|

市場調查報告書

商品編碼

1694033

德國住宅閘道器-市場佔有率分析、產業趨勢與成長預測(2025-2030)Germany Residential Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

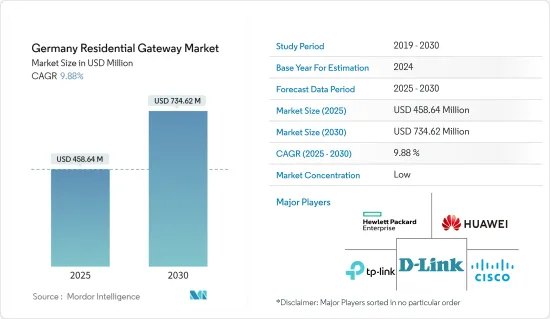

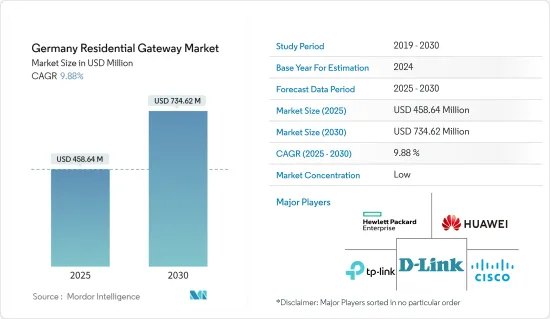

預計 2025 年德國住宅閘道器市場規模為 4.5864 億美元,到 2030 年將達到 7.3462 億美元,預測期內(2025-2030 年)的複合年成長率為 9.88%。

德國消費者中網路和寬頻普及率的提高是德國住宅閘道器市場的主要驅動力之一。家庭網路普及率高正在推動對提供無縫可靠連接的家庭閘道器設備(如數據機和路由器)的需求。

關鍵亮點

- 由於寬頻普及率不斷提高以及家庭網路技術的進步,德國家庭閘道器設備的市場需求強勁。德國家庭擴大配備了各種各樣的數位設備、多媒體應用、連網家用電子電器、語音和資料通訊平台以及娛樂系統。

- 此外,對共用網路連線、同時網路存取以及家庭音訊和視訊串流的需求不斷成長,推動了德國對住宅閘道器設備的需求。此外,德國消費者對智慧家庭的日益傾向刺激了家庭閘道器設備的採用,從而支持了市場的成長。

- 此外,在家工作和智慧家庭計劃的結合,正在為德國各地家庭帶來對強大、可靠和高性能 Wi-Fi 的巨大需求,這使得家庭閘道器設備更受歡迎,因為它們提供了必要的連接,使用戶能夠充分利用互聯家庭。市場供應商正在抓住這一機會,提供支援先進 Wi-Fi 標準的家庭閘道器設備,這些標準可提供提高家庭環境中設備性能所需的速度、可靠性和低延遲。

- 此外,德國對智慧家居設備的採用正在成長。智慧恆溫器、保全攝影機和語音助理等連網設備依賴穩定、高速的網路連接,因此需要使用先進的家庭閘道器。

- 德國個人資料外洩事件不斷增加,已成為資料外洩事件第二常見的國家。資料外洩的頻率和嚴重程度不斷增加,對住宅閘道器市場造成了巨大的限制。由於閘道器是資料進入家庭網路的主要入口點,因此其易受網路威脅的弱點是消費者和製造商最關心的問題。

- 新冠疫情導致德國長期封鎖,導致家庭閘道器設備大量使用,線上遊戲、遠端工作和串流服務對高速網路連線的需求激增。疫情過後,對快速可靠的網路連線的需求不斷成長,以及智慧家居設備、電視、筆記型電腦和智慧型手機等各種家用電子電器在家庭住宅領域的顯著滲透,對德國市場的成長產生了積極影響。

德國家庭閘道器市場趨勢

路由器佔據市場佔有率主導地位

- 隨著智慧型裝置、遠端工作和高清串流媒體的興起,德國對路由器等可靠、高速家庭網路設備的需求激增。該國領先的市場供應商提供支援多種設備的路由器,包括 4K 串流媒體、AR/VR 遊戲、線上學習、智慧家庭和視訊通話。例如,Linksys Hydra Pro 6E (AXE6600) 可同時為超過 55 台裝置列出多Gigabit速度。同樣,TP-Link 的 Archer AX72 Pro 路由器可以連接超過 100 台設備,並支援 MU-MIMO 和 OFDMA,以減少擁塞並將平均吞吐量提高四倍。

- 此外,TP-Link、D-Link、AVM GmbH 和 Linksys 等市場參與企業也不斷創新其路由器產品,以滿足德國各地家庭對可靠、高速網路連線不斷變化的需求。例如,D-link在德國提供EAGLE PRO AI AX1500智慧路由器。它結合最新的Wi-Fi 6技術與人工智慧,提升Wi-Fi覆蓋範圍和速度,並不斷最佳化和改進,為您的家庭提供可靠、高效、快速的網路覆蓋。

- 預計DSL路由器在德國住宅閘道器市場將享有強勁的需求。這是由市場領先供應商不斷推出支援多功能連接、超快速度和高品質通訊的新型 DSL 路由器所支援的。例如,TP-Link 的 AC2100 Wi-Fi MU-MIMO VDSL/ADSL 電話數據機路由器使用最新的 Super VDSL 技術(VDSL2 Profile 35b)列出了高達 350Mbps 的網路速度。該路由器配備 4XGigabitLAN 端口,可幫助您的有線設備實現尖峰時段高清串流媒體和遊戲效能。

- 總體而言,隨著 4K/8K 串流媒體、AR/VR 遊戲、線上遊戲、線上學習、視訊會議和在家工作等趨勢在德國蓬勃發展,預計未來幾年對採用 Wi-Fi 6E 和 Wi-Fi 7 等先進 Wi-Fi 標準的路由器的需求將會成長。此外,市場領先供應商不斷創新路由器技術,以滿足日益成長的家庭可靠網路連接需求,預計也將在預測期內推動路由器的需求。

數位用戶線路(DSL) 推動成長

- 由於線上遊戲、視訊通話、串流媒體和在家工作等線上活動的增加,德國家庭對始終線上網路連線的需求顯著增加。透過將 DSL 連接到數據機和路由器等家庭閘道器設備,網路服務供應商(ISP) 可以透過現有電話線為德國各地的家庭提供高速連接,這推動了德國家庭閘道器市場對 DSL 連接的需求。

- 預計在預測期內,數據機將在 DSL 領域獲得顯著發展,因為它們可以連接到網路服務供應商(ISP) 並為家庭提供網路服務。家庭對高速連接的需求不斷成長,以及德國家庭大量採用 DSL,推動了對路由器和數據機等家庭閘道器設備的需求,這些設備將電腦連接到電話線以存取網際網路。

- 該國市場的供應商正在提供利用先進 Wi-Fi 標準(例如用於 DSL 連接的 WiFi 6)的家庭閘道設備。例如,AVM GmbH 提供 FRITZ.Box 7590 AX! Box 7590 AX 利用 WiFi 6 實現高速家庭網路連線。 FRITZ VDSL 35b 超級向量化! Box 7590 AX 的 VDSL 35b Super Vectoring 可提供比傳統線路高達 300Mbit/s 甚至更高的速度。

- 總體而言,預計德國住宅閘道器市場對數用戶線路 (DSL) 連接的需求將在預測期內成長,這主要歸因於德國家庭中 DSL 的高普及率以及德國對寬頻網路存取的需求不斷增加。截至 2023 年,德國將擁有 3,820 萬個活躍的固定寬頻連線。此外,鑑於許多德國家庭仍在使用固定電話,建立 DSL 連接既快速又簡單,進一步支持了這一領域的成長。

德國住宅閘道器市場概況

德國家庭閘道器市場是一個分散且競爭激烈的市場,主要參與者包括思科系統公司、TP-Link Corporation Pte。有限公司、D-Link Corporation、華為技術有限公司和惠普企業公司。該市場的參與企業正在採取聯盟、併購和投資等策略來加強其產品並獲得永續的競爭優勢。

- 2024年3月,中興通訊參加德國柏林FTTH Conference 2024。此次大會匯集了光纖通訊產業的高階主管、決策者、意見領袖和投資者。為提升居家Wi-Fi訊號覆蓋,中興通訊推出創新連網家庭解決方案,包括Wi-Fi 7、XGS-PON ONT、Mesh Wi-Fi & FTTR、SCP(智慧雲端平台)管理平台。

- 2023 年 10 月,Linksys 發布了首款家用 Wi-Fi 7 網狀系統 Linksys Velop Pro 7。透過此次發布,該公司提供了一種 Wi-Fi 操作模式,可實現高速串流媒體、協作和遊戲體驗,並且可以在不到 10 分鐘的時間內完成設定。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 宏觀經濟情境分析

- 各國通訊業監管現狀

第5章市場動態

- 市場促進因素

- IP流量激增

- 消費者網路和寬頻普及率不斷提高

- 政府支援措施和Wi-Fi 6的普及

- 市場問題

- 對資料安全和隱私的擔憂日益加劇

- 家庭閘道器設備定價模式及價格分析

- 關於 Wi-Fi 標準類型的關鍵見解

- 德國家庭閘道器設備進出口貿易分析

- 德國寬頻網路普及率關鍵指標

第6章市場區隔

- 整體市場、估計和預測

- 市場總量、估計和預測(百萬美元)

- 市場總量、估計與預測-設備數量(百萬台)

- 依產品類型

- 數據機

- 路由器

- 擴展器和中繼器

- 網路交換機

- 其他設備(無線網路基地台、VoIP類比電話適配器、光纖ONT等)

- 託管Wi-Fi服務

- 按連線類型

- 數位用戶線路(DSL)

- 乙太網路電纜

- 光纖電纜

第7章競爭格局

- 德國主要廠商市場佔有率分析

- 公司簡介

- Cisco Systems Inc.

- TP-link Corporation Pte. Ltd

- D-Link Corporation

- Huawei Technologies Co. Ltd

- Hewlett Packard Enterprise Company

- ZTE Corporation

- Linksys Holdings Inc.

- Mikrotikls SIA

- Juniper Networks Inc.

- Adtran Holdings Inc.

- Zyxel Communications Corp.(Unizyx Holding Corp.)

- AVM Computersysteme Vertriebs GmbH

- ASUSTeK Computer Inc.

第8章投資分析

第9章:未來市場展望

The Germany Residential Gateway Market size is estimated at USD 458.64 million in 2025, and is expected to reach USD 734.62 million by 2030, at a CAGR of 9.88% during the forecast period (2025-2030).

Rising internet and broadband penetration among consumers in Germany is one of the major drivers of the German residential gateway market. The high penetration of the internet in the country's households has necessitated the demand for residential gateway devices, such as modems and routers, for seamless and reliable connectivity.

Key Highlights

- With increased broadband penetration and technological advances in home networking, there is a considerable market demand for residential gateway devices in Germany. Households in Germany are increasingly populated with various digital devices, multimedia applications, networked appliances, voice and data communications platforms, entertainment systems, and much more.

- In addition, the rising demand for Internet connection sharing, simultaneous Internet access, and in-home audio and video streaming have driven the demand for residential gateway devices in Germany. Additionally, the shifting inclination toward smart homes among consumers in Germany has facilitated the utilization of residential gateway devices in households, thus supporting market growth.

- Moreover, the combination of work-from-home and smart home initiatives is creating significant demand for robust, reliable, and performant Wi-Fi environments in households across Germany, and residential gateway devices are gaining traction to deliver the necessary connectivity features that enable users to take advantage of networked homes. Market vendors are capitalizing on the opportunity and offering residential gateway devices on advanced Wi-Fi standards to deliver the requisite speed, reliability, and low latency to improve the performance of devices in home environments.

- Also, smart home devices have been increasingly adopted in Germany. Connected devices such as smart thermostats, security cameras, and voice assistants rely on a stable and high-speed internet connection, necessitating the use of advanced residential gateways.

- Germany is witnessing a growing number of personal data breaches and has become the second-largest country in terms of data breaches. Data breaches' escalating frequency and severity represent a formidable restraint for the residential gateway market. As the gateway serves as the primary entry point for data into a home network, its vulnerability to cyber threats becomes a paramount concern for consumers and manufacturers alike.

- The COVID-19 pandemic resulted in a significant uptake of residential gateway devices in Germany owing to prolonged lockdowns, which proliferated the demand for high-speed internet connectivity for online gaming, remote work, and streaming services. Post-pandemic, the rising demand for high-speed and reliable internet connectivity and the significant uptake of various consumer electronic devices, such as smart home devices, television (TV), laptops, and smartphones in the country's residential sector, are positively influencing the market's growth in Germany.

Germany Residential Gateway Market Trends

Routers to Hold Major Market Share

- With the growth of smart devices, remote work, and high-definition streaming, the demand for reliable and high-speed home networking devices such as routers has surged in Germany. Major market vendors in the country offer routers that support many devices for 4K streaming, AR/VR gaming, online learning, smart home, and video calling. For instance, Linksys's Hydra Pro 6E (AXE6600) simultaneously provides multi-gigabit speed to more than 55 devices. Similarly, TP-Link's Archer AX72 Pro router can connect 100+ devices and supports MU-MIMO and OFDMA to reduce congestion and quadruple the average throughput.

- Moreover, market players such as TP-Link, D-Link, AVM GmbH, and Linksys constantly innovate their router offerings to meet the ever-evolving demand for reliable and high-speed network connectivity in households across Germany. For instance, D-link offers the EAGLE PRO AI AX1500 Smart Router in Germany, which combines the latest Wi-Fi 6 technology with Artificial Intelligence, offering improved Wi-Fi coverage and speed that is constantly optimized and improved for reliable, efficient, and fast Internet coverage in households.

- DSL routers are analyzed to gain significant demand in the German residential gateway market, supported by the continuous launch of new DSL routers by significant market vendors that support versatile connectivity, ultra-fast speed, and high-quality telephony. For instance, TP-Link's AC2100 Wi-Fi MU-MIMO VDSL/ADSL telephony modem router offers internet speeds of up to 350 Mbps using the latest Super VDSL technology (VDSL2 Profile 35b). The routers come with 4X Gigabit LAN ports that help wired devices achieve peak HD streaming and gaming performance.

- Overall, as trends such as 4K/8K Streaming, AR/VR Gaming, Online Gaming, Online Learning, Video Conferencing, and Working from Home gain momentum in Germany, the demand for routers utilizing advanced Wi-Fi standards such as Wi-Fi 6E and Wi-Fi 7 will witness growth in the coming years. In addition, continuous innovation in routers by major market vendors to support the growing demand for reliable network connectivity in households will drive the demand for routers over the forecast period.

Digital Subscriber Lines (DSL) to Witness Growth

- The demand for always-on internet connectivity has been increasing significantly in German households owing to growing online activities such as online gaming, video calls, streaming, and working from home. This has driven the demand for DSL connections in the German residential gateway market as the connection between DSL and residential gateway devices such as modems and routers, etc., allows internet service providers (ISPs) to offer high-speed connections over existing telephone lines in households across Germany.

- By offering, modems are analyzed to witness significant traction in the DSL segment over the forecast period to connect to the Internet Service Provider (ISP) and provide internet in households. The rising demand for high-speed connections among households and significant penetration of DSL in households across Germany drive the demand for residential gateway devices such as modems to connect a router or computer to telephone lines for the internet.

- Market vendors in the country offer residential gateway devices utilizing advanced Wi-Fi standards such as WiFi 6 for DSL connections. For instance, AVM GmbH offers FRITZ! Box 7590 AX utilizes WiFi 6 for high-speed home network connectivity. VDSL 35b supervectoring in FRITZ! Box 7590 AX can achieve speeds of up to 300 Mbit/s and more on conventional lines.

- Overall, the demand for digital Subscriber Lines (DSL) connections in the German residential gateway market is analyzed to grow over the forecast period, primarily supported by the high penetration of DSL across households in Germany and the ever-increasing demand for broadband internet access in Germany. As of 2023, there were 38.2 million Active Fixed Broadband Connections across Germany. Furthermore, the DSL connection setup is fast and easy, considering many homes in Germany still use landline phones, thus further supporting the segment growth.

Germany Residential Gateway Market Overview

The German Residential Gateway Market is fragmented and competitive, with the presence of major players like Cisco Systems Inc., TP-Link Corporation Pte. Ltd, D-Link Corporation, Huawei Technologies Co. Ltd, and Hewlett Packard Enterprise Company. Players in the market are adopting strategies such as partnerships, mergers and acquisitions, and investments to enhance their products and gain sustainable competitive advantage.

- In March 2024, ZTE Corporation participated in the FTTH Conference 2024 in Berlin, Germany. The conference brought together corporate executives, decision-makers, thought leaders, and investors from the optical communication industry. To improve Wi-Fi signal coverage at home, ZTE Corporation presented an innovative connected home solution, which includes Wi-Fi 7, XGS-PON ONT, Mesh Wi-Fi & FTTR, and SCP (Smart Cloud Platform) management platform.

- In October 2023, Linksys announced that it had launched its first Wi-Fi 7 Mesh System for home connectivity, Linksys Velop Pro 7. With this launch, the company provides the Wi-Fi operating mode to date, and it delivers fast streaming, collaboration, and gaming experiences and can be set up in less than 10 minutes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Macro-Economic Scenarios

- 4.3 Regulatory Landscape Related to the Telecom Industry in the Country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth in IP Traffic

- 5.1.2 Increasing Internet and Broadband Penetration Among Consumers

- 5.1.3 Supportive Government Initiatives and Roll-out of Wi-Fi 6

- 5.2 Market Challenges

- 5.2.1 Increasing Concerns Related to Data Security and Privacy

- 5.3 Analysis of Pricing Model and Pricing of Residential Gateway Devices

- 5.4 Key Insights On Types of Wi-Fi Standards

- 5.5 Trade Analysis Related to Import/Export of Residential Gateway Devices w.r.t Germany

- 5.6 Key Metrics Related to Broadband Internet Adoption in Germany

6 MARKET SEGMENTATION

- 6.1 Overall Market Estimates and Forecast

- 6.1.1 Overall Market Estimates and Forecast - Value in USD Million

- 6.1.2 Overall Market Estimates and Forecast - Device Volume in Million Units

- 6.2 By Offering Type

- 6.2.1 Modem

- 6.2.2 Router

- 6.2.3 Extenders and Repeaters

- 6.2.4 Network Switch

- 6.2.5 Other Devices (Wireless Access Point, VoIP Analog telephony adapter, Fiber ONT, etc.)

- 6.2.6 Managed Wi-Fi Services

- 6.3 By Connection Type

- 6.3.1 Digital Subscriber Lines (DSL)

- 6.3.2 Ethernet Cable

- 6.3.3 Fiber Cable

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis of Major Vendors in Germany

- 7.2 Company Profiles

- 7.2.1 Cisco Systems Inc.

- 7.2.2 TP-link Corporation Pte. Ltd

- 7.2.3 D-Link Corporation

- 7.2.4 Huawei Technologies Co. Ltd

- 7.2.5 Hewlett Packard Enterprise Company

- 7.2.6 ZTE Corporation

- 7.2.7 Linksys Holdings Inc.

- 7.2.8 Mikrotikls SIA

- 7.2.9 Juniper Networks Inc.

- 7.2.10 Adtran Holdings Inc.

- 7.2.11 Zyxel Communications Corp. (Unizyx Holding Corp.)

- 7.2.12 AVM Computersysteme Vertriebs GmbH

- 7.2.13 ASUSTeK Computer Inc.