|

市場調查報告書

商品編碼

1694041

外包服務-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Outsourcing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

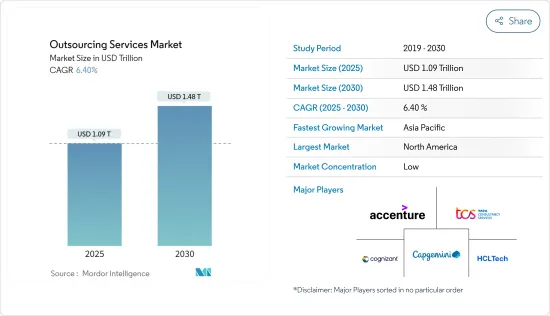

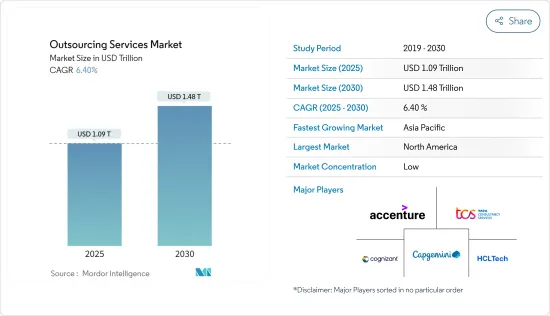

外包服務市場規模預計在 2025 年達到 1.09 兆美元,預計到 2030 年將達到 1.48 兆美元,預測期內(2025-2030 年)的複合年成長率為 6.4%。

越來越注重降低營運成本、熟練勞動力短缺以及外包服務採用先進技術等因素正在推動公司開發新服務以佔領市場佔有率。預計預測期內市場將大幅成長。

關鍵亮點

- 由於各種因素,越來越多的公司開始轉向外包服務。主要原因之一是,透過外包給人事費用較低的國家可以實現潛在的成本節約,從而大幅節省與工資、社會福利和管理費用相關的開支。此外,公司將資源和管理精力集中在核心業務活動上,以增強競爭力並促進成長。

- 市場參與企業正在收購歐洲的各種外包公司,以擴大基本客群。例如,參與企業客戶經驗服務公司 Konecta 於 2024 年 2 月收購了英國業務流程外包公司 Bespoke,增強了其在英語市場的地位。 Bespoke 的主要生產設施位於南非德班。

- 此外,Konecta 還在美國德克薩斯州聖安東尼奧開設了一個營運中心,以擴展其英語服務。這些策略性措施符合 Konecta 更廣泛的地理擴大策略,旨在更好地服務英語客戶,特別是在境外外包服務領域。這些擴張使 Konecta 成為業界的重要參與企業。

- 此外,雲端運算在業務流程外包中的日益普及對 BPO 服務的採用產生了重大影響。雲端運算正在幫助 BPO 供應商加快產品上市時間、降低成本並加強品管流程。

- 此外,市場上的雲端運算可確保即時運算支援和系統金鑰、通用存取以及根據所需的業務目的隨時調整的配置。預計這些好處將在預測期內對業務流程外包領域雲端運算的整體採用產生正面影響。

- 然而,對於資料安全、客製化、資料遷移、IT 結構中的動態需求以及對最終用戶定製成本的影響的擔憂預計將在預測期內阻礙市場成長。

外包服務市場趨勢

資訊科技外包領域將經歷顯著成長

- 市場越來越注重透過外包非核心業務來發揮核心競爭力,透過依賴外包供應商實現差異化,持續轉向雲端服務,以及採用虛擬基礎設施,這些都推動著組織對 IT 的關注。此外,隨著對數位轉型的日益重視,企業越來越依賴創造性應用程式的效能和 IT 服務所能提供的擴充功能。

- 因此,企業和組織正在進行策略轉變,優先考慮其核心優勢和關鍵功能,同時將非關鍵 IT業務外包給外部服務供應商。這一趨勢認知到將內部資源和專業知識集中在直接有助於公司競爭優勢和整體業務成長的活動上的重要性。

- 這種轉變背後的關鍵促進因素之一是認知到關注核心競爭力的重要性。公司對資源和專業知識的投資越來越具體,並將其分配給直接有助於提高競爭優勢的活動。外包非核心 IT業務可使公司將注意力和資源重新轉向創新、產品開發和以客戶為中心的計劃,從而提高其市場定位和敏捷性。

- 此外,由於中小企業採用先進技術的投資增加,中小企業領域的市場也正在擴大。預計這些因素將在未來幾年為 IT 外包供應商提供巨大的成長機會。

- 例如,2023 年 5 月,英國三所大學根據哈特里國家數位創新中心 (HNCDI) 計畫獲得總計 450 萬英鎊的資助,用於建立中小企業 (SME) 參與中心。紐卡斯爾大學、阿爾斯特大學和卡迪夫大學預計將提供有針對性的、易於獲取的幫助,幫助中小企業透過採用超級運算、數據分析、視覺計算和人工智慧 (AI) 等先進的數位技術來更好地競爭和發展。

- 此外,雲端運算的不斷普及透過提供可擴展、經濟高效且靈活的解決方案,顯著促進了 IT 外包市場的成長。據Flexera Software稱,到2024年,73%接受調查的公司將採用混合雲端。企業正在轉向雲端服務以降低基礎設施成本並提高靈活性。這種轉變使得 IT 外包供應商能夠提供雲端管理、整合和安全方面的專業服務。

- 因此,企業可以專注於其核心業務,同時外包複雜的 IT業務。對雲端運算專業知識的需求正在推動 IT 外包的成長。這是因為企業尋求利用雲端技術的優勢,而無需大量的內部資源。這一趨勢正在加速各行各業的創新和業務效率。

北美佔據主要市場佔有率

- 美國在北美外包服務市場佔有重要地位。隨著該地區科技巨頭對業務流程外包服務的需求不斷成長,該地區的主導地位預計將持續下去。此外,雲端運算需求的快速成長以及為滿足個人需求而不斷提升的服務個人化程度也有望推動該地區的擴張。

- 許多加拿大公司正在轉型,不再只依賴公共雲端服務。相反,他們採用融合公共、私有和傳統基礎架構的混合 IT 方法。推動這一轉變的是那些看到了透過混合雲端策略來增強業務和客戶服務的好處的企業。加拿大政府依照「雲端優先」的方針,優先考慮雲端服務作為IT投資、技術和計劃的優先選擇。透過利用私營部門的創新,政府的目標是使其IT基礎設施更加靈活。預計政府針對 IT 發展採取的此類措施將推動市場成長。

- 此外,在北美營運的公司擴大將人工智慧和自動化技術納入其外包流程中。這一趨勢旨在提高效率並最大限度地減少人工干預。外包領域對人工智慧和自動化的採用正在穩步增加。該公司正在使用人工智慧、RPA(機器人流程自動化)和機器學習來簡化業務、提高效率並降低成本。作為回應,外包服務供應商正在轉向以人工智慧為中心的解決方案,以更智慧的數據主導洞察力來豐富他們的服務。

- 在該地區,許多公司都在其 BPO 服務中使用人工智慧。例如,Expivia 透過優先考慮技術和人工智慧重塑了 BPO 服務格局。該公司不再僅依賴傳統基準,而是優先考慮技術主導策略,以確保其客戶獲得策略價值。

- 此外,大型企業擴大採用 IT 外包策略,以獲得更好的後端 IT 支援和IT基礎設施更新,這可能會推動美國市場的成長。例如,2023年7月,塔塔諮詢服務公司(TCS)擴大了與美國醫療技術公司GE醫療科技的合作關係,幫助該公司轉變IT營運模式,以管理應用程式並推動創新。透過此次合作,TCS將為GE醫療提供IT應用開發、維護、合理化和標準化等外包服務,以支持該國大型企業市場的成長。

外包服務業概況

外包服務市場是半固定的,由各種供應商提供的服務。主要供應商包括埃森哲、塔塔顧問服務有限公司、Capgemini SA、Cognizant、HCL Technologies Limited 等。市場參與企業正在加強其投資組合,並透過策略夥伴關係和創新產品尋求長期競爭優勢。

2024年3月,Celegence Holdings LLC對Sotelius進行了策略性投資,Sotelius是藥品安全和醫療事務領域主要企業。這項投資是 Soterius A 輪資金籌措的一部分,旨在建立夥伴關係。透過利用兩個團隊的專業知識,此次合作旨在擴大兩家公司的業務範圍並推動共同成長。

2024 年 1 月,數位科技公司 Varanium Cloud Limited 將在馬哈拉斯特拉邦Sawantwadi 建立其第二個辦公室和業務流程外包 (BPO) 中心。該BPO中心將專門提供資料核算、身份驗證和債務催收等服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 外包服務市場的監管現狀

第5章市場動態

- 市場促進因素

- 越來越多的雲端遷移和虛擬基礎架構的採用

- 對效率和可擴展性的需求不斷增加

- 透過物聯網提升BPO服務效率

- 市場限制

- 資料安全、客製化、資料遷移

- IT架構的動態需求影響最終用戶的客製化成本

- 外包服務市場的關鍵技術趨勢

第6章市場區隔

- 按服務類型

- 業務流程外包

- 資訊科技外包

- 人力資源外包

- 知識流程外包

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 愛爾蘭

- 瑞典

- 亞洲

- 中國

- 印度

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章競爭格局

- 公司簡介

- Accenture PLC

- Tata Consultancy Services Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- HCL Technologies Ltd

- Teleperformance SE

- Evelyn Partners Group Limited

- Thomson Reuters Corporation

- TTEC Holdings Inc.

- Trinitar Solutions LLP

- Amdocs Limited

- Infosys Bpm(Infosys Limited)

- Automatic Data Processing Inc.

- General Outsourcing Public Company Limited

- Concentrix Corporation

第8章投資分析

第9章 市場機會與未來展望

The Outsourcing Services Market size is estimated at USD 1.09 trillion in 2025, and is expected to reach USD 1.48 trillion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Factors such as the rising emphasis on minimizing operational expenses, the unavailability of a skilled workforce, and the incorporation of advanced technology in outsourcing services are propelling players to develop new services to capture market share. The market is expected to witness significant growth during the forecast period.

Key Highlights

- Organizations are increasingly turning to outsourcing services, driven by various factors. One major factor is the cost-saving potential when outsourcing to countries with lower labor costs, which can lead to substantial reductions in expenses related to salaries, benefits, and overheads. Additionally, companies are focusing their resources and management efforts on core business activities, enhancing their competitive edge and fostering growth.

- The market players are acquiring various outsourcing firms in the European region to expand their customer base. For instance, in February 2024, Konecta, a global player in Customer Experience services, bolstered its presence in English-speaking markets by acquiring Bespoke, a United Kingdom-based business process outsourcing firm. Bespoke's primary production facilities are in Durban, South Africa.

- Additionally, Konecta expanded its English services by launching its inaugural operations center in San Antonio, Texas (USA). These strategic moves align with Konecta's broader geographic expansion strategy, enriching its offerings for English-speaking clients, notably in offshoring services. With these expansions, Konecta is solidifying its standing as a critical player in the industry.

- Moreover, the growing popularity of cloud computing in business process outsourcing is a significant factor affecting the adoption of BPO services. Cloud computing aids BPO operators in improving the time to market, reducing costs, and enhancing the quality control process.

- Furthermore, cloud computing in the market ensures instant computing support and system keys, universal access, and adjustable provisioning whenever needed for required business purposes. These advantages are expected to positively impact the overall adoption of cloud computing in the business process outsourcing sector during the forecast period.

- However, concerns related to data security, customization, and data migration, coupled with the dynamic needs of the IT structure, impacting the cost of customization for end users, are poised to hamper market growth during the forecast period.

Outsourcing Services Market Trends

The Information Technology Outsourcing Segment to Witness Significant Growth

- The market is witnessing a rising emphasis on leveraging the core competencies by outsourcing non-core operations, increasing organizations' focus on IT to gain differentiation by relying on outsourced vendors, continuing the shift to cloud services, and embracing virtualized infrastructure. Moreover, due to the growing emphasis on digital transformation, organizations depend on the performance of creative applications and extensions that IT services can provide.

- Hence, there is a strategic shift among businesses and organizations to prioritize their core strengths and critical functions while outsourcing non-essential IT operations to external service providers. This trend recognizes the importance of focusing internal resources and expertise on activities directly contributing to a company's competitive advantage and overall business growth.

- One of the primary drivers behind this shift is recognizing the critical importance of focusing on core competencies. Businesses are increasingly specific about investments in their resources and expertise, allocating them to activities directly contributing to their competitive advantage. Outsourcing non-core IT operations allows organizations to divert their attention and resources toward innovation, product development, and customer-centric efforts, enhancing their market positioning and agility.

- Further, the market is witnessing an expansion in the SME sector due to the rising investments in SMEs to adopt advanced technologies. These factors are further expected to create substantial growth opportunities for IT outsourcing vendors in the coming years.

- For instance, in May 2023, three UK universities collectively received GBP 4.5 million to establish small and medium-sized enterprise (SME) engagement hubs under the HNCDI (Hartree National Centre for Digital Innovation) program. Newcastle University, Ulster University, and Cardiff University are expected to provide targeted and accessible help for SMEs to boost their competitiveness and growth by adopting advanced digital technologies such as supercomputing, data analytics, visual computing, and artificial intelligence (AI).

- Furthermore, rising cloud deployment is significantly augmenting the growth of the IT outsourcing market by offering scalable, cost-effective, and flexible solutions. According to Flexera Software, as of 2024, 73% of enterprises surveyed implement a hybrid cloud in their organizations. Businesses increasingly leverage cloud services to reduce infrastructure costs and improve agility. This shift enables IT outsourcing providers to offer specialized cloud management, integration, and security services.

- Consequently, organizations can focus on core activities while outsourcing complex IT tasks. The demand for cloud expertise drives IT outsourcing growth as companies seek to harness cloud technology's benefits without the need for extensive in-house resources. This trend accelerates innovation and operational efficiency across industries.

North America to Hold a Significant Market Share

- The United States holds a significant position in the North American outsourcing services market. Due to the growing demand for business process outsourcing services from the region's tech giants, the region is expected to maintain its dominance. The surge in the overall demand for cloud computing and the personalization of service offerings to better meet individual needs are also expected to drive regional expansion.

- Many Canadian companies are transitioning from solely relying on public cloud services. Instead, they are embracing a hybrid IT approach, blending public, private, and traditional infrastructure. This shift is driven by the benefits these organizations see in enhancing their operations and customer service through a hybrid cloud strategy. In line with its "cloud-first" approach, the Canadian government prioritizes cloud services for IT investments, techniques, and projects. By leveraging private-sector innovations, the government aims to enhance the agility of its IT infrastructure. Such government initiatives toward IT development are expected to drive market growth.

- Moreover, businesses operating within North America are increasingly integrating AI (artificial intelligence) and automation technologies into their outsourcing processes. This trend aims to boost efficiency and minimize manual intervention. The adoption of AI and automation in outsourcing is on a steady rise. Companies are turning to AI, RPA (Robotic Process Automation), and machine learning to streamline operations, enhance efficiency, and reduce expenses. In response, outsourcing service providers are pivoting toward AI-centric solutions, enriching their services with smarter, data-driven insights for clients.

- Various players in the region are using AI in BPO services. For instance, Expiviahas reshaped the landscape of BPO services by prioritizing technology and AI. Rather than relying solely on conventional benchmarks, the company prioritizes technology-driven strategies, ensuring its clients derive strategic value.

- Also, large enterprises are increasingly adopting IT outsourcing strategies for better backend IT support and IT infrastructure updates, which would drive market growth in the United States. For instance, in July 2023, Tata Consultancy Services (TCS) expanded its relationship with GE HealthCare Technologies Inc., a medical technology company based in the United States, to help transform its IT operating model for managing its applications and driving innovation. After this collaboration, TCS would provide outsourcing services for IT application development, maintenance, rationalization, and standardization of GE Healthcare, supporting the growth of the market in the country's large enterprise sector.

Outsourcing Services Industry Overview

The outsourcing services market is semi-consolidated with an array of services from various vendors. Major vendors include Accenture, TATA Consultancy Services Limited, Capgemini, Cognizant, and HCL Technologies Limited. Market players are enhancing their portfolios and seeking long-term competitive advantages through strategic partnerships and innovative product offerings.

In March 2024, Celegence Holdings LLC strategically invested in Soterius Inc., a key player in outsourced services, collaboration technologies, and data assets within the drug safety and medical affairs domain. This investment, a part of Soterius' Series A financing, has forged a partnership that capitalizes on the strengths of both Celegence and Soterius. By leveraging the expertise of their teams, this collaboration aims to broaden their reach and fuel mutual growth.

In January 2024, Varanium Cloud Limited, a digital technology company, is establishing its second office and business process outsourcing (BPO) center in Sawantwadi, Maharashtra. The BPO center would specialize in services such as data accounting, background verification, and debt recovery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Regulatory Landscape of Outsourcing Services Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure

- 5.1.2 Growing Demand for Efficiency and Scalable IT Infrastructure

- 5.1.3 Internet of Things for Efficient Delivery of BPO Services

- 5.2 Market Restraints

- 5.2.1 Data Security, Customization, and Data Migration

- 5.2.2 Dynamic Needs of IT Structure Impacts the Cost of Customization for End Users

- 5.3 Key Technological Trends in Outsourcing Services Market

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Business Process Outsourcing

- 6.1.2 Information Technology Outsourcing

- 6.1.3 Human Resource Outsourcing

- 6.1.4 Knowledge Process Outsourcing

- 6.1.5 Other Service Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Ireland

- 6.2.2.5 Sweden

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.5 Middle East and Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 Saudi Arabia

- 6.2.5.3 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Tata Consultancy Services Limited

- 7.1.3 Capgemini SE

- 7.1.4 Cognizant Technology Solutions Corporation

- 7.1.5 HCL Technologies Ltd

- 7.1.6 Teleperformance SE

- 7.1.7 Evelyn Partners Group Limited

- 7.1.8 Thomson Reuters Corporation

- 7.1.9 TTEC Holdings Inc.

- 7.1.10 Trinitar Solutions LLP

- 7.1.11 Amdocs Limited

- 7.1.12 Infosys Bpm (Infosys Limited)

- 7.1.13 Automatic Data Processing Inc.

- 7.1.14 General Outsourcing Public Company Limited

- 7.1.15 Concentrix Corporation