|

市場調查報告書

商品編碼

1693792

馬來西亞資料中心市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Malaysia Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

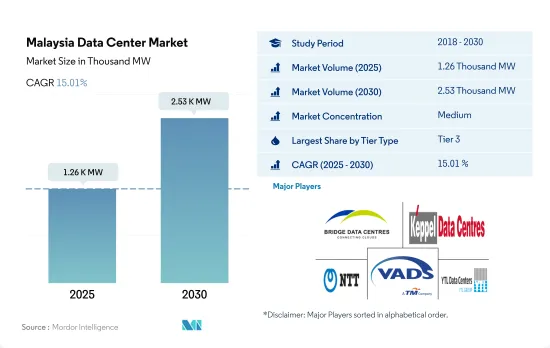

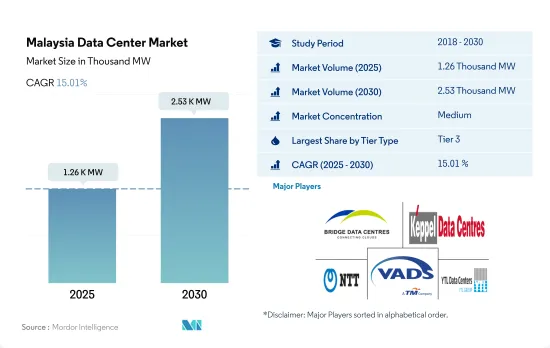

馬來西亞資料中心市場規模預計在 2025 年達到 1,260MW,預計到 2030 年將達到 2,530MW,複合年成長率為 15.01%。

預計主機託管收益將在 2025 年達到 7.1 億美元,到 2030 年將達到 18.732 億美元,預測期內(2025-2030 年)的複合年成長率為 21.41%。

2023 年,Tier 3 資料中心將佔據大部分市場佔有率,並將成為預測期內成長最快的市場

- 馬來西亞資料中心市場的一級和二級細分市場的 IT 負載容量在 2021 年達到 0.59MW,到 2022 年成長到 2.39MW。預計到 2029 年將達到 3.59 MW,複合年成長率為 5.99%。然而,Tier 3 段在 2021 年的 IT 負載容量為 257.85 兆瓦。預計該容量將從 2022 年的 457.66 兆瓦成長到 2029 年的 1,379.11 兆瓦,複合年成長率為 17.07%。第三層級的成長率高於其他層級。

- Tier 3 資料中心能夠進行並發維護,允許對電源或冷卻系統進行計劃維護工作,而無需中斷資料中心內電腦硬體的運作。許多通訊業者正致力於在該國建立三級設施。資料中心等數位基礎設施的發展將在實現5G應用方面發揮核心作用。此外,各投資者已簽署協議,將在該國推出 5G 服務。例如,2022年11月,馬來西亞通訊業者Celcom與DiGi核准了一項合併協議。一旦兩家公司完全合併,新公司將成為通訊業者,擁有超過2,000萬用戶。

- 預計 Tier 4 資料中心領域在不久的將來將保持停滯狀態,但未來幾年可能會提供成長機會。目前,TelcoHubeXchange 和 Regal Orion Sdn Bhd 是馬來西亞僅有的兩家擁有 Tier 4 認證設施的公司。

馬來西亞資料中心市場趨勢

不斷成長的數位消費需求將推動馬來西亞的資料中心需求

- 到 2022 年,馬來西亞的智慧型手機用戶數量將達到 2,946 萬人。預計到 2029 年,人口將達到 3,254 萬,預測期內的複合年成長率為 1.43%。

- 根據谷歌對馬來西亞行動搜尋的調查結果,52%的人口使用行動電話進行搜尋,36%使用個人電腦或筆記型電腦,12%使用平板電腦。因此,馬來西亞高達 64% 的搜尋都是透過行動裝置進行的。由於新冠肺炎疫情爆發和嚴格實施包括全天待在室內的行動管制令,馬來西亞的網路流量在2020年3月第一週增加了23%。第二週增加了8.6%,但有關網速慢的申訴也開始浮出水面。這可能是由於活躍網路用戶數量的增加。

- 馬來西亞在2020年疫情爆發至2021年第一季期間新增了300萬數位消費者。鑑於馬來西亞55.9%的電子商務交易是在行動裝置上完成的,《2022年馬來西亞數位報告》稱,智慧型手機普及率的提高意味著未來幾年將有更多人選擇網路購物。

5G 的擴展以及馬來西亞通訊業者Celcom 和 DiGi 之間正在進行的合併正在推動馬來西亞資料中心容量的增加。

- 馬來西亞主要的通訊業者包括 Celcom、Digi、Maxis、U Mobile、Telekom Malaysia 和 Time dotCom。以馬來西亞實際地理行動網路覆蓋範圍而言,Celcom 以 9.2 分(滿分 10 分)位居第一,其次是 Digi 和 Maxis,各得 8.6 分,U Mobile 得 7.7 分,Unifi 得 7.0 分。

- 愛立信在馬來西亞 5G 服務領域處於領先地位,與 Digital Nasional Berhad 密切合作,為該國提供世界一流的 5G 網路。 5G將成為馬來西亞數位轉型的催化劑,並為IR4.0奠定平台。目前,馬來西亞政府已確定700MHz、3.5GHz和26/28GHz為馬來西亞推出5G的先鋒頻段。

- 馬來西亞電信業者Celcom 和 DiGi 也核准了合併協議。一旦兩家公司完全合併,新公司將成為馬來西亞最大的通訊業者,擁有超過2,000萬用戶。該公司還聲稱,5G技術的引進將對該國GDP產生1,500億令吉的正面影響,並創造75萬個就業機會。

馬來西亞資料中心產業概況

馬來西亞資料中心市場適度整合,前五大公司佔據62.24%的市佔率。該市場的主要企業包括 Bridge Data Center(秦皇島金沙江集團)、Keppel DC REIT Management Pte。 Ltd、NTT Ltd、VADS BERHAD(TM One)和楊忠禮資料中心控股私人有限公司(YTL Power International Berhad)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動數據速度

- 寬頻數據速度

- 光纖連接網路

- 法律規範

- 馬來西亞

- 價值鍊和通路分析

第6章市場區隔

- 熱點

- 賽城 – 吉隆坡

- 新山

- 馬來西亞其他地區

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 超大規模

- 小規模

- 等級類型

- 1級和2級

- 第 3 層

- 第 4 層

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AIMS DATA CENTRE SDN BHD

- Bridge Data Center(Chindata Group)

- Csf Group

- HDC Data Centre SDN BHD(HDC)

- IPServerOne

- Keppel DC REIT Management Pte. Ltd

- NTT Ltd

- Open DC SDN BHD

- TelcoHubeXchange

- VADS BERHAD(TM One)

- YTL Data Center Holdings Pte Ltd(YTL Power International Berhad)

- Zenlayer Inc.

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模與DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 數據包

- 詞彙表

The Malaysia Data Center Market size is estimated at 1.26 thousand MW in 2025, and is expected to reach 2.53 thousand MW by 2030, growing at a CAGR of 15.01%. Further, the market is expected to generate colocation revenue of USD 710 Million in 2025 and is projected to reach USD 1,873.2 Million by 2030, growing at a CAGR of 21.41% during the forecast period (2025-2030).

Tier 3 data centers accounts for majority market share in 2023, it is the fastest growing in forecasted period

- The tier 1 & 2 segment of the Malaysian data center market reached an IT load capacity of 0.59 MW in 2021 and then grew to 2.39 MW in 2022. The capacity is expected to reach 3.59 MW by 2029, recording a CAGR of 5.99%. However, the tier 3 segment recorded an IT load capacity of 257.85 MW in 2021. The capacity is anticipated to grow from 457.66 MW in 2022 to 1,379.11 MW by 2029, registering a CAGR of 17.07%. The tier 3 segment has a higher growth rate than all other tiers.

- A tier 3 data center is concurrently maintainable, allowing for any planned maintenance activity of power and cooling systems to take place without disrupting the operations of computer hardware located in the data center. Most telecom operators are focusing on establishing tier 3 facilities in the country as they prevent uneven disturbances. The development of digital infrastructure, such as data centers, is central to enabling 5G applications. Various investors are also signing agreements to launch 5G services in the country. For instance, in November 2022, Malaysian telcos Celcom and DiGi approved a merger agreement. Once the two companies are fully merged, the new entity will be one of the largest carriers in Malaysia, with over 20 million subscribers.

- The tier 4 data center segment is expected to remain stagnant in the near future but will see increased opportunities over the coming years. Currently, TelcoHubeXchange and Regal Orion Sdn Bhd are the only companies with Tier 4 certified facilities in Malaysia.

Malaysia Data Center Market Trends

Growth in digital consumers boost the data center demand in country

- The total number of smartphone users in the country was 29.46 million in 2022. This is expected to witness a CAGR of 1.43% during the forecast period, reaching 32.54 million by 2029.

- According to Google's research findings regarding mobile searches in Malaysia, a share as high as 52% of the population use mobile phones to search, 36% use their computers or laptops, and 12% use tablets. Thus, a staggering 64% of the searches performed in Malaysia are through mobile devices. Due to the COVID-19 pandemic and the strict enforcement of MCO, which included remaining indoors at all times, internet traffic in Malaysia recorded a 23% increase in the first week of March 2020. While the second week saw an 8.6% increase, complaints of slow internet speeds also began emerging. This could be due to the growing number of active internet users.

- Malaysia added three million new digital consumers between the pandemic's start in 2020 and the first quarter of 2021. Considering that 55.9% of e-commerce transactions in Malaysia are completed on a mobile device, the growing smartphone penetration means more people will opt to shop online over the coming years, according to the Digital 2022-Malaysia report.

Expansion of 5G and rising mergers between companies such as Malaysian telcos Celcom and DiGi increase data center facilities in Malaysia

- Major telecommunication operators in Malaysia include Celcom, Digi, Maxis, U Mobile, Telekom Malaysia, and Time dotCom. In terms of actual geographical mobile network coverage in Malaysia, Celcom is ranked first, with 9.2 out of 10 points, followed by Digi and Maxis, which have 8.6 points each, followed by U Mobile with 7.7 points and Unifi with 7.0 points.

- Ericsson is at the forefront of 5G services in Malaysia, where it is working closely with Digital Nasional Berhad to deliver a world-class 5G network for Malaysia. 5G will serve as the catalyst for Malaysia's digital transformation and provide the platform for IR4.0. Currently, the government has identified 700MHz, 3.5GHz, and 26/28GHz as the pioneer spectrum bands for the roll-out of 5G in Malaysia.

- Malaysian telcos Celcom and DiGi have also approved a merger agreement. Once the two companies are fully merged, the new entity will be the largest carrier in Malaysia, with over 20 million subscribers. The company also said that the implementation of 5G technology would have a positive impact of MYR 150 billion on the country's GDP and create 750,000 jobs.

Malaysia Data Center Industry Overview

The Malaysia Data Center Market is moderately consolidated, with the top five companies occupying 62.24%. The major players in this market are Bridge Data Center (Chindata Group), Keppel DC REIT Management Pte. Ltd, NTT Ltd, VADS BERHAD (TM One) and YTL Data Center Holdings Pte Ltd (YTL Power International Berhad) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Malaysia

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Cyberjaya-Kuala Lumpur

- 6.1.2 Johor Bahru

- 6.1.3 Rest of Malaysia

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 AIMS DATA CENTRE SDN BHD

- 7.3.2 Bridge Data Center (Chindata Group)

- 7.3.3 Csf Group

- 7.3.4 HDC Data Centre SDN BHD (HDC)

- 7.3.5 IPServerOne

- 7.3.6 Keppel DC REIT Management Pte. Ltd

- 7.3.7 NTT Ltd

- 7.3.8 Open DC SDN BHD

- 7.3.9 TelcoHubeXchange

- 7.3.10 VADS BERHAD (TM One)

- 7.3.11 YTL Data Center Holdings Pte Ltd (YTL Power International Berhad)

- 7.3.12 Zenlayer Inc.

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms