|

市場調查報告書

商品編碼

1836548

地工合成材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Geosynthetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

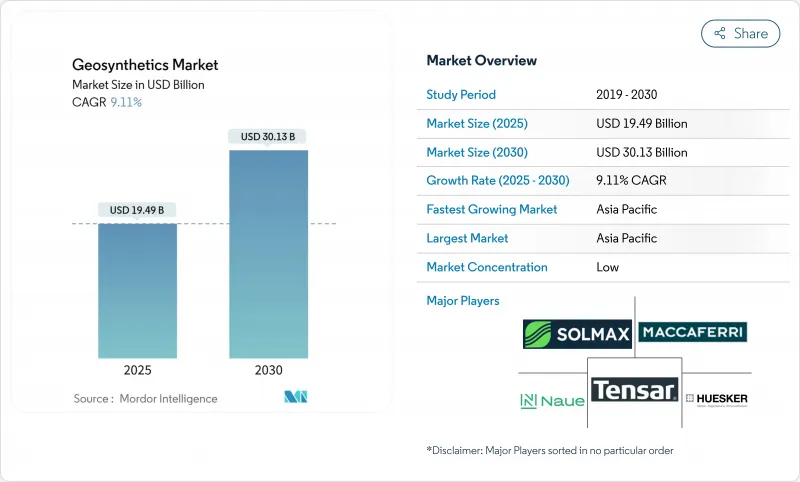

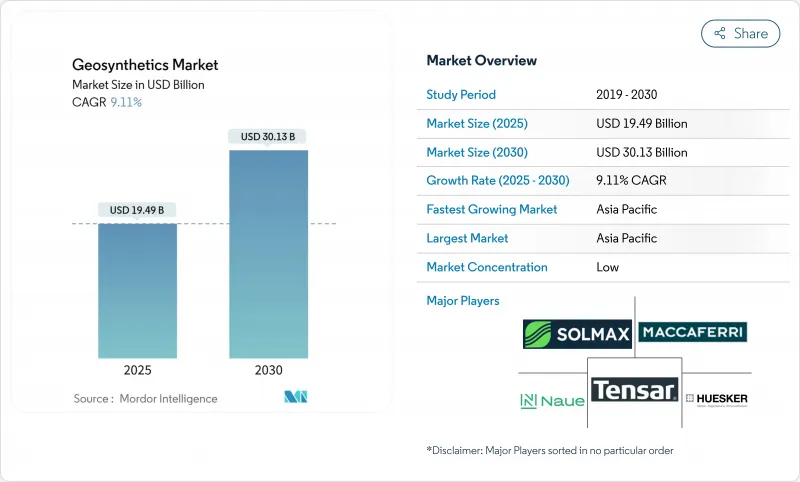

預計 2025 年地工合成材料市場規模為 194.9 億美元,到 2030 年將達到 301.3 億美元,預測期間(2025-2030 年)的複合年成長率為 9.11%。

成長取決於五種力量的匯聚。亞太、北美和中東的基礎設施項目正在採用地工合成作為路基、擋土牆和海岸防禦工事的解決方案。美國、歐盟和日本的監管機構正在強制執行更嚴格的遏制和過濾標準,這些標準更傾向於地工止水膜和地工織物,而不是傳統材料。智慧材料的持續研發正在整合感測器和再生聚合物,以延長使用壽命並實現即時狀態監測。農業和採礦業是新興的終端用戶,它們被新型地工格網和脫水管的侵蝕控制和尾礦管理優勢所吸引。同時,原料波動和不斷變化的歐洲微塑膠法規正在降低短期盈利,但也刺激了可生物分解和可回收投入的創新。

全球地工合成材料市場趨勢與洞察

地工織物在建設產業的應用不斷擴大

道路、橋樑和地基計劃的需求正在推動地工合成材料市場的發展,因為承包商可以用地工織物布加固材料取代厚骨材層,從而在保持結構承載力的同時將材料成本降低高達30%。美國聯邦公路管理局目前根據「建設美國,購買美國」條款將大多數地工合成材料材料歸類為建築材料,該條款將自2025年3月起強制要求在聯邦援助計畫中採購國內產品。城市開發商也擴大選擇地工合成材料用於綠色屋頂,而薄膜和排水複合材料可將雨水徑流和冷卻負荷降低高達50%。這些變化加在一起,將在2024年推動該領域的應用佔有率達到38%,從而保持該行業的長期發展勢頭。

地工織物在採礦活動中的使用日益增多

尾礦倉儲設施營運商正在安裝複合式襯墊、地工格網和脫水管,以符合尾礦管理的全球行業標準,降低液化風險並提高安全記錄。 Husker公司已為礦山運輸道路和廢棄物堆部署了專用加固和過濾系統,其澳洲業務的使用壽命顯著延長。隨著金屬需求的激增,地工合成材料的產業應用正在促進採礦業收益的成長,推動整體複合年成長率達到0.3%。

聚丙烯價格波動

聚丙烯和高密度聚乙烯價格波動推高了生產成本,並擠壓了整個地工合成材料市場的利潤空間。生產商正在嘗試對消費後塑膠進行化學回收,以規避原料風險並減少碳足跡。巴西石化公司(Braskem)在巴西的13.9萬噸產能擴張計畫預計在2026年前緩解拉丁美洲的供應緊張。

報告中分析的其他促進因素和限制因素

- 嚴格的環境保護法規結構

- 增加農業用途

- 歐洲新推出的微塑膠法規

細分分析

聚丙烯、聚乙烯和聚酯合計將佔2024年總收入的94%,預計到2030年,其整體複合年成長率將達到9.1%,凸顯了它們的性價比優勢。這類合成纖維擁有久經考驗的抗張強度、耐化學性和供應充足性——這些指標支撐了它們在地工合成材料市場的領先地位。在嚴格的美國通訊協定下,高密度聚苯乙烯地工止水膜仍是危險廢棄物處理池和堆浸墊片的首選襯墊。

企業永續性的不斷加強,正在推動天然纖維和可生物分解聚合物的研究。儘管該領域目前的市場佔有率僅為個位數,但歐盟對微塑膠的監管壓力正在加速植物來源地工格網和聚乳酸(PLA)混合不織布的現場試驗。使用香蒲(Typha domingensis)製成的纖維格柵進行的示範試驗表明,它們符合侵蝕控制設計要求,同時在作物週期內完全可生物分解。如果這些創新得到大規模檢驗,地工合成材料市場中的生態材料部分可望從2028年起實現兩位數的成長率。

預計地工止水膜將在 2024 年佔據 35% 的市場佔有率,成為收入的主導,超過地工合成材料市場中的其他產品類型,到 2030 年的複合年成長率為 10.27%。垃圾掩埋蓋板的最初應用已擴展到需要接近零滲透性的 PFAS 圍堵池、厭氧潟湖和浮體式覆蓋水庫計劃。

地工織物仍然是過濾和加固領域的主要材料。然而,隨著監管部門對纖維損耗的嚴格審查,以及材料替代的不斷增加,其成長正在放緩。地工複合物和襯墊(將排水芯與地工織物或膜結合在一起)因其輕薄的外形和多功能性而日益受到青睞,對那些尋求減少開挖量和溫室氣體排放的承包商來說極具吸引力。這些動態表明,在預測期內,地工合成材料的市場佔有率將逐漸轉移到多功能工程系統。

區域分析

隨著公共部門計劃與私人工業的合併,到2024年,亞太地區將佔全球總收入的45%,複合年成長率達9.99%。中國的「一帶一路」走廊將推動高鐵路堤防和沙漠公路用地工止水膜的大量訂單。印度的「智慧城市計畫」將鼓勵地方政府掩埋改造和將地工織物嵌入混凝土護岸的運河建設合約。日本和韓國正在推動抗震擋土牆的研發,將地工合成材料材料加強與輕型路堤相結合,增強了對地工膜抗震性能的需求。

受美國基礎設施現代化計畫的推動,北美終端用戶使用量持續成長。日本國土交通省要求在國內採購建築材料,這推動了聯邦公路、陸軍工程兵團防洪計劃以及機場跑道擴建計畫的採用。加拿大油砂產業的尾礦壩維修和墨西哥的跨洋走廊建設也將成為進一步的成長點。

歐洲嚴格的循環經濟政策維持了現有的採用率,但在生產者適應微塑膠限制措施的同時,短期產量成長受到限制。德國、法國和英國青睞符合報廢回收標準的優質地工止水膜和地工複合物。在斯堪地那維亞的基礎設施領域,創新公司正在試用可生物分解的襯墊,這預示著未來地工合成材料市場佔有率將向環保認證產品轉變。

南美、中東和非洲的貢獻雖小,但戰略需求正在成長。巴西Mineracao的擴張正在推動礬土殘渣計劃中地工合成材料的使用,而沙烏地阿拉伯的NEOM和紅海旅遊計劃則指定使用地工格網來穩定海岸。用於集水壩和沙漠公路網路的地工格網融資正在支撐這些新興地區的穩定需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 地工織物在建設產業的應用不斷擴大

- 採礦業中地工織物的使用日益增多

- 嚴格的環境保護法規結構

- 增加農業用途

- 材料工程的技術進步

- 市場限制

- 聚丙烯價格波動

- 歐洲微塑膠法規日益嚴格,或將限制傳統地工織物的使用

- 產品標準化問題

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模及成長預測(金額)

- 按材質

- 聚丙烯、聚乙烯、聚酯

- 其他

- 按類型

- 地工織物

- 地工止水膜

- 地工複合物

- 地工合成襯墊等

- 按功能

- 分離

- 引流

- 加強

- 過濾

- 防潮層

- 按用途

- 建築學

- 運輸

- 環境

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ACE Geosynthetics

- Agru America Inc.

- Belton Industries

- Berry Global Inc.

- Bonar Plastics

- Carthage Mills

- Contech Engineered Solutions LLC

- Dow

- Freudenberg Group

- Geo-Synthetics Systems LLC(GSI)

- Hanes Geo Components

- Huesker International

- KayTech

- Minerals Technologies Inc.

- Naue GmbH & Co. KG

- Officine Maccaferri SpA

- Presto Products Company

- SKAPS Industries

- Solmax

- Strata Systems Inc.

- Taian Modern Plastic Co., Ltd

- TENAX SPA

- Tensar, A Division of CMC

- Tessilbrenta SpA

第7章 市場機會與未來展望

The Geosynthetics Market size is estimated at USD 19.49 billion in 2025, and is expected to reach USD 30.13 billion by 2030, at a CAGR of 9.11% during the forecast period (2025-2030).

Growth rests on five converging forces. Infrastructure programmes in Asia Pacific, North America, and the Middle East are embedding geosynthetic solutions in roadbeds, retaining walls, and coastal defences because the materials cut aggregate demand and accelerate build schedules. Regulatory bodies in the United States, the European Union, and Japan are mandating stricter containment and filtration standards that favour geomembranes and geotextiles over conventional options. 1 Ongoing R&D in smart materials integrates sensors and recycled polymers to extend service life and enable real-time condition monitoring. Agriculture and mining are emerging end-users, drawn by the erosion-control and tailings-management benefits achieved with newer geogrids and dewatering tubes. Meanwhile, raw-material volatility and evolving European microplastic rules are tempering near-term profitability but also stimulating innovation toward biodegradable or recycled inputs.

Global Geosynthetics Market Trends and Insights

Growing Usage of Geotextiles in Construction Industry

Demand from road, bridge, and foundation projects is elevating the geosynthetics market as contractors replace thicker aggregate layers with geotextile reinforcement that preserves structural capacity while trimming up to 30% of material costs. The U.S. Federal Highway Administration now classifies most geosynthetics as construction materials under the Build America Buy America provisions, triggering mandatory domestic sourcing on federal-aid schemes from March 2025. Urban developers are also selecting geosynthetics for green roofs, where membranes and drainage composites cut stormwater runoff and drop cooling loads by up to 50%. Collectively, these changes underpin a 38% application share in 2024 and sustain long-term momentum for the segment.

Increase Usage of Geotextiles in Mining Activities

Operators of tailings storage facilities are installing composite liners, geogrids, and dewatering tubes to comply with the Global Industry Standards for Tailings Management, thereby reducing liquefaction risks and improving safety records. HUESKER has rolled out purpose-built reinforcement and filtration systems for mine haul roads and waste piles, demonstrating service life gains in Australian operations. As metals demand surges, industry uptake of geosynthetics helps mining account for a growing revenue slice and delivers a 0.3% uplift to the overall CAGR.

Volatile Polypropylene Pricing

Price swings in polypropylene and HDPE inflate production costs and compress margins across the geosynthetics market. Producers are trialling chemical recycling of used plastics to hedge raw-material risk and lower carbon footprints. Braskem's 139,000-ton capacity expansion in Brazil may ease supply tightness in Latin America by 2026.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Regulatory Framework for Environmental Protection

- Increased Agricultural Applications

- Emerging Europe Micro-plastic Rules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene, polyethylene and polyester together represented 94% of 2024 revenue and should mirror the overall 9.1% CAGR toward 2030, underscoring their cost-to-performance advantage. This synthetic cohort enjoys well-documented tensile strength, chemical resistance and supply availability, indicators that underpin its leadership in the geosynthetics market. High-density polyethylene geomembranes remain the preferred liner for hazardous-waste cells and heap leach pads under strict EPA protocols epa.gov.

Rising corporate sustainability commitments are propelling natural-fiber and biodegradable polymer research. Though the segment currently secures a single-digit share, EU regulatory pressure on microplastics is accelerating field trials of plant-based geogrids and PLA-blended nonwovens. Demonstrations with Typha domingensis fibre grids revealed break strengths that satisfy erosion-control design values while allowing full biodegradation within a cropping cycle. If validated at scale, these innovations could grow the eco-material slice of the geosynthetics market size at double-digit rates after 2028.

Geomembranes led 2024 turnover with a 35% share and are positioned to register a 10.27% CAGR to 2030, outperforming other product categories in the geosynthetics market. Early adoption in landfill caps has expanded to PFAS containment basins, anaerobic lagoons, and floating-cover reservoir projects that demand near-zero permeability.

Geotextiles remain a large-volume workhorse for filtration and reinforcement. Yet growth is slower as regulatory scrutiny on fibre loss intensifies, spurring material substitutions. Geocomposites and liners that pair drainage cores with geotextiles or membranes are picking up velocity because they combine multiple functions in a thinner profile, appealing to contractors chasing lower excavation volumes and reduced greenhouse-gas footprints. These dynamics imply a gradual redistribution of geosynthetics market share toward multifunctional engineered systems through the forecast window.

The Geosynthetics Market Report Segments the Industry by Material (Polypropylene, Polyethylene, and Polyester, and Others), Type (Geotextile, Geomembrane, Geocomposite, and More), Function (Separation, Drainage, Reinforcement, and More), Application (Construction, Transportation, Environmental, and Other Applications) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific held 45% of 2024 revenue and will expand at a 9.99% CAGR as public-sector megaprojects converge with private industrial parks. China's Belt and Road corridors drive bulk orders for geomembranes in high-speed rail embankments and desert expressways. India's Smart Cities Mission catalyses municipal landfill upgrades and canal-lining contracts that embed geotextiles in concrete revetments. Japan and South Korea channel R&D into earthquake-resistant retaining walls that combine geosynthetic reinforcement with lightweight fills, reinforcing demand resilience.

