|

市場調查報告書

商品編碼

1693797

非洲資料中心 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Africa Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

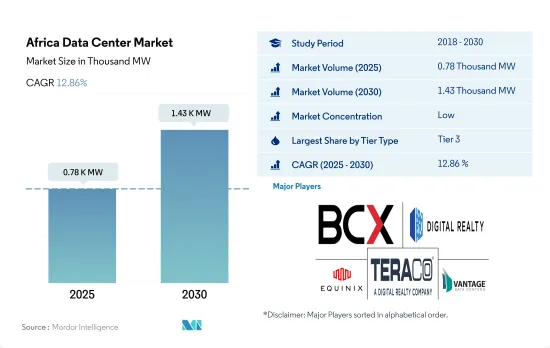

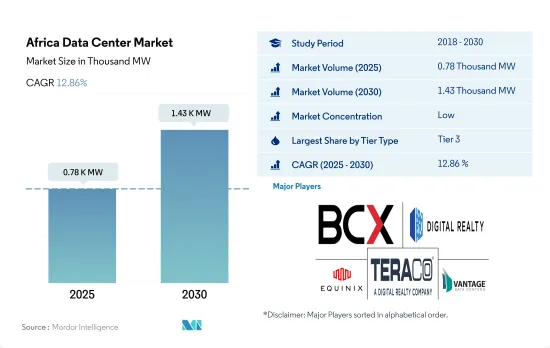

預計 2025 年非洲資料中心市場規模將達到 780MW,到 2030 年將達到 1,430MW,複合年成長率為 12.86%。

預計 2025 年主機託管收益將達到 7.502 億美元,2030 年將達到 17.096 億美元,預測期內(2025-2030 年)的複合年成長率為 17.91%。

預計到 2023 年,Tier 3 資料中心將佔據容量的大部分佔有率,並在整個預測期內保持主導地位。

- 人工智慧、物聯網和區塊鏈技術在通訊、雲端運算和政府等各個領域的不斷發展,促進了非洲數據消費的擴大。

- 非洲有 400 多個科技中心,遍佈 42 個國家的 93 個城市。 2022 年,非洲新興企業透過 1,000 筆交易籌集了約 48 億美元,而 2021 年在 820 輪融資中籌集了約 43.3 億美元。這些科技新興企業可能需要低延遲、高速、不間斷的網路和雲端設施,以確保持續的客戶服務。對更好的基礎設施日益成長的需求可能會刺激對更多 IT 負載容量和更多 Tier 3 和 4 認證資料中心設施的需求。

- 長期成長願景是建立至少一個 Tier 3 認證的資料中心,以彌補建立該設施的初始高成本。然而,由於電力供應有限,一級和二級設施正在失去吸引力。因此,為了確保投資的長期性並滿足對更快、更可靠的資料儲存和處理設施日益成長的需求,公司正專注於建立 3 級和 4 級設施。

- 4 級資料中心提供更高的頻寬速度、更低的延遲、更好的連線性和災害復原選項。因此,預計 4 級細分市場在預測期內的複合年成長率為 18.02%,而 3 級細分市場為 14.40%,1 級和 2 級細分市場為 3.26%。

南非將在 2023 年主導非洲資料中心市場,並預計在整個預測期內繼續佔據主導地位

- 南非是非洲領先的資料中心國家,擁有約4,200萬網路用戶。該國網際網路普及率接近70%,並且正在快速適應電子商務和其他需求的產生。因此,資料中心營運商正在該地區建立資料中心設施,以滿足日益成長的設施需求。

- 2021年,南非將佔據約63.1%的市場佔有率,其次是其他非洲國家(24.4%)和奈及利亞(12.4%)。鞏固其在南非佔有率的是 Terraco Data Environments(被 Digital Realty 收購),目前擁有 36.72% 的市場佔有率,IT 負載容量為 150MW。 Digital Realty 等公司透過其子公司 Medallion Communication Ltd 和 Teraco Data Environments 宣布計劃在預測期內開發 IT 負載容量分別為 160 MW 和 110 MW 的超級資料中心。

- 開普敦憑藉其部署的感測器實現物聯網和即時數據分析,在全球智慧城市中名列前茅。智慧城市透過向市民提供各種智慧服務產生大量數據。

- 隨著營運商計劃擴大基於物聯網的設備部署,預計該國將出現更多這樣的智慧城市。在非洲其他地區,還有像盧安達基加利這樣的智慧城市,這些城市安裝了感測器來測量空氣品質、監測電網安全、檢測漏水等。由於上述因素,南非資料中心市場預計將成長,預測期內複合年成長率為 15.68%。

非洲資料中心市場的趨勢

Jumia、Takealot、Kilimall 等線上市場推動非洲資料中心發展

- 非洲的數據消費量將從2016年的每月0.6GB增加到2022年的每月2.25GB,預計到2029年將達到每月約11.3GB。使用串流媒體和數位付款等數位服務的智慧型手機用戶數量的增加預計將推動未來的數據消耗。

- 由於通訊業者計劃關閉 2G 和 3G 服務並增強現有的 4G 服務,到 2029 年頻寬速度可能會增加約 52.5Mbps。 43個非洲國家推出5G服務可能會導致更高的頻寬速度和增加數據消費量。預計年輕人對 Netflix、Disney+ 和 Amazon Prime 等流行串流媒體服務的使用率將會成長。

- 預計非洲的網路購物數量將從 2016 年的 1.389 億增加到 2022 年的 3.878 億,到 2025 年可能達到 5.198 億左右。 Jumia、Takealot、Kilimall 和 Konga 是該地區領先的線上市場。隨著使用這些數位服務的人數增加,數據消費量也在增加。為了向客戶提供無縫服務,企業需要將機架數量從 2022 年的 64,735 個增加到 2029 年的 188,643 個(複合年成長率為 15.4%),IT 負載容量可能會從 2022 年的 518.7 兆瓦增加到 20296 年的 1,222 兆瓦。

數位錢包(M-Pesa)和 OTT 平台的日益普及可能會導致資料交換的增加,從而導致該地區資料中心的增加。

- 中國價格實惠的智慧型手機的普及、肯亞等國取消16%的一般消費稅以及非洲青年採用數位化服務進行學習和其他活動,正在推動該地區智慧型手機數量的成長。

- 2019年,智慧型手機連線的總佔有率佔44%,隨著該技術的採用率提高,預計到2025年這一佔有率將達到75%。該地區的智慧型手機連線數量分別為南非約8,900萬、奈及利亞約1.63億、埃及約7,560萬。約 60% 的奈及利亞用戶和 21% 的南非用戶使用 M-Pesa 等數位錢包。 Netflix、Disney+ 和 Amazon Prime 是該地區主要的 OTT參與企業,其中 Netflix 以 2022 年約 640 萬用戶的數量領先非洲市場。 5G 服務在非洲的推出一直很緩慢。這些服務已在奈及利亞、南非、波札那、肯亞、茅利求斯、馬達加斯加、塞席爾、坦尚尼亞、多哥、辛巴威和尚比亞等多個國家推出。

- 非洲大陸由約 54 個國家組成,其中只有 11 個國家提供 5G 服務。因此,到2027年,預計非洲的5G用戶比例僅為10%。沃達豐等電信業者正致力於加強其4G服務,並計劃在2026年停止其2G和3G服務。為了提供用戶更好的服務,企業需要增加機架數量,這可能導致IT負載能力逐年增加。

非洲資料中心產業概況

非洲資料中心市場較為分散,前五大公司佔了39.90%的市場。市場的主要企業包括 Business Connexion (Pty) Ltd、Digital Realty Trust Inc.、Equinix Inc.、Teraco Data Environments (Digital Realty) 和 Vantage Data Centers LLC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝的機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動數據速度

- 寬頻數據速度

- 光纖連接網路

- 法律規範

- 奈及利亞

- 南非

- 價值鍊和通路分析

第6章市場區隔

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 超大規模

- 小規模

- 等級類型

- 1級和2級

- 第 3 層

- 第 4 層

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他

- 國家

- 奈及利亞

- 南非

- 其他非洲國家

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Africa Data Centres(Cassava Technologies)

- Business Connexion(Pty)Ltd

- Digital Parks Africa(Pty)Ltd

- Digital Realty Trust Inc.

- Equinix Inc.

- ONIX Data Center

- Rack Centre Limited

- Raxio Group BV

- Teraco Data Environments(Digital Realty)

- Vantage Data Centers LLC

- WIOCC(Open Access Data Centres)

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模與DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 數據包

- 詞彙表

The Africa Data Center Market size is estimated at 0.78 thousand MW in 2025, and is expected to reach 1.43 thousand MW by 2030, growing at a CAGR of 12.86%. Further, the market is expected to generate colocation revenue of USD 750.2 Million in 2025 and is projected to reach USD 1,709.6 Million by 2030, growing at a CAGR of 17.91% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, and is expected to dominate through out the forecasted period

- Increasing developments in artificial intelligence, IoT, and blockchain technology across varying sectors, including telecom, cloud, and government, have contributed to the growing data consumption in Africa.

- Africa has more than 400 technology hubs across 93 cities in 42 countries. In 2022, the African start-ups raised about USD 4.8 billion through 1,000 deals, compared to about USD 4.33 billion raised across 820 rounds in 2021. These technology start-ups may require low latency and high-speed, uninterrupted internet and cloud facilities to ensure continuous customer service. The increasing demand for better infrastructure may fuel the demand for more IT load capacity and more Tier 3 and 4-certified data center facilities.

- The long-term growth vision is better suited to set up at least Tier 3-certified data centers to cover the initial high cost of establishing the facilities. However, Tier 1 & 2 facilities were losing traction, given the limited power availability. Hence, to ensure the longevity of investments and tackle the increasing demand for faster and more reliable data storage and processing facilities, companies are focusing on constructing Tier 3 and 4 facilities.

- Tier 4 data centers offer higher bandwidth speed, low latency, better connectivity, and disaster recovery options. Thus, during the forecast period, the Tier 4 segment is expected to record a CAGR of 18.02%, compared to the Tier 3 segment at 14.40% and the Tier 1 & 2 segment at 3.26%.

South Africa dominates the Data center market in Africa in 2023, and would continue to keep its dominance in forecasted period

- South Africa is the most prominent country for data centers in Africa since the country comprises about 42 million internet users. It also has internet penetration rates closer to 70%, and its adaptation to e-commerce and other demand-generating aspects is growing. This, in turn, has led data center operators to set up their data center facilities in the region to leverage the increasing demand for the facilities.

- South Africa held a market share of around 63.1%, followed by the Rest of African countries at 24.4%, and Nigeria accounted for 12.4% in 2021. The company that has strengthened its market share in South Africa is Teraco Data Environments (acquired by Digital Realty), which currently has a market share of 36.72% and operates at an IT load capacity of 150 MW. Through its subsidiaries, Medallion Communication Ltd and Teraco Data Environments, companies such as Digital Realty have announced plans to develop mega and massive data centers with IT load capacities of 160 MW and 110 MW during the forecast period.

- Cape Town has been ranked among the top smart cities worldwide for its IoT and real-time data analysis through sensor implementation. Smart cities create huge amounts of data owing to the varying smart services imparted to the citizens.

- The country is expected to witness more such smart cities as operators plan to extend the deployment of IoT-based devices. The Rest of Africa segment also comprises smart cities like Kigali, Rwanda, which have sensors to measure air quality, monitor the power grid's safety, and detect water leakages. Due to all the above factors, the South African data center market is expected to grow and register a CAGR of 15.68% over the forecast period.

Africa Data Center Market Trends

Online markets such as Jumia, Takealot, Kilimall, and others to boost Data centers in Africa

- Africa's data consumption increased from 0.6 GB/month in 2016 to 2.25 GB/month in 2022. It is expected to reach around 11.3 GB/month by 2029. A growing number of smartphone users using digital services such as streaming and digital payments are expected to boost data consumption in the future.

- As telecom companies plan to shut down their 2G and 3G services and strengthen their existing 4G services, bandwidth speeds may increase by around 52.5 Mbps by 2029. The implementation of 5G services in 43 African countries may lead to increased bandwidth speeds, which may also increase data consumption. The use of popular streaming services such as Netflix, Disney+, and Amazon Prime is expected to grow among the youth.

- The number of online shoppers in Africa increased from 138.9 million in 2016 to 387.8 million in 2022, which may reach around 519.8 million by 2025. Jumia, Takealot, Kilimall, and Konga are a few leading online marketplaces in the region. The growing user base for these digital services has resulted in increased data consumption. To provide seamless services to customers, companies may have to increase the number of racks from 64,735 in 2022 to 188,643 by 2029, with a CAGR of 15.4%, which may also increase the IT load capacity from 518.7 MW in 2022 to 1,226.2 MW by 2029.

Increase use of digital wallets (M-Pesa) and use of OTT platforms, would increase data exchange leading to increase in data centers in the region.

- The availability of affordable Chinese smartphones, the removal of the general sales tax of 16% in countries such as Kenya, and the growing use of digitalization services by African youth for learning and other activities are boosting the number of smartphones in the region.

- In 2019, the total share of smartphone connections accounted for 44%, and with the growing adoption of technology, this share is expected to reach 75% by 2025. South Africa, Nigeria, and Egypt account for around 89 million, 163 million, and 75.6 million smartphone connections in the region, respectively. Around 60% of the users in Nigeria and 21% in South Africa use digital wallets such as M-Pesa for conducting transactions. Netflix, Disney+, and Amazon Prime are the leading OTT players in the region, with Netflix leading the African market with a subscriber base of around 6.4 million in 2022. The deployment of 5G services has been slow in Africa. These services have been launched in a few countries, such as Nigeria, South Africa, Botswana, Kenya, Mauritius, Madagascar, Seychelles, Tanzania, Togo, Zimbabwe, and Zambia.

- The African continent comprises around 54 countries, of which only 11 could implement 5G services. Hence, Africa is expected to have only 10% of 5G users by 2027. Telecom companies like Vodafone are focusing on strengthening their 4G services and plan to shut down their 2G and 3G services by 2026. To offer better services to users, companies may have to increase the number of racks, which may, in turn, increase the IT load capacity over the years.

Africa Data Center Industry Overview

The Africa Data Center Market is fragmented, with the top five companies occupying 39.90%. The major players in this market are Business Connexion (Pty) Ltd, Digital Realty Trust Inc., Equinix Inc., Teraco Data Environments (Digital Realty) and Vantage Data Centers LLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Nigeria

- 5.6.2 South Africa

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Data Center Size

- 6.1.1 Large

- 6.1.2 Massive

- 6.1.3 Medium

- 6.1.4 Mega

- 6.1.5 Small

- 6.2 Tier Type

- 6.2.1 Tier 1 and 2

- 6.2.2 Tier 3

- 6.2.3 Tier 4

- 6.3 Absorption

- 6.3.1 Non-Utilized

- 6.3.2 Utilized

- 6.3.2.1 By Colocation Type

- 6.3.2.1.1 Hyperscale

- 6.3.2.1.2 Retail

- 6.3.2.1.3 Wholesale

- 6.3.2.2 By End User

- 6.3.2.2.1 BFSI

- 6.3.2.2.2 Cloud

- 6.3.2.2.3 E-Commerce

- 6.3.2.2.4 Government

- 6.3.2.2.5 Manufacturing

- 6.3.2.2.6 Media & Entertainment

- 6.3.2.2.7 Telecom

- 6.3.2.2.8 Other End User

- 6.4 Country

- 6.4.1 Nigeria

- 6.4.2 South Africa

- 6.4.3 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Africa Data Centres (Cassava Technologies)

- 7.3.2 Business Connexion (Pty) Ltd

- 7.3.3 Digital Parks Africa (Pty) Ltd

- 7.3.4 Digital Realty Trust Inc.

- 7.3.5 Equinix Inc.

- 7.3.6 ONIX Data Center

- 7.3.7 Rack Centre Limited

- 7.3.8 Raxio Group BV

- 7.3.9 Teraco Data Environments (Digital Realty)

- 7.3.10 Vantage Data Centers LLC

- 7.3.11 WIOCC (Open Access Data Centres)

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms