|

市場調查報告書

商品編碼

1836515

人工草皮:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Artificial Turf - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

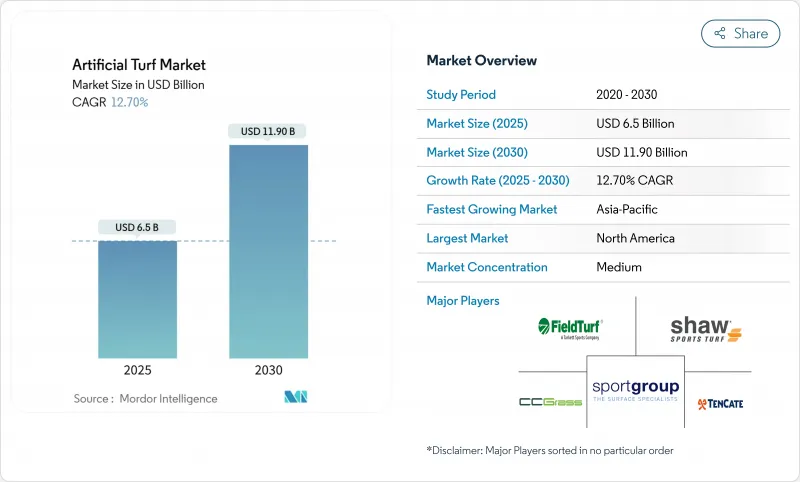

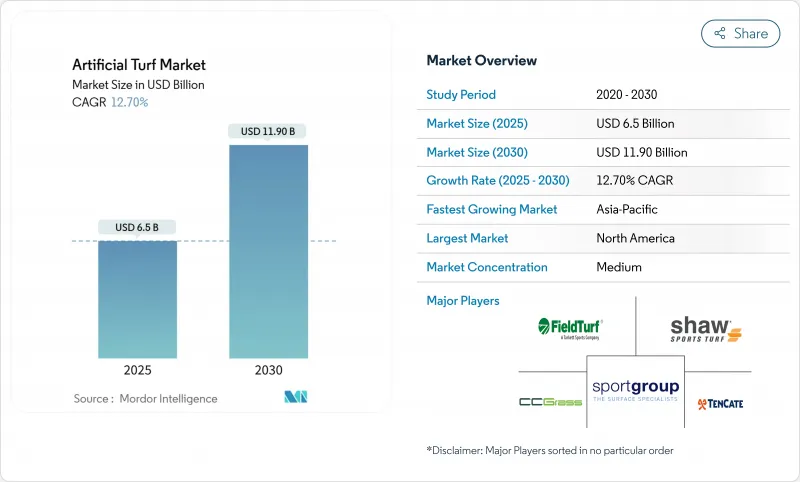

預計人工草皮草坪市場規模到 2025 年將達到 65 億美元,到 2030 年將達到 119 億美元,複合年成長率為 12.7%。

乾旱風險上升和強制性節水法正將需求從體育場館轉向住宅、商業和民用基礎設施。 Tarkett(FieldTurf)和TenCate Grass等全球領導者憑藉大規模擠出能力和早期回收計劃捍衛市場佔有率,而Shaw Sports Turf、CCGrass和越來越多的區域專家則利用接近性和定價靈活性來贏得與市政當局和學校的合約。目前的創新集中在低熱纖維化學品、不含PFAS的配方和閉合迴路回收夥伴關係關係上,以應對日益嚴格的歐盟微塑膠法規和北美生產者延伸責任提案。買家擴大評估供應商的報廢解決方案和經過驗證的冷卻性能,即使整體市場繼續分散,他們仍向技術所有者提供溢價。

全球人工草皮市場趨勢與洞察

嚴格節水義務

加州的AB 1572法案和科羅拉多的SB 24-005法案禁止使用非功能性草坪進行飲用水灌溉,並禁止新安裝非功能性草坪。這些加速的計劃不僅給安裝商帶來了巨大的壓力,還加速了人工草皮草坪的更換週期,實際上將人工草皮市場鎖定在公共日程表而非球隊賽季預算中。亞利桑那州、內華達州和澳洲部分地區的地方政府已開始起草類似的法令,以保護日益減少的含水層。

擴及綜合體育場館

精英場館對場地的要求越來越高,需要在緊湊的賽程內舉辦足球、橄欖球和音樂會。梅賽德斯-奔馳體育場2025年的FieldTurf CORE安裝項目和SoFi體育場2026年世界盃的混合草坪試點項目,透過大型合約展示了下一代系統的潛力。這些升級的規格將在兩到三個競標週期內過渡到大學和二級設施,使每個旗艦計劃的收益翻倍。

審視微塑膠和奈米塑膠污染

歐洲化學品管理局估計,運動場每年排放1.6萬噸微塑膠,加速了歐洲大陸逐步淘汰橡膠顆粒的進程。製造商將不得不重新設計填充物,並尋找聚合物黏合或植物來源替代品,這將導致系統成本增加8%至12%。科學研究證實,奈米塑膠纖維會因機械磨損而脫落,這強化了實施更嚴格規格限制和擴大生產者責任計畫的論點。

報告中分析的其他促進因素和限制因素

- 住宅和商業景觀美化需求飆升

- 城市熱島氣候調適計劃

- 初始安裝成本高

細分分析

2024年,體育用品將佔據人工草皮市場的42.7%,其中專業和大學場地的更換週期為8-10年。接觸性運動、曲棍球、網球和棒球場正在尋求能夠最佳化球滾動和衝擊衰減的纖維配方,以增強高階產品線,即使在樹脂成本上漲的情況下也能保持利潤率。

升級產品包括熱反射顏料和縫合標籤,用於記錄維護數據以進行保固檢驗。同時,隨著地方政府重視抗旱工作,該市場將超過任何其他體育細分市場,到2030年複合年成長率將達到15.3%。商業設施正在採用寬卷產品以消除接縫,而運動場則指定使用符合ASTM F1292跌落高度標準的墊片。

區域分析

北美38.2%的佔有率凸顯了更換週期的規律性和鎖定基準需求的監管壓力。加州禁止飲用水用於非功能性草坪;科羅拉多也禁止種植草坪,導致合規計劃即時,但時間安排靈活性有限。墨西哥的市立公園更傾向於使用人造草坪,以控制水費上漲,並在氣溫升高的情況下延長運動時間。

亞太地區將迎來最快的成長,到2030年複合年成長率將達到14.4%,這得益於中國和印度的體育場建設,以及澳洲縮短供應鏈的製造業規模。該地區的貨運優勢支撐著東南亞地區的出口,而日本人口密集的城市地區則是調溫布料的試驗田。在韓國,政府補助抵消了學校體育場的前期成本,加速了其在小學教育機構的應用。

歐洲的環境法規日益複雜。歐洲禁止使用顆粒填充材料,迫使俱樂部轉向聚合物黏合彈性體或礦物填充材料,雖然提高了系統價格,但也延長了使用壽命。溫布利球場的零廢棄物回收測試展示了法甲俱樂部正在評估的2026年球場維修的循環模板。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 嚴格節水義務

- 將安裝範圍擴大到綜合體育場館

- 住宅和商業景觀美化需求激增

- 城市熱島氣候調適計劃

- 採用自主鋪設草皮機器人

- 草皮回收/EPR計劃

- 市場限制

- 對微塑膠和奈米塑膠污染的擔憂

- 初期實施成本高

- 歐盟禁止使用橡膠顆粒填充物

- 球員面臨熱應激訴訟的風險

- 監管狀況

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模與成長預測(價值,美元)

- 按用途

- 運動的

- 接觸性運動

- 曲棍球

- 網球

- 其他運動

- 休閒

- 景觀

- 運動的

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 中東

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Tarkett(FieldTurf)

- TenCate Grass(Leonard Green & Partners, LP)

- Shaw Sports Turf

- CCGrass

- Sports Group(Polytan)

- Act Global(Beaulieu International Group)

- SprinTurf(Integrated Turf Solutions LLC)

- ForeverLawn

- SIS Pitches

- Victoria PLC

- Global Syn-Turf

- Lano Sports(Lano Carpets NV)

- Watershed Geo

第7章 市場機會與未來展望

The artificial turf market is valued at USD 6.5 billion in 2025 and is forecast to reach USD 11.9 billion by 2030, registering a 12.7% CAGR.

Heightened drought risk and mandatory water-conservation laws are shifting demand beyond sports venues into residential, commercial, and civic infrastructure. Competitive intensity remains moderate; global leaders such as Tarkett (FieldTurf) and TenCate Grass defend their share through large-scale extrusion capacity and early-stage recycling programs, while Shaw Sports Turf, CCGrass, and a growing cadre of regional specialists leverage proximity and price agility to win municipal and school contracts. Innovation now centers on low-heat fiber chemistries, PFAS-free formulations, and closed-loop recycling partnerships that address tightening EU microplastics rules and North American extended-producer-responsibility proposals. Buyers increasingly evaluate suppliers on end-of-life solutions and verified cooling performance, giving technology owners a pricing premium even as overall market fragmentation persists.

Global Artificial Turf Market Trends and Insights

Stringent Water-Conservation Mandates

California's AB 1572 and Colorado's SB 24-005 remove potable-water irrigation from nonfunctional lawns and ban new nonfunctional turf, converting discretionary upgrades into compliance obligations. Accelerated timelines strain installer capacity and pull forward replacement cycles, effectively anchoring the artificial turf market to public-policy calendars rather than team-season budgets. Municipalities in Arizona, Nevada, and parts of Australia have begun drafting parallel ordinances to safeguard dwindling aquifers.

Expanding Installation in Multi-Sport Stadia

Elite venues increasingly demand fields that can host football, soccer, and concerts within compressed scheduling windows. Mercedes-Benz Stadium's 2025 FieldTurf CORE installation and SoFi Stadium's hybrid turf pilot for the 2026 World Cup illustrate the visibility that large contracts create for next-generation systems. These specification uplifts migrate to collegiate and secondary facilities within two to three bid cycles, multiplying the revenue influence of each flagship project.

Micro- and Nano-Plastic Pollution Scrutiny

The European Chemicals Agency estimates sports pitches contribute 16,000 tons of microplastics annually, accelerating momentum for a continent-wide crumb-rubber phase-out Manufacturers must redesign infill containment and explore polymer-bound or plant-based alternatives, raising system costs by 8%-12%. Scientific studies have now confirmed nano-plastic fiber shedding under mechanical wear, strengthening arguments for tighter specification limits and extended producer responsibility schemes.

Other drivers and restraints analyzed in the detailed report include:

- Surging Residential and Commercial Landscaping Demand

- Urban Heat-Island Climate-Resilience Projects

- High Upfront Installation Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sports accounted for a 42.7% slice of the artificial turf market in 2024, anchoring recurring eight- to ten-year replacement cycles across professional and collegiate venues. Contact Sports, hockey, tennis and baseball fields pursue fiber blends that optimize ball roll and shock attenuation, reinforcing a premium tier that shields margins even when resin costs climb.

Upgrades now include heat-reflective pigments and stitched labels that log maintenance data for warranty validation. Meanwhile, the landscape cohort is advancing at a 15.3% CAGR to 2030, outpacing every sports sub-segment as municipalities pivot toward drought resilience. Commercial complexes adopt wide-roll products to cut seam labor, while playgrounds specify underlay pads that meet ASTM F1292 fall-height criteria.

The Artificial Turf Market is Segmented by Usage (Sports, Leisure, and Landscape) and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 38.2% stake underscores replacement-cycle regularity and regulatory pressure that lock in baseline demand. California's potable-water ban for nonfunctional lawns and Colorado's turf-planting moratorium create immediate compliance projects with limited scheduling flexibility. Mexico's municipal parks favor synthetics to curb rising water bills and extend play hours despite temperature spikes.

Asia-Pacific delivers the fastest growth at 14.4% CAGR through 2030, propelled by stadium construction in China and India, plus an Australian manufacturing scale that shortens supply chains. The region's freight advantage supports exports across Southeast Asia, while Japan's dense urban zones provide test beds for heat-mitigating fibers. Government grants in South Korea offset upfront costs for school pitches, accelerating penetration in primary education facilities.

Europe wrestles with environmental regulation complexity. The European ban on particulate infill forces clubs to transition to polymer-bound elastomers or mineral options, lifting system prices, but also extending service life. Wembley Stadium's zero-landfill pitch-recycling trial showcases a circular template that French Ligue 1 clubs are now evaluating for 2026 renovations.

- Tarkett (FieldTurf)

- TenCate Grass (Leonard Green & Partners, L.P.)

- Shaw Sports Turf

- CCGrass

- Sports Group (Polytan)

- Act Global (Beaulieu International Group)

- SprinTurf (Integrated Turf Solutions LLC)

- ForeverLawn

- SIS Pitches

- Victoria PLC

- Global Syn-Turf

- Lano Sports (Lano Carpets NV)

- Watershed Geo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent water-conservation mandates

- 4.2.2 Expanding installation in multi-sport stadia

- 4.2.3 Surging residential and commercial landscaping demand

- 4.2.4 Urban-heat-island climate resilience projects

- 4.2.5 Adoption of autonomous turf-laying robots

- 4.2.6 Circular turf recycling/EPR programs

- 4.3 Market Restraints

- 4.3.1 Micro and nano-plastic pollution scrutiny

- 4.3.2 High upfront installation cost

- 4.3.3 European Union ban on crumb-rubber infill

- 4.3.4 Player heat-stress litigation risk

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat from Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Usage

- 5.1.1 Sports

- 5.1.1.1 Contact Sports

- 5.1.1.2 Field Hockey

- 5.1.1.3 Tennis

- 5.1.1.4 Other Sports

- 5.1.2 Leisure

- 5.1.3 Landscape

- 5.1.1 Sports

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of Noth America

- 5.2.2 South America

- 5.2.2.1 Brazil

- 5.2.2.2 Argentina

- 5.2.2.3 Rest of South America

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Russia

- 5.2.3.7 Rest of Europe

- 5.2.4 Asia-Pacific

- 5.2.4.1 China

- 5.2.4.2 Japan

- 5.2.4.3 India

- 5.2.4.4 Australia

- 5.2.4.5 Rest of Asia-Pacific

- 5.2.5 Middle East

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Rest of Middle East

- 5.2.6 Africa

- 5.2.6.1 South Africa

- 5.2.6.2 Rest of Africa

- 5.2.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Tarkett (FieldTurf)

- 6.4.2 TenCate Grass (Leonard Green & Partners, L.P.)

- 6.4.3 Shaw Sports Turf

- 6.4.4 CCGrass

- 6.4.5 Sports Group (Polytan)

- 6.4.6 Act Global (Beaulieu International Group)

- 6.4.7 SprinTurf (Integrated Turf Solutions LLC)

- 6.4.8 ForeverLawn

- 6.4.9 SIS Pitches

- 6.4.10 Victoria PLC

- 6.4.11 Global Syn-Turf

- 6.4.12 Lano Sports (Lano Carpets NV)

- 6.4.13 Watershed Geo