|

市場調查報告書

商品編碼

1836449

製藥膜過濾:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Pharmaceutical Membrane Filtration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

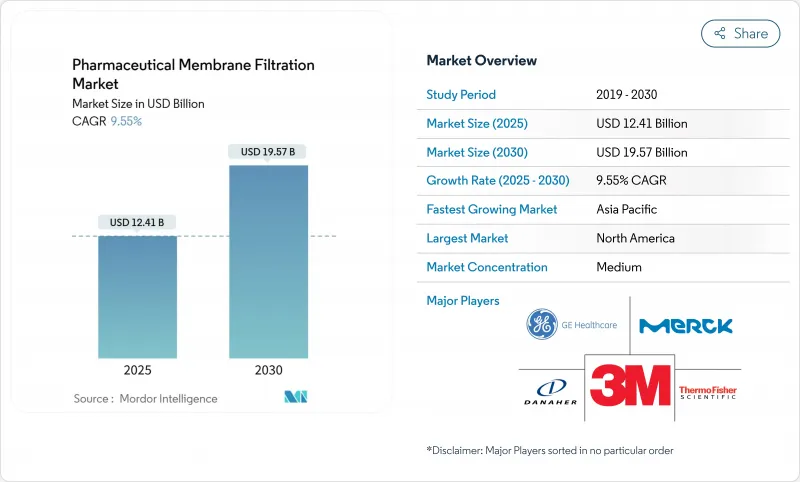

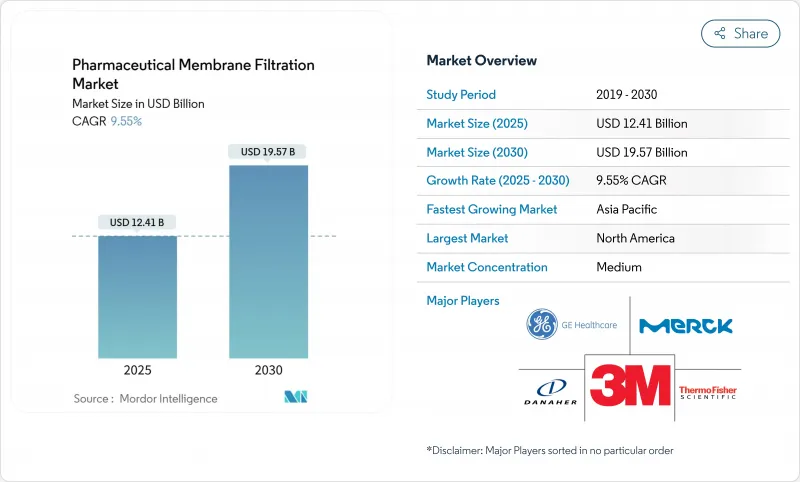

預計 2025 年醫藥膜過濾市場規模為 124.1 億美元,到 2030 年將達到 195.7 億美元,預測期內(2025-2030 年)的複合年成長率為 9.55%。

生技藥品、基因療法和疫苗計畫激增,推動了對高性能無菌過濾器的需求。該行業也受益於監管壓力,要求其展示能夠提高生產靈活性並限制交叉污染的病毒清除和一次性系統。奈米過濾、連續處理和即時分析方面的投資正在推動這些技術的進一步應用,尤其是在病毒去除、蛋白質濃縮和注射用水操作方面。北美憑藉著成熟的生物加工基礎設施和美國食品藥物管理局(FDA)的明確指導,保持了主導地位;而亞太地區則在大規模產能擴張和生物技術獎勵的推動下,發展勢頭強勁。

全球製藥膜過濾市場趨勢與見解

一次性技術的採用日益增多

一次性過濾組件已成為現代生技藥品設施的核心支柱,可將轉換時間縮短高達50%,並無需進行清潔驗證。與中空纖維切向流設計的兼容性使生產商能夠快速改裝現有生產線。靈活的袋式系統可實現個人化治療的並行宣傳活動,整合感測器可傳輸關鍵品質數據,滿足FDA持續監測的要求。降低公用事業和人事費用,以及減輕建築材料重量,可減少浪費,進一步提高成本效益。隨著基因治療規模的擴大,內毒素去除率>99.999%的一次性濾芯可實現快速批次週轉,且無跨產品交叉污染的風險。此模型符合需要快速現場部署和突波能力的疫情防治策略。

擴大生技藥品和基因治療產品線

全球生技藥品研發管線超過10,000種,每個專案都需要強大的病毒過濾,以達到6 log10或更高的病毒截留率。旭化成的Planova FG1可提供7倍的通量,在不影響病毒截留率的情況下縮短處理時間。更新後的Q5A(R2)指南提倡基於風險的驗證,並鼓勵針對特定應用的過濾器開發,以支援快速商業化。這一趨勢也延伸到了mRNA疫苗,該疫苗需要在低結合條件下進行澄清和滅菌,以保護脆弱的脂質奈米顆粒。

高資本投入

商業規模的過濾設備成本可能超過1000萬美元,包括滑軌、分析和驗證。整合PAT感測器會增加額外費用,需要資料歷史記錄和經過認證的網路安全層。新興市場的製造商通常依靠撥款和合作夥伴關係來獲得資金,而外匯波動可能會侵蝕預算。賽默飛世爾科技以41億美元收購Solventum,顯示了在淨化技術領域保持競爭力所需的投入。跨國公司必須跨地區複製測試通訊協定,導致資本膨脹,並被重複的設施所束縛。

報告中分析的其他促進因素和限制因素

- 嚴格的監管要求

- 奈米過濾技術的進展

- 膜污染問題與生命週期縮短

細分分析

聚醚碸 (PES) 憑藉其高耐化學性和低蛋白結合率,將在 2024 年佔據醫藥膜過濾市場的 32.84%。其親水性使其能夠支持 211 mL/min 的流速,且蛋白質吸附率低於 1%,從而在單抗純化過程中實現穩定的產量。表面磺酸鹽和 PEG 接枝增強了其親水性,延長了使用壽命並減少了結垢。

儘管受到PFAS(全氟辛烷磺酸)的嚴格審查,PVDF預計仍將以10.01%的複合年成長率成長,這得益於其低萃取物和適用於最終灌裝線的特性。監管的不確定性促使供應商開發不含PFAS的產品,而使用者則正在評估PVDF在線上蒸汽循環中的熱穩定性。混合纖維素酯、尼龍和聚丙烯膜可滿足利基實驗室和成本敏感型應用的需求,這些應用對極高的堅固性並非必要。對比研究表明,即使在高固態含量下,PES也能保持滲透性,而PVDF在低結合無菌過濾方面表現出色。製造商的目標是開發超潔淨等級的產品,以滿足日益嚴格的萃取物限值,並在儲存期間保持產品純度。

微過濾將在2024年佔據44.32%的收入佔有率,這得益於其在細胞收穫和微生物附著量去除方面的成熟應用。阻力級數模型可實現精確的放大,確保中試資料轉換為實際生產。連續微過濾與交替切向流結合,可提高強化補料分批培養的收穫產量。由於疫苗和基因治療產品線需要高通量病毒去除,奈米過濾的複合年成長率將達到12.95%。

2D材料塗層可在不犧牲20奈米孔隙率的情況下提高水滲透性,從而實現高於6 log10的病毒去除率。小型化鑽機有助於確定最佳pH值和電導率窗口,調整參數可實現900%的通量提升。超過濾對於緩衝液交換和蛋白質濃縮仍然至關重要,而逆滲透則用於注射系統的水處理。

本報告按材料(例如聚醚碸、聚二氟亞乙烯)、技術(例如微過濾)、製程階段(例如最終產品無菌過濾)、規模(例如實驗室)和地區(例如北美、歐洲、亞太地區、中東和非洲以及南美)對醫藥膜過濾市場進行了細分。市場預測以美元計算。

區域分析

2024年,北美將在製藥膜過濾市場保持36.55%的佔有率,這得益於密集的生技藥品工廠網路以及FDA以清晰的指導方針支持先進製造。聯邦政府為對抗疫情提供的獎勵正在支持對高容量一次性系統和連續生產線的支出。歐洲緊隨其後,受附件1修正案的推動,該修正案強制生產商採用PUPSIT和自動化完整性檢查。企業正在投資病毒過濾器和數據豐富的設備,以滿足嚴格的審核要求。

隨著各國政府向物流投入大量資金,到 2030 年,亞太地區的複合年成長率將達到 11.67%。 Cytiva 投資 1.5 億美元在韓國的工廠和 MilliporeSigma 投資 3 億歐元在韓國大田的工廠標誌著該地區的崛起,使當地能夠供應無菌過濾器和一次性套件並縮短物流鏈。中國和印度正在加強 GMP 合規性,近 90% 的中國和印度生物技術營運商都計劃進入全球市場。隨著 CDMO 尋求經濟多元化,拉丁美洲和中東地區正在以巴西和沙烏地阿拉伯為首取得進展。 ICH 指南的協調促進了技術轉讓,使跨國公司能夠在多個大洲部署相同的過濾系統。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 一次性技術的採用日益增多

- 擴大生技藥品和基因治療產品線

- 嚴格的監管要求

- 奈米過濾技術的進展

- 增加研發投入

- 在新興市場擴大製藥生產

- 市場限制

- 高資本投入

- 膜污染問題與生命週期縮短

- 整合複雜性

- 開發中地區認知度較低

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測(單位:美元)

- 按材質

- 聚醚碸(PES)

- 聚二氟亞乙烯(PVDF)

- 混合纖維素酯和醋酸纖維素(MCE和CA)

- 尼龍

- 聚丙烯及其他

- 依技術

- 微過濾

- 超過濾

- 奈米過濾

- 逆滲透及更多

- 按流程階段

- 最終產品無菌過濾

- 原料藥說明

- 細胞分離/收集

- 水和公用設施過濾

- 空氣/氣體過濾

- 按規模

- 實驗室

- 飛行員

- 商業化生產

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第6章 競爭態勢

- 市場集中度

- 市佔率分析

- 公司簡介

- 3M Company

- Danaher

- Merck KGaA

- Sartorius Stedim Biotech

- Thermo Fisher Scientific

- Parker Hannifin

- Repligen Corporation

- GEA Group

- Graver Technologies

- GE Healthcare

- Meissner Filtration

- Alfa Laval

- Cobetter Filtration

- Amazon Filters

- Porvair Filtration Group

- Novasep

- Donaldson Company

- Asahi Kasei

- Tami Industries

- Cole-Parmer

第7章 市場機會與未來展望

The Pharmaceutical Membrane Filtration Market size is estimated at USD 12.41 billion in 2025, and is expected to reach USD 19.57 billion by 2030, at a CAGR of 9.55% during the forecast period (2025-2030).

Demand stems from the surge in biologics, gene therapies, and vaccine programs that require sterile, high-performance filters. The sector also benefits from regulatory pressure to prove viral clearance and from single-use systems that heighten production agility while curbing cross-contamination. Investments in nanofiltration, continuous processing, and real-time analytics further lift adoption, especially for virus removal, protein concentration, and water-for-injection operations. North America retains a leading position thanks to an entrenched bioprocessing base and clear guidance from the FDA, while Asia-Pacific gains momentum on the back of large-scale capacity additions and biotech incentives.

Global Pharmaceutical Membrane Filtration Market Trends and Insights

Increasing Adoption of Single-Use Technologies

Single-use filtration assemblies shorten change-over times by up to 50% and remove cleaning validation, making them a central pillar of modern biologics facilities. Compatibility with hollow-fiber tangential-flow designs lets producers retrofit legacy lines quickly. Flexible bag-based systems permit parallel campaigns for personalized therapies, while built-in sensors transmit critical quality data that satisfy FDA expectations for continuous monitoring. Cost advantages rise as utilities and labor shrink, and waste volumes decline thanks to lighter construction materials. As gene therapy volumes scale, single-use cartridges rated to >99.999% endotoxin removal enable rapid batch turnaround without risking cross-product carryover. The model aligns with pandemic-preparedness strategies that require fast site deployment and surge capacity.

Expansion of Biologics & Gene Therapy Pipelines

The global biologics pipeline surpasses 10,000 active programs, each requiring robust virus filtration that meets >6 log10 reduction mandates. Plasmid DNA and viral vectors impose high-viscosity loads that spur demand for membranes with optimized pore geometry to avoid shear-induced degradation.Asahi Kasei's Planova FG1 delivers seven-fold higher flux, cutting process time without compromising retention. Updated Q5A(R2) guidance promotes risk-based validation, encouraging application-specific filter development that supports rapid commercialization. The trend extends to mRNA vaccines, where clarification and sterilization must proceed under low binding conditions to protect fragile lipid nanoparticles.

High Capital Investment

Commercial-scale filtration suites cost upward of USD 10 million once skids, analytics, and validation are included, a hurdle for small firms and CDMOs. Integration of PAT sensors raises spending further because data historians and cybersecurity layers must be certified. Emerging-market manufacturers often rely on subsidies or partnerships to secure funding, and currency fluctuations can erode budgets. Thermo Fisher's USD 4.1 billion Solventum purchase shows the size of bets required to stay competitive in purification technology. Multinational companies must duplicate test protocols across regions, swelling capital tied up in duplicate equipment.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Regulatory Requirements

- Advancements in Nanofiltration Technology

- Membrane Fouling Issues & Reduced Lifecycle

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PES accounted for 32.84% of the pharmaceutical membrane filtration market in 2024, favored for high chemical resistance and low protein binding. Its hydrophilic nature supports 211 mL/min flow rates with protein adsorption below 1%, enabling consistent yields in mAb purification. Surface sulfonation and PEG grafting deepen hydrophilicity, stretch lifespan, and limit fouling.

PVDF is projected to grow at 10.01% CAGR despite PFAS scrutiny, owing to its low extractables and suitability for final fill lines. Regulatory uncertainty encourages suppliers to devise PFAS-free variants, but users value PVDF's thermal stability for steam-in-place cycles. Mixed cellulose ester, nylon, and polypropylene membranes satisfy niche lab or cost-sensitive tasks where extreme robustness is not essential. Comparative studies find PES retains permeability under high solids loads while PVDF excels in low-binding sterile filtration. Manufacturers target ultraclean grades that meet ever tighter leachables limits, preserving product purity throughout storage.

Microfiltration held 44.32% revenue share in 2024 due to entrenched use for cell harvesting and bioburden reduction. Resistance-in-series models allow accurate scale-up, ensuring pilot data translate to manufacturing. Continuous microfiltration combined with alternating tangential flow lifts harvest titers for intensified fed-batch cultures. Nanofiltration is set to rise at 12.95% CAGR on the back of vaccine and gene therapy pipelines demanding virus removal under high flux.

Two-dimensional material coatings raise water permeability without sacrificing 20 nm pore exclusion, facilitating >6 log10 virus clearance. Scale-down rigs help define optimal pH and conductivity windows, driving 900% throughput gains when parameters are tuned. Ultrafiltration remains vital for buffer exchange and protein concentration, whereas reverse osmosis handles water treatment for injection systems.

The Report Covers Pharmaceutical Membrane Filtration Market is Segmented by Material (Polyethersulfone, Polyvinylidene Difluoride, and More), Technique (Microfiltration, and More), Process Stage (Final Product Sterile-Filtration, and More), Scale (Laboratory, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.55% share of the pharmaceutical membrane filtration market in 2024, powered by a dense network of biologics plants and an FDA that endorses advanced manufacturing with clear guidance. Federal incentives for pandemic preparedness sustain spending on high-capacity single-use systems and continuous lines. Europe follows closely, driven by Annex 1 revisions that compel producers to adopt PUPSIT and automated integrity checks. Firms invest in virus filters and data-rich skids to navigate stringent audit expectations.

Asia-Pacific is set to grow at 11.67% CAGR through 2030 as governments pour funds into biotech hubs. Cytiva's USD 150 million Korean site and MilliporeSigma's EUR 300 million plant in Daejeon signal the region's ascent, offering local supply of sterile filters and single-use kits that shorten logistics chains. China and India increase GMP adherence, with close to 90% of Chinese and 100% of Indian biomanagers targeting global market entry. Latin America and the Middle East make incremental progress, led by Brazil and Saudi Arabia, which court CDMOs to diversify their economies. Harmonization of ICH guidelines eases technology transfer, enabling global firms to deploy identical filtration trains across multiple continents.

- 3M

- Danaher

- Merck

- Sartorius

- Thermo Fisher Scientific

- Parker Hannifin

- Repligen

- GEA Group

- Graver Technologies

- GE Healthcare

- Meissner Filtration

- Alfa Laval

- Cobetter Filtration

- Amazon Filters

- Porvair Filtration Group

- Novasep

- Donaldson Company

- Asahi Kasei

- Tami Industries

- Cole-Parmer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Single-Use Technologies

- 4.2.2 Expansion of Biologics & Gene Therapy Pipelines

- 4.2.3 Stringent Regulatory Requirements

- 4.2.4 Advancements in Nanofiltration Technology

- 4.2.5 Rising R&D Investments

- 4.2.6 Expanding Pharmaceutical Manufacturing in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 High Capital Investment

- 4.3.2 Membrane Fouling Issues & Reduced Lifecycle

- 4.3.3 Complexity in Integration

- 4.3.4 Limited Awareness in Developing Regions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Material

- 5.1.1 Polyethersulfone (PES)

- 5.1.2 Polyvinylidene Difluoride (PVDF)

- 5.1.3 Mixed Cellulose Ester & Cellulose Acetate (MCE & CA)

- 5.1.4 Nylon

- 5.1.5 Polypropylene & Others

- 5.2 By Technique

- 5.2.1 Microfiltration

- 5.2.2 Ultrafiltration

- 5.2.3 Nanofiltration

- 5.2.4 Reverse-Osmosis & Others

- 5.3 By Process Stage

- 5.3.1 Final Product Sterile-filtration

- 5.3.2 Bulk Drug Substance Clarification

- 5.3.3 Cell Separation & Harvesting

- 5.3.4 Water & Utility Filtration

- 5.3.5 Air/Gas Filtration

- 5.4 By Scale

- 5.4.1 Laboratory

- 5.4.2 Pilot

- 5.4.3 Commercial Production

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Danaher

- 6.3.3 Merck KGaA

- 6.3.4 Sartorius Stedim Biotech

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 Parker Hannifin

- 6.3.7 Repligen Corporation

- 6.3.8 GEA Group

- 6.3.9 Graver Technologies

- 6.3.10 GE Healthcare

- 6.3.11 Meissner Filtration

- 6.3.12 Alfa Laval

- 6.3.13 Cobetter Filtration

- 6.3.14 Amazon Filters

- 6.3.15 Porvair Filtration Group

- 6.3.16 Novasep

- 6.3.17 Donaldson Company

- 6.3.18 Asahi Kasei

- 6.3.19 Tami Industries

- 6.3.20 Cole-Parmer

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment