|

市場調查報告書

商品編碼

1694045

美國感測器-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)United States Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

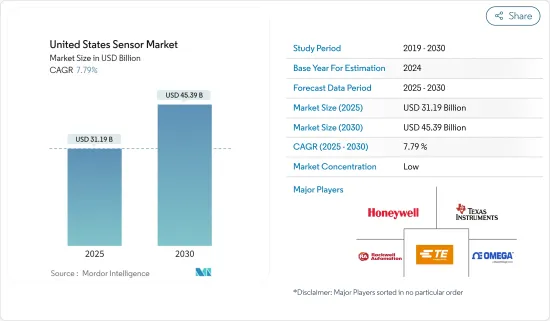

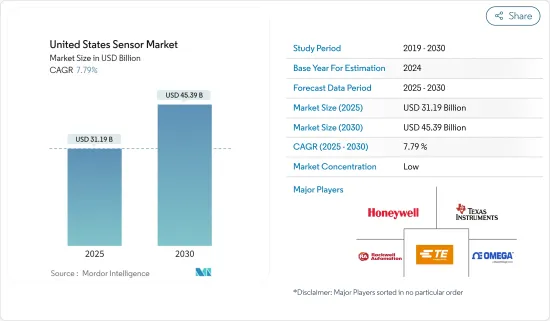

預計 2025 年美國感測器市場規模為 311.9 億美元,預計到 2030 年將達到 453.9 億美元,市場估計和預測期(2025-2030 年)的複合年成長率為 7.79%。

感測器旨在檢測和響應來自物理環境的各種輸入,包括壓力、熱量、光、運動和濕度。產生的訊號通常以人類可讀的形式顯示在感測器的位置,或透過網路以電子方式傳輸,以便於讀取和進一步處理。

從智慧型手機導航系統到駕駛輔助系統,各行各業對智慧感測器技術的需求都在成長。感測器在保持技術領域的競爭力方面發揮關鍵作用。物聯網 (IoT)、穿戴式健康監測系統和汽車自動化等主要趨勢正在推動這一需求。因此,智慧感測器變得越來越容易獲得,使各行各業的公司能夠提高自動化程度、生產力、效率和安全性。

隨著製程自動化的進步,感測技術也發生了顯著的變化,推動了功能更強大、互聯互通的感測設備的開發。隨著數位化轉型的加速,對流程自動化、改進的異常檢測和更好的預測性維護能力的需求正在成長,推動了感測技術的廣泛應用。

持續的技術進步推動了美國汽車產業對電子感測器的需求,尤其是位置感測應用。該行業對電氣化和自動駕駛等技術進步的關注正在推動對感測器的需求。此外,在汽車中加入位置感測器的趨勢預示著市場成長前景光明。

此外,美國智慧汽車市場的不斷擴大以及汽車目標商標產品製造商(OEM)對感測器的使用不斷增加也推動了汽車領域對感測器的需求。強制在車輛中使用某些感測器的法規的實施進一步推動了汽車行業對感測器的需求不斷成長。

雖然感測器整合增強了工業自動化,但它會增加成本,這可能會成為成本敏感型應用的限制因素。此外,新產品所需的高昂研發成本也是一個重大挑戰,尤其是對於資金有限的中小型感測器製造商而言。

美國感測器市場趨勢

預計可伸縮安全注射器市場在預測期內將顯著成長

- 化學感測器是一種對特定分析物進行選擇性和可逆性響應並提供可進行全面成分分析的電輸出訊號的分析裝置。該國的污染水平正在上升,增加了對化學感測器的需求。化學感測器在分析不同樣品成分方面的應用日益增多,推動了其普及。值得注意的是,對低成本和攜帶式化學感測器(包括先進的正交變體)的需求激增是推動市場成長的關鍵趨勢。

- 工業發展刺激了各種有毒物質的生產,包括致癌性、致突變和一般危險的化學物質。儘管受到嚴格控制,這些物質仍然對人類健康構成威脅。

- 此外,醫療產業對化學感測器的興趣日益濃厚,這種感測器可以提供連續、即時的生理和化學數據,並以非侵入的方式監測人體生物流體(如淚液、唾液、汗液、組織液和人體揮發物)中的生化標記。

- 最近的進展集中在電化學生物感測器上,特別是用於監測代謝物、蛋白質、化學物質和細菌。測量人體內的生物物理量已成為醫學和醫療保健領域的重要焦點。大量柔軟、穿戴式和可拆卸的感測器已被開發並商業化,用於監測體育、醫療和保健應用中的關鍵參數。

- 此外,隨著糖尿病盛行率的急劇上升,各國政府正在增加對先進診斷方法的投資,從而刺激化學感測器在醫療保健領域的廣泛應用。

- 2024 年全國糖尿病統計報告顯示,美國有 3,840 萬成年人患有糖尿病。其中確診2,930萬人,未確診970萬人。特別值得注意的是,美國人口的29.2%(即1,650萬人)年齡在65歲或以上。此外,估計每年有 120 萬美國人被診斷出患有糖尿病。預計未來幾年中國糖尿病患者數量的增加將刺激市場成長。

預計北美將在預測期內佔據主要市場佔有率

- 家用電子電器領域包括智慧型手機、筆記型電腦、平板電腦、電視、遊戲機、智慧家居設備、數位相機等。智慧型穿戴裝置不包括在此領域。

- 許多家用電子電器產品,如行動電話、筆記型電腦、遊戲機、微波爐和冰箱,都使用溫度、接近度和運動感測器進行操作。對這些設備的高需求是市場成長的主要驅動力。

- 家用電子電器產品中的感測器在改善各種家用電子電器家用電子電器產品)的功能性、可用性和整體性能方面發揮著至關重要的作用。這些感測器使這些設備能夠與周圍環境進行交互,並描述觸控感應介面、運動偵測、影像捕捉和環境監測等功能。

- 隨著智慧建築變得越來越普及,感測設備被擴大用於智慧家庭應用。由於智慧家用電子電器、智慧家庭物聯網設備的廣泛應用以及技術進步和創新,對感測器的需求預計會增加。此外,無線技術的日益普及正在推動智慧家用電子電器市場的發展,預計這將為感測器開闢新的市場機會。

- 例如,在美國,根據消費者科技協會 (CTA) 的數據,智慧家庭設備銷售總收入預計將在 2023 年達到 235 億美元,而 2018 年為 197 億美元。由於對節能家用電子電器的需求不斷成長,預計智慧科技市場對專用感測器的需求將會增加。

- 智慧家用電子電器的普及將由感測器技術、人工智慧、巨量資料分析和物聯網設備推動。預計2024年美國家用電子電器產品零售額將達到5,120億美元,到2023年OLED電視預計將創造23億美元的銷售額,而掌上遊戲機預計將創造15億美元的銷售額。

美國感測器產業概況

美國感測器市場是細分的,預計在預測期內,感測器行業知名企業的不斷湧現將加劇競爭對手之間的競爭。德州儀器公司、泰科電子有限公司、歐米茄工程公司、霍尼韋爾國際公司和羅克韋爾自動化公司等市場現有企業正在對整個市場產生重大影響。

2024 年 2 月-意法半導體推出了一款一體化直接飛行時間 (dToF) 3D LiDAR 模組,擁有市場領先的 2.3k 解析度。此外,該公司還宣布世界上最小的 50 萬像素間接飛行時間 (iToF) 感測器的早期設計成功。 VL53L9 是一款新型直接 ToF 3D LiDAR 設備,解析度高達 2.3k 區域。此 LiDAR 具有市場上獨一無二的雙掃描泛光照明功能,能夠偵測小物體和邊緣,同時擷取 2D 紅外線 (IR) 影像和 3D 深度圖資訊。

2024 年 1 月 - ams Osram 在舊金山的 Photonics West 上展示其 Mira 產品系列的最新成員 Mira016 CMOS 影像感測器。 Mira016 是一款背照式(BSI) 雙層感應器,採用緊湊的 1.8 毫米 x 1.8 毫米封裝,解析度為 400 x 400 像素。它以全解析度、90 fps 運行,僅消耗 20 mW 的功率,即使在近紅外線範圍內也能實現高量子效率,以低功耗提供高性能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈/供應鏈分析

第5章市場動態

- 市場促進因素

- 對物聯網和連網型設備的需求不斷成長

- 汽車產業擴大採用先進感測器技術

- 市場限制

- 初始成本高

第6章市場區隔

- 依產品類型

- 壓力

- 等級

- 流動

- 接近度

- 環境

- 化學

- 慣性

- 磁的

- 霍爾效應感測器

- 其他磁性感測器

- 位置感測器

- 電流感測器

- 其他

- 按運轉方式

- 光學的

- 電阻

- 生物感測器

- 壓阻式

- 影像

- 電容式

- 壓電

- 騎士

- 雷達

- 其他操作模式

- 按最終用戶產業

- 車

- 家用電子電器

- 能源

- 工業/其他

- 健康與福利

- 建築、農業、採礦

- 航太

- 機器人技術

第7章競爭格局

- 公司簡介

- Texas Instruments Incorporated

- TE Connectivity Ltd

- Omega Engineering Inc.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Siemens AG

- STMicroelectronics Inc.

- AMS Osram AG

- NXP Semiconductors NV

- Infineon Technologies AG

- Bosch Sensortec GmbH

- Sick AG

- ABB Limited

- Omron Corporation

- Allegro MicroSystems Inc

第8章 市場展望

The United States Sensor Market size is estimated at USD 31.19 billion in 2025, and is expected to reach USD 45.39 billion by 2030, at a CAGR of 7.79% during the forecast period (2025-2030).

A sensor is designed to detect and react to various inputs from the physical environment, such as pressure, heat, light, motion, and moisture. The resulting output typically consists of a signal that can be displayed in a human-readable format at the sensor's location or transmitted electronically over a network for easy reading or additional processing.

The increasing demand for intelligent sensor technology is evident in various industries, from smartphone navigation systems to driver-assistance systems. Sensors are playing a vital role in staying competitive in the technology sector. Major trends like the Internet of Things (IoT), wearable health monitoring systems, and vehicle automation drive this demand. Consequently, intelligent sensors are now more accessible, enabling businesses in various industries to enhance automation, productivity, efficiency, and safety measures.

The evolution of sensing technology is apparent with advancements in process automation, leading to the development of more capable and interconnected sensing devices. As the shift toward digitalization speeds up, there is a growing demand for increased process automation, improved anomaly detection, and predictive maintenance capabilities, prompting a significant uptake of sensing technology.

Due to ongoing technological advancements, the automotive industry in the United States is experiencing a growing need for electronic sensors, especially for position-sensing applications. The industry's focus on technical progress, such as electrification and autonomous driving, has increased the demand for sensors. Additionally, the trend of incorporating position sensors into vehicles demonstrates a promising future for the market's growth.

Additionally, the increasing market for smart vehicles and the growing use of sensors by automotive original equipment manufacturers (OEMs) in the United States also drive the demand for sensors in the automotive sector. The rise in demand for sensors in the automotive industry is further bolstered by the enforcement of regulations requiring the use of specific sensors in vehicles.

While integrating sensors enhances industrial automation, it comes with an added cost that may be a limiting factor in cost-sensitive applications. Furthermore, the high costs associated with research and development for creating new products pose a significant challenge, especially for smaller sensor manufacturers that may lack funds.

United States Sensor Market Trends

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- Chemical sensors are analyzers that respond selectively and reversibly to specific analytes, providing an electrical output signal that enables a comprehensive composition analysis. The country's escalating pollution levels have bolstered the demand for these sensors. Rising applications for chemical sensors in analyzing diverse sample compositions drive their adoption. Notably, the market is witnessing a surge in demand for low-cost, portable chemical sensors, including advanced orthogonal variants, underscoring a significant trend poised to propel the market's growth.

- Industrial development has spurred the production of various toxic materials, encompassing carcinogenic, mutagenic, and generally hazardous chemicals. Despite stringent management, these substances continue to endanger human health.

- Furthermore, the healthcare industry is increasingly interested in chemical sensors due to their capability to deliver continuous, real-time physiological and chemical data and non-invasive monitoring of biochemical markers in human biofluids such as tears, saliva, sweat, interstitial fluid, and human volatiles.

- Recent advancements have concentrated on electrochemical biosensors, particularly for monitoring metabolites, proteins, chemicals, and bacteria. Measuring biophysical quantities in the human body has been a significant focus in healthcare and medicine. Numerous flexible, wearable, and detachable sensors have been developed and commercialized to monitor critical parameters in sports, healthcare, and medical applications.

- Furthermore, as diabetes rates surge, the country's governments are ramping up investments in advanced diagnostic methods, fueling the uptake of chemical sensors in healthcare.

- The National Diabetes Statistics Report of 2024 revealed that 38.4 million adults in the United States had diabetes. Among them, 29.3 million had been diagnosed, while a concerning 9.7 million were undiagnosed. Notably, 29.2% of the American population, equating to 16.5 million seniors, were aged 65 and above. Furthermore, an estimated 1.2 million Americans are diagnosed with diabetes each year. The increasing number of diabetes patients in the country every year is expected to fuel the market's growth in the coming years.

North America Expected to Hold Significant Market Share During the Forecast Period

- The consumer electronics segment includes smartphones, laptops, tablets, televisions, gaming consoles, smart home devices, digital cameras, and others. Smart wearables are not considered in this segment.

- Most consumer electronics, such as mobile phones, laptops, game consoles, microwaves, and refrigerators, operate with temperature, proximity, motion sensors, etc. The high demand for these devices is a crucial factor contributing to the market's growth.

- Sensors in consumer electronics play a crucial role in improving the functionality, user-friendliness, and overall performance of a wide range of consumer electronic products, including smartphones, tablets, wearables, gaming consoles, home appliances, and others. These sensors enable these devices to interact with their surroundings and offer touch-sensitive interfaces, motion detection, image capture, environmental monitoring, and more capabilities.

- Sensing devices are used in more smart home applications as smart structures gain popularity. The demand for sensors is expected to increase due to the growing popularity of smart consumer electronics, IoT devices for smart homes, and technological advancements and innovations. Additionally, the growing use of wireless technologies, propelling the market for smart consumer electronics, is anticipated to open up new market opportunities for sensors.

- For instance, according to the Consumer Technology Association (CTA), in the United States, total revenue from the sales of smart home devices was estimated to reach USD 23.5 billion in 2023, compared to USD 19.7 billion in 2018. It is anticipated that the market for smart technology will witness rising demand for energy-saving appliances and increasing demand for sensors with applications.

- The adoption of smart home appliances will be fueled by sensor technology, AI, big data analytics, and IoT-enabled devices. Projections indicate that 2024 retail sales in the United States for consumer electronics will hit a significant USD 512 billion. In 2023, OLED TVs were on track to rake in USD 2.3 billion, while portable gaming consoles were eyeing a revenue of USD 1.5 billion.

United States Sensor Industry Overview

The United States Sensor market is fragmented, and the increasing presence of prominent manufacturers in the sensor industry is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as Texas Instruments Incorporated, TE Connectivity Ltd, Omega Engineering Inc., Honeywell International Inc., Rockwell Automation Inc., etc., considerably influence the overall market.

February 2024 - STMicroelectronics introduced an all-in-one, direct Time-of-Flight (dToF) 3D LiDAR module boasting a market-leading 2.3k resolution. Additionally, the company has disclosed an early design win for the world's smallest 500k-pixel indirect Time-of-Flight (iToF) sensor. The VL53L9, a novel direct ToF 3D LiDAR device, offers a resolution of up to 2.3k zones. Featuring a dual scan flood illumination, which is unparalleled in the market, this LiDAR can detect small objects and edges while simultaneously capturing 2D infrared (IR) images and 3D depth map information.

January 2024 - ams OSRAM announced the showcase of the latest member of the Mira product family, the Mira016 CMOS image sensor, at Photonics West in San Francisco. The Mira016 boasts a resolution of 400 x 400 pixels for a backside illuminated (BSI) double-stack sensor that comes in a compact 1.8 mm x 1.8 mm package. It operates at a power of 20 mW at full resolution and 90 fps and also offers high quantum efficiency in the near-infrared, providing high performance with low power consumption.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain/Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for IoT and Connected Devices

- 5.1.2 Increasing Adoption of Advanced Sensor Technologies in Automotive Industry

- 5.2 Market Restraints

- 5.2.1 High Initial Cost Involved

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Pressure

- 6.1.2 Level

- 6.1.3 Flow

- 6.1.4 Proximity

- 6.1.5 Environmental

- 6.1.6 Chemical

- 6.1.7 Inertial

- 6.1.8 Magnetic

- 6.1.8.1 Hall Effect Sensors

- 6.1.8.2 Other Magnetic Sensors

- 6.1.9 Position Sensors

- 6.1.10 Current Sensors

- 6.1.11 Other Types

- 6.2 By Mode of Operation

- 6.2.1 Optical

- 6.2.2 Electrical Resistance

- 6.2.3 Biosensor

- 6.2.4 Piezoresistive

- 6.2.5 Image

- 6.2.6 Capacitive

- 6.2.7 Piezoelectric

- 6.2.8 Lidar

- 6.2.9 Radar

- 6.2.10 Other Modes of Operation

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Consumer Electronics

- 6.3.3 Energy

- 6.3.4 Industrial and Other

- 6.3.5 Medical and Wellness

- 6.3.6 Construction, Agriculture and Mining

- 6.3.7 Aerospace

- 6.3.8 Robotics

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 TE Connectivity Ltd

- 7.1.3 Omega Engineering Inc.

- 7.1.4 Honeywell International Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Siemens AG

- 7.1.7 STMicroelectronics Inc.

- 7.1.8 AMS Osram AG

- 7.1.9 NXP Semiconductors NV

- 7.1.10 Infineon Technologies AG

- 7.1.11 Bosch Sensortec GmbH

- 7.1.12 Sick AG

- 7.1.13 ABB Limited

- 7.1.14 Omron Corporation

- 7.1.15 Allegro MicroSystems Inc