|

市場調查報告書

商品編碼

1693842

北美聚醚醚酮(PEEK)市場:佔有率分析、產業趨勢與成長預測(2024-2029)North America Polyether Ether Ketone (peek) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

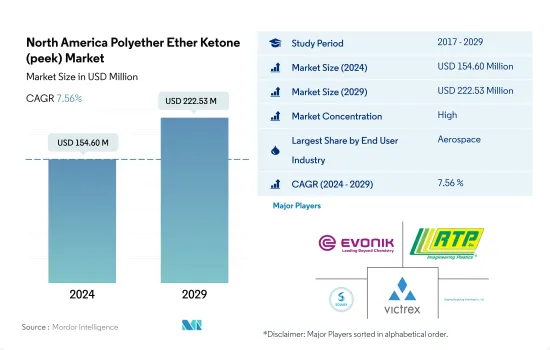

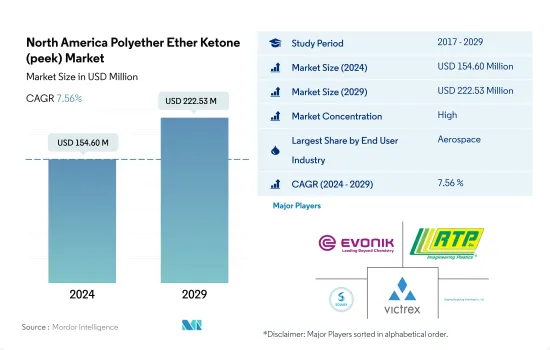

北美聚醚醚酮 (PEEK) 市場規模預計在 2024 年為 1.546 億美元,預計到 2029 年將達到 2.2253 億美元,在預測期內(2024-2029 年)的複合年成長率為 7.56%。

航太工業的成長和對高品質飛機零件的需求將在預測期內推動市場成長

- PEEK 樹脂因其重量輕、強度高、低疲勞和低可燃性而受到各行各業的歡迎。其低可燃性使其能夠承受高達近 600°C 的燃燒。 2022年美國將佔據北美PEEK市場的85.2%。

- 受新冠疫情影響,2020年北美PEEK市場下滑,市場規模較2019年下降6.60%。供應鏈中斷、原料短缺、以及包括美國在內的該地區許多國家實施全國封鎖等因素導致了市場下滑。不過,PEEK 樹脂的需求此後有所復甦,2022 年成長率將達到 7.68%。

- PEEK材料廣泛應用於北美航太工業,製造飛機內部零件、飛行控制零件等多種物品。預計未來幾年北美航太零件產量的成長將推動對 PEEK 樹脂的需求。預計飛機零件生產收益將從 2022 年的 1,932 億美元增至 2029 年的 3,002 億美元。

- 電氣和電子產業是北美 PEEK 樹脂成長最快的終端用戶領域,預測期內(2023-2029 年)的複合年成長率以金額為準9.47%。預計到2029年,該產業的PEEK樹脂消費量將達到約1億噸。這一趨勢是由北美,特別是美國的半導體產量成長所推動的,美國佔全球半導體產量的12%。為了進一步推動美國半導體製造業的發展,政府已在2022年投資520億美元。

由於航太、汽車和電氣及電子工業的成長,美國很可能在該地區 PEEK 樹脂市場佔據主導地位。

- 2022年,北美將佔全球聚醚醚酮(PEEK)樹脂消費量的19.8%。 PEEK是北美多個產業的重要聚合物,包括汽車、航太、電氣和電子。

- 由於航太、汽車、電氣和電子工業的不斷發展,美國是該地區最大的 PEEK 樹脂消費國。 2022年,該國的飛機零件收益將達到1,814億美元,高於2021年的1,727億美元。預計未來幾年,飛機零件產量的成長將推動該國對 PEEK 樹脂的需求。

- 由於汽車和電氣電子設備產量的增加,墨西哥對 PEEK 樹脂的需求正在大幅增加。 2023年,該國的汽車和航太工業可能分別佔墨西哥PEEK市場的27.4%和10.1%。預計未來中國汽車和電氣電子設備產量的成長將推動對 PEEK 樹脂的需求。

- 墨西哥是北美成長最快的 PEEK 樹脂消費國,預計預測期內以金額為準為 9.92%。墨西哥也是北美第二大汽車生產國。預計到 2029 年,該國的汽車產量將達到 590 萬輛,高於 2023 年的 400 萬輛。預計到 2023 年,該國的電子產業產值將達到 150.9 億美元,到 2027 年將達到 248.2 億美元。在預測期內,汽車和電子產品產量的成長預計將推動該國對 PEEK 樹脂的需求。

北美聚醚醚酮(PEEK)市場趨勢

科技創新強勁成長推動全產業成長

- 2017年至2019年,北美電氣和電子設備產量的複合年成長率超過1.4%,這得益於技術進步以及智慧電視、冰箱和空調等家用電子電器產品的需求不斷成長。電子創新的快速步伐推動了對更新、更快的電子產品的需求。因此,該地區的電氣和電子設備產量也在增加。

- 由於新冠疫情的影響、生產設施關閉、供應鏈中斷以及各種其他限制因素,2020 年北美電子產品銷售額與 2019 年相比下降了約 9%。結果,該地區2020年電氣和電子設備生產收益與前一年同期比較下降了4.7%。

- 2021年該地區消費性電子產品銷售額將達到約1,130億美元,較2020年成長4%。因此,2021年北美電氣和電子設備產量與前一年同期比較增13.8%。

- 到2027年,北美預計將成為全球第三大電氣和電子設備生產地區,約佔全球市場佔有率的10.5%。虛擬實境、物聯網解決方案和機器人等先進技術在家用電子電器產品中的出現,提高了效率並降低了成本,為家用電子電器產業帶來了巨大的利益。該地區家用電子電器產業的市場規模預計將從 2023 年的 1,276 億美元成長到 2027 年的約 1,618 億美元。因此,該地區對電氣和電子產品的需求預計將會增加。

北美聚醚醚酮(PEEK)產業概覽

北美聚醚醚酮(PEEK)市場相當集中,前五大公司佔100%。市場的主要企業包括贏創工業股份公司、RTP公司、索爾維、威格斯、浙江鵬富龍科技等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 電氣和電子

- 包裝

- 法律規範

- 加拿大

- 墨西哥

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 電氣和電子

- 工業/機械

- 其他

- 國家

- 加拿大

- 墨西哥

- 美國

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Evonik Industries AG

- Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- Polyplastics-Evonik Corporation

- RTP Company

- Solvay

- Victrex

- Zhejiang Pengfulong Technology Co., Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 5000180

The North America Polyether Ether Ketone (peek) Market size is estimated at 154.60 million USD in 2024, and is expected to reach 222.53 million USD by 2029, growing at a CAGR of 7.56% during the forecast period (2024-2029).

Growing aerospace industry and demand for high-quality aircraft components to drive market growth during the forecast period

- PEEK resin is popular across various industries for its lightweight, high strength, low fatigue, and low flammability characteristics. It can resist combustion up to nearly 600°C due to its low flammability properties. The United States accounted for 85.2% of the North American PEEK market in 2022.

- The PEEK market in North America experienced a decline in 2020 due to the impact of the COVID-19 pandemic, with the market volume falling by 6.60% compared to 2019. Factors such as supply chain disruptions, a shortage of raw materials, and nationwide lockdowns in numerous countries in the region, including the United States, contributed to the market's decline. However, in subsequent years, demand for PEEK resin rebounded, with a growth rate of 7.68% in 2022, attributed to a steady supply of raw materials.

- PEEK material is extensively used in North America's aerospace industry for producing aircraft interior parts, flight control components, and many other items. The escalating production of aerospace components in North America is expected to drive the demand for PEEK resin over the coming years. Revenue from aircraft component production is projected to increase from USD 193.2 billion in 2022 to USD 300.2 billion by 2029.

