE) 架構的資本投資。供應商正在採用「技術中立」的產品組合,以維持內燃機的價值流,同時為需求轉向插電式混合動力汽車和燃料電池做好準備,從而限制汽車燃料輸送系統市場的下行風險。

全球汽車燃料供應系統市場趨勢與洞察

嚴格的排放法規推動先進的燃料輸送模組

歐盟7標準自2026年11月起對所有輕型引擎的顆粒物和氮氧化物排放基準值進行了加強,而美國環保署第三階段計劃則要求在2027年將重型卡車的氮氧化物排放標準降至35毫克/馬力/小時。這將迫使汽車製造商在全球平台上統一高壓泵和汽油顆粒過濾器的排放標準。耐久性要求將提高到16萬公里,這將促使供應商開發長壽命噴油器和耐腐蝕導軌。

增加全球汽車產量並振興帕爾克

輕型汽車產量將在2025年復甦,隨著歐洲汽車平均車齡超過12年,汽車更換週期也將縮短,這將增強汽車燃油供應系統市場的零件需求。汽車製造商將在印度、印尼和墨西哥設立本地工廠,從而為一級供應商帶來區域採購吸引力。車隊營運商將更新硬體以滿足燃油經濟性基準,儘管電動車的普及,但內燃機汽車的市場地位仍將持續提升。

電動車的快速成長導致內燃機汽車佔比下降。

中國和加州正加速推進到2035年實現完全零排放的目標。電動車的蓬勃發展預計將使內燃機汽車的利潤池在未來十年內減少50%。燃油泵和噴油器並未整合到電池平台中,這將帶來長期的阻力,但地區差異使汽車燃油輸送系統市場在重型車輛、農村地區和新興市場領域中保持著重要的地位。

報告中分析的其他促進因素和限制因素

- 乘用車對缸內噴油引擎的需求不斷增加

- 輕型商用車銷售增加

- 燃料系統部件原料價格波動;

細分分析

到2024年,燃油泵將佔汽車燃油輸送系統市場收入的37.81%,並將繼續成為所有尺寸引擎的重要組成部分,支撐汽車燃油輸送系統市場。燃油泵的普及將確保即使在電氣化發展的情況下也能實現穩定的供應。到2030年,受2,200 psi汽油直噴(GDI)需求的推動,噴油器將以7.14%的複合年成長率快速成長,這將推動「智慧」先進設計和用於乙醇混合燃料的不銹鋼導軌的發展。

目前,組件升級主要集中在機載診斷、遠端壓力感測和無線韌體,這些技術可以減少意外停機。生質燃料的興起推動了對耐腐蝕管路和過濾器的需求,而蒸氣回收閥和油箱安裝感測器則提升了電子產品的價值。儘管未來電動車市場面臨淘汰的威脅,但這些轉變正共同推動汽車燃油輸送系統組件市場呈現上升趨勢。

2024年,乘用車將佔汽車燃油輸送系統市場收益的64.33%。掀背車和轎車需要經濟高效的無回流泵,而SUV由於扭矩負載增加而整合高壓油軌。輕型商用車的複合年成長率預計為6.23%,更重視耐用性而非效率,因此保留鋼絲編織軟管和可更換過濾器。

隨著每日行駛里程的增加和車輛遠端資訊處理開闢了改裝業務,中型和重型卡車維持高流量柴油噴射軌道以穩定車隊數量(儘管數量較少),直到電池密度允許遠距替代方案,從而保持汽車燃料供應系統市場的工作週期多樣性。

區域分析

預計到2024年,亞太地區將佔據汽車燃油供應系統市場收入的38.55%,超過其他地區,到2030年的複合年成長率將達到6.92%。中國汽車製造商正在泰國和印尼建造燃油系統子系統,以規避關稅並縮短物流鏈,從而增強整個東南亞汽車燃油供應系統市場。日本的半導體合資企業也確保了高壓幫浦微控制器的供應,從而降低了該地區的供應風險。

北美仍然技術雄厚,這得益於美國環保署 (EPA) 法規,該法規要求在 2027 年實現每桶馬力小時氮氧化物排放量達到 0.035 克。美國2,600 萬美元的 E15 基礎設施計畫等投資正在推動生質燃料的普及,從而創造了對乙醇相容導軌和密封件的利基市場需求,從而擴大了汽車燃料輸送系統市場。墨西哥具有吸引力的經濟勞動力價格以及 USMCA 貿易優惠,正在鼓勵一級供應商在拉莫斯阿里斯佩和阿瓜斯卡連特斯增加產能。

歐洲面臨歐7和加速碳中和的雙重壓力。原始設備製造商正在2026年之前維修顆粒過濾器和蒸氣抑制硬體,這增加了每輛車的零件成本,但供應商訂單卻保持不變。東歐工廠正在降低生產線組裝成本,以確保在西歐工廠轉向電動模組之際保持競爭力。從西班牙到德國的氫能走廊試驗,為汽車燃料供應系統市場在燃料電池應用方面提供了早期立足點。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 嚴格的排放法規推動先進燃料輸送模組的採用

- 增加全球汽車產量並振興帕爾克

- 乘用車對缸內噴油引擎的需求不斷增加

- 新興市場輕型商用車銷售成長

- 將智慧診斷功能整合到電動燃油泵中

- 合成/生質燃料混合物對耐腐蝕管線的需求迅速增加

- 市場限制

- 電動車快速成長降低內燃機汽車佔有率

- 燃油系統部件原料價格波動;

- 由於蒸發排放法規更加嚴格,系統成本增加

- 半導體短缺擾亂電子泵浦控制器

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模與成長預測(價值,美元)

- 按組件

- 燃油幫浦

- 燃油噴射器

- 燃油導軌

- 燃油壓力調節器

- 燃油濾清器

- 燃油管路和軟管

- 其他

- 按車輛類型

- 搭乘用車

- 掀背車

- 轎車

- 跑車轎小轎車

- SUV與跨界車

- 商用車

- 輕型商用車(LCV)

- 中型和重型商用車(MCV 和 HCV)

- 搭乘用車

- 按燃料類型

- 汽油

- 柴油引擎

- 靈活燃料(E10-E85)

- CNG和LPG

- 生質燃料和合成燃料

- 氫

- 按供應方式

- 進氣道燃油噴射

- 缸內噴油

- 無回流燃油系統

- 共軌柴油噴射

- 按分銷管道

- OEM(工廠安裝)

- 售後市場(更換)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太地區其他國家

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Delphi Technologies(BorgWarner)

- Magna International Inc.

- TI Fluid Systems plc(TI Automotive)

- Toyoda Gosei Co., Ltd.

- Ucal Fuel Systems Ltd.

- Marelli Holdings Co., Ltd.

- Hitachi Astemo Ltd.

- Stanadyne LLC

- Carter Fuel Systems LLC

- Aisin Corporation

- Valeo SA

- MS Motorservice International GmbH(Pierburg)

- Walbro LLC

- Johnson Electric Holdings Ltd.

- Woodward, Inc.

第7章 市場機會與未來展望

- 閒置頻段和未滿足需求評估

The automotive fuel delivery system market size stood at USD 5.13 billion in 2025 and is forecast to reach USD 6.74 billion by 2030, advancing at a 5.61% CAGR.

The growth trajectory reflects the sector's ability to meet tougher emission limits while staying relevant in an era of rising electrification. Euro 7 rules that apply from July 2025 and the EPA Phase 3 standards, effective 2027, are pushing automakers toward high-precision injection modules and corrosion-resistant lines, sustaining capital expenditure on modern internal-combustion (ICE) architectures. Suppliers adopt "technology-neutral" portfolios that keep ICE value streams alive yet prepare for plug-in and fuel-cell demand shifts, limiting downside risk for the automotive fuel delivery system market.

Global Automotive Fuel Delivery System Market Trends and Insights

Stringent Emission Norms Driving Advanced Fuel-Delivery Modules

Euro 7 tightens particulate and NOx thresholds for all light-duty engines from November 2026, while EPA Phase 3 slashes NOx to 35 mg/hp-hr for heavy trucks in 2027 . Automakers are therefore standardizing high-pressure pumps and gasoline particulate filters across global platforms. Durability requirements rise to 160,000 km, pushing suppliers to develop long-life injectors and corrosion-proof rails, factors that underpin the automotive fuel delivery system market through 2030.

Rising Global Vehicle Production and Parc Rejuvenation

Light-vehicle output rebounded in 2025, and replacement cycles shortened as average fleet age passed 12 years in Europe, reinforcing component demand for the automotive fuel delivery system market. Vehicle-makers localize plants in India, Indonesia, and Mexico, creating regional sourcing pull for tier-1 suppliers. Fleet operators refresh hardware to meet fuel-economy benchmarks, prolonging ICE relevance despite EV penetration.

Rapid Growth of Electric Vehicles Reducing ICE Share

China and California are accelerating toward full zero-emission mandates by 2035. EV momentum is cutting ICE-linked profit pools by an anticipated 50% this decade. Fuel pumps and injectors are absent from battery platforms, creating long-run headwinds, yet regional differences keep the automotive fuel delivery system market relevant in heavy-duty, rural, and developing-country segments.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Gasoline Direct-Injection Engines in Passenger Cars

- Increasing Sales of Light Commercial Vehicles

- Volatility in Raw-Material Prices for Fuel-System Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fuel pumps generated 37.81% revenue of the automotive fuel delivery system market in 2024 and remain indispensable across all engine sizes, anchoring the automotive fuel delivery system market. Their ubiquity provides steady volumes even as electrification advances. Accelerating fastest, injectors will rise at 7.14% CAGR to 2030 on the back of 2,200 psi GDI requirements, pushing "smart" tip designs and stainless-steel rails for ethanol blends.

Component upgrades now emphasize on-board diagnostics, remote pressure sensing, and over-the-air firmware that cuts unplanned downtime. Biofuel growth lifts demand for corrosion-resistant lines and filters, while vapor-recovery valves and tank-mounted sensors add incremental electronics value. Together, these shifts keep the automotive fuel delivery system market size for components on an upward curve despite future EV displacement threats.

Passenger cars delivered 64.33% of the automotive fuel delivery system market revenue in 2024. Hatchbacks and sedans require cost-efficient returnless pumps, whereas SUVs integrate higher-pressure rails because of increased torque loads. Light commercial vehicles, forecast at 6.23% CAGR, prefer robustness over efficiency, sustaining steel-braid hoses and replaceable filters, a pattern that enlarges the automotive fuel delivery system market share commanded by commercial platforms.

Longer daily mileage and fleet telematics open retrofitting business, while medium and heavy trucks, though smaller in volume, retain high-flow diesel injection rails that stabilize volumes until battery densities permit long-haul substitution. As such, the automotive fuel delivery system market remains diversified across duty cycles.

The Automotive Fuel Delivery System Market Report is Segmented by Component (Fuel Pump, Fuel Injector, and More), Vehicle Type (Passenger Cars, and Commercial Vehicles), Fuel Type (Gasoline, Diesel, and More), Delivery Method (Port Fuel Injection, Gasoline Direct Injection, and More), Distribution Channel (OEM (Factory-Fitted) and Aftermarket (Replacement)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captured 38.55% of the automotive fuel delivery system market's 2024 turnover and will outpace all other regions with a 6.92% CAGR to 2030, owing to China's outsized production, India's highway expansion, and ASEAN's localized assembly clusters. Chinese OEMs are building fuel-system subsystems in Thailand and Indonesia to bypass tariffs and shorten logistics chains, strengthening the automotive fuel delivery system market across Southeast Asia. Semiconductor joint ventures in Japan also secure microcontroller flow for high-pressure pumps, buffering regional supply risk.

North America remains technology-rich, driven by EPA regulations that mandate 0.035 g/b-hp-hr NOx by 2027. Investments such as the USDA's USD 26 million E15 infrastructure program expand biofuel uptake, creating niche demand for ethanol-ready rails and seals that enlarge the automotive fuel delivery system market. Mexico's attractively priced labor and USMCA trade benefits encourage tier-1s to add capacity in Ramos Arizpe and Aguascalientes.

