|

市場調查報告書

商品編碼

1694003

北美棒狀包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Stick Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

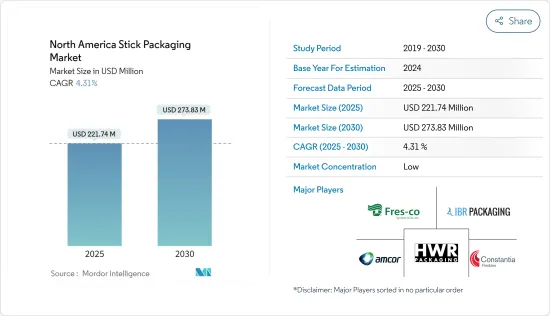

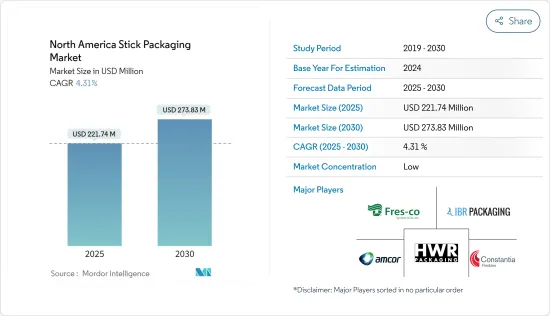

北美棒狀包裝市場規模預計在 2025 年為 2.2174 億美元,預計到 2030 年將達到 2.7383 億美元,預測期內(2025-2030 年)的複合年成長率為 4.31%。

就出貨量而言,預計將從 2025 年的 31.2 億台成長到 2030 年的 37.8 億台,預測期間(2025-2030 年)的複合年成長率為 3.94%。

關鍵亮點

- 北美對單份包裝的需求受到消費者購買行為變化的推動,靈活、經濟高效且易於使用的包裝的普及預計將推動市場發展。與其他軟包裝一樣,條形包裝重量輕、方便且便於攜帶。單份尺寸的條狀包裝為消費者提供了獨特的賣點。

- 此外,採用優質包裝材料生產的棒狀包裝還可作為維持產品新鮮度和延長保存期限的工具。所有這些因素都推動了全部區域全球對棒狀包裝的需求。

- 此外,單獨包裝是一個全新的創新概念。因此,該市場仍未開發,行業參與企業擁有利用這一尚未開發的細分市場的絕佳機會。技術的快速採用加上市場區隔將加劇競爭,最終導致產量增加。

- 根據產品的保存期限要求、永續性目標和內容,條狀包裝可採用多種材質,包括塑膠、鋁箔和層壓紙。塑膠棒包裝通常更受青睞,因為它們具有成本效益並且能夠保持產品新鮮度。

- 此外,對於小型企業來說,條形包裝是一種經濟有效的銷售單一產品的方式,但前提是使用塑膠作為材料。但隨著美國逐步淘汰一次性塑膠,一次性塑膠包裝即將失去在市場上的地位。預計這將阻礙市場成長。

北美棒狀包裝市場趨勢

個人護理和化妝品領域將顯著成長

- 不斷變化的消費趨勢、對旅行友善選擇的關注以及社交媒體的影響都促使棒狀包裝的個人護理用品越來越受歡迎。隨著行業不斷創新並滿足不斷變化的消費者需求,棒狀包裝有望在塑造個人護理和化妝品包裝的未來方面保持其重要性。

- 不斷發展的美麗偶像、對自我護理的重視以及日益增強的護膚意識是影響北美化妝品和個人保養用品消費的因素。為了滿足這種需求,方便、便攜的棒狀包裝越來越受歡迎。棒狀包裝的化妝品(例如化妝品和化妝水樣品)可讓消費者嘗試新產品或在旅行時使用。

- 社群媒體和美容影響者的影響在塑造化妝品行業消費者偏好方面發揮著重要作用。棒狀包裝產品經常出現在教學和評論中,由於其易於使用和美觀的外觀而越來越受歡迎,促進了市場的成長。

- 棒狀包裝的使用不僅限於傳統零售。餐飲、飯店和健身中心等領域也開始青睞棒狀包裝的個人護理用品。例如,飯店設施中擴大提供一次性使用的洗髮精、護髮素和沐浴露小袋或小棒。

- 棒狀包裝有助於開發護髮行業的定製配方和有針對性的治療方法。專用油護理、免沖洗護髮素和頭皮乳液可以輕鬆配製並以條狀包裝形式提供,為消費者提供滿足其獨特護髮需求的客製化解決方案。產品開發中的這種靈活性使得護髮產品更加多功能和有效。

美國將呈現最高成長率

- 棒狀包裝用於即食香辛料混合物、單份飲料(如咖啡、茶、糖、牛奶、飲料混合物等)等產品,因為它有助於保持產品的新鮮度,從而延長保存期限。北美是世界上都市化最高的地區之一。該地區的城市人口嚴重依賴咖啡店和茶館。

- 棒狀包裝以其方便和便攜性而聞名。咖啡消費量的增加,尤其是忙碌生活方式的興起,可能會推動單杯咖啡的需求。這種包裝形式易於攜帶、打開和處理,為越來越多尋求快速、輕鬆享用咖啡的消費者提供了便利。

- 根據美國對外農業服務局的數據,2023/2024會計年度美國咖啡消費量超過2,730萬袋(每袋60公斤)。單份咖啡消費量的增加與單獨用餐的趨勢一致。棒狀包裝非常適合單份產品,讓消費者可以輕鬆測量一杯所需的咖啡量。這一趨勢是由人們對新鮮、方便和減少廢棄物的渴望所驅動的。

- 美國國家咖啡協會 (NCA) 發布了《2023 年全國咖啡數據趨勢報告》。該報告追蹤了過去 70 年來美國咖啡消費的最重要趨勢。報告顯示,咖啡仍是美國人最受歡迎的飲料,63%的受訪者每天都喝咖啡。這使得咖啡在美國的受歡迎程度超過了瓶裝水、茶和自來水。

- 在美國,優質咖啡和專門食品咖啡的消費量正在大幅增加。隨著消費者對咖啡品質的要求越來越高,飯店業也熱衷於提供高品質的單份咖啡以滿足這一需求。美國人的生活方式以快節奏、忙碌的文化為特徵,對便利的需求日益成長。棒狀包裝完美契合了這一趨勢,讓飯店住宿無需複雜的沖泡設備即可快速、輕鬆地享用一杯咖啡。此外,條狀包裝迎合了咖啡愛好者群體的偏好,鼓勵飯店採用創新的包裝解決方案,以滿足對優質、便利和個人化咖啡體驗日益成長的需求。

北美棒狀包裝產業概況

北美棒狀包裝市場由多個全球和區域參與企業組成,在競爭激烈的市場空間中爭奪關注。該行業高度細分,包括 Amcor Plc、Constantia flexibles Group GmbH、Fres-Co System Inc、IBR Packaging 和 HWR Packaging LLC 等市場現有企業以及一些區域包裝企業。

- 2023 年 11 月 - Amcor 宣布與最大的永續聚乙烯製造商之一 NOVA Chemicals Corp. 簽署了一份合作備忘錄,以採購 RPE(再生聚乙烯)來製造軟包裝薄膜。 Amcor 推動包裝循環的關鍵舉措之一是增加 RPE 在軟包裝中的使用。 NOVA Chemicals 希望在未來幾年內擴大其北美回收業務,以實現其行業領先的目標,即在含有再生成分的產品中佔據聚乙烯 (PE) 總銷售額的 30% 的市場佔有率。

- 2023 年 4 月 - Fres-Co System USA Inc. 已開始採取以永續性為重點的方法,透過 NextRex 回收計畫申請並認證其可回收咖啡包裝。其帶有角撐板的零售咖啡包裝與其創新的排氣閥相結合的認證凸顯了 Fres-co 對環保實踐的承諾,並使其成為第一家通過該計劃認證的超高阻隔包裝和接近零氧氣透過的單一來源軟包裝供應商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 生態系分析

- 行業標準和法規

- 消費者和最終用戶對棒狀包裝的偏好分析

第5章市場動態

- 市場促進因素

- 由於生產成本低,對條狀包裝食品的需求不斷增加

- 棒狀包裝在製藥業日益普及

- 市場問題

- 加大對一次性塑膠的禁令

第6章市場區隔

- 材料類型

- 塑膠

- 金屬化薄膜

- 紙

- 最終用戶

- 飲食

- 咖啡和茶產品

- 乳製品(優格、奶粉等)

- 其他食品和飲料(香辛料、調味料、鹽、糖、醬汁、蘸料等)

- 製藥

- 個人護理和化妝品

- 其他最終用戶(黏合劑/密封劑、化學品等)

- 飲食

- 國家

- 美國

- 加拿大

第7章競爭格局

- 公司簡介

- Amcor Group GmbH

- Constantia Flexibles Group GmbH

- Fres-co System Usa Inc.

- IBR Packaging

- HWR Packaging LLC

- Sonoco Products Company

- CATALENT INC.

- Sonic Packaging Industries

- Elis Packaging Solutions Inc.

- Glenroy Inc.

- Brand Nutra LLC

- Avery Dennison Corporation

第8章:市場的未來

The North America Stick Packaging Market size is estimated at USD 221.74 million in 2025, and is expected to reach USD 273.83 million by 2030, at a CAGR of 4.31% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 3.12 billion units in 2025 to 3.78 billion units by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

Key Highlights

- The demand for single-serve packaging in North America is attributed to changing consumer buying behavior, and the increasing prevalence of flexible, cost-effective, and user-friendly packaging is expected to drive the market. Like all flexible packaging, stick packs are lightweight, convenient, and highly portable. The single-serve size of stick packs serves as a unique selling point for consumers.

- Moreover, stick packaging can also serve as a tool for keeping products fresh and increasing their shelf life when produced with quality packaging materials when produced with quality packaging materials. All these factors boost the demand for stick packaging globally across the region.

- Additionally, single-service packaging is a new and innovative concept. As a result, the market remains unexplored, and industry players have tremendous opportunities to profit from this untapped market segment. The rapid adoption of technologies, combined with the fragmented nature of the market, leads to intense competition, ultimately increasing production output.

- Stick packs are available in various materials, including plastic, aluminum foil, and laminated paper, depending on the product's shelf-life requirements, sustainability objectives, and content. Plastic stick packs are generally preferred due to their cost-effectiveness and ability to keep products fresh.

- Moreover, Stick-pack packaging is a cost-effective way for small businesses to sell individual products, but only when they use plastic as a material, but single-use plastic packaging is on the verge of losing its grip on the market as the United States is phasing out single-use plastic. This is expected to hinder the market's growth.

North America Stick Packaging Market Trends

Personal Care and Cosmetics Segment to Witness Significant Growth

- Changing consumption trends, a focus on travel-friendly options, and the influence of social media contribute to the increasing popularity of stick-packaged personal care items. As the industry continues to innovate and cater to evolving consumer needs, stick packaging is expected to maintain its significance in shaping the future of personal care and cosmetics packaging.

- Factors like evolving beauty idols, a growing emphasis on self-care, and a heightened consciousness about skincare have shaped the consumption of cosmetic and personal care goods in North America. To cater to this demand, the market has witnessed a surge in the popularity of stick packaging, which offers convenience and portability. Stick-packaged cosmetics, like makeup or lotion samples, enable consumers to try out new products or use them while traveling.

- The influence of social media and beauty influencers has played a significant role in shaping consumer preferences in the cosmetics industry. Stick-packaged products, often featured in tutorials and reviews, gain popularity due to their user-friendly and visually appealing nature, contributing to their growth in the market.

- The use of stick packaging is not limited to traditional retail. Sectors such as hospitality, hotels, and fitness centers are incorporating stick-packaged personal care items into their offerings. Hotel amenities, for example, increasingly include single-use sachets or sticks of shampoo, conditioner, and body wash.

- Stick packaging allows for the development of customized formulas and targeted treatments in the hair care industry. Specialized oil treatments, leave-in conditioners, and scalp lotions can be easily formulated and delivered in stick packs, providing consumers with tailored solutions for their unique hair care needs. This product development flexibility enhances the variety and effectiveness of hair care offerings.

United States to Witness the Highest Growth Rate

- Stick packaging is used for products such as ready-portioned spice mixes and single-serve beverages, including coffee, tea, sugar, milk, drink mixes, and many more, owing to its ability to keep the products fresh, thereby providing a longer shelf life. North America is one of the most urbanized regions across the globe. The region's urban population largely depends on coffee shops and tea parlous.

- Stick packaging is known for its convenience and portability. With increased coffee consumption, especially for on-the-go lifestyles, there may be a higher demand for single-serve coffee sticks. This packaging format is easy to carry, open, and dispose of, making it convenient for consumers increasingly looking for quick and hassle-free ways to enjoy their coffee.

- According to the USDA Foreign Agricultural Service, Coffee consumption in the United States amounted to over 27.30 million 60-kilogram bags in the 2023/2024 fiscal year. The rise in single-serve coffee consumption aligns with the trend towards individualized portions. Stick packaging is well-suited for single-serve products, allowing consumers to easily measure and use the right amount of coffee for a single cup. This trend is driven by the desire for freshness, convenience, and reducing waste.

- The National Coffee Association (NCA) has released its National Coffee Data Trends Report 2023. The report tracks the most significant trends in coffee consumption in the United States over the past 70 years. According to the report, coffee remains the most popular beverage among Americans, with 63% of respondents consuming it daily. This puts coffee ahead of bottled water, tea, and tap water in terms of popularity in the United States.

- The United States has experienced a significant surge in premium and specialty coffee consumption. As consumers become more discerning about the quality of their coffee, hotels in the hospitality sector are motivated to offer high-quality, single-serve options that cater to this demand. The American lifestyle, marked by a fast-paced, on-the-go culture, has led to an increased demand for convenience. Stick packaging aligns perfectly with this trend, allowing hotel guests to enjoy a quick and hassle-free cup of coffee without needing elaborate brewing equipment. Moreover, stick packaging caters to the preferences of a coffee-savvy consumer base, driving hotels to adopt innovative packaging solutions that cater to the growing demand for premium, convenient, and personalized coffee experiences.

North America Stick Packaging Industry Overview

The North America stick packaging market comprises several global and regional players vying for attention in a contested market space. The industry is highly fragmented, comprising market incumbents such as Amcor Plc, Constantia Flexibles Group GmbH, Fres-Co System Inc, IBR Packaging, HWR Packaging LLC, and several regional packaging firms.

- November 2023 - Amcor announced signing an MOU with one of the largest sustainable polyethylene manufacturers, NOVA Chemicals Corp., for procuring RPE (Recycled Polyethylene) to produce flexible packaging films. One of Amcor's key initiatives to promote packaging circularity is increasing the use of RPE in flexible packaging. NOVA Chemicals is looking to grow its recycling operations in North America in the next few years to meet its industry-leading goal of achieving a 30% market share of total sales of polyethylene (PE) from products containing recycled materials.

- April 2023 - Fres-Co System USA Inc. has launched a sustainability-driven approach exemplified by submitting and certifying its recyclable coffee package in the NextRex Recycling program, which stands as a critical growth strategy for the company. The certification of its gusseted retail coffee package, coupled with the innovative degassing valve, highlights Fres-co's commitment to eco-friendly practices and establishes it as the first single-source flexible packaging provider with ultra-high barrier packaging and a near-zero oxygen transmission rate certified in the program.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Standards and Regulations

- 4.5 Analysis of Consumer and End-user Preference for Stick Packaging

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demands of Food In Stick Packs Due to Low Cost of Manufacturing

- 5.1.2 Increasing Penetration in the Pharmaceutical Industry for Stick Packs

- 5.2 Market Challenges

- 5.2.1 Increasing Ban on Single-Use Plastics

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastic

- 6.1.2 Metalized Films

- 6.1.3 Papers

- 6.2 End User

- 6.2.1 Food And Beverage

- 6.2.1.1 Coffee and Tea Products

- 6.2.1.2 Dairy Products (Yogurt, Milk Powder, Etc.)

- 6.2.1.3 Other Food And Beverage Products (Spices & Condiments, Salt & Sugar, Sauces & Dips, Etc.)

- 6.2.2 Pharmaceuticals

- 6.2.3 Personal Care and Cosmetics

- 6.2.4 Other End Users (Adhesive and Sealant, Chemicals, Among Others)

- 6.2.1 Food And Beverage

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Constantia Flexibles Group GmbH

- 7.1.3 Fres-co System Usa Inc.

- 7.1.4 IBR Packaging

- 7.1.5 HWR Packaging LLC

- 7.1.6 Sonoco Products Company

- 7.1.7 CATALENT INC.

- 7.1.8 Sonic Packaging Industries

- 7.1.9 Elis Packaging Solutions Inc.

- 7.1.10 Glenroy Inc.

- 7.1.11 Brand Nutra LLC

- 7.1.12 Avery Dennison Corporation