|

市場調查報告書

商品編碼

1693850

中東聚醯胺:市場佔有率分析、產業趨勢和成長預測(2024-2029)Middle East Polyamide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

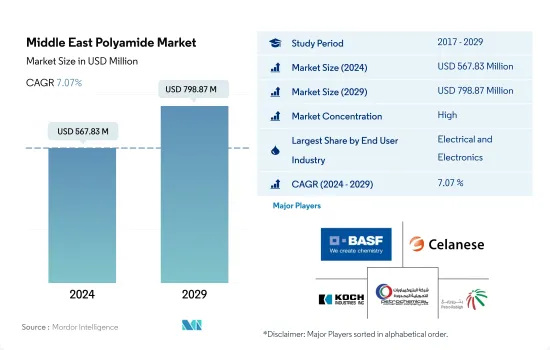

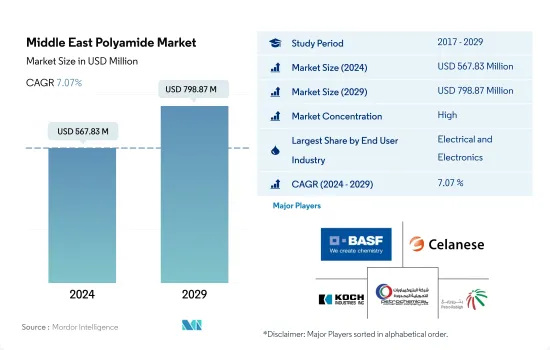

預計 2024 年中東聚醯胺市場規模為 5.6783 億美元,到 2029 年將達到 7.9887 億美元,預測期內(2024-2029 年)的複合年成長率為 7.07%。

建築業成為聚醯胺的最大消費產業

- 聚醯胺具有多種物理特性,使其成為製造和工業應用的理想選擇,包括耐磨性、耐腐蝕性、耐化學性、阻燃性、低透氣滲透性、柔韌性和強度。在中東,阿拉伯聯合大公國2022年的消費量將占到總消費量的30%。

- 建築業是聚醯胺的最大消費產業。沙烏地阿拉伯和阿拉伯聯合大公國等國家以其大規模的基礎設施計劃而聞名。聚醯胺用於各種建築業產品,包括管道、螺絲、板材、墊片、安全網、桿、管、墊圈、螺栓和管道配件。由於該地區即將實施和正在進行的大型企劃數量,預計預測期內對聚醯胺的需求(以以金額為準)將以 4.11% 的複合年成長率成長。

- 汽車產業是該地區第二大聚醯胺消費產業。聚醯胺是生產汽車引擎蓋下零件和燃油系統最常用的塑膠之一。該地區的汽車生產主要由伊朗主導。然而,阿拉伯聯合大公國和沙烏地阿拉伯擁有強大的MRO活動,是聚醯胺的重要市場。預計在預測期內,汽車市場聚醯胺的消費量將以 5.55% 的複合收益成長。

- 由於該地區消費性電子產品市場規模的快速擴張,電氣和電子產業是聚醯胺成長最快的消費產業,預計2023年至2029年期間的複合年成長率為7.92%,到2029年達到1.236億美元。預計在預測期內(2023-2029年),聚醯胺市場的以收益為準率為9.36%。

阿拉伯聯合大公國聚醯胺消費量成長最快

- 以金額為準計算,2022年中東地區將佔全球聚醯胺樹脂消費量的約2.59%。聚醯胺是汽車、包裝、電氣和電子等多個行業的關鍵聚合物。

- 沙烏地阿拉伯是該地區最大的聚醯胺樹脂消費國,這得益於其新興的汽車和包裝產業。沙烏地阿拉伯的塑膠包裝產量從 2021 年的 180 萬噸增加到 2022 年的 200 萬噸。受快速成長的生活方式和新興經濟體的經濟成長推動,對加工和包裝食品的偏好正在推動該國食品包裝市場的發展。人們越來越偏好加工食品的主要原因是人口從農村到都市區的轉移。沙烏地阿拉伯是中東最大的電子商務市場之一。隨著包裝需求的增加,未來幾年該地區對聚醯胺樹脂的需求可能會增加。

- 阿拉伯聯合大公國是該地區聚醯胺樹脂成長最快的國家。預計預測期內(2023-2029 年)的以金額為準年成長率為 8.08%。由於對智慧型手機、筆記型電腦、個人電腦、相機、電視等技術先進的家用電子電器家用電子電器電器產品的需求將會成長。預計該國家用電子電器產量將從 2023 年的 18 億美元成長到 2027 年的約 25 億美元的市場規模。因此,預計該國家用電子電器產業的成長將在未來幾年增加對聚醯胺樹脂的需求。

中東聚醯胺市場趨勢

政府和私參與企業的投資增加

- 在中東,沙烏地阿拉伯已迅速崛起為電氣電子產業主要市場之一。除石油和天然氣工業外,沙烏地阿拉伯擁有龐大的消費群和廣泛的工業,這些都推動了電氣和電子工業年產量的快速成長。因此,2017年至2019年期間,該地區電氣和電子設備生產以收益為準的複合年成長率為18%。

- 2020年,新冠疫情增加了遠距辦公和家庭娛樂家用電子電器產品的需求。 2020年,沙烏地阿拉伯的智慧型手機普及率達到全球最高,約97%,約60%的沙烏地阿拉伯消費者能夠透過社群網路發現新的賣家。沙烏地阿拉伯電子商務成長近60%(2019-2020年),主要原因是受到疫情的影響。電氣和電子產品生產收益比上年度成長1.8%。

- 預計預測期內(2023-2029 年),電氣和電子製造業的複合年成長率為 8.51%。成長的主要動力可能是政府和三星等製造商的投資增加。三星也在中東推廣其 5G 無線技術。沙烏地阿拉伯已根據其「2030願景」計畫推出了5G網路。預計所有這些因素都將在預測期內促進該地區的電子產品生產。

中東聚醯胺產業概況

中東聚醯胺市場相當鞏固,前五大公司佔100%的市佔率。該市場的主要企業包括BASF公司、塞拉尼斯公司、科氏工業公司、PCC、拉比格煉油公司和石油化學公司(Petro Rabigh)等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 電氣和電子

- 包裝

- 進出口趨勢

- 聚醯胺(PA)貿易

- 價格趨勢

- 回收概述

- 聚醯胺(PA)回收趨勢

- 法律規範

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 電氣和電子

- 工業/機械

- 包裝

- 其他

- 子樹脂類型

- 芳香聚醯胺

- 聚醯胺(PA)6

- 聚醯胺(PA)66

- 聚鄰苯二甲醯胺

- 國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

第6章競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Arkema

- BASF SE

- Celanese Corporation

- EMS-Chemie Holding AG

- Koch Industries, Inc.

- LANXESS

- PCC

- Rabigh Refining and Petrochemical Company(Petro Rabigh)

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 5000189

The Middle East Polyamide Market size is estimated at 567.83 million USD in 2024, and is expected to reach 798.87 million USD by 2029, growing at a CAGR of 7.07% during the forecast period (2024-2029).

Building and construction industry to become the largest consumer of polyamides

- Polyamides have several physical properties that make them ideal for manufacturing and industrial use, including resistance against abrasion, corrosion, chemical, and flame, along with low gas permeability, flexibility, and strength. In the Middle East, the United Arab Emirates accounted for 30% of the total volume consumed in 2022.

- The building and construction industry is the largest consumer of polyamides. Countries like Saudi Arabia and the United Arab Emirates are well known for their massive infrastructure projects. Polyamides are used in a variety of goods in the construction industry, including pipes, screws, sheets, spacers, safety netting, rods, tubes, washers, bolts, and plumbing fittings. In line with the number of upcoming and ongoing mega projects in the region, the demand for polyamides is expected to record a CAGR of 4.11% by value during the forecast period.

- The automotive industry is the second-largest consumer of polyamides in the region. Polyamide is one of the most used plastics in the production of under-the-hood components and fuel systems of a vehicle. The region's vehicle production is primarily dominated by Iran. However, high MRO activities in the United Arab Emirates and Saudi Arabia make them important markets for polyamides. The consumption of polyamides in the automotive market is expected to record a CAGR of 5.55% by revenue during the forecast period.

- The electrical and electronics industry is the fastest-growing consumer of polyamides due to the rapidly growing market size of consumer electronics in the region, which may record a CAGR of 7.92% from 2023 to 2029, resulting in a market size of USD 123.6 million by 2029. The market for polyamides is expected to witness a growth of 9.36% in terms of revenue during the forecast period (2023-2029).

UAE to exhibit the fastest growth in the consumption of polyamide

- The Middle East accounted for around 2.59% by value of the global consumption of polyamide resin in 2022. Polyamide is a key polymer for various industries, including automotive, packaging, and electrical and electronics.

- Saudi Arabia is the largest consumer of polyamide resin in the region, owing to its rising automotive and packaging industries. Plastic packaging production in Saudi Arabia reached 2.0 million tons in 2022 from 1.8 million tons in 2021. The preference for processed and packaged foods has propelled the food packaging market in the country due to rapidly developing lifestyles and economic growth. The primary reason for the growing preference for processed foods is the shift in population dynamics from rural to urban areas. Saudi Arabia has one of the largest e-commerce markets in the Middle East. With the increasing demand for packaging, the demand for polyamide resin is likely to increase in the region in the future.

- The United Arab Emirates is the fastest-growing country for polyamide resin in the region. It is expected to register a CAGR of 8.08% in terms of value during the forecast period (2023-2029). The surge in demand for technologically advanced consumer electronics and appliances such as smartphones, laptops, computers, cameras, televisions, and others is expected to boost consumer electronics demand in the country in the future. Consumer electronics production in the country is projected to reach a market volume of around USD 2.5 billion in 2027 from USD 1.8 billion in 2023. As a result, growth in the consumer electronics industry in the country is projected to increase the demand for polyamide resin over the coming years.

Middle East Polyamide Market Trends

Growing investments from the government and private players

- In the Middle East, Saudi Arabia is quickly emerging as one of the key markets for the electrical and electronics industry. Aside from the oil and gas industry, the country has a sizable consumer base and a broad range of industrial pursuits, contributing to the rapid annual increase in production for the electrical and electronics industry. Thus, electrical and electronics production in the region registered a CAGR of 18% from 2017 to 2019 in revenue terms.

- In 2020, the demand for consumer electronics for remote working and home entertainment increased due to the COVID-19 pandemic. In 2020, Saudi Arabia registered the highest smartphone penetration rate, around 97%, in the world, which enabled approximately 60% of Saudi customers to discover new sellers through social networks. Saudi Arabia faced a higher rate of e-commerce growth, nearly 60% (between 2019 and 2020), mainly due to the pandemic. The revenue from electrical and electronics production increased by 1.8% compared to the previous year.

- Electrical and electronic production is expected to witness a CAGR of 8.51% in value during the forecast period (2023-2029). The major driving component behind the growth is likely to be the growing investments from the government and the manufacturers like Samsung. Samsung has also been pitching its 5G wireless technology to the Middle East. Saudi Arabia implemented a 5G network in line with the Vision 2030 initiative. All such factors are expected to boost electronics production over the forecast period in the region.

Middle East Polyamide Industry Overview

The Middle East Polyamide Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are BASF SE, Celanese Corporation, Koch Industries, Inc., PCC and Rabigh Refining and Petrochemical Company (Petro Rabigh) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polyamide (PA) Trade

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 Saudi Arabia

- 4.5.2 United Arab Emirates

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Aramid

- 5.2.2 Polyamide (PA) 6

- 5.2.3 Polyamide (PA) 66

- 5.2.4 Polyphthalamide

- 5.3 Country

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 Celanese Corporation

- 6.4.4 EMS-Chemie Holding AG

- 6.4.5 Koch Industries, Inc.

- 6.4.6 LANXESS

- 6.4.7 PCC

- 6.4.8 Rabigh Refining and Petrochemical Company (Petro Rabigh)

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219