|

市場調查報告書

商品編碼

1694013

義大利的數位轉型:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Italy Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

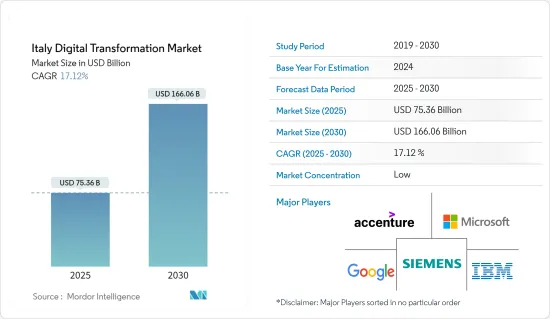

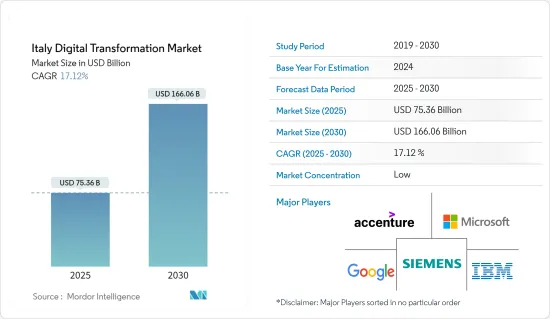

義大利數位轉型市場規模預計在 2025 年為 753.6 億美元,預計到 2030 年將達到 1,660.6 億美元,預測期內(2025-2030 年)的複合年成長率為 17.12%。

數位轉型涉及將數位技術引入組織的多個領域,以改變公司的運作方式並為客戶提供價值。透過數位轉型,企業可以從改善業務流程和業務、增強客戶體驗、建立品牌聲譽和提高客戶維繫受益。

關鍵亮點

- 義大利是歐盟第三大經濟體,在數位轉型方面取得了顯著進展,預計將實現2030年數位十年的目標。在歐盟委員會 2022 年數位經濟和社會指數(DESI)中,義大利在 27 個歐盟成員國中排名第 18 位,得分為 49.3,而歐盟(52.3)則為。

- 過去五年來,義大利在 DESI 分數方面取得的進步令人印象深刻。數位議題在該國獲得了政治關注,政府推出了重大舉措和政策措施。

- 數位轉型可以幫助義大利中小企業和大公司應對與中斷相關的眾多風險,例如市場波動、企業重組和意外的地緣政治事件,這些事件可能會產生不正常的結果。巨量資料、雲端運算和人工智慧等數位技術的採用可以幫助企業從傳統結構轉向新的數位化結構,從而推動複雜產品和服務的採用。

- 義大利製造業面臨缺乏具備智慧製造知識的熟練專業人員的問題,這對智慧製造的採用產生了重大影響。米蘭理工大學觀察站的一項調查顯示,40% 的受訪者「不知道」智慧製造技術。在先進自動化(認知和協作機器人)領域,先進的 HMI 軟體解決方案記錄的意識水平最低。所有受訪的公司都同意,數位技能的短缺給創新製造技術的採用帶來了壓力。

- 新冠疫情對義大利數位轉型領域產生了正面影響。許多企業在疫情期間面臨巨大損失,被迫投入大量資金進行業務數位化。網路、無線連線和雲端運算正在改變一些企業。金融服務業、政府、醫療保健、零售和教育等產業正經歷重大轉型。

義大利數位轉型市場趨勢

物聯網(IoT)將佔據主要市場佔有率

- 物聯網是數位轉型的關鍵驅動力,它將實體設備和感測器連接到網際網路,以創建智慧互聯系統。這種連接將實現即時數據收集和分析,有助於提高業務效率、改善決策、創建新的經營模式並推動各行各業的自動化。

- 企業和服務供應商正在將物聯網作為推動其數位轉型和提高業務效率的關鍵推動因素。物聯網促進了即時數據的收集和分析,使組織能夠做出明智的決策並最佳化流程。

- 物聯網將透過創造新的投資機會、改善客戶體驗、提高生產力、降低營運成本和效率以及增強經營模式來影響組織的數位轉型。物聯網已成為醫療保健、政府/教育、安全和通訊等行業的必需品,因為它具有許多優勢,並可能在未來幾年成為競爭因素。

- 人工智慧 (AI) 和物聯網 (IoT) 正在推動數位轉型。人工智慧利用機器學習和各種先進演算法為物聯網增加價值。另一方面,物聯網提供人工智慧連接和數據主導的輸入,透過提供巨量資料和洞察力實現數位轉型,從而提高生產力和效率。

- 全球物聯網需求擴張的另一個驅動力是消費性物聯網設備的成長,例如家庭和建築物中使用的智慧家用電子電器。預計未來智慧型能源和照明、智慧家用電子電器、智慧安全和語音助理的需求將會很高。消費者物聯網市場收入預計將從 2022 年的 20.8 億歐元(22.4 億美元)成長到 2028 年的 24.2 億歐元(26.1 億美元)。預計這將推動對支援數位轉型成長的基於物聯網的解決方案和服務的需求。

電訊和IT產業將經歷巨大成長

- 義大利是歐洲最大的 IT 和通訊市場之一,對更快、更無縫的連接的需求正在迅速成長。該領域的成長得益於行動寬頻服務的日益普及、對高速網路的投資以及為網路設備供應商創造的新機會。

- 根據GSMA的《歐洲移動經濟2023報告》,到2030年,大多數歐洲國家的行動網路普及率將超過70%。義大利、丹麥、西班牙和葡萄牙的參與率均超過96%。義大利消費者是智慧型手機的頻繁用戶,到 2023 年普及率將達到 88%。此外,5G FWA 意味著通訊業者的商機增加。近年來,5G在義大利越來越受歡迎。

- IT 透過擁有和實施這項運動來領導大多數位轉型計劃。自動化和人工智慧的提高將改善客戶服務並創造更高價值的勞動力。智慧工作流程簡化了業務流程、提高了生產力並使員工能夠做出更明智的決策。

- 為了應對競爭威脅、市場趨勢和不斷變化的客戶期望,數位轉型將技術和最佳實踐結合在一起,以實現快速的產品開發、新的客戶體驗和新的經營模式。

義大利數位轉型市場概況

義大利數位轉型市場較為分散,國內和國際參與企業均擁有數十年的產業經驗。參與企業包括埃森哲公司、Google有限責任公司(Alphabet Inc.)、西門子、IBM 公司和微軟。

- 2023 年 12 月 - 埃森哲收購客戶管理 IT 和 SirfinPA,擴展其面向義大利公共部門的數位轉型能力。埃森哲在米蘭簽署協議,收購客戶管理 IT 和 SirfinPA,這兩家義大利技術諮詢公司為公共部門提供支持,專注於司法和公共。此次收購符合埃森哲幫助義大利公共服務部門建立數位核心、為公民提供更好服務的重點。

- 2023 年 6 月-微軟宣佈在義大利推出首個雲端區域。這將為義大利企業提供可擴展、高可用性和彈性的雲端服務,並表明微軟致力於推動該國的數位轉型和永續創新。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 評估宏觀經濟趨勢的影響

- 重大監理改革分析

第5章市場動態

- 市場促進因素

- 數位化成熟度高,對科技採用持開放態度

- 數位轉型是國家恢復重建計畫的優先事項

- 中小企業擴大採用雲端運算

- 市場限制

- 數位技能短缺

- 數據共用通訊協定

- 生態系分析

- 系統整合服務市場

第6章市場區隔

- 依技術

- 分析人工智慧和機器學習

- 物聯網 (IoT)

- 網路安全

- 工業機器人

- 擴增實境

- 區塊鏈

- 雲端運算和邊緣運算

- 3D列印

- 其他

- 按最終用戶產業

- 製造業

- 石油、天然氣和公共產業

- 旅行與交通

- 零售與電子商務

- BFSI

- 醫療保健

- 通訊和 IT

- 其他(政府、環境、教育、媒體、娛樂)

第7章競爭格局

- 公司簡介

- Accenture PLC

- Google LLC(Alphabet Inc.)

- Siemens

- IBM Corporation

- Microsoft

- Cognex Corporation

- Hewlett Packard Enterprise Development LP

- SAP SE

- Oracle

- Adobe Inc.

第8章投資分析

The Italy Digital Transformation Market size is estimated at USD 75.36 billion in 2025, and is expected to reach USD 166.06 billion by 2030, at a CAGR of 17.12% during the forecast period (2025-2030).

Digital transformation includes implementing digital technologies in several areas of an organization, changing how a company functions, and providing value to customers. Businesses may benefit from digital transformation by improving business processes and operations, improving client experiences, building a brand reputation, and increasing customer retention.

Key Highlights

- Italy is the third largest EU economy and is demonstrating substantial progress in the digital transformation to reach the 2030 Digital Decade targets. Italy ranked 18th out of 27 EU Member States with a score of 49.3 compared to the EU (52.3) in the European Commission's Digital Economy and Society Index (DESI) 2022.

- According to the progress of its DESI score over the past five years, Italy has been advancing remarkably. Digital issues have gained political traction in the country by introducing significant government initiatives and launching policy measures.

- Digital transformation assists Italian SMEs and large firms deal with numerous risks connected with disruption, such as market volatility, rebuilding corporate, and unanticipated geopolitical events, which can result in irregular consequences. Adopting digital technologies such as big data, cloud computing, and AI will help businesses shift from a traditional setup to a new digitalized setup that facilitates the introduction of sophisticated products and services.

- In the Italian manufacturing sector, firms lack skilled experts in smart manufacturing knowledge, significantly impacting adoption. The Milan's Politecnico Observatories survey revealed that 40% of the respondents were "not aware" of smart manufacturing technologies. Among the advanced automation (cognitive and collaborative robotics), Advanced HMI software solutions recorded the lowest level of awareness. All companies participating in the survey agreed that the lack of digital skills burdens the adoption of innovative manufacturing technologies.

- The COVID-19 pandemic favorably impacted Italy's digital transformation sector. Many firms faced massive losses during the pandemic and were compelled to invest significantly in digitizing their operations. The internet, wireless connections, and cloud computing are transforming several businesses. BFSI, government, healthcare, retail, and education are among the industries that are undergoing significant transformation.

Italy Digital Transformation Market Trends

Internet of Things (IoT) to Hold Major Market Share

- The Internet of Things is a key driver of digital transformation that connects physical devices and sensors to the Internet, creating smart and connected systems. This connection enables real-time data collection and analysis, improving operational efficiency, better decision-making, new business models, and increased automation across various industries.

- Enterprises and service providers are concentrating on IoT as the key enabler to augment digital transformation and unlock operational efficiencies as it facilitates the collection and analysis of real-time data, enabling organizations to make informed decisions and optimize processes.

- The Internet of Things impacts organizations' digital transformation by creating new investment opportunities, improving customer experience, increasing productivity, lowering operational costs and efficiency, and empowering business models. It has become essential for industries, including healthcare, government and education, security, and communication, owing to numerous benefits that could act as a competitive factor in the coming years.

- Artificial intelligence (AI) and the Internet of Things (IoT) drive digital transformation, as AI adds value to IoT by utilizing machine learning and various advanced algorithms. Also, IoT, on the other hand, provides AI connectivity and data-driven inputs and enables digital transformation by delivering big data and insights that improve productivity and efficiency.

- Another driver of IoT demand growth worldwide is the growth of consumer IoT devices, such as smart appliances, used in homes and buildings. Smart energy and lighting, smart appliances, smart security, and voice assistants are expected to be in high demand in the future. The revenue of the consumer IoT market is expected to reach EUR 2.42 billion (USD 2.61 billion) in 2028 from EUR 2.08 billion (USD 2.24 billion) in 2022. This would propel the demand for IoT-based solutions and services supporting digital transformation growth.

Telecom and IT to Witness Major Growth

- Italy is among Europe's largest IT and telecom markets, with rapidly growing demand for faster, seamless connectivity. The segment's growth is attributed to the rising adoption of mobile broadband services, investments in high-speed networks, and the availability of new opportunities for network and equipment vendors.

- According to GSMA's Mobile Economy Europe 2023 Report, as of 2030, most European nations had mobile internet penetration rates above 70%. Italy, Denmark, Spain, and Portugal have over 96% subscriber penetration rates. Consumers in Italy frequently use smartphones, with an adoption rate of 88% in 20230. Further, 5G FWA represents an increased revenue opportunity for operators. Italy is witnessing a growing penetration of 5G in recent years.

- The IT sector leads most digital transformation projects due to ownership and implementation of the trend. Increasing automation and AI improves customer service and produces higher-value labor. Intelligent workflows streamline operational processes, boost output, and empower staff to make smarter decisions.

- In response to changes in competitive threats, market trends, and customer expectations, digital transformation integrates technology and best practices for quick product development, new customer experiences, and new business models.

Italy Digital Transformation Market Overview

The Italy digital transformation market is fragmented, with local and international players having decades of industry experience. Some players include Accenture PLC, Google LLC (Alphabet Inc.), Siemens, IBM Corporation, and Microsoft.

- December 2023 - Accenture expands digital transformation capabilities for Italy's public sector by acquiring customer management IT and SirfinPA. Accenture has signed an agreement in Milan to acquire Customer Management IT and SirfinPA, a pair of jointly-owned Italian technology consultancies supporting the public sector and specializing in justice and public safety. The acquisition aligns with Accenture's focus on helping Italian public service organizations build their digital core and deliver enhanced services to the citizens they serve.

- June 2023 - Microsoft announced the upcoming availability of its first cloud region in Italy, providing Italian organizations access to scalable, available, and resilient cloud services and confirming its commitment to promoting digital transformation and sustainable innovation in the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of Macroeconomic Trends

- 4.3 Analysis of Key Regulatory Reforms

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Digital Maturity and Openness Toward Technology Adoption

- 5.1.2 High Emphasis on Digital Transformation as Part of National Recovery and Resilience Plan

- 5.1.3 Rising Cloud Adoption in SMEs

- 5.2 Market Restraints

- 5.2.1 Lack of Digital Skills

- 5.2.2 Data Sharing Protocols

- 5.3 Industry Ecosystem Analysis

- 5.4 System Integration Services Market

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Analytics AI and ML

- 6.1.2 Internet of Things (IoT)

- 6.1.3 Cybersecurity

- 6.1.4 Industrial Robotics

- 6.1.5 Extended Reality

- 6.1.6 Blockchain

- 6.1.7 Cloud and Edge Computing

- 6.1.8 3D Printing

- 6.1.9 Others

- 6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Oil, Gas and Utilities

- 6.2.3 Travel and Transportation

- 6.2.4 Retail and e-commerce

- 6.2.5 BFSI

- 6.2.6 Healthcare

- 6.2.7 Telecom and IT

- 6.2.8 Others (Government, Environment, Education, Media and Entertainment)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Siemens

- 7.1.4 IBM Corporation

- 7.1.5 Microsoft

- 7.1.6 Cognex Corporation

- 7.1.7 Hewlett Packard Enterprise Development LP

- 7.1.8 SAP SE

- 7.1.9 Oracle

- 7.1.10 Adobe Inc.