- The electrical and electronics industry represents the fastest-growing end-user segment for PEEK resin in North America, with a CAGR of 9.47% in terms of value during the forecast period (2023-2029). The industry's consumption of PEEK resin is anticipated to reach approximately 100 tons by 2029. This trend is driven by the growing semiconductor production in North America, particularly in the United States, which accounts for 12% of global semiconductor production. To further boost US semiconductor manufacturing, the government invested USD 52 billion in 2022.

United States may dominate the region's PEEK resin market due to its growing aerospace, automotive, and electrical and electronics industries

- North America accounted for 19.8% of the global consumption of polyether ether ketone (PEEK) resin in 2022. PEEK is a key polymer for various industries in North America, including automotive, aerospace, and electrical and electronics.

- The United States is the region's largest consumer of PEEK resin due to its growing aerospace, automotive, and electrical and electronics industries. The country's revenue from aircraft components reached USD 181.4 billion in 2022 from USD 172.7 billion in 2021. The growing aircraft component production is projected to drive the demand for PEEK resin in the country over the coming years.

- Mexico's demand for PEEK resin is increasing significantly due to growing vehicle and electrical and electronics production. In 2023, the country's automotive and aerospace industries may account for 27.4% and 10.1% of the Mexican PEEK market, respectively. The country's increasing vehicle and electrical and electronics production is projected to drive the demand for PEEK resin in the future.

- Mexico is the fastest-growing consumer of PEEK resin in North America, with a projected CAGR of 9.92% in terms of value during the forecast period. Mexico is also North America's second-largest vehicle producer. Vehicle production in the country is projected to reach 5.9 million units in 2029 from 4.0 million units in 2023. The country's electronics industry is projected to reach USD 15.09 billion in 2023 to USD 24.82 billion in 2027. The increasing automotive and electronic production is projected to drive the demand for PEEK resin in the country during the forecast period.

North America Polyether Ether Ketone (peek) Market Trends

Strong growth of technological innovations to augment the overall growth of the industry

- Electrical and electronics production in North America witnessed a CAGR of over 1.4% between 2017 and 2019 owing to the advancement of technology, coupled with the increasing demand for consumer electronics products, such as smart TVs, refrigerators, air conditioners, and other products. The rapid pace of electronic technological innovation is driving the demand for newer and faster electronic products. As a result, it has also increased the electrical and electronics production in the region.

- Electronic device sales in North America fell by around 9% in 2020 compared to 2019, owing to the COVID-19 impact, because of the production facility shutdowns, supply chain disruptions, and various other constraints. As a result, revenue from electrical and electronics production in the region decreased by 4.7% in 2020 compared to the previous year.

- In 2021, the sales of consumer electronics in the region reached around USD 113 billion, 4% higher than in 2020. As a result, North America's electrical and electronics production grew by 13.8% in 2021 in terms of revenue compared to the previous year.

- By 2027, North America is projected to be the third-largest region for electrical and electronics production and account for a share of around 10.5% of the global market. The emergence of advanced technologies such as virtual reality, IoT solutions, and robotics into consumer electronic products to achieve efficiency and low cost has provided a significant advantage to the consumer electronics industry. The consumer electronics industry in the region is projected to reach a market volume of around USD 161.8 billion by 2027 from USD 127.6 billion in 2023. As a result, the demand for electrical and electronic products in the region is projected to increase.

North America Polyether Ether Ketone (peek) Industry Overview

The North America Polyether Ether Ketone (peek) Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are Evonik Industries AG, RTP Company, Solvay, Victrex and Zhejiang Pengfulong Technology Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 Canada

- 4.2.2 Mexico

- 4.2.3 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Other End-user Industries

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 Mexico

- 5.2.3 United States

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Evonik Industries AG

- 6.4.2 Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- 6.4.3 Polyplastics-Evonik Corporation

- 6.4.4 RTP Company

- 6.4.5 Solvay

- 6.4.6 Victrex

- 6.4.7 Zhejiang Pengfulong Technology Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219