Europe faces the twin pressures of Euro 7 and accelerated carbon-neutrality pledges. OEMs are retrofitting particulate filters and vapor-containment hardware ahead of 2026, raising per-vehicle bill-of-materials but sustaining supplier order books. Eastern European plants offer lower costs for line assemblies, ensuring competitiveness even as Western European factories pivot to electric modules. Hydrogen corridor pilots from Spain to Germany are also giving the automotive fuel delivery system market an early foothold in fuel-cell applications.

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Delphi Technologies (BorgWarner)

- Magna International Inc.

- TI Fluid Systems plc (TI Automotive)

- Toyoda Gosei Co., Ltd.

- Ucal Fuel Systems Ltd.

- Marelli Holdings Co., Ltd.

- Hitachi Astemo Ltd.

- Stanadyne LLC

- Carter Fuel Systems LLC

- Aisin Corporation

- Valeo SA

- MS Motorservice International GmbH (Pierburg)

- Walbro LLC

- Johnson Electric Holdings Ltd.

- Woodward, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent emission norms driving adoption of advanced fuel-delivery modules

- 4.2.2 Rising global vehicle production and parc rejuvenation

- 4.2.3 Growing demand for gasoline direct-injection engines in passenger cars

- 4.2.4 Increasing sales of light commercial vehicles in emerging markets

- 4.2.5 Integration of smart diagnostics within electric fuel pumps

- 4.2.6 Surge in synthetic/bio-fuel blends requiring corrosion-resistant lines

- 4.3 Market Restraints

- 4.3.1 Rapid growth of electric vehicles reducing ICE share

- 4.3.2 Volatility in raw-material prices for fuel-system components

- 4.3.3 Tightening evaporative-emission norms raising system cost

- 4.3.4 Semiconductor shortages disrupting electronic pump controllers

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Fuel Pump

- 5.1.2 Fuel Injector

- 5.1.3 Fuel Rail

- 5.1.4 Fuel Pressure Regulator

- 5.1.5 Fuel Filter

- 5.1.6 Fuel Line and Hoses

- 5.1.7 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.1.1 Hatchback

- 5.2.1.2 Sedan

- 5.2.1.3 Sports Car and Coupe

- 5.2.1.4 SUV and Crossover

- 5.2.2 Commercial Vehicles

- 5.2.2.1 Light Commercial Vehicles (LCV)

- 5.2.2.2 Medium and Heavy Commercial Vehicles (MCV and HCV)

- 5.2.1 Passenger Cars

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Flex Fuel (E10-E85)

- 5.3.4 CNG and LPG

- 5.3.5 Biofuel and Synthetic Fuel

- 5.3.6 Hydrogen

- 5.4 By Delivery Method

- 5.4.1 Port Fuel Injection

- 5.4.2 Gasoline Direct Injection

- 5.4.3 Returnless Fuel Systems

- 5.4.4 Common-Rail Diesel Injection

- 5.5 By Distribution Channel

- 5.5.1 OEM (Factory-fitted)

- 5.5.2 Aftermarket (Replacement)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Nigeria

- 5.6.5.6 Egypt

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 DENSO Corporation

- 6.4.4 Delphi Technologies (BorgWarner)

- 6.4.5 Magna International Inc.

- 6.4.6 TI Fluid Systems plc (TI Automotive)

- 6.4.7 Toyoda Gosei Co., Ltd.

- 6.4.8 Ucal Fuel Systems Ltd.

- 6.4.9 Marelli Holdings Co., Ltd.

- 6.4.10 Hitachi Astemo Ltd.

- 6.4.11 Stanadyne LLC

- 6.4.12 Carter Fuel Systems LLC

- 6.4.13 Aisin Corporation

- 6.4.14 Valeo SA

- 6.4.15 MS Motorservice International GmbH (Pierburg)

- 6.4.16 Walbro LLC

- 6.4.17 Johnson Electric Holdings Ltd.

- 6.4.18 Woodward, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment