|

市場調查報告書

商品編碼

1694011

北美企業資料檔案 (EIA) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Enterprise Information Archiving (EIA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

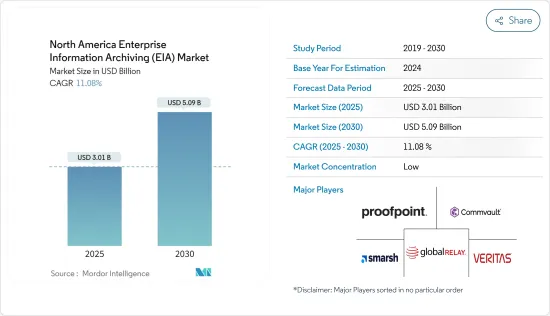

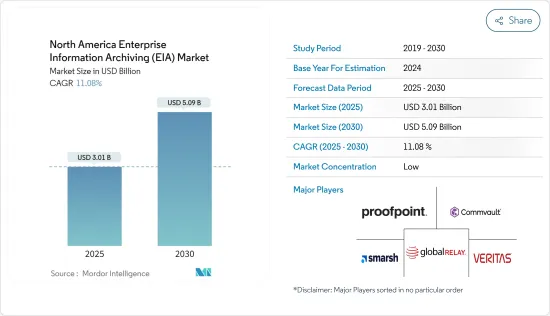

北美企業資料存檔市場規模預計在 2025 年為 30.1 億美元,預計到 2030 年將達到 50.9 億美元,預測期內(2025-2030 年)的複合年成長率為 11.08%。

關鍵亮點

- 該地區企業產生的資料主要包括非結構化資料和結構化資料。這些數據形式多樣,從傳統資料庫中的結構化數值資料,到非結構化文字文件、視訊、音訊、電子郵件、股票行情數據和金融交易。企業資料歸檔解決方案將您的所有資料儲存在檔案儲存中,並在需要時提供存取。隨著企業尋求從其數據中獲取更多價值、智慧和效用,這些解決方案預計在預測期內將會成長。

- 這些歸檔解決方案主要解決如何儲存結構化和非結構化資料這一日益嚴重的問題。傳統上,企業資料庫僅包含存儲在為確保一致性而定義的表中的結構化資料。

- 然而,透過歸檔解決方案,公司正在尋找儲存非結構化資料的方法,例如包含大量文字和視覺組件的公司資料的 PowerPoint 或 SharePoint 文件。這些資料來源是非結構化的,需要其他歸檔、儲存和搜尋方法,從而增加了對資訊歸檔工具和資源的需求,以適應各種材料的歸檔。

- 由於多種因素(主要是風險和監管),許多企業歸檔流程都是在內部管理的。然而,面對資料洪流,內部資料歸檔越來越成為不可行的選擇,且不永續。企業資訊歸檔解決方案使用戶能夠建立規則,以便在各種環境中安全有效地歸檔和保存資料。

- 這些解決方案還提供了選擇能夠帶來明確、可量化效益的正確模型的能力;例如,用戶可以利用低成本存儲,同時在法規允許的情況下保留內部部署選項。使用傳統儲存解決方案的企業內部儲存的大量內容和資訊預計將對不斷升級其基礎設施的組織構成挑戰。

- 在經濟擴張期間,對商業產品和服務的需求更大。由於活動的增加,公司經常投資企業資料檔案 (EIA) 系統等技術來提高生產力和業務效率。目標是簡化業務、降低開支並使您的公司長期成功。根據世界銀行估計,2023年北美的GDP為32.32兆美元,預計2023-24年將成長1.5%,這有望促進商業活動和企業資訊檔案(EIA)系統投資的潛力。

北美企業資料檔案(EIA)市場趨勢

雲端運算領域強勁成長

- 虛擬技術在雲端基礎的伺服器上遠端託管企業應用程式。沒有前期成本,資料定期備份,公司只需為其使用的資源付費。對於擁有積極的全球擴張計劃的企業來說,雲端運算更具吸引力,因為它使他們能夠輕鬆地從任何地方與客戶、合作夥伴和其他企業進行溝通。

- 選擇雲端運算模式的公司將進行實質審查,以確保其第三方供應商保持最新狀態並遵守其行業的所有監管義務。您必須保護敏感資料並維護客戶、合作夥伴和員工的隱私。

- 此外,雲端運算的日益普及使得各行各業產生的資料更加容易取得。企業資料歸檔軟體利用公共雲端和私有雲端平台為企業提供所需的靈活性、可擴展性和成本節約。因此,市場參與企業正在提供雲端基礎的解決方案來管理這些大量數據。

- 此外,美國資訊長協會 (NASCIO) 的一份報告發現,到 2023 年,約有 88% 的受訪州首席資訊長表示雲端運算的採用正在加速,這與各個業務領域向雲端運算的轉變相吻合。這反映了人們對雲端運算優勢的廣泛認可以及在各種業務領域利用雲端服務的必要性。

- 此外,美國首席資訊長協會 (NASCIO) 的報告預測,到 2023 年,混合雲端和多重雲端設定將成為遷移到雲端的常態。全州約 23% 至 24% 的系統和應用程式目錄採用了基礎設施即服務 (IaaS) 和軟體即服務 (SaaS) 模型。隨著向雲端的持續轉變,混合雲端和多重雲端配置正成為IT基礎設施的常態。

美國佔有很大的市場佔有率

- 北美地區,尤其是美國,很早就採用了傳統企業資料歸檔解決方案中的最新技術進步,例如與人工智慧、雲端和行動技術的整合。此外,該地區也是微軟公司、Barracuda Networks Inc.、Proofpoint Inc. 和 Smarsh Inc. 等資訊存檔供應商的所在地。

- 根據 NASSCOM 的《2023 年 IT 現代化調查》,無論最終使用者屬於哪個領域,IT 現代化都是大多數企業的首要任務。報告指出,由於高度重視創新、擁有龐大且成熟的IT市場、發達的金融市場和強力的法規環境,北美企業在IT現代化方面領先其他國家。

- 美國醫療保健領域對物聯網的需求正在成長。據美國阿魯巴公司稱,73%的醫療保健機構正在使用物聯網進行維護和監控。由於醫院必須儲存敏感的患者資料至少七年,該地區醫療保健領域的這些舉措正在推動對 EIA 解決方案的需求。預計到 2028 年,美國物聯網市場將產生約 2,970 億美元的收入,從而推動所研究的市場發展。

- 政府為各行業制定的數據存檔標準和法規是該地區推動市場成長的關鍵成長要素之一。總體而言,用戶需要對其雲端基礎設施有一定程度的信任才能有效地規劃和營運業務,因此,市場供應商傾向於採用在雲端領域擁有強大影響力的供應商的雲端平台,例如亞馬遜網路服務和 Azure,以便為其客戶提供不間斷的服務。此外,由於雲端運算投資的增加,預計在整個企業資訊歸檔市場預測期內,雲端基礎的類別將成長最快。

北美企業資料檔案(EIA)市場概覽

北美企業資料歸檔市場較為分散,現有的技術領導者由於擁有分銷管道、現有業務關係和創新平台而比新進入的競爭對手具有優勢。參與者包括 Proofpoint, Inc.、Commvault、Smarsh, Inc.、Global Relay Communications, Inc. 和 Veritas Technologies LLC。

- 2023 年 11 月,美國數位通訊合規與情報供應商 Smarsh Inc. 宣布與領先的內容雲公司 Box 加強整合。此次合作為受到嚴格電子通訊監管要求的專業人士提供了無縫、安全的儲存和監控解決方案。

- 2023 年 8 月,SADA 加強了與 Google Cloud 的夥伴關係,透過在人工智慧和安全領域不斷成長的解決方案和與 Google Cloud 的夥伴關係,推動了 2023 年的進一步成功和發展勢頭。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢影響分析

第5章市場動態

- 市場促進因素

- 雲端基礎模式和訂閱模式的採用率不斷提高

- 企業數據量快速成長

- 巨量資料分析與AI技術融合

- 市場限制

- 缺乏處理大量內容的技術專業知識

- 對企業資料安全和隱私的擔憂

- 關鍵使用案例

- 生態系分析

- 價格及定價模式分析

- 按內容類型分類的成長趨勢

第6章市場區隔

- 透過提供

- 軟體

- 按服務

- 按部署

- 雲

- 本地

- 按組織規模

- 中小型企業

- 大型企業

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 零售與電子商務

- 醫療保健

- 政府

- 媒體娛樂

- 教育

- 其他

- 按國家

- 美國

- 加拿大

第7章競爭格局

- 公司簡介

- Proofpoint, Inc.

- Commvault

- Smarsh Inc.

- Global Relay Communications Inc.

- Veritas Technologies LLC

- Barracuda Networks, Inc.

- Microsoft

- Open Text Corporation

- Jatheon Technologies

- Dell Technologies

第8章 購買因素與競爭優勢

第9章投資分析

The North America Enterprise Information Archiving Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 5.09 billion by 2030, at a CAGR of 11.08% during the forecast period (2025-2030).

Key Highlights

- Data generated by enterprises across the region includes mainly unstructured and structured data. This data is bifurcated into various formats, from structured, numeric data in traditional databases to unstructured text documents, videos, audio, e-mails, stock ticker data, and financial transactions. The enterprise information archiving solutions store all data in the archive storage and make it accessible when required. As organizations have positioned themselves to extract more value, intelligence, and utility from the data, these solutions are expected to grow during the forecast period.

- These archiving solutions primarily address the increasing issue of how to store structured and unstructured data. Traditionally, the corporate databases contained only structured data stored in defined tables for consistency.

- However, with archiving solutions, companies have been looking at ways to keep their unstructured data, e.g., PowerPoint and SharePoint files, which contain a lot of corporate data in a combination of text and visual components. As these data sources are less structured, they need other archiving, storage, and retrieval methods, driving the demand for information archiving tools and resources to accommodate the archiving of diverse materials.

- Many enterprise archival processes are being managed on-premise, primarily owing to multiple factors, including risk and regulation. However, on-premise data archiving is increasingly becoming an unfeasible option and will not be sustainable in the face of the incoming data deluge. Enterprise information archiving solutions enable users to write the rules for archiving and storing data safely and effectively in different environments.

- These solutions also present the ability to choose the appropriate model that delivers clear and quantifiable benefits, allowing users, for example, to take advantage of the lower cost storage where regulation allows while retaining the on-premise options where stipulated. The massive volume of content and information kept inside the businesses using traditional storage solutions is expected to become a problem for an organization that constantly upgrades its infrastructure.

- There is a greater need for business goods and services during economic expansion. Due to this increase in activity, businesses frequently invest in technology like Enterprise Information Archiving (EIA) systems that can increase productivity and operational efficiency. The goal is to streamline operations, cut expenses, and put the company in a position for long-term success. According to a World Bank estimate, the North American GDP, which was USD 32.32 trillion in 2023, is predicted to increase by 1.5% in 2023-24, suggesting that corporate activity and possible Enterprise Information Archiving (EIA) system investments are projected to flourish.

North America Enterprise Information Archiving (EIA) Market Trends

Cloud Segment to Witness Major Growth

- Virtual technology hosts a company's applications remotely on a cloud-based server. There are no upfront costs, data is backed up regularly, and businesses only pay for resources they use. The cloud has even more appeal for companies planning aggressive worldwide expansion, as it allows them to communicate with customers, partners, and other enterprises from anywhere with no effort.

- Businesses that choose the cloud computing paradigm conduct due diligence to ensure that their third-party provider is up to date and complies with all their industry's regulatory obligations. Sensitive data must be safeguarded, and the privacy of customers, partners, and employees must be protected.

- Furthermore, the growing use of the cloud has aided the data created across various industries. Enterprise information archiving software uses public and private cloud platforms to provide enterprises with the required agility, scalability, and cost savings. As a result, market participants are offering cloud-based solutions to manage such massive data.

- Moreover, according to the National Association of State Chief Information Officers (NASCIO) report, in 2023, around 88% of state CIO respondents stated that accelerating cloud adoption aligns with the trend of ongoing migration to the cloud across operating domains. It reflects the widespread recognition of the benefits of cloud computing and the need to leverage cloud services for various operational domains.

