|

市場調查報告書

商品編碼

1693803

泰國資料中心-市場佔有率分析、產業趨勢與成長預測(2025-2030)Thailand Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

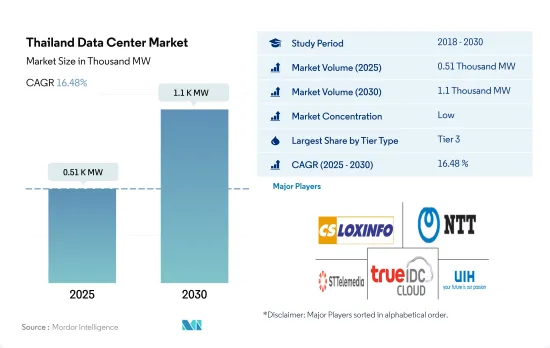

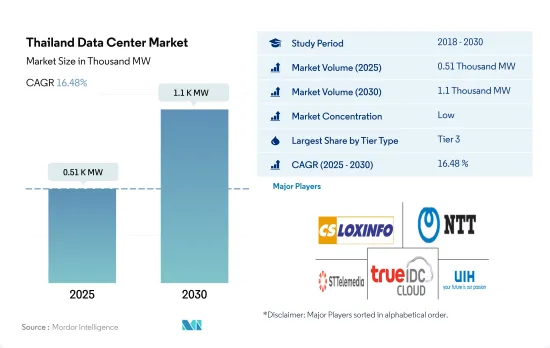

泰國的資料中心市場規模預計在 2025 年達到 510MW,預計在 2030 年達到 1,100MW,複合年成長率為 16.48%。

預計 2025 年主機託管收益將達到 5.093 億美元,2030 年將達到 12.049 億美元,預測期內(2025-2030 年)的複合年成長率為 18.79%。

三級資料中心設施佔據該地區的市場佔有率,預計未來幾年將繼續佔據市場佔有率的主導地位。

- 該國沒有一級或二級認證設施。三級資料中心部分的 IT 負載容量在 2021 年達到 71.48MW。預計容量將從 2022 年的 74.33 MW 成長到 2029 年的 199.55 MW,複合年成長率為 15.15%。 2021年,Tier 4資料中心部分的IT負載容量達到20MW。預計容量將從2022年的20MW成長到2029年的50MW,複合年成長率為13.99%。

- 泰國的大多數設施都通過了 Tier 3 認證,這意味著可以在不中斷資料中心正常業務的情況下更換或移除 IT 元件。

- 目前,泰國只有一家工廠獲得 Tier 4 認證:SUPERNAP Thailand。該設施具有很強的彈性,非常適合隨時承受高流量。國家電信(NT)、TOT 和 SUPERNAP(泰國)簽署了一份合作備忘錄(資料中心雲端服務夥伴關係計畫),以支持政府的數位現代化。

泰國資料中心市場趨勢

不斷成長的數位消費需求將推動泰國對資料中心的需求

- 2022 年泰國智慧型手機用戶數為 5,700 萬,預計到 2029 年將達到 6,020 萬,預測期內複合年成長率為 0.83%。

- 根據《數位2022:泰國》,泰國展現出強大的數位化準備水平,網路使用、社群媒體參與、行動連線、網路購物和數位付款的普及率很高。國內電商商家的增加也推動了銷售額的成長。跨境消費佔泰國電子商務總價值的一半(50%)。泰國的行動商務市場已成為該國主要的電子商務分銷管道,佔所有網路購物交易的 52%,價值 136 億美元。這使得泰國成為該地區行動商務的先驅之一。

- 預計到 2022 年底,泰國的 5G 覆蓋率將超過 85%。新的夥伴關係和發展正在增加 5G 在智慧型手機上的使用。例如,2022 年 7 月,愛立信與泰國國王科技大學吞武里分校(KMUTT)宣佈建立夥伴關係,幫助泰國學生培養面向未來的 5G ICT 技能。泰國是東南亞推出 5G 商業服務的先驅,它已做好準備,打造雄心勃勃的工業 4.0 無線生態系統,以增強消費者的行動體驗,並支援製造業、能源和醫療保健產業的數位化。

