|

市場調查報告書

商品編碼

1694028

中國醫藥包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

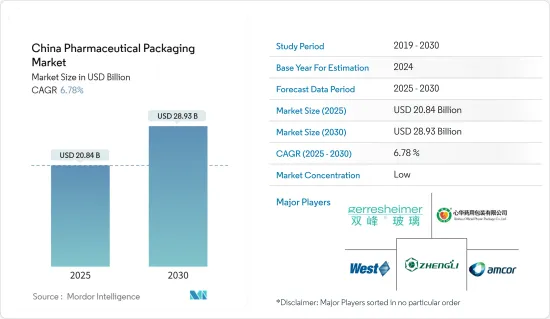

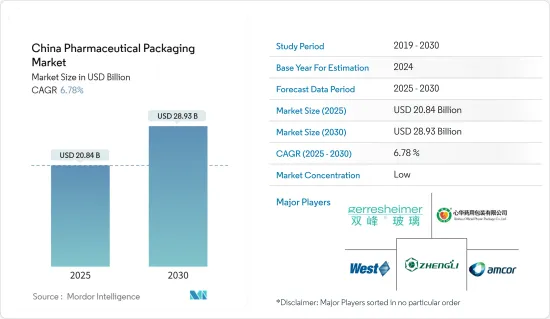

預計2025年中國醫藥包裝市場規模為208.4億美元,到2030年預計將達到289.3億美元,預測期內(2025-2030年)的複合年成長率為6.78%。

中國醫藥產業的成長為中國醫藥包裝企業創造了機會。鼓勵中國醫藥包裝企業發展研發團隊,探索創新、綠色、安全、功能性和永續的包裝材料和產品。

關鍵亮點

- 中國政府推動醫療產業轉型的措施預計將推動醫藥包裝產業的發展。中國正積極升級醫藥包裝設施和材料,推動藥品多元化發展,為醫藥包裝企業帶來新的機會。

- 中國製藥業在由中國食品藥物監督(CFDA)和國家監督監督管理局(NMPA)等機構執行的嚴格監管標準框架內運作。這些標準涵蓋了包裝設計、材料成分、標籤要求和安全通訊協定等各個方面。遵守這些標準是不可協商的,並且需要在包裝實踐中一絲不苟地關注細節。

- 奈米技術可以開發奈米結構材料,透過保護藥物免受光、濕氣和氧氣等環境因素的影響,提高藥物的穩定性。這可提高藥品的保存期限和療效。奈米技術正在推動智慧包裝解決方案的發展,該解決方案可以監測藥品狀況並提供有關溫度、濕度和光照等因素的即時回饋。這有助於確保藥品整個生命週期的品質和功效。

- 在醫藥包裝市場,瓶子、管瓶、泡殼包裝和標籤等原料對於包裝材料的生產至關重要。原料供應商擁有很大的議價能力,尤其是當他們佔據市場主導地位或原料供應短缺時。他們可以利用這種權力提高價格或對藥品包裝製造商施加不利條款。因此,包裝材料的生產成本可能會增加。

- 塑膠包裝憑藉其輕盈、耐用、多功能和成本效益等優勢,已成為包裝行業中一股強大的力量。塑膠包裝廣泛應用於醫療、保健等需要包裝支撐的各個產業。中國材料包裝發展歷史悠久,已形成完善的產業鏈。在這個鏈條中,上游環節由原料供應商組成,負責供應生產塑膠包裝材料的合成樹脂和塑膠添加劑。

中國醫藥包裝市場趨勢

柏林倉庫總量領先

- 隨著中國建立了製藥業的標準框架,中國藥用玻璃安瓿瓶和管瓶市場預計將擴大。在國內,醫藥包裝材料在藥品儲存過程中的穩定性以及包裝使用時的安全性越來越受到重視。由於玻璃包裝具有耐用性、非反應性、透明度、環境相容性和多功能性,製藥公司擴大採用玻璃包裝。此外,醫療保健系統投資的增加、研發的增加以及醫藥支出的增加正在推動對管瓶的需求。

- 特別是過去幾年與COVID-19疫情相關的藥品和疫苗需求,導致管瓶和安瓿瓶的需求增加。藥品和腸外包裝製造商正在大幅提高生產能力。由於製造商滿載運作,每月可生產數百萬個小管瓶和安瓿瓶。

- 根據美國有線電視新聞網(CNN)報道,截至2023年3月,全球已接種約130億劑新冠疫苗,其中中國當地約佔34.91億劑。

- 玻璃管瓶和安瓿瓶在已開發國家的應用越來越廣泛。受新冠疫情影響,新興國家的醫療保健和製藥業正在成長,凸顯了中國市場的潛力。此外,在該地區營運的公司正致力於提高生產能力。

- 同樣,製藥和生命科學終端用戶對管瓶和安瓿瓶的需求也在上升。由於需求波動,市場持續青睞這些終端用戶,因此參與企業正集中精力推出新產品。

- 2023 年 10 月,玻璃先驅肖特推出了下一代 I 型硼矽酸玻璃管。新產品和相關服務支持製藥業的三大關鍵趨勢:複雜藥物開發、永續性數位化。製藥公司使用該公司的玻璃管生產高品質的管瓶、安瓿瓶、注射器和藥筒,用於儲存簡單和複雜的藥物。特別是,該公司認為未來生物製藥的需求將會增加,包裝和材料必須滿足更嚴格的要求和規定。

時尚服飾板塊引領收益

- 折疊紙盒是最受歡迎的二次包裝產品類型。這些紙箱用途廣泛,可以用於多種用途。折疊式紙盒具有多種優點,包括靈活性、剛性以及簡單、經濟的平板包裝運輸和儲存。折疊式盒包裝可保護藥品免受光、濕氣和污染等外部因素的影響,確保藥品的安全。這種保護可保持藥物的功效和完整性。在製藥業,引入無線射頻識別(RFID)智慧標籤技術來防止產品克隆也將有助於市場擴張。

- 由於行業競爭激烈,對印刷藥品紙盒的需求正在增加。這些紙盒提供了充足的空間用於發布監管訊息和品牌廣告,並且比小瓶、管瓶和容器提供了更多的標籤空間。最新的印刷藥品包裝市場創新融合了防篡改和兒童防護功能。這些功能得益於先進的材料技術和設計,進一步推動了對印刷藥品紙盒的需求。

- 服藥依從性差的問題普遍存在,導致慢性疾病併發症和醫療費用增加。為了解決這個問題,藥盒和泡殼包裝等包裝已廣泛推廣,擴大了此類產品的市場。

- 藥盒是一種可重複使用的多隔間容器,用於存放特定時間應服用的藥物。與泡殼包裝不同,它們可以由患者、非正式看護者或醫療保健提供者填充,而無需專家干預。對於患有多種慢性病的老年人,一些醫療保健提供者建議使用泡殼包裝、藥盒和折疊式紙盒作為包含藥物資訊的二次包裝。

- 從成長前景和市場規模來看,中國醫藥市場仍然是最重要的市場之一。保險覆蓋範圍的擴大、人口老化、醫療需求高的中階的不斷壯大以及慢性病是成長的主要原因。

- 根據國際糖尿病聯盟預測,2045年華人成年人糖尿病盛行率將達12.5%。泡殼包裝是中國最常用的藥品包裝。大型製藥公司使用堅固且用途廣泛的紙盒包裝來保護泡殼。因此,隨著藥品泡殼包裝的成長,折疊紙盒的需求也預計會增加。

中國醫藥包裝市場概況

中國醫藥包裝市場由全球企業和中小企業高度細分。市場的主要企業包括格雷斯海姆雙峰藥用玻璃(丹陽)(Gerresheimer AG)、West Pharmaceutical Services Inc.、台山新華藥用包裝、寧波正利藥用包裝和 Amcor Group GMBH。市場參與企業正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 11 月—全球公認的永續包裝解決方案供應商 Amcor 宣布了其醫療層壓解決方案的最新進展。這種創新產品有助於在聚乙烯回收流中創造完全可回收的全薄膜包裝。透過大幅減少最終包裝的碳排放,這項新解決方案滿足了醫療設備應用的基本性能標準,同時支持醫療公司在不損害患者安全的情況下實現其永續發展目標。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 醫藥包裝產業法規、政策及標準

- 醫藥包裝產業的最新創新和新產品開發趨勢

- 原料分析

第5章市場動態

- 市場促進因素

- 包裝監管標準和嚴格的仿冒品措施

- 奈米技術對新一代創新包裝解決方案的影響

- 市場限制

- 供應商議價能力導致原物料成本波動

第6章新興趨勢分析與關鍵成功因素

第7章市場區隔

- 按初級包裝

- 藥用塑膠瓶

- 瓶子和罐子

- 泡殼包裝

- 預灌封注射器

- 管瓶和安瓿瓶

- 點滴容器

- 預充式吸入器

- 其他初級包裝產品(袋、管、蓋、封口等)

- 透過二次包裝

- 折疊式盒和紙盒(紙質)

- 紙板(紙本)

- 袋子/小袋(軟)

- 泡殼(紙塑)

- 其他二次包裝產品(托盤、標籤等)

第8章競爭格局

- 公司簡介

- Gerresheimer Shuangfeng Pharmaceutical Glass(Danyang)Co. Ltd(Gerresheimer AG)

- West Pharmaceutical Services Inc.

- Taishan Xinhua Pharmaceutical Packaging Co. Ltd

- Ningbo Zhengli Pharmaceutical Packaging

- Amcor Group GMBH

- Perlen Packaging(Suzhou)Co. Ltd

- Shandong Pharmaceutical Glass Co. Ltd

- Yuhuan Kang-jia Enterprise Co. Ltd

- Dongguan Fukang Plastic Products Co. Ltd

- JOTOP Glass

- Jiangsu Hanlin Pharmaceutical Packaging

- Hangzhou Xunda Packaging Co., Ltd.

- Luoyang Dirante Pharmaceutical Packaging Material Co. Ltd

- Share of China Pharmaceutical Packaging Companies in Global Market

第9章 投資展望

第10章:市場的未來

The China Pharmaceutical Packaging Market size is estimated at USD 20.84 billion in 2025, and is expected to reach USD 28.93 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

The growth of the Chinese pharmaceutical sector creates business opportunities for the country's pharmaceutical packaging companies. China's pharmaceutical packaging firms are encouraged to develop research and development teams to explore innovative, environmentally friendly, safe, functional, and sustainable packaging materials and products.

Key Highlights

- The Chinese government's policies to advance the transformation of the country's medicine industry are expected to promote the development of the pharmaceutical packaging sector. China is actively upgrading its pharmaceutical packaging facilities and materials and diversifying its pharmaceutical products, bringing new opportunities to pharmaceutical packaging firms.

- The Chinese pharmaceutical industry operates within a framework of stringent regulatory standards enforced by authorities such as the China Food and Drug Administration (CFDA) and the National Medical Products Administration (NMPA). These standards encompass various aspects of packaging design, material composition, labeling requirements, and safety protocols. Compliance with these standards is non-negotiable and requires meticulous attention to detail in packaging practices.

- Nanotechnology enables the development of nanostructured materials that can enhance the stability of drugs by protecting them from environmental factors such as light, moisture, and oxygen. This leads to increased shelf-life and efficacy of pharmaceutical products. Nanotechnology enables the development of smart packaging solutions that can monitor the condition of the drug and provide real-time feedback on factors such as temperature, humidity, and exposure to light. This helps ensure the quality and efficacy of pharmaceutical products throughout their lifecycle.

- In the pharmaceutical packaging market, raw materials such as bottles, vials, blister packs, and labels are essential for manufacturing packaging materials. Suppliers of raw materials wield significant bargaining power, especially when they hold a dominant position in the market or when the raw material is scarce. They can leverage this power to increase prices or impose unfavorable terms on pharmaceutical packaging manufacturers. This, in turn, can lead to higher production costs for packaging materials.

- Plastic packaging has emerged as a formidable player in the packaging industry due to its advantageous properties, such as lightweight, high durability, versatility, and cost-effectiveness. It has widespread application in various industries, including medicine, healthcare, and other sectors requiring packaging support. The development of material packaging in China has a rich history and has matured into a well-established industrial chain. In this chain, the upstream sector comprises raw material suppliers responsible for providing synthetic resins and plastic additives for manufacturing plastic packaging materials.

China Pharmaceutical Packaging Market Trends

Berlin Leads in Total Warehousing Take-up

- The Chinese pharmaceutical glass ampoules and vials market is expected to expand as China has established a standard framework for the pharmaceutical industry. The country is increasingly focusing on the stability of pharmaceutical packaging materials during drug storage and the safety of the packaging when used. Pharmaceutical companies increasingly use glass packaging because of its durability, non-reactivity, transparency, eco-friendliness, and versatility. Additionally, glass vials are in high demand due to increasing investment and R&D in healthcare systems and rising drug spending.

- Notably, the demand for vials and ampoules has grown due to the demand for medications and vaccinations related to the COVID-19 pandemic in the past few years. Manufacturers of pharmaceutical and parenteral packaging have greatly boosted their capacity for production. Millions of vials and ampoules are produced monthly by manufacturers operating at full capacity.

- According to CNN, as of March 2023, approximately 13 billion COVID-19 vaccine doses had been administered globally, with Mainland China accounting for almost 3.491 billion of this total.

- Glass vials and ampoules are becoming more widely used in developed countries. As a result of COVID-19, the healthcare and pharmaceutical sectors are growing in emerging nations, which presents the potential for the Chinese market. Additionally, players operating in the region focus on increasing their production capacity.

- Similarly, the demand for vials and ampoules among end users of pharmaceutical and life sciences is increasing. The market continues to favor these end users for demand variation, so players are concentrating on launching new products.

- In October 2023, the glass pioneer SCHOTT introduced next-generation type I Borosilicate glass tubing. This new product and its associated services will support three key trends in the pharma industry: the development of complex pharmaceuticals, sustainability, and digitalization. Pharmaceutical converters use the company's glass tubing to produce high-quality vials, ampoules, syringes, or cartridges to store simple and complex drugs. In particular, the company sees an increasing demand for biopharmaceutical products in the future, where packaging and materials will need to meet more stringent requirements and regulations.

Fashion and Apparel Segment to Lead in Revenue

- Folding cartons constitute the most popular type of secondary packaging product. These cartons are versatile and can be used in many ways. Folding cartons offer several advantages, including flexibility, rigidity, and easy and cost-effective flat-pack shipping and storage. The folding box packaging ensures the safety of pharmaceutical products by protecting them from external factors like light, moisture, and contamination. This protection helps preserve the potency and integrity of the medications. Implementing radio-frequency identification (RFID) smart labeling technology to prevent product replication in the pharmaceutical industry will also contribute to market expansion.

- The demand for printed pharmaceutical cartons is rising due to the industry's stiff competition. In addition to providing ample space for regulatory information and brand advertising, these cartons also offer more room than small bottles, vials, and containers. The latest printed pharmaceutical packaging market innovation incorporates tamper-evident and child-proof features. These features are achieved through advanced material technology and design, further driving the demand for pharmaceutical printed cartons.

- The problem of inadequate medication adherence is prevalent, leading to an increase in chronic disease complications and healthcare expenditures. Packaging interventions such as pillboxes and blister packs have been widely recommended to address this issue, leading to a growing market for such products.

- Pillboxes are reusable multi-compartment containers designed to hold medications to be consumed at specific times. Unlike blister packs, they do not require professional action and can be filled by patients, informal caregivers, or healthcare providers. Multiple healthcare providers recommend using blister packs, pillboxes, and folding cartons as secondary packaging with medication information for the aging with multiple chronic diseases.

- The Chinese pharmaceutical market is still one of the most important in terms of growth prospects and market size. The expansion of insurance coverage, the aging population, the growing middle class with higher healthcare needs, and chronic diseases are the main reasons for this growth.

- According to the International Diabetes Federation, the forecasted prevalence of diabetes among adults in China will be 12.5 % by 2045. Blister packaging is the most common type of pharmaceutical packaging used in China. Major pharmaceutical companies use sturdy and versatile folding carton packaging to protect the blister. Therefore, with the growth of pharmaceutical blister packaging, there would be a consequent growth in demand for folding cartons.

China Pharmaceutical Packaging Market Overview

The Chinese pharmaceutical packaging market is highly fragmented due to global players and small and medium-sized enterprises. Some of the major players in the market are Gerresheimer Shuangfeng Pharmaceutical Glass (Danyang) Co. Ltd (Gerresheimer AG), West Pharmaceutical Services Inc., Taishan Xinhua Pharmaceutical Packaging Co. Ltd, Ningbo Zhengli Pharmaceutical Packaging, and Amcor Group GMBH. Market players are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Amcor, a renowned global provider of sustainable packaging solutions, launched its latest advancement in Medical Laminates solutions. This innovative offering facilitates the creation of fully recyclable, all-film packaging within the polyethylene recycling stream. By significantly reducing the carbon footprint of the final package, this new solution meets the performance standards essential for medical device applications while supporting medical companies in advancing their sustainability objectives without compromising patient safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Regulations, Policies, and Standards for Pharmaceutical Packaging

- 4.5 Recent Innovations and New Product Development in the Pharmaceutical Packaging Industry

- 4.6 Raw Material Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Regulatory Standards on Packaging and Stringent Norms Against Counterfeit Products

- 5.1.2 Impact of Nanotechnology due to Innovative and New-generation Packaging Solutions

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Cost due to Suppliers' Bargaining Power

6 EMERGING TREND ANALYSIS AND KEY SUCCESS FACTORS

7 MARKET SEGMENTATION

- 7.1 By Primary Packaging

- 7.1.1 Pharmaceutical Plastic Bottles

- 7.1.2 Bottles and Jars

- 7.1.3 Blister Packaging

- 7.1.4 Pre-fillable Syringes

- 7.1.5 Vials and Ampoules

- 7.1.6 IV Containers

- 7.1.7 Prefillable Inhalers

- 7.1.8 Other Primary Packaging Products (Pouches, Tubes, Caps, Closures, Etc.)

- 7.2 By Secondary Packaging

- 7.2.1 Folding Boxes and Cartons (Paper-based)

- 7.2.2 Corrugated Shipping Containers (Paper-based)

- 7.2.3 Bags and Pouches (Flexible)

- 7.2.4 Clamshells (Paper and Plastic)

- 7.2.5 Other Secondary Packaging Products (Trays, Labels among Others)

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Gerresheimer Shuangfeng Pharmaceutical Glass (Danyang) Co. Ltd (Gerresheimer AG)

- 8.1.2 West Pharmaceutical Services Inc.

- 8.1.3 Taishan Xinhua Pharmaceutical Packaging Co. Ltd

- 8.1.4 Ningbo Zhengli Pharmaceutical Packaging

- 8.1.5 Amcor Group GMBH

- 8.1.6 Perlen Packaging (Suzhou) Co. Ltd

- 8.1.7 Shandong Pharmaceutical Glass Co. Ltd

- 8.1.8 Yuhuan Kang-jia Enterprise Co. Ltd

- 8.1.9 Dongguan Fukang Plastic Products Co. Ltd

- 8.1.10 JOTOP Glass

- 8.1.11 Jiangsu Hanlin Pharmaceutical Packaging

- 8.1.12 Hangzhou Xunda Packaging Co., Ltd.

- 8.1.13 Luoyang Dirante Pharmaceutical Packaging Material Co. Ltd

- 8.2 Share of China Pharmaceutical Packaging Companies in Global Market