- Moreover, according to the National Association of State Chief Information Officers (NASCIO) report, 2023 hybrid and multi-cloud settings will already be standard when moving to the cloud. Infrastructure as a Service (IaaS) and Software as a Service (SaaS) models are used in around 23% to 24% of the state's overall system and application catalogs. It confirms that hybrid and multi-cloud setups have become customary in IT infrastructure, reflecting the ongoing migration to the cloud.

United States to Hold Significant Market Share

- The North American region, particularly the United States, has been an early adopter of the latest technological advancements within traditional enterprise information archiving solutions, such as integration technologies with AI, cloud, and mobile technologies. Moreover, the region also has a stronghold of information archiving vendors, such as Microsoft Corporation, Barracuda Networks Inc., Proofpoint Inc., and Smarsh Inc.

- According to NASSCOM's 2023 IT modernization survey across a mix of end-user sectors, IT modernization is the topmost priority for most enterprises. The report states that North American enterprises are ahead of others in the IT modernization journey due to a strong focus on innovation, large and mature IT markets, well-developed financial markets, and a robust regulatory environment.

- The United States is witnessing demand for IoT in healthcare. According to United States-based Aruba, 73% of healthcare organizations use IoT for maintenance and monitoring. Such initiatives in the regional healthcare sector drive the demand for EIA solutions as hospitals must store patient-sensitive data for a minimum period of 7 years. The IoT market in the United States is expected to generate around USD 297 billion by 2028, boosting the market studied.

- Governmental standards and regulations framed for various industries regarding data archiving are one of the significant growth drivers for the region, driving market growth. Overall, as users require a reasonable level of confidence in cloud infrastructures to plan and operate their businesses efficiently, the market vendors tend to adopt cloud platforms of recognized vendors in cloud space, such as Amazon Web Services and Azure, to provide uninterrupted services to their clients. Furthermore, due to increased cloud investment, the cloud-based category is predicted to grow fastest throughout the enterprise information archiving market projection period.

North America Enterprise Information Archiving (EIA) Market Overview

The North American enterprise information archiving market is fragmented, and access to the distribution channel, already present business relations, and innovative platforms gives the established market tech giants an advantage over the new competitors. Proofpoint, Inc., Commvault, Smarsh, Inc., Global Relay Communications, Inc., and Veritas Technologies LLC are some players.

- November 2023, Smarsh Inc., the USA-based market vendor providing digital communications compliance and intelligence, announced an enhanced integration with Box, the leading Content Cloud. The collaboration delivers a seamless, secure retention and oversight solution for professionals subject to stringent regulatory requirements for their electronic communications.

- August 2023, SADA strengthened its partnership with Google Cloud, fueled by solutions and partnership growth-expertise in AI and security with Google Cloud powers further success and momentum in 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Analysis of Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Cloud-based and Subscription-based Model

- 5.1.2 Rapid Increase in the Data Volumes in Enterprises

- 5.1.3 Integration of Big Data Analytics and AI Technologies

- 5.2 Market Restraints

- 5.2.1 Lack of Technical Expertise in Dealing With High Content Volume

- 5.2.2 Concerns Related to Security and Privacy of Enterprise Data

- 5.3 Key Use Cases

- 5.4 Ecosystem Analysis

- 5.5 Analysis of Pricing and Pricing Model

- 5.6 Growth Trends of Different Content Types

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premises

- 6.3 By Organization Size

- 6.3.1 SMEs

- 6.3.2 Large Enterprises

- 6.4 By End-user Industries

- 6.4.1 BFSI

- 6.4.2 IT and Telecom

- 6.4.3 Retail and E-commerce

- 6.4.4 Healthcare

- 6.4.5 Government

- 6.4.6 Media and Entertainment

- 6.4.7 Education

- 6.4.8 Other End-user Industries

- 6.5 By Country

- 6.5.1 United States

- 6.5.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Proofpoint, Inc.

- 7.1.2 Commvault

- 7.1.3 Smarsh Inc.

- 7.1.4 Global Relay Communications Inc.

- 7.1.5 Veritas Technologies LLC

- 7.1.6 Barracuda Networks, Inc.

- 7.1.7 Google

- 7.1.8 Microsoft

- 7.1.9 Open Text Corporation

- 7.1.10 Jatheon Technologies

- 7.1.11 Dell Technologies