|

市場調查報告書

商品編碼

1836463

甲基三級丁基醚(MTBE):市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Methyl Tertiary Butyl Ether (MTBE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

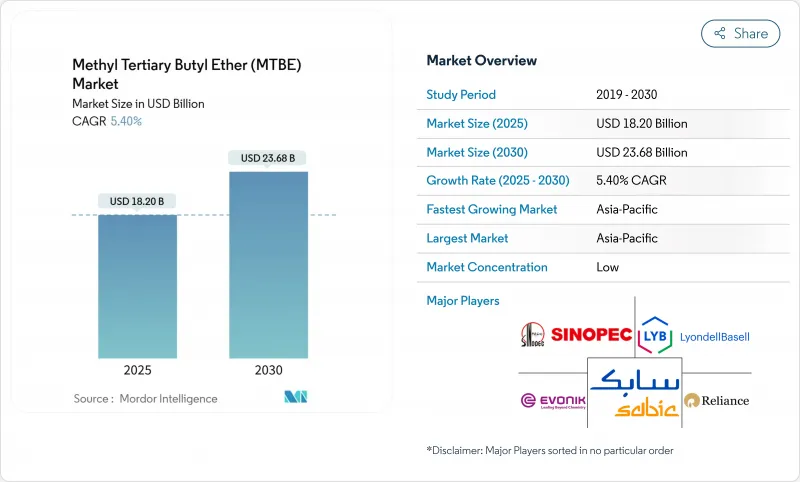

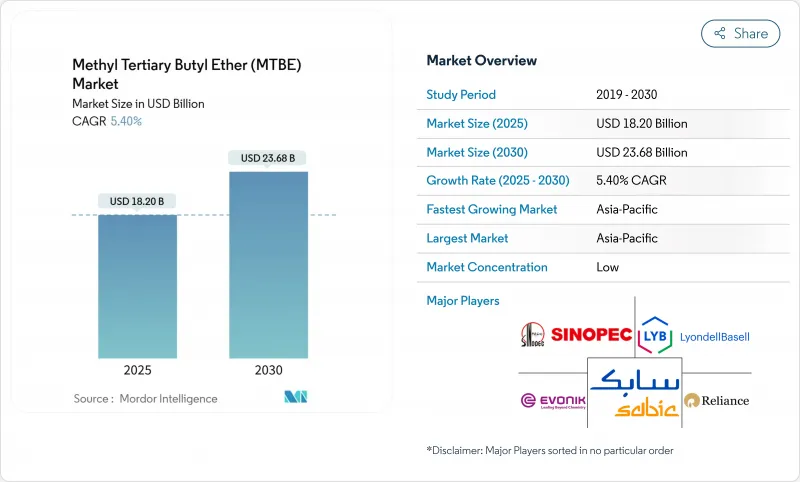

甲基三級丁基醚(MTBE) 市場規模預計在 2025 年為 182 億美元,預計到 2030 年將達到 236.8 億美元,預測期內(2025-2030 年)的複合年成長率為 5.40%。

需求成長的促進因素包括:向更清潔燃燒、更高辛烷值汽油的轉變、中東地區煉油廠的不斷擴張以及藥物提取過程的穩定應用。一體化煉油和石化聯合體使生產商能夠靈活地平衡汽油添加劑的生產和合成橡膠用高純度異丁烯日益成長的需求。亞太地區的排放法規(例如國六排放標準)持續提高優質燃料中甲基叔丁基醚(MTBE)的平均混合比例,而中國各地的甲醇制汽油計劃正在擴大甲基叔丁基醚(MTBE)作為中間體的可用資源。

全球甲基三級丁基醚(MTBE)市場趨勢與洞察

亞太地區低芳烴、高辛烷值汽油法規激增

中國六國法規要求減少廢氣氨排放。對照研究表明,MTBE 混合物在低溫冷啟動循環中可顯著降低排放。中國和印度的煉油廠正在將優質混合比例從 8% 提高到 15%。強勁的乘用車銷售和強勁的都市區車隊更新進一步支撐了需求。區域燃料經銷商青睞 MTBE,因為在蒸氣限制下,MTBE 比烷基化物或乙醇成本更低,測試辛烷值更高。這些法規支持持續投資於毗鄰催化重整裝置的專用 MTBE 生產線,為亞洲生產商提供規模經濟,以抵消殘油供應的波動性。

中東煉油廠擴建與專用MTBE裝置整合

海灣石油生產商正在其混合進料裂解裝置中整合甲基叔丁基醚(MTBE)迴路,以最大限度地提高Butene的利用率。沙烏地基礎工業公司(SABIC)在Petrokemya的年產100萬噸計劃計畫於2025年下半年完成機械竣工,這將鞏固其作為該地區穩定供應商的地位。朱拜勒也制定了類似的計劃,透過最佳化原料,針對性地分配異丁烯和甲醇原料,以確保利潤率。這種整合將在汽油和丁基橡膠需求疲軟期間提高運轉率,增強甲基叔丁基醚市場的韌性。從物流角度來看,海灣地區靠近亞洲,在季節性混合料波動期間縮短了現貨貨物的前置作業時間。

替代產品的可用性

乙醇在美國汽油市場中的地位正在提升,監管機構根據聯邦可再生燃料標準允許乙醇的摻混比例高達10%。加州空氣資源委員會的模型假設,到2046年,乙醇市場將以10%的乙醇為主,而15%的乙醇市場將進一步擴大。美國煉油系統已於2007年從新配方汽油中淘汰了甲基叔丁基醚(MTBE),這降低了基準需求,並對全球經濟成長產生了持久的負面影響。歐洲部分地區也出現了類似的政策趨勢,可能會限制乙醇的長期應用。

報告中分析的其他促進因素和限制因素

- 亞洲採用甲醇汽油路線導致 MTBE 需求增加

- MTBE 作為原料藥特殊萃取中的助溶劑的應用日益增多

- 在北美被歸類為污染物,隨後禁止在汽油混合物中使用

細分分析

受汽油添加劑和大型化學中間體需求的推動,到2024年,工業級原油將佔總產量的90%。原料純度通常為98.50%,並透過沿海碼頭的專用油罐基礎設施進行運輸。醫藥級原油雖然只佔總產量的10%,但隨著連續製藥廠採用甲基叔丁基醚(MTBE)進行結晶控制,預計其複合年成長率將達到5.98%。

到2024年,直接合約將涵蓋70%的出貨量,因為煉油廠和大型化學公司將透過長期協議購買駁船和鐵路車輛。這種結構減少了物流交接,並確保了品管和混合原料規格的一致性。分銷商為按托盤採購的中端油漆、橡膠和製藥公司供貨,佔出貨量的25%。隨著買家利用數位競標和合規文件工具,線上入口網站的複合年成長率達到6.40%。因此,叔甲基丁基醚市場正在逐步轉向一種混合履約模式,將電子商務訂單與區域油庫交付相結合。

全球甲基三級丁基醚(MTBE) 市場報告按等級(工業級、醫藥級)、分銷管道(直銷、分銷商、線上銷售)、應用(汽油添加劑、異丁烯、其他)、最終用戶行業(汽車、石油和天然氣、其他)和地區(亞太地區、北美、歐洲、南美、中東和非洲)對行業進行細分。

區域分析

預計到2024年,亞太地區將佔全球銷售額的42%,到2030年複合年成長率將達到6.23%。在中國,歐VI等效燃油標準的日益嚴格,加上國內MTG計劃的推進,正在結構性地推動辛烷值提升劑的需求。隨著巴拉特第六階段標準在全國推廣,印度也正處於類似的發展階段。

在北美,儘管美國墨西哥灣沿岸仍保持相當大的出口能力,但受州級禁令的影響,消費量有所放緩。歐洲的情況則是喜憂參半:儘管受到部分限制,但地中海沿岸的一些調合廠仍在優質無鉛汽油中使用MTBE,從而維持著小眾需求。

與此同時,中東生產商繼續以具有競爭力的離岸價瞄準歐洲夏季需求缺口。南美洲和非洲繼續成長,儘管規模較小,但巴西和奈及利亞擴大了無鉛汽油合併規模,且MTBE在蒸氣壓合規性方面優於芳烴。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 亞太地區低芳烴、高辛烷值汽油強制標準的普及

- 中東煉油廠擴建及 MTBE 裝置整合。

- 由於亞洲採用甲醇制汽油(MTG)路線,MTBE 需求增加

- 高性能輪胎對異辛烯(透過甲基叔丁基醚脫氫)的需求不斷增加

- MTBE 作為原料藥特殊萃取中的助溶劑的應用日益增多

- 市場限制

- 替代產品的可用性

- 在北美被歸類為污染物,隨後禁止在汽油混合物中使用

- 蒸汽裂解裝置C4殘液進料速率不穩定

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測(數量)