North America continues to consolidate end-user uptake, led by the United States' infrastructure modernisation package. DOT mandates for domestic sourcing of construction materials elevate adoption throughout federal highways, Army Corps flood-control projects and airport runway extensions. Canada's tailings-dam upgrades in the oil-sand sector and Mexico's inter-oceanic corridor represent additional growth nodes.

Europe's stringent circular-economy policies sustain existing penetration yet temper short-term volume gains while producers adapt to microplastic caps. Germany, France and the United Kingdom favour premium geomembranes and geocomposites that meet end-of-life recyclability criteria. Innovators trial biodegradable liners in Scandinavian infrastructure, signalling future shifts in geosynthetics market share toward eco-certified products.

South America and the Middle East & Africa contribute smaller but increasingly strategic volumes. Brazil's Mineracao expansion spurs geosynthetic containment in bauxite residue disposal, whereas Saudi Arabia's NEOM and Red Sea tourism projects specify geogrids for coastal stabilisation. Multilateral financing for water-harvesting dams and desert road networks underpins a steady demand trajectory across these emerging territories.

- ACE Geosynthetics

- Agru America Inc.

- Belton Industries

- Berry Global Inc.

- Bonar Plastics

- Carthage Mills

- Contech Engineered Solutions LLC

- Dow

- Freudenberg Group

- Geo-Synthetics Systems LLC (GSI)

- Hanes Geo Components

- Huesker International

- KayTech

- Minerals Technologies Inc.

- Naue GmbH & Co. KG

- Officine Maccaferri SpA

- Presto Products Company

- SKAPS Industries

- Solmax

- Strata Systems Inc.

- Taian Modern Plastic Co., Ltd

- TENAX SPA

- Tensar, A Division of CMC

- Tessilbrenta S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of Geotextiles in Construction Industry

- 4.2.2 Increase Usage of Geotextiles in Mining Activities

- 4.2.3 Stringent Regulatory Framework for Environmental Protection

- 4.2.4 Increased Agricultural Applications

- 4.2.5 Technological Advancements in Material Engineering

- 4.3 Market Restraints

- 4.3.1 Volatile Polypropylene Pricing

- 4.3.2 Emerging Europe Micro-plastic Rules Potentially Restricting Conventional Geotextiles

- 4.3.3 Product Standardization Issues

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Polypropylene, Polyethylene, and Polyester

- 5.1.2 Others

- 5.2 By Type

- 5.2.1 Geotextile

- 5.2.2 Geomembrane

- 5.2.3 Geocomposite

- 5.2.4 Geosynthetic Liner and Others

- 5.3 By Function

- 5.3.1 Separation

- 5.3.2 Drainage

- 5.3.3 Reinforcement

- 5.3.4 Filtration

- 5.3.5 Moisture Barrier

- 5.4 By Application

- 5.4.1 Construction

- 5.4.2 Transportation

- 5.4.3 Environmental

- 5.4.4 Other Applications

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ACE Geosynthetics

- 6.4.2 Agru America Inc.

- 6.4.3 Belton Industries

- 6.4.4 Berry Global Inc.

- 6.4.5 Bonar Plastics

- 6.4.6 Carthage Mills

- 6.4.7 Contech Engineered Solutions LLC

- 6.4.8 Dow

- 6.4.9 Freudenberg Group

- 6.4.10 Geo-Synthetics Systems LLC (GSI)

- 6.4.11 Hanes Geo Components

- 6.4.12 Huesker International

- 6.4.13 KayTech

- 6.4.14 Minerals Technologies Inc.

- 6.4.15 Naue GmbH & Co. KG

- 6.4.16 Officine Maccaferri SpA

- 6.4.17 Presto Products Company

- 6.4.18 SKAPS Industries

- 6.4.19 Solmax

- 6.4.20 Strata Systems Inc.

- 6.4.21 Taian Modern Plastic Co., Ltd

- 6.4.22 TENAX SPA

- 6.4.23 Tensar, A Division of CMC

- 6.4.24 Tessilbrenta S.p.A.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Expected Increase in Usage Green Roof and Green Wall Construction