|

市場調查報告書

商品編碼

1693922

日本資料中心伺服器市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan Data Center Server - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

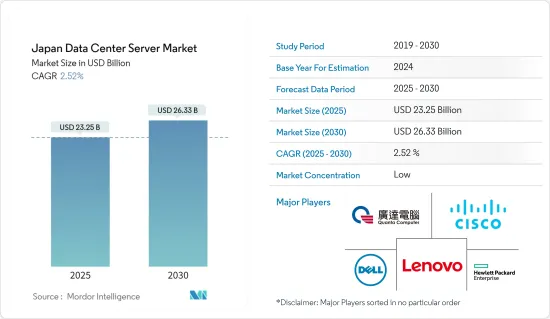

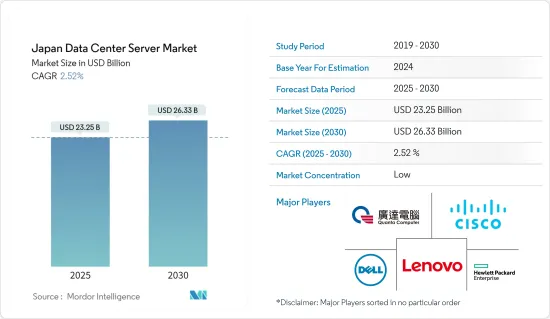

日本資料中心伺服器市場規模預計在2025年為232.5億美元,預計到2030年將達到263.3億美元,預測期內(2025-2030年)的複合年成長率為2.52%。

日本對資料中心的需求正在快速成長,使其成為一個越來越有吸引力的商業市場。解決環境問題的努力、政府對當地資料中心的支持、產業結構的變化以及由於技術進步而導致的生活方式的改變都在日本資料中心市場中發揮著重要作用,導致對伺服器的需求不斷成長。

關鍵亮點

- 市場成長的主要動力是日本地區對超大規模建築的需求不斷成長。大阪的優勢在於其集中了多種產業,包括環境、新能源、製藥和製造業。這個充滿活力的生態系統促進了超大規模資料中心與推動全球永續性和技術進步的產業之間的獨特合作。大阪府人口為880萬,國內生產毛額達3,600億美元,經濟規模與挪威相當。

- 日本被廣泛認為是網路普及率最先進的經濟體之一。截至2023年,日本網路使用率(個人)為82.9%,光纖發展率為99.3%。寬頻用戶數4,380萬戶,其中FTTH用戶3,660萬戶,CATV網路用戶650萬戶,行動寬頻用戶(4G、5G)1.84億戶。

- 排放在2050 年實現淨零碳排放的目標,而雲端資料中心的能源效率對於減少日本的碳足跡可以發揮關鍵作用。

- 日本政府認知到雲端技術可以為日本帶來的好處以及它對刺激創新和培育非傳統經營模式的積極影響,因此推出了一系列舉措來推廣雲端運算,作為進一步實現國家數位化的更廣泛計劃的一部分。

- 要建立伺服器,您首先必須購買各個元件。您需要組裝伺服器並安裝必要的軟體。客製化、擁有和維護伺服器需要資源。適合長期計劃和內部知識累積。

日本資料中心伺服器市場趨勢

刀鋒型伺服器外形尺寸市場預計將顯著成長

- 刀鋒型伺服器是一種小型電腦,用於在電腦或系統網路內託管和分發資料。它充當電腦、應用程式、程式和系統之間的連結。據Cloudscene稱,截至2023年9月,日本共有218個資料中心。由於需要最大限度地提高空間和電源效率,刀鋒型伺服器通常用於大型資料中心。

- 日本已確認擁有近 40 個大型資料中心設施,預計未來幾年還會有更多。日本政府計劃透過分散海底電纜登陸基地、多樣化登陸點的方式,在全國各地建造多個新的資料中心。海底電纜主要鋪設在日本東太平洋沿岸,其中許多集中在東京、志摩等特定地區。政府計劃將登陸基地分散到其他地區,以增強經濟安全。這可能會導致新的集中區域的大型資料中心部分顯著成長,從而刺激對刀鋒型伺服器的需求。

- 首都地區的土地和電力限制推高了建築成本,有可能減緩新開發,並加劇來自國內外參與企業的競爭。資料中心建設公司正在日本稀缺的土地上投資建造新的資料中心,但由於需求量大,這些資料中心很可能具有很高的運算能力。在這種情況下,刀鋒型伺服器刀鋒型伺服器的優勢在於其有限的運算元件允許客戶將更多的伺服器安裝到更小的機架區域,從而提高密度。

- 一些亞洲國家,例如日本,不支援 110V 電力基礎設施。因此,我們無法達到美國所享有的功率密度。例如,美國一個採用三相220V電源的資料中心可以支援15kW的機架。然而,支援這種功率密度需要專門的冷卻解決方案。如果您的電源限制為 110V,那麼無論供應商是誰,刀片都不是一個可行的解決方案。例外的是部門解決方案,例如 HP BladeSystem C3000 和 IBM BladeCenter S。

- 此外,刀鋒型伺服器專為高效能處理而設計。與機架伺服器不同,刀鋒型伺服器是可熱插拔的。這意味著您可以移除和更換叢集中的刀鋒型伺服器,而無需關閉整個叢集。當管理員需要更換刀鋒型伺服器刀鋒型伺服器將其移出叢集進行維護時,這大大減少了停機時間。

- 了解刀鋒型伺服器技術的過去、現在和未來對於日本各種規模的組織都至關重要,這樣IT基礎設施做出明智的決策。憑藉其緊湊的設計、高效能和可擴展性,隨著技術的不斷發展,刀鋒型伺服器預計在未來許多年內仍將是基礎設施的重要組成部分。

IT 和通訊作為最終用戶產業將快速成長

- 日本的資訊和通訊技術 (ICT) 產業處於創新的前沿,推動著顯著的進步並創造了面向未來的環境。 ICT 領域正在利用最尖端科技開闢一個充滿可能性的世界,同時面臨決定其成長的挑戰。

- 日本 ICT 市場的成長主要得益於物聯網 (IoT) 設備在家用電子電器、軍事、農業和建築等各個領域的日益廣泛的使用。日本擁有一些世界領先的 ICT 公司,包括索尼、松下、富士通、NEC 和東芝公司,這些公司在日本發展成為 ICT 中心的過程中發揮關鍵作用。政府增加支出以維持一流和先進的基礎設施,以及許多現代化和改進計劃的成功實施,都促進了市場的擴張。

- 由於電子日本策略的快速擴張,日本的ICT市場預計將實現成長,該策略專注於地方電子政府計劃,包括公民參與、自我評估和對線上政務服務的回饋。

- 日本擁有高品質的基礎設施和服務,包括ICT基礎設施、通訊技術、教育和醫療保健,以及高度的商業和社會穩定性。日本政府正在採取措施支持私營部門的數位轉型和中小企業的崛起。

- 智慧城市是日本政府實現社會5.0的關鍵舉措之一。第六個策略技術基礎設施(STI)計畫涉及1000多個組織,包括地方政府、區域團體和私人公司,並設定了2025年實施100項措施的目標。智慧城市官民合作關係平台將取代地方的、分散的數位環境,以促進官民合作關係關係並發展區域計劃。具體措施包括到2030年集中實施「我的號碼」(公民身分證)系統並制定資料庫註冊標準。

- 此外,日本電信業者正在投資6G。 6G系統不僅超越5G,還提供更快的速度、更高的容量、更低的延遲、新的高頻率頻段(100GHz及以上)、擴展到空中、海上和太空的通訊範圍,以及超低功耗和超低成本的通訊。根據內務部,截至2023年3月,日本5G合約數量約6,980萬份。 2022 年 6 月,NEC、富士通和諾基亞宣布將合作測試新的行動通訊技術,目標是到 2030 年實現 6G 服務商業化。

- 因此,政府為促進 IT 產業發展而採取的舉措,以及科技公司整體投資的增加和國家資料中心的成長,可能會促進日本伺服器市場的發展。

日本資料中心伺服器產業概況

日本的資料中心伺服器市場高度細分,主要公司包括戴爾科技公司、惠普企業、思科系統、聯想Group Limited和廣達電腦公司。該市場的參與企業正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023年12月-富士通宣布將依照該策略在日本成立專門的硬體業務公司,以進一步加強以伺服器和儲存解決方案為主的硬體業務的管理。

- 2023 年 8 月 - 惠普企業宣布,phoenixNAP 將透過採用 Ampere Computing 節能處理器的雲端原生 HPE ProLiant RL300 Gen11 伺服器擴展其實機雲端平台。擴展的服務將支援人工智慧推理、雲端遊戲和其他雲端原生工作負載,並提高效能和能源效率。

- 2023 年 7 月-富士通宣布推出新伺服器 BS2,000 SE730/SE730B。最新的 SE 代伺服器被視為管理大量資料的高階效能平台。它提供了極高的可用性,是關鍵任務應用程式的理想平台。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 新建資料中心增加,網路基礎建設發展加快

- 雲端和物聯網服務的採用率不斷提高

- 市場問題

- 初期投資高

- COVID-19影響評估

第6章市場區隔

- 按外形尺寸

- 刀鋒型伺服器

- 機架式伺服器

- 塔式伺服器

- 按最終用戶

- 資訊科技/通訊

- BFSI

- 政府

- 媒體娛樂

- 其他

第7章競爭格局

- 公司簡介

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- Cisco Systems Inc.

- Lenovo Group Limited

- Quanta Computer Inc.

- Super Micro Computer Inc.

- Huawei Technologies Co. Ltd

- Fujitsu Limited

- NEC Corporation

- IBM Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Japan Data Center Server Market size is estimated at USD 23.25 billion in 2025, and is expected to reach USD 26.33 billion by 2030, at a CAGR of 2.52% during the forecast period (2025-2030).

Japan's demand for data centers is proliferating and becoming more attractive as a business market. Environmental initiatives, government support for local data centers, changes in industrial structure, and changing lifestyles due to technological advancements all play a significant role in the Japanese data center market, resulting in major demand for the server market.

Key Highlights

- The major driver for the market growth is the growing demand for hyperscale construction in the Japanese region. Osaka's strength lies in its diverse concentration of industries, encompassing environmental, new energies, pharmaceuticals, and manufacturing sectors. This vibrant ecosystem fosters a unique coaction between hyperscale data centers and industries driving global sustainability and technological advancement. With a population of 8.8 million, Osaka Prefecture has a GDP of USD 360 billion, similar to the size of Norway's economy.

- Japan is widely regarded as one of the most advanced economies in terms of Internet penetration. As of 2023, Japan's Internet usage rate (individuals) was 82.9%, and the development rate of optical fiber was 99.3%. The number of broadband subscribers was 43.8 million, which includes 36.6 million FTTH subscribers and 6.5 million CATV Internet subscribers, while the number of mobile broadband subscribers (4G and 5G) was 184 million.

- The energy efficiency of cloud data centers can play a crucial role in reducing Japan's carbon footprint to achieve the Japanese government's goal of net-zero carbon emissions by 2050.

- Having recognized the benefits cloud technologies can provide to the country and their positive effect on encouraging innovation and fostering non-conventional business models, the Japanese government has been launching numerous initiatives to promote the cloud as part of the broader plans to digitalize the country further.

- To build a server, one must buy individual components first. They have to assemble the server and install the necessary software. It is resource-intensive to customize, own, and maintain a server. It is well-suited for long-term projects and knowledge-building within the company.

Japan Data Center Server Market Trends

Blade Server Form Factor Segment is Expected to Witness Significant Growth

- A blade server is a small computer used to host and distribute data within a network of computers and systems. It acts as a link between computers, applications, programs, and systems. According to Cloudscene, as of September 2023, there were 218 data centers in Japan. A blade server is typically used in larger data centers due to the need to maximize space and power utilization and efficiency, have high computing needs, and support higher thermal and electrical loads.

- There are close to 40 data centers in Japan that are identified as extensive data center facilities and are expected to increase in the coming years. The Japanese government plans to build several new data centers nationwide by decentralizing landing bases for submarine cables to diversify landing points. Submarine cables are laid mainly on Japan's eastern Pacific Ocean side, with many concentrated in certain areas, such as Tokyo and Shima. The government intends to disperse landing bases in other areas and strengthen economic security. This may lead to significant growth in the large DC segments in newer concentrated areas, boosting the demand for blade servers.

- Constraints on land and power in the greater Tokyo area result in higher construction costs, possible delays for new developments, and fierce competition from domestic and foreign players. DC construction companies are investing in new data centers to build new data centers on scarce land in Japan, but as the demand is high, these data centers are likely to have high computing power. The advantage of blade servers in this situation is that, due to the limited computing components of blade servers, customers can fit more servers into a smaller rack area to increase the density.

- Some Asian countries, such as Japan, do not support 110 V power infrastructure. As a result, they are unable to achieve the power density enjoyed in the United States. For example, a 3-phase 220V power data center in the United States can support a 15 kW rack. However, special cooling solutions are needed to support this power density. Blades are not a viable solution in cases where power is restricted to 110V, no matter the vendor. An exception to this would be a departmental solution, such as the HP BladeSystem C3000 or IBM BladeCenter S.

- Further, blade servers are designed for high-performance processing. Unlike rack servers, blade servers can be hot-swapped. This means that one can remove and replace a blade server in a cluster without powering down the whole cluster. This significantly reduces downtime when an administrator needs to swap out a blade server or move a blade server out of the cluster for maintenance.

- Understanding blade server technology's past, present, and future is essential for organizations of all sizes in Japan to make informed decisions regarding their IT infrastructure. Due to their compact design, high performance, and scalability, blade servers are expected to remain a key component of that infrastructure for many years as they continue to evolve and evolve with the ever-evolving world of technology.

IT and Telecommunication to be the Fastest Growing End-user Industry

- Japan's Information and Communications Technology (ICT) sector is at the forefront of innovation, driving remarkable progress and creating a future-proof environment. The ICT sector opens up a world of possibilities by utilizing state-of-the-art technologies while facing the challenges that define its growth.

- The growth of the Japanese ICT market is mainly driven by the growing use of Internet of Things (IoT) devices across various sectors, such as consumer electronics, military, agriculture, and construction. Japan is home to some of the most prominent ICT organizations in the world, such as Sony, Panasonic, Fujitsu, NEC, and Toshiba (Toshiba), which are playing an important role in the growth of Japan as an ICT hub. The increasing government spending on maintaining the top-of-the-line and advanced infrastructure and the proper implementation of many modernization and improvement projects contribute to the market's expansion.

- Japan's ICT market is expected to grow due to the rapid expansion of E-Japan's strategy, which focuses on local e-government projects, such as citizen participation, self-assessment, and feedback on online government services.

- Japan has a high level of stability in business and society, as well as high-quality infrastructure and services such as ICT infrastructure, communication technology, education, healthcare, and more. The Japanese government is taking steps to support the private sector's digital transformation and the emergence of small and medium-sized enterprises (SMEs).

- Smart Cities are one of the Japanese government's key initiatives to bring Society 5.0 to life. The 6th Strategic Technology Infrastructure (STI) plan set a goal of 100 initiatives10 to be implemented by 2025 with the participation of 1000+ organizations from local government, regional organizations, and private enterprises. The "Smart City Public-Private Partnership platform" will replace the local and dispersed digital landscape to promote public-private partnerships and develop regional projects. Specific initiatives include centralizing the MyNumber (citizens ID) system and developing database registry standards by 2030.

- Further, the telecom companies in Japan are investing in 6G. The 6G system will not only outperform 5G, but it will also offer high speed, high capacity, low latency, new high-frequency bands (above 100 GHz), extend communication coverage to the sky, sea, and space, and provide ultra-low power consumption and ultra-low-cost communications. According to the Ministry of Internal Affairs and Communications, about 69.8 million 5G subscriptions were counted in Japan as of March 2023. In June 2022, NEC (NEC), Fujitsu (Fujitsu), and Nokia (Nokia) joined forces to test new mobile communication technologies to launch 6G services commercially by 2030.

- Thus, with the overall increase in investment by tech companies, government initiatives to improve the IT industry development and growth in data centers in the country would boost the server market in Japan.

Japan Data Center Server Industry Overview

The Japan data center server market is highly fragmented with the presence of major players like Dell Technologies Inc., Hewlett Packard Enterprise, Cisco Systems Inc., Lenovo Group Limited, and Quanta Computer Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2023 - Fujitsu announced the launch of a dedicated company for the hardware business in Japan in alignment with this strategy and to further strengthen the management of its hardware business, which primarily focuses on servers and storage solutions.

- August 2023 - Hewlett Packard Enterprise announced that phoenixNAP is expanding its Bare Metal Cloud platform with cloud-native HPE ProLiant RL300 Gen11 servers, using energy-efficient processors from Ampere Computing. The expanded services support AI inferencing, cloud gaming, and other cloud-native workloads with enhanced performance and energy efficiency.

- July 2023 - Fujitsu announced a new server, BS2000 SE730/SE730B. The servers of the latest SE generation are a valued platform in the high-end performance range for managing the largest data volumes. The servers offer extremely high availability and serve as an ideal platform for mission-critical applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Construction of New Data Centers, Development of Internet Infrastructure

- 5.1.2 Increasing Adoption of Cloud and IoT Services

- 5.2 Market Challenge

- 5.2.1 High Initial Investments

- 5.3 Assessment of COVID-19 Impact

6 MARKET SEGMENTATION

- 6.1 By Form Factor

- 6.1.1 Blade Server

- 6.1.2 Rack Server

- 6.1.3 Tower Server

- 6.2 By End User

- 6.2.1 IT and Telecommunication

- 6.2.2 BFSI

- 6.2.3 Government

- 6.2.4 Media and Entertainment

- 6.2.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Technologies Inc.

- 7.1.2 Hewlett Packard Enterprise

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Lenovo Group Limited

- 7.1.5 Quanta Computer Inc.

- 7.1.6 Super Micro Computer Inc.

- 7.1.7 Huawei Technologies Co. Ltd

- 7.1.8 Fujitsu Limited

- 7.1.9 NEC Corporation

- 7.1.10 IBM Corporation