- 按年級

- 工業級

- 醫藥級

- 按分銷管道

- 直銷

- 經銷商

- 網上銷售

- 按用途

- 汽油添加劑

- 異丁烯

- 溶劑

- 其他用途

- 按最終用戶產業

- 車

- 石油和天然氣

- 化學

- 製藥

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- Eni SpA

- ENOC Company

- Enterprise Products Partners LP

- ETRONAS Chemicals Group Berhad

- Evonik Industries AG

- Exxon Mobil Corporation

- Formosa Plastics Corporation, USA

- Gazprom

- Huntsman International LLC

- LUKOIL

- LyondellBasell Industries Holdings BV

- QAFAC

- Reliance Industries Limited

- SABIC

- Shell plc

- Vinati Organics Limited

- Wanhua

第7章 市場機會與未來展望

The Methyl Tertiary Butyl Ether Market size is estimated at USD 18.20 billion in 2025, and is expected to reach USD 23.68 billion by 2030, at a CAGR of 5.40% during the forecast period (2025-2030).

Demand is rooted in the shift toward cleaner-burning, high-octane gasoline, mounting petro-refinery expansion in the Middle East, and steady uptake in pharmaceutical extraction processes. Integrated refinery-petrochemical complexes give producers flexibility to balance gasoline additive volumes with rising requirements for high-purity isobutylene used in synthetic rubber. Asia Pacific emission standards, such as China-6, continue to lift average MTBE blend rates in premium fuel grades, while methanol-to-gasoline projects across China extend the addressable pool for MTBE as an intermediate.

Global Methyl Tertiary Butyl Ether (MTBE) Market Trends and Insights

Surging Low-Aromatic, High-Octane Gasoline Mandates in Asia Pacific

China-6 regulations require lower tail-pipe ammonia emissions; controlled studies show MTBE blends deliver measurable reductions during cold-start cycles at low ambient temperatures. Refiners in China and India are lifting blend ratios from 8% to 15% in premium grades. Robust passenger-car sales and steady urban fleet renewal further support demand. Regional fuel marketers prefer MTBE because it raises research octane at a lower cost than alkylate or ethanol under vapour-pressure limits. These mandates underpin sustained investment in dedicated MTBE trains adjacent to catalytic reformers, giving Asian producers scale economies that offset raffinate supply variance.

Petro-refinery Expansion in the Middle East Integrated with On-purpose MTBE Units

Producers in the Gulf are embedding MTBE loops within mixed-feed crackers to maximise butenes utilisation. SABIC's 1 million-tpa project at Petrokemya will reach mechanical completion in late 2025, reinforcing the region's role as a swing supplier. Similar schemes in Jubail allocate on-purpose isobutylene and methanol streams to safeguard margin through feedstock optimisation. Integration improves operating rates when gasoline or butyl rubber demand softens, thereby adding resilience to the methyl tertiary butyl ether market. Logistically, the Gulf's proximity to Asia shortens lead times for spot cargoes during seasonal blend swings.

Availability of Substitutes

Ethanol retains a firm foothold in US gasoline because regulators permit up to 10 vol% blends under the federal Renewable Fuel Standard. California Air Resources Board modelling assumes E10 remains dominant through 2046, with scenarios for E15 expansion. The US refining system eliminated MTBE from reformulated gasoline by 2007, lowering baseline demand and exerting a persistent negative pull on global growth. Similar policy currents in parts of Europe could temper long-run uptake, although energy density and vapour-pressure differences hinder full substitution in warmer climates

Other drivers and restraints analyzed in the detailed report include:

- Methanol-to-Gasoline Route Adoption in Asia Elevating MTBE Demand

- Growing Use of MTBE as Co-solvent in Specialty Extraction for Pharma APIs

- Classification as Pollutant and Consequent Ban of Use in Gasoline Blending in North America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial grade accounted for 90% of tonnage in 2024, driven by bulk gasoline additive demand and large-scale chemical intermediates. Material typically carries a purity of 98.50% and is routed through dedicated tank infrastructure at coastal terminals. Pharmaceutical grade, although just 10% by volume, is set to climb faster on a 5.98% CAGR as continuous drug manufacturing plants adopt MTBE for controlled crystallisations.

Direct contracts covered 70% of 2024 shipments as refineries and major chemical companies source barge or railcar lots via long-term agreements. This structure reduces logistical handoffs and aligns quality control with blend-stock specifications. Distributors supply mid-sized paint, rubber, and pharma firms that purchase pallet quantities, accounting for 25% of volumes. Online portals exhibit a 6.40% CAGR as buyers leverage digital tenders and compliance documentation tools. The methyl tertiary butyl ether market is thus moving gradually toward hybrid fulfillment models that integrate e-commerce ordering with regional tank farm delivery.

The Global Methyl Tertiary Butyl Ether (MTBE) Market Report Segments the Industry by Grade (Industrial Grade and Pharmaceutical Grade), Distribution Channel (Direct Sales, Distributors, and Online Sales), Application (Gasoline Additives, Isobutene, and More), End-User Industry (Automotive, Oil and Gas, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific held 42% of global revenue in 2024, and is forecast to grow at 6.23% CAGR to 2030. China's expanded Euro-VI equivalent fuel standard mandates, coupled with domestic MTG projects, raise structural demand for octane boosters. India follows a similar trajectory as Bharat Stage VI norms widen nationwide.

North America reflects subdued consumption after state-level bans, yet the US Gulf Coast retains substantial export capacity. Europe presents a mixed picture. While partial restrictions exist, certain Mediterranean blenders still use MTBE in premium unleaded formulations, maintaining niche demand.

Meanwhile, Middle Eastern producers continue to target European summer demand gaps with competitive FOB pricing. South America and Africa remain smaller but growing as Brazil and Nigeria widen unleaded gasoline pooling that benefits MTBE over aromatics in terms of vapour pressure compliance.

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- Eni S.p.A

- ENOC Company

- Enterprise Products Partners L.P.

- ETRONAS Chemicals Group Berhad

- Evonik Industries AG

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Gazprom

- Huntsman International LLC

- LUKOIL

- LyondellBasell Industries Holdings B.V.

- QAFAC

- Reliance Industries Limited

- SABIC

- Shell plc

- Vinati Organics Limited

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Low-Aromatic, High-Octane Gasoline Mandates in Asia Pacific

- 4.2.2 Petro-refinery Expansion in Middle-East Integrated with On-purpose MTBE Units

- 4.2.3 Methanol-to-Gasoline (MTG) Route Adoption in Asia Elevating MTBE Demand

- 4.2.4 Rising Demand for Iso-octene (via MTBE Dehydrogenation) in High-performance Tires

- 4.2.5 Growing Use of MTBE as Co-solvent in Specialty Extraction for Pharma APIs

- 4.3 Market Restraints

- 4.3.1 Availability of Substitutes

- 4.3.2 Classification as Pollutant and Consequent Ban of Use in Gasoline Blending in North America

- 4.3.3 Volatility in C4 Raffinate Availability from Steam Crackers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 Industrial Grade

- 5.1.2 Pharmaceutical Grade

- 5.2 By Distribution Channel

- 5.2.1 Direct Sales

- 5.2.2 Distributors

- 5.2.3 Online Sales

- 5.3 By Application

- 5.3.1 Gasoline Additives

- 5.3.2 Isobutene

- 5.3.3 Solvents

- 5.3.4 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Oil and Gas

- 5.4.3 Chemicals

- 5.4.4 Pharmaceuticals

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BP plc

- 6.4.2 Chevron Phillips Chemical Company LLC

- 6.4.3 China Petrochemical Corporation

- 6.4.4 CNPC

- 6.4.5 Eni S.p.A

- 6.4.6 ENOC Company

- 6.4.7 Enterprise Products Partners L.P.

- 6.4.8 ETRONAS Chemicals Group Berhad

- 6.4.9 Evonik Industries AG

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 Formosa Plastics Corporation, U.S.A.

- 6.4.12 Gazprom

- 6.4.13 Huntsman International LLC

- 6.4.14 LUKOIL

- 6.4.15 LyondellBasell Industries Holdings B.V.

- 6.4.16 QAFAC

- 6.4.17 Reliance Industries Limited

- 6.4.18 SABIC

- 6.4.19 Shell plc

- 6.4.20 Vinati Organics Limited

- 6.4.21 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Innovation in Bio-based MTBE for Gasoline