通訊業者加大對 5G 網路擴展的投資將推動市場成長

- 泰國的5G普及率為9.2%,是東協地區最高的,僅次於新加坡的13.9%。根據數位經濟與社會(DES)預測,到2027年,泰國的5G用戶數量預計將達到7,000萬,佔行動服務用戶總數的73%。

- 泰國是亞太地區最早推出5G的市場之一,AIS和TrueMove H均於2020年第一季推出了5G商用服務。加速5G在泰國市場的普及是AIS和TrueMove H的主要目標之一,兩家公司都計劃在2021年底前實現200萬個5G連接。 2021年,用戶在AIS網路上享受了最快的平均整體下載速度和5G下載速度。 AIS 的下載速度為 19.4Mbps,以 1.7Mbps(9.7%)的領先優勢,奪得整體下載速度大獎。在 5G 下載速度大獎中,AIS 的下載速度為 180.3Mbps,以 57.4Mbps(46.7%)的領先優勢,位居第二的 TrueMove H。

- OpenGov Asia 近日報道稱,泰國數位經濟與社會部(MDES)、數位經濟促進局(DEPA)與中國跨國科技公司宣佈在曼谷成立泰國5G生態系統研發中心(5G EIC)。此次推出旨在透過生態系統協作加速5G創新並促進數位經濟。泰國資料中心的興起是由行動網際網路速度的加快所推動的,這直接影響了資料流量並增加了對更多機架的需求。

泰國資料中心產業概況

泰國資料中心市場較為分散,前五大公司佔了29.67%的市場。市場的主要企業有:CS LOXINFO PUBLIC COMPANY LIMITED、NTT Ltd、STT GDC Pte Ltd、True Internet Data Center、United Information Highway等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動數據速度

- 寬頻數據速度

- 光纖連接網路

- 法律規範

- 泰國

- 價值鍊和通路分析

第6章市場區隔

- 熱點

- 曼谷

- 其他中東和非洲地區

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 超大規模

- 小規模

- 等級類型

- 1級和2級

- 第 3 層

- 第 4 層

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AIMS DATA CENTRE(THAILAND)LTD

- CS LOXINFO PUBLIC COMPANY LIMITED

- Internet Thailand Public Company Limited

- ISPIO(NIPA Technology Co. Ltd)

- JasTel Network Co. Ltd

- NTT Ltd

- Proen Proimage Engineering & Communication

- STT GDC Pte Ltd

- SUPERNAP(THAILAND)COMPANY LIMITED

- TCC Technology

- True Internet Data Center Co. Ltd

- United Information Highway Co. Ltd

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 數據包

- 詞彙表

The Thailand Data Center Market size is estimated at 0.51 thousand MW in 2025, and is expected to reach 1.1 thousand MW by 2030, growing at a CAGR of 16.48%. Further, the market is expected to generate colocation revenue of USD 509.3 Million in 2025 and is projected to reach USD 1,204.9 Million by 2030, growing at a CAGR of 18.79% during the forecast period (2025-2030).

Tier 3 DC facilities dominates the market share in the region and is expected to dominate in coming years

- The country has no facility certified with Tier 1 and Tier 2. The tier 3 data center segment reached an IT load capacity of 71.48 MW in 2021. The capacity is anticipated to grow from 74.33 MW in 2022 to 199.55 MW by 2029 at a CAGR of 15.15%. The tier 4 data center segment reached an IT load capacity of 20 MW in 2021. The capacity is anticipated to grow from 20 MW in 2022 to 50 MW by 2029 at a CAGR of 13.99%.

- In most Thai facilities, IT components can be replaced or removed without interrupting routine data center operations, so most facilities are Tier 3 certified.

- Currently, only one facility in Thailand has Tier 4 certification, i.e., SUPERNAP Thailand. It has a high fault-tolerant facility, which is ideal for consistently high traffic levels. National Telecom (NT), TOT, and SUPERNAP (Thailand) signed an MOU supporting governmental digital modernization, which is called the Data Center and Cloud Services Partnership Program.

Thailand Data Center Market Trends

Increasing number of digital consumers boost the data center demand in country

- The total number of smartphone users in the country was 57 million in 2022, which is expected to increase and register a CAGR of 0.83% during the forecast period to reach 60.2 million by 2029.

- Thailand shows a strong level of digital readiness with a high penetration rate for internet usage, social media engagement, mobile connections, online shopping, and digital payments, according to the "Digital 2022: Thailand." An increase in domestic e-commerce merchants also promotes sales growth. Cross-border spending is half (50%) of Thailand's total e-commerce spend. The Thai mobile commerce market is already the dominant e-commerce sales channel in the country, used for 52% of all online shopping transactions and worth USD 13.6 billion. This makes the country one of the regional forerunners for mobile commerce.

- Thailand was expected to end 2022 with a 5G coverage of over 85% of the country's population. With newer partnerships and development, the usage of 5G in smartphones is increasing. For instance, in July 2022, Ericsson and the King Mongkut University of Technology Thonburi (KMUTT) announced a partnership to support Thai students in building 5G ICT skills for the future. As the pioneer in launching 5G commercial service in Southeast Asia, Thailand is well positioned to develop its ambitious Industry 4.0 wireless ecosystem to enhance the consumer mobile experience and support the digitization of its manufacturing, energy, and healthcare industries.

The increasing investments for the expansion of 5G network by Operators drives the growth of the market

- Thailand has one of the highest penetration rates of 5G in the ASEAN region, with 9.2%, only behind Singapore, with 13.9%. Thailand's 5G subscriptions are expected to reach 70 million by 2027, or 73% of the total subscriptions in mobile services, according to Digital Economy and Society (DES).

- Thailand was one of the first markets to launch 5G in the Asia-Pacific region, with AIS and TrueMove H both launching commercial 5G services during Q1 2020. Driving 5G adoption in the market is one of the primary objectives for AIS and TrueMove H, and each had targeted 2 million 5G connections by the end of 2021. In 2021, users saw the fastest average overall and 5G download speeds on AIS' network. The operator won overall Download Speed Experience with a score of 19.4 Mbps, 1.7 Mbps (9.7%) ahead of second-placed TrueMove H. AIS also won the 5G Download Speed Experience award, clocking in at 180.3 Mbps and commanding a major lead of 57.4 Mbps (46.7%) over the runner-up TrueMove H. DTAC lagged behind its rivals.

- OpenGov Asia recently reported that the Thai Ministry of Digital Economy and Society (MDES), Digital Economy Promotion Agency (DEPA), and a Chinese multinational technology company announced the launch of the Thailand 5G Ecosystem Innovation Center (5G EIC) in Bangkok. This launch aims to accelerate 5G innovation through ecosystem collaboration and boost the digital economy. The rise of data centers in the nation is facilitated by the rising mobile internet speeds, which directly impacts data traffic and raises the demand for more racks.

Thailand Data Center Industry Overview

The Thailand Data Center Market is fragmented, with the top five companies occupying 29.67%. The major players in this market are CS LOXINFO PUBLIC COMPANY LIMITED, NTT Ltd, STT GDC Pte Ltd, True Internet Data Center Co. Ltd and United Information Highway Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Thailand

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Bangkok

- 6.1.2 Rest of Thailand

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 AIMS DATA CENTRE (THAILAND) LTD

- 7.3.2 CS LOXINFO PUBLIC COMPANY LIMITED

- 7.3.3 Internet Thailand Public Company Limited

- 7.3.4 ISPIO (NIPA Technology Co. Ltd)

- 7.3.5 JasTel Network Co. Ltd

- 7.3.6 NTT Ltd

- 7.3.7 Proen Proimage Engineering & Communication

- 7.3.8 STT GDC Pte Ltd

- 7.3.9 SUPERNAP (THAILAND) COMPANY LIMITED

- 7.3.10 TCC Technology

- 7.3.11 True Internet Data Center Co. Ltd

- 7.3.12 United Information Highway Co. Ltd

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms