|

市場調查報告書

商品編碼

1693854

中東衛星通訊:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Middle East Satellite Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

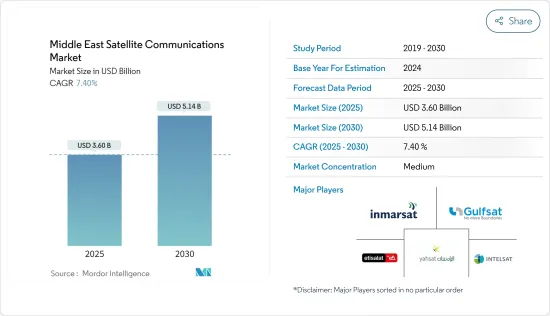

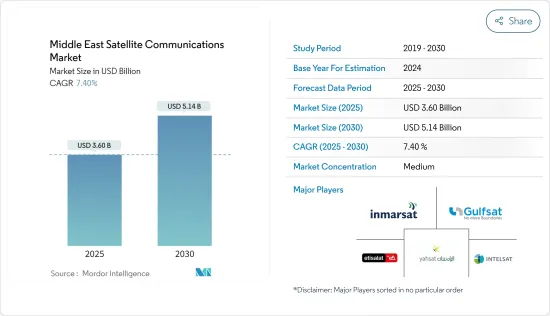

中東衛星通訊市場規模預計在 2025 年為 36 億美元,預計到 2030 年將達到 51.4 億美元,預測期內(2025-2030 年)的複合年成長率為 7.4%。

關鍵亮點

- 預計行動寬頻需求不斷成長、智慧型手機和智慧型穿戴裝置使用量不斷成長以及行動視訊採用需求激增等因素將在預測期內推動 5G 的成長,從而推動研究市場的成長。此外,小型化、連接技術、強大的網路環境、低功耗計算、無線射頻識別和 M2M通訊的進步預計將推動衛星通訊市場的發展。

- 對於寬頻通訊的需求持續有增無減,且不一定與地點相關。這種需求包括在固定地點和移動中作業的飛機、船舶和車輛(包括緊急應變人員)上的使用者的連接需求。這三個平台都需要沿途保持持續的連接,而這些線路通常會經過大都會圈服務不足和人口稀少的地區。預計這些趨勢將推動市場的成長。

- 衛星通訊的變化以及各種通訊和電腦流程的進步導致了該領域創新領域新機會的出現。隨著工業生產設施和採礦作業進入更難以到達的地形,透過地面和通訊通訊實現高效無線互連的需求正在迅速增加。

- 利用地面通訊基礎設施實現此類操作的解決方案(通常是 LTE,長期演進)相對較慢、昂貴且不易擴展。衛星通訊是一種有效的替代方案,因為它具有卓越的可靠性、成本效益、良好的可訪問性和可擴展性,為研究市場的成長提供了無數機會。

- 然而,衛星技術的快速發展和該地區衛星通訊服務的持續普及,增加了網路攻擊的風險和頻率,這可能會影響中東衛星通訊領域的發展和穩定。

- 由於衛星通訊在提供語音和數據方面有廣泛的應用,新冠疫情增加了對衛星通訊的需求。此外,為了維持企業運作和人們之間的聯繫,對衛星通訊(包括網路和寬頻服務)的需求也在增加。娛樂業進一步依賴衛星通訊來傳遞新聞和娛樂,讓人們可以在舒適的家中隨時了解 COVID-19 指南和其他必要資訊。這種日益成長的依賴性極大地支持了被調查市場的成長。

中東衛星通訊市場趨勢

網路營運中心 (NOC) 推動成長

- 網路營運中心 (NOC) 是透過電腦、通訊或衛星網路進行網路監控和控制或網路管理的一個或多個站點。衛星網路環境處理大量音訊和影像資料以及情報、監控和偵察資料。憑藉更強大的基礎設施,許多組織受益於更好的管理和按需報告。監控功能可幫助 NOC 減少不必要的警報和警報疲勞。

- 隨著中東地區採用 5G、物聯網 (IoT) 和邊緣運算等新技術,日益增加的複雜性正在決定 NOC 的未來。隨著企業轉向雲端基礎的服務並採用最新、最具創新性的技術,網路管理必須變得同樣靈活、跟上步伐並保持最佳實踐。預計 NOC 將變得更加靈活和多功能,充分發揮其潛力,取得成果,並無縫現代化,以反映新的先進能力。

- 此外,預計透過該地區的合作夥伴關係實現的擴張將有助於預測期內的市場成長率。例如,2023年9月,衛星服務供應商OneWeb與NEOM認知技術生態系統背後的科技公司TONOMUS的合資企業First Tech Web Company Limited委託沙烏地阿拉伯建設公司Albabtain LeBlanc在沙烏地阿拉伯塔布克開發衛星站。

- 該衛星站將成為合資企業地面基礎設施的一部分,透過為該地區服務不足的人群和企業提供穩定、高速的寬頻連接,幫助解決沙烏地阿拉伯以及全部區域落差問題。該站預計將於 2023 年底完工,Al-Babaten LeBlanc 將加入 OneWeb,與中東、歐洲、非洲和亞洲的合作夥伴攜手合作。

- 總體而言,中東衛星通訊市場網路營運中心(NOC)的成長受到幾個關鍵因素的推動,這些因素主要導致了全部區域對高效、可靠的通訊解決方案的需求不斷成長。

土地部分確認成長

- 陸地平台部門是指專為陸基營運和通訊需求設計的衛星通訊解決方案和服務。衛星通訊陸地平台解決方案旨在為陸地上的固定和偏遠地區以及陸地基礎設施提供無縫連接、可靠的數據傳輸和高效的通訊服務,使用戶能夠建立強大而可靠的通訊鏈路、訪問關鍵數據並確保中東多樣化陸地景觀和地形的持續營運連接。

- 中東地區地面基礎設施正在快速發展,包括不斷擴大的都市區、工業區和交通網路,這推動了跨地面設施和地點的數據傳輸、連接和營運協調的需求,需要強大而可靠的通訊解決方案。

- 此外,國防和政府部門重視安全和有彈性的通訊服務以支援國防和邊防安全,這進一步推動了陸地平台領域採用衛星通訊解決方案。根據斯德哥爾摩國際和平實驗室(SIPRI)的數據,2022年中東地區軍費總開支估計為1,840億美元,比2021年成長3.2%。

- 這一成長主要得益於沙烏地阿拉伯王國的支出成長 16%,預計 2022 年沙烏地阿拉伯的支出將達到 750 億美元,位居中東第一、全球第五,這也是該國自 2018 年以來首次增加支出。卡達位居中東第三、全球第 20 位,預計支出為 156 億美元,是支出增幅最高的國家,與前一年同期比較成長了 27%。中東地區軍事開支的快速成長凸顯了該地區對加強國家安全和防禦態勢的日益重視,從而導致對滿足軍事和防禦需求的先進衛星通訊解決方案的需求增加。

- 總體而言,陸地平台市場部分受到地面基礎設施的持續發展以及國防和政府部門對安全和彈性通訊服務的日益重視的推動,從而促進了陸地平台市場部分的持續成長。

中東衛星通訊產業概況

在中東衛星通訊市場,許多供應商透過各種成長策略相互競爭,包括聯盟、夥伴關係和新進者。知名參與企業包括 E&ETISALAT(阿拉伯聯合大公國電信集團公司 PJSC)、L3Harris Technologies Inc.、Gulfsat Communications Company、Al Yah Satellite Communications Company PJSC 和 Inmarsat Global Limited(Viasat Inc.)。

2023 年 9 月,Al Yahr 衛星通訊公司與阿拉伯聯合大公國政府夥伴關係政府解決方案部門 Yahrsat 政府解決方案,引起波動。此次合作旨在未來 17 年提供基於通訊的託管服務,使該公司的收益增加 51 億美元,並在整個預測期內顯著加強市場影響。

同時,歐洲通訊衛星公司 (Eutelsat Communications SA) 完成了與全球領先的低地球軌道 (LEO) 衛星通訊網路 OneWeb 的全股票合併。該子公司以 Eutelsat OneWeb 的名稱進行商業性營運,並在倫敦設有營運基地,這標誌著該公司發展歷程中的一個重要里程碑。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 物聯網 (IoT) 與自主系統的發展

- 軍事和國防衛星通訊解決方案需求不斷成長

- 市場限制

- 衛星通訊面臨的網路安全威脅

- 資料傳輸受到干擾

第6章市場區隔

- 按類型

- 地面設施

- 衛星閘道器

- 甚小孔徑終端(VSAT)設備

- 網路營運中心(NOC)

- 衛星新聞採集(SNG)設備

- 服務

- 行動衛星服務(MSS)

- 地球觀測服務

- 地面設施

- 按平台

- 可攜式的

- 土地

- 海上

- 航空

- 按行業

- 海上

- 國防和政府機構

- 企業

- 媒體和娛樂

- 其他最終用戶

第7章競爭格局

- 公司簡介

- Inmarsat Global Limited(Viasat Inc.)

- Al Yah Satellite Communications Company PJSC

- Gulfsat Communications Company

- L3Harris Technologies Inc.

- E& ETISALAT and(Emirates Telecommunication Group Company PJSC)

- Eutelsat Communications SA

- Intelsat SA

- Thales Group

- Saudi Telecom Company(STC)

- Raytheon Technologies Corporation

- Arabsat

第8章投資分析

第9章 市場機會與未來趨勢

The Middle East Satellite Communications Market size is estimated at USD 3.60 billion in 2025, and is expected to reach USD 5.14 billion by 2030, at a CAGR of 7.4% during the forecast period (2025-2030).

Key Highlights

- Factors such as the rising demand for mobile broadband, the growing use of smartphones and smart wearable devices, and the surging demand for mobile video adoption are expected to drive the growth of 5G over the forecast period, which is expected to aid the growth of the market studied. Furthermore, advancements in miniaturization, connected technologies, robust network environment, low-power computing, radio frequency identification, and M2M communication are anticipated to drive the satellite communication market.

- The demand for broadband communications continues unabated and is not necessarily location-specific. Such demands include connectivity requirements for users on aircraft, ships, and vehicles (including first responders) that operate at fixed locations and while in motion. These three platforms need continuous connectivity along their travel routes, often taking them through unserved parts of major metropolitan areas and less densely populated areas. Such trends are expected to aid in the growth of the studied market.

- Changes in satellite communications and the progress in all kinds of telecommunications and computer processes led to the evolution of new opportunities in innovative areas in the sector. As industrial production facilities and mining operations move further into inaccessible terrains, the requirement for efficient wireless interconnection through terrestrial and satellite communications is increasing rapidly.

- To fulfill the operations, the solutions leveraging terrestrial mobile communication infrastructures, typically like long-term evolution (LTE), are relatively slow, expensive, and not easily scalable. Satellite communication is an efficient alternative because of its superior reliability, cost-effectiveness, excellent accessibility, and scalability, thereby providing plenty of opportunities for the growth of the market being studied.

- However, as the region continues to witness rapid advancements in satellite technology and an upsurge in satellite communication services, there is an increased risk and frequency of cyberattacks, which might impact the growth and stability of the satellite communications sector in the Middle East.

- The COVID-19 pandemic increased the demand for satellite communication due to its vast applications in providing voice data. Furthermore, the demand was driven by the increasing need for satellite communications, including internet and broadband services, to continue operations and keep people connected. The entertainment industry has further depended on satellite communication to deliver news and entertainment, which allowed people to remain updated regarding COVID-19 guidelines and other necessary information while being restricted at home. Such increased dependency has largely supported the growth of the studied market.

Middle East Satellite Communications Market Trends

Network Operation Center (NOC) is to Witness the Growth

- A network operations center (NOC) is one or more sites from which network monitoring and control, or network management, over a computer, telecommunications, or satellite network is exercised. Large volumes of voice and video data and intelligence, surveillance, and reconnaissance data are processed in satellite network environments. With enhanced infrastructure, many organizations benefit from better administration and on-demand reporting. With their monitoring capabilities, NOCs help reduce undesirable alerts and alert fatigue.

- As new technologies, like 5G, the Internet of Things (IoT), and edge computing are adopted in the Middle East, deepening complexity defines the future of NOCs. As businesses advance toward cloud-based services and adopt the latest, most innovative technologies, network management must be just as agile, keep pace, and maintain best practices. The NOC is expected to become even more flexible and versatile, to work at its full potential and deliver results, and seamlessly modernize to reflect new, progressive capabilities.

- Further, the growing expansions through collaborations in the region are analyzed to contribute to the market growth rate during the forecast period. For instance, in September 2023, First Tech Web Company Limited, a joint venture between OneWeb, a satellite service provider, and TONOMUS, the tech company powering the ecosystem of cognitive technologies at NEOM - has appointed Albabtain LeBlanc, a Saudi Arabian construction company, to develop a satellite station in Tabuk, Saudi Arabia.

- By providing a consistent, fast broadband connection to people and businesses that are unserved or under-resourced throughout the Middle East regions, this station forms part of joint ventures' ground infrastructure, which seeks to support the objective of addressing the Digital Divide between Saudi Arabia and the wider MENA region. With Albabtain LeBlanc joining the OneWeb roster for partners across the Middle East, Europe, Africa, and Asia, this station is scheduled to be completed by the end of 2023.

- Overall, the growth of the Network Operation Center (NOC) in the Middle East satellite communications market is primarily driven by several key factors that contribute to the increasing demand for efficient and reliable communication solutions across the region.

Land Segment to Witness the Growth

- The land platform segment refers to satellite communication solutions and services specifically designed for terrestrial operations and communication requirements on land. Land platform solutions in satellite communications are developed to facilitate seamless connectivity, reliable data transmission, and efficient communication services for fixed terrestrial locations, remote sites, and terrestrial infrastructure, thereby enabling users to establish robust and dependable communication links, access critical data, and ensure continuous operational connectivity across diverse terrestrial landscapes and geographical terrains in the Middle East.

- The ongoing development of terrestrial infrastructure in the Middle East, including expanding urban areas, industrial zones, and transportation networks, necessitates robust and reliable communication solutions to support the growing need for data transmission, connectivity, and operational coordination across various terrestrial facilities and locations.

- Additionally, the defense and government sector's emphasis on secure and resilient communication services to support national defense and border security further drives the adoption of satellite communication solutions within the land platform segment. The total military spending in the Middle East was estimated to be USD 184 billion in 2022, up 3.2% from 2021, according to data from the Stockholm International Peace Research Institute (SIPRI).

- The increase was attributed to the Kingdom of Saudi Arabia's 16% spending growth, which resulted in an estimated USD 75 billion in 2022, ranking first in the Middle East and five globally, its first increase since 2018, and Qatar, which ranked third in the Middle East and 20 globally with an estimated spend of USD 15.6 billion, registered the highest year-over-year spending growth of any country, with a 27% increase. The surge in military spending across the Middle East highlights the region's growing emphasis on strengthening national security and defense preparedness, leading to an increased demand for sophisticated satellite communication solutions tailored to the requirements of military and defense applications.

- Overall, the land platform segment in the market is being driven by the continuous development of terrestrial infrastructure, increasing emphasis on secure and resilient communication services within the defense and government sectors, contributing to the sustained growth of the land platform segment in the market.

Middle East Satellite Communications Industry Overview

In the Middle East satellite communications market, numerous vendors vie for prominence through diverse growth strategies such as collaborations, partnerships, and new launches. Notable players include E& ETISALAT (Emirates Telecommunication Group Company PJSC), L3Harris Technologies Inc., Gulfsat Communications Company, Al Yah Satellite Communications Company PJSC, and Inmarsat Global Limited (Viasat Inc.).

In September 2023, Al Yah Satellite Communications made waves with its Government Solutions arm, Yahsat Government Solutions, forging a partnership with the UAE government. This alliance aims to deliver satellite communication-based managed services for the next 17 years, propelling the company's revenue by USD 5.1 Billion and significantly bolstering its market presence across Middle Eastern countries throughout the forecast period.

Simultaneously, Eutelsat Communications SA finalized an all-share merger with OneWeb, a prominent global low Earth orbit (LEO) satellite communications network. Operating commercially as Eutelsat OneWeb, this subsidiary maintains its operational hub in London, marking a significant milestone in the company's trajectory.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Growth of Internet of Things (IoT) and Autonomous Systems

- 5.1.2 Increasing Demand for Military and Defense Satellite Communication Solutions

- 5.2 Market Restraints

- 5.2.1 Cybersecurity Threats to Satellite Communication

- 5.2.2 Interference in Transmission of Data

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ground Equipment

- 6.1.1.1 Satellite Gateway

- 6.1.1.2 Very Small Aperture Terminal (VSAT) Equipment

- 6.1.1.3 Network Operation Center (NOC)

- 6.1.1.4 Satellite News Gathering (SNG) Equipment

- 6.1.2 Services

- 6.1.2.1 Mobile Satellite Services (MSS)

- 6.1.2.2 Earth Observation Services

- 6.1.1 Ground Equipment

- 6.2 By Platform

- 6.2.1 Portable

- 6.2.2 Land

- 6.2.3 Maritime

- 6.2.4 Airborne

- 6.3 By End-User Vertical

- 6.3.1 Maritime

- 6.3.2 Defense and Government

- 6.3.3 Enterprises

- 6.3.4 Media and Entertainment

- 6.3.5 Other End-User Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Inmarsat Global Limited (Viasat Inc.)

- 7.1.2 Al Yah Satellite Communications Company PJSC

- 7.1.3 Gulfsat Communications Company

- 7.1.4 L3Harris Technologies Inc.

- 7.1.5 E& ETISALAT and (Emirates Telecommunication Group Company PJSC)

- 7.1.6 Eutelsat Communications S.A.

- 7.1.7 Intelsat S.A.

- 7.1.8 Thales Group

- 7.1.9 Saudi Telecom Company (STC)

- 7.1.10 Raytheon Technologies Corporation

- 7.1.11 Arabsat