|

市場調查報告書

商品編碼

1693786

歐洲阻隔膜:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Barrier Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

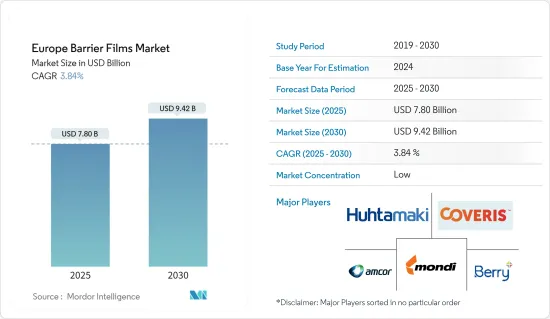

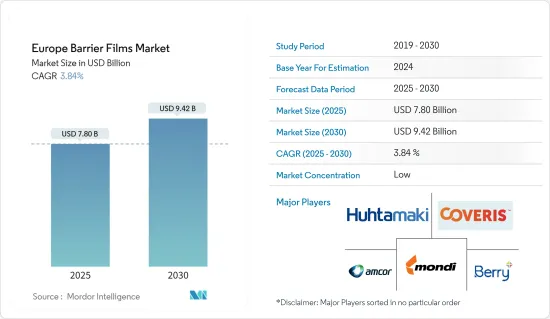

預計 2025 年歐洲阻隔膜市場規模為 78 億美元,到 2030 年將達到 94.2 億美元,預測期內(2025-2030 年)的複合年成長率為 3.84%。

市場規模反映了各種包裝產品的銷售額,例如由各種材料製成的袋子和小袋、拉伸膜和收縮膜、托盤蓋膜、包裝膜和成型網以及泡殼基膜。這些產品銷往歐洲各地的各種終端用戶行業,包括寵物食品、食品和飲料、製藥和醫療、居家醫療和個人護理。

關鍵亮點

- 薄膜是食品包裝最受歡迎的選擇之一。由於其安全性,薄膜比傳統食品包裝材料更受青睞。這種材料不易受到污染和盜竊。在膠片上列印訊息很容易。該薄膜具有優異的阻隔性、重量輕、可回收。預計製藥業對阻隔膜的需求以及食品和飲料包裝中阻隔膜的日益廣泛的應用將在預測期內推動阻隔膜市場的成長。由於各終端用戶產業的阻隔需求不斷增加,歐洲阻隔膜市場因對高性能薄膜的需求龐大而大幅擴張。阻隔膜很可能在合適的應用中得到更頻繁的使用,並且成本更低,尤其是隨著加工技術的進步。

- 收縮膜主要用於電子商務領域包裝各種商品。該薄膜具有多種優點,包括廣泛的氧氣透過率、適合各種食品包裝(肉類、奶酪、家禽、零售包裝)的最佳保存期限、優質的產品外觀、高抗衝擊性和抗穿刺性、包裝剛性產品或具有鋒利邊緣的產品時的低洩漏、冷凍溫度下的強度保持以及包裝完整性的維護。然而,預計預測期內,回收基礎設施差和阻隔膜原料價格波動將阻礙阻隔膜市場的成長。此外,對阻隔膜核准和銷售的嚴格規定和標準也是阻礙市場需求的挑戰。

- 除此之外,阻隔膜的進步已顯示出足夠的測量能力以滿足有機光伏和 OLED 所需的低滲透性水平。阻隔膜的目的是保護產品免於因濕氣和氧氣而劣化。歐洲是世界上最大的化妝品和個人護理市場之一。英國、德國、法國、義大利、西班牙和波蘭等主要國家主導歐洲個人護理市場。

- 阻隔膜廣泛用於包裝個人保健產品,以延長保存期限、防止破損並保留活性成分,而無需使用防腐劑。歐洲製造商正在開發具有阻氧、阻濕和保香功能的高阻隔薄膜。

- 未來五到十年,歐洲的塑膠回收再利用預計將大幅增加,尤其是在當局和消費者日益成長的壓力下。減少廢棄物和提高塑膠價值鏈循環性的目標正在被各國政府和知名品牌不斷討論和完善。預計這將對所研究市場的成長構成挑戰。

- 自新冠疫情爆發以來,歐洲食品和飲料行業的線上銷售額隨著時間的推移顯著成長。封鎖和就地避難的建議迫使人們尋找新的方式來完成日常業務。受疫情影響最嚴重的國家增幅最大。

- 根據研究公司Voyado的數據顯示,疫情期間首次網購食品雜貨的消費者比例在西班牙為30%,法國為22%,英國和義大利為20%,瑞典和丹麥為14%,芬蘭為11%,波蘭、荷蘭、比利時和德國為10%,挪威為9%。此外,68% 在網路上購買食品雜貨的新購物者表示,他們計劃將來再次這樣做。人們習慣的這些變化對阻隔膜市場產生了正面的影響。

歐洲阻隔膜市場趨勢

食品和寵物食品市場錄得顯著成長

- 在食品業,每種產品都有自己的品質和包裝規格。因此,食品包裝必須從食品包裝到食用提供適當的環境條件。在食品領域,每種產品都有獨特的屬性和包裝需求。因此,食品包裝必須從食品包裝到食用提供適當的環境條件。阻隔膜是一種柔韌、無溶劑、不透水的共擠結構(單層或多層),不會與包裝食品產生反應。它還可以限制礦物油和紫外線的遷移,並防止與氧氣、二氧化碳和水分的相互作用。這種堅硬的屏障由特殊材質製成,還能保留食物的顏色、味道、質地、香氣和風味等特性。

- 歐洲食品工業經常使用阻隔膜來延長保存期限,並作為防潮和防氧的屏障保護食品免受外界影響。食品包裝的新應用正在導致食品包裝規範的嚴格化。需要關注的關鍵環節是採用更好的阻隔膜來打造真正的包裝。為了延長食品保存期限,降低食品腐敗變質的風險,必須提高包裝薄膜的阻隔性能。包裝片材可塗有 PVDC 或鋁塗層,以達到優異的阻隔性能。

- 據德國冷凍食品研究所稱,冷凍食品銷售收益從一年前的 159.2 億歐元(173.1 億美元)成長到前年的約 195.4 億歐元(212.5 億美元)。數據顯示,過去十年冷凍食品銷售收入一直在逐漸增加。預計這一成長趨勢將在預測期內持續下去,全部區域的阻隔膜銷售創造巨大的機會。

- 越來越多的寵物主人開始注重健康,並希望他們的寵物和他們吃同樣的食物。無麩質和無穀物替代品、永續採購的產品以及可與任何高級餐廳菜單相媲美的優質美食原料是當前寵物食品的一些趨勢。這給寵物食品製造商提出了一個有趣的難題。

- 在歐洲國家,阻隔膜常用於烘焙點心、冷凍食品、水產品、洋芋片、零嘴零食、肉類和乳製品、乾果和寵物食品。由於對健康、衛生、輕量和環保包裝的需求不斷增加,食品和寵物食品產業不斷發展,預計歐洲阻隔膜市場將會成長。

德國佔有較大的市場佔有率

- 德國憑藉其尖端的技術創新、悠久的全球製藥傳統以及不斷成長的醫療產品需求,被認為是藥品研究、開發、銷售和生產的理想地點之一。由於人口結構的變化、慢性病的增加以及人們對預防和自我治療的興趣日益濃厚,歐洲最大的醫藥市場擴張速度超過了德國經濟。

- 袋子等軟包裝具有成本效益、重量輕、方便(密封、可重新密封、易於攜帶)的特點,同時確保新鮮度,尤其是對於烘焙食品、糖果零食和乳製品等食品而言。對易於抓握、握持、食用和攜帶的食品的需求不斷成長,推動了對包裝袋的需求。為了滿足這一需求,製造商正專注於使食品包裝便攜化,這有望推動德國對阻隔包裝領域的需求。

- 新冠疫情導致營養飲料和健康食品的需求急劇增加。大多數此類產品都裝在塑膠袋或塑膠袋中。塑膠由於其強度高、重量輕,擴大被用於包裝。由於消費者更喜歡易於攜帶和處理的包裝,因此包裝行業對包裝袋的需求正在上升。阻隔包裝由於其成本效益和延長的保存期限而在許多行業中越來越受歡迎。

- 德國領先的嬰兒食品製造商 Jufico 在德國市場推出了其有機品牌 FruchtBar,該品牌採用無鋁、完全可回收的單一材料包裝袋(Pouch5)。包裝袋由預製吸嘴袋領域的全球領導者 Guarapac 開發,是第一款採用阻隔性、可回收單一材料製成的預製吸嘴袋。

- 德國人對新的飲食潮流和文化影響持開放態度。隨著我們逐漸成熟,我們的健康和福祉變得越來越重要,我們也越來越重視食物品質。這也為袋裝包裝市場創造了新的機會。

- 根據德國聯邦統計局的數據,德國包裝產業的收益預計在 2022 年超過 350 億歐元(383.5 億美元),高於前一年的 296 億歐元(324.3 億美元)。研究報告顯示,德國包裝產業去年呈現成長。

- 德國是歐盟最大的食品和飲料市場。食品加工工業是德國第三大產業。根據德國聯邦統計局的數據,2008 年德國食品和動物飼料生產商的收益約為 1,358 億歐元(1,498.7 億美元),到 2021 年這一數字已增至 1,650.1 億歐元(1,818 億美元)。預計所有這些因素都將推動該地區對阻隔膜的需求。

歐洲阻隔膜產業概況

歐洲阻隔膜市場高度分散,主要參與者包括 Amcor、Mondi Group PLC、Berry Global 和 Huhtamaki Oyj,以及一些區域包裝參與者。市場參與企業正在採取聯盟、創新、併購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 3 月:Amcor 和 Nfinite Nanotechnology Inc. 啟動一項合作研究舉措,測試 Nfinite 奈米塗層技術的應用,以改善可回收和生物分解性的包裝。

- 2022 年 12 月:作為持續致力於實現塑膠回收再利用閉迴路的一部分,Coveris推出了一個名為「ReCover」的新業務部門。 ReCover 將作為一家獨立企業營運,以自籌資金的方式向 Coveris 工廠提供材料,並向尋求市場上尚未提供的再生材料的第三方客戶提供材料。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 硬包裝的替代品

- 生物分解性阻隔膜的興起

- 市場限制

- 有關回收的環境法規

第6章市場區隔

- 按包裝產品

- 袋子和小袋

- 拉伸收縮包裝膜

- 托盤蓋膜

- 包裝膜和成網

- 泡殼基膜

- 按材質

- 聚乙烯

- BOPET

- 聚丙烯(CPP和BOPP)

- 聚氯乙烯

- 其他材料(EVOH、聚苯乙烯(PS)、尼龍)

- 按最終用戶產業

- 食品 寵物食品

- 飲料

- 製藥和醫療

- 個人及居家醫療

- 其他

- 按國家

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 其他歐洲國家

第7章競爭格局

- 公司簡介

- Amcor PLC

- Coveris Holdings

- Mondi Group PLC

- Berry Global Group Inc.

- Huhtamaki Oyj

- Sealed Air Corporation

- Bak Ambalaj

- Constantia Flexibles

- Cellografica Gerosa SpA

- Wipak Oy(Wihuri Oy)

- Danaflex Group

- UFLEX Limited

- CDM Sp.zoo

- adapa Holding GsembH

- Di Mauro Officine Grafiche SpA

- Sudpack Verpackungen

- Gualapack

- Toppan Inc.

第8章投資分析

第9章:市場的未來

The Europe Barrier Films Market size is estimated at USD 7.80 billion in 2025, and is expected to reach USD 9.42 billion by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

The market size reflects the sale value of various packaging products, such as bags and pouches, stretch and shrink wrap films, tray lidding films, wrapping films and forming webs, and blister base films made from various material types. These products are consumed by different end-user industries across Europe, including pet food and food, beverage, pharmaceutical and medical, and home and personal care.

Key Highlights

- Films are one of the most popular choices for food packaging. Films are preferred to conventional materials for food packaging in terms of safety. This material is less susceptible to contamination and pilferage. It is easy to print information on films. Films have superior barrier properties, are lightweight, and can be recycled. The demand for barrier films in the pharmaceutical industry and expanding applications of barrier films in food and beverage packaging are expected to drive the growth of the barrier films market during the forecast period. Owing to the increasing barrier demands across various end-user industries, the market for barrier films in Europe is largely expanding due to the enormous demand for high-performance films. Barrier films are likely to be used more frequently in suitable applications and at lower costs due to advancements, notably in processing technology.

- Shrink films are predominantly used in the e-commerce sector for wrapping various products. The films offer various benefits, such as a wide range of oxygen transmission rates, optimal shelf-life for a variety of food packaging (meat, cheese, poultry, and case-ready packaging), premium product presentation, high impact, and puncture resistance, fewer leakers when packing rigid and sharp-edged products, retained strength at freezing temperatures and preserved package integrity.However, poor infrastructure facilities for recycling and fluctuations in barrier film raw material prices are expected to hinder the growth of the barrier films market during the forecast period. Also, stringent regulations and standards for the approval and marketing of barrier films are challenges inhibiting demand in the market.

- Aside from that, advances in barrier films provide adequate measurements at the low permeability levels needed for organic photovoltaics and OLEDs. Barrier films are intended to protect the product against moisture and oxygen deterioration. Europa has one of the largest cosmetics and personal care markets globally. Major countries, including the United Kingdom, Germany, France, Italy, Spain, and Poland, dominate the European personal care market.

- Barrier films are widely used in the packaging of personal care products to extend their shelf life, prevent breakage, and retain the active components without using additional preservatives. European manufacturers are creating high-barrier films, providing an oxygen barrier, a moisture barrier, and scent preservation to confined items.

- In the next five to ten years, European plastic recycling is anticipated to increase dramatically, especially in response to rising pressure from authorities and consumers. Targets to minimize waste and increase the circularity of the plastics value chain are being discussed and improved by governments and large brands constantly. This is expected to pose a challenge to the growth of the market studied.

- Europe's food and beverage industry has experienced significant growth and increased due to online sales over time since the start of the COVID-19 pandemic. People have been compelled to develop new ways to complete their daily tasks due to lockdowns and advisories to stay inside. The nations impacted most by the pandemic have witnessed the most significant increase.

- According to the research Voyado, the proportion of consumers who made their first-ever online grocery purchases during the pandemic was 30% in Spain, 22% in France, 20% in the United Kingdom and Italy, 14% in Sweden and Denmark, 11% in Finland, 10% in Poland, the Netherlands, Belgium, and Germany, and 9% in Norway. Also, 68% of new customers who bought groceries online confirmed that they would keep doing so in the future. This shift in people's habits has positively impacted the barrier films market.

Europe Barrier Films Market Trends

Food and Pet Food Markets to Register Significant Growth

- In the food industry, every product has unique qualities and packaging specifications. Therefore, food packaging should offer the proper environmental conditions from when food is packed until consumed. Every product has unique attributes and packaging needs in the food sector. Therefore, food packaging should offer the proper environmental conditions from when food is packaged until it is consumed. Barrier films have a flexible, solvent-free, impermeable co-extruded structure (single or several layers) that does not react with the packaged food. It also limits the migration of mineral oil and UV radiation and aids in preventing interaction with oxygen, carbon dioxide, or moisture. This rigid barrier, created using specialized materials, also maintains food characteristics, including color, taste, texture, aroma, and flavor.

- Barrier films are frequently used in Europe's food industries to increase shelf life and protect food goods from external effects by acting as moisture and oxygen barriers. New applications for food packaging have led to stricter specifications for food product packaging. A significant area that requires attention is better barrier films to build real packaging. In order to extend food's shelf life and lower the risk of food spoilage and damage, the packaging film's barrier characteristics must be improved. The packaging sheet can be coated with either a PVDC or aluminum coating to obtain superior barrier characteristics.

- According to Deutsches Tiefkuhlinstitut, revenues from frozen food sales were approximately EUR 19.54 billion (USD 21.25 billion) in the previous year, up from EUR 15.92 billion (USD 17.31 billion) in the year before. As per the data, the revenue from the sales of frozen food has been gradually increasing during the past decade. This increasing trend is expected to remain in the forecast period, creating a huge opportunity to sell barrier films across the region.

- An increasing number of health-conscious pet owners want their pets to eat at par with them. Gluten-free and grain-free alternatives, sustainable sourcing, and premium gourmet ingredients that wouldn't look out of place on a fine-dining menu are some of the current trends in pet food. This poses an intriguing conundrum for pet food producers.

- In European countries, a barrier film is often used for items such as baked goods, biscuits, frozen foods, seafood, chips and snacks, meat and dairy products, dry fruits, and pet food. The Europe barrier films market is expected to witness growth due to the growing food and pet food industries owing to the increasing demand for healthy, hygienic, lightweight, and eco-friendly packaging.

Germany to Hold Significant Market Share

- Germany is considered one of the immaculate locations for pharmaceutical R&D, sales, and production of medicines due to its cutting-edge innovation, long tradition as the world's pharmacy, and constantly increasing demand for healthcare products. Europe's largest pharmaceutical market is expanding faster than the German economy due to demographic change, increased chronic diseases, and a greater focus on prevention and self-medication.

- Flexible packaging, such as a pouch, is cost-effective and lightweight, providing convenience (zip-locks, re-sealable seals, and easy to carry) while ensuring freshness, especially in food products like bakery, confectionery, and dairy food. The growing demand for easy food options to grab, hold, eat, or carry is driving the demand for packaging pouches. To meet this demand, manufacturers are putting extra effort into making food packaging portable, which is expected to boost the demand in the barrier packaging sector in Germany.

- The demand for nutritious drinks and healthy food surged dramatically due to the COVID-19 pandemic. Most of these items come in plastic bags and pouches. Plastics are sturdy and lightweight, which increases their use in packing. Consumers like packaging that is portable and easy to handle; therefore, the demand for pouches in the packaging business has increased. Barrier packaging is becoming more popular in numerous industries due to its cost-effectiveness and increased shelf life.

- Jufico, a leading German baby-food producer, launched its organic brand FruchtBar in fully recyclable Monomaterial pouches without Aluminum (Pouch5) into the German market. The pouch was developed by Gualapack, the world leader of premade spouted pouches, and is the first premade spouted pouch available in high-barrier recyclable mono-material.

- The German population is open to new food trends and cultural influences. It is increasingly placing value on food quality, with health and well-being gaining importance as the population matures. This also creates new opportunities for pouch packaging, especially in the market.

- According to Statistisches Bundesamt, the German packaging sector earned over EUR 35 billion (USD 38.35 billion) in revenue in 2022, an increase from EUR 29.6 billion (USD 32.43 billion) over the previous year. As per the research report, the packaging industry in Germany witnessed growth in the past year.

- Germany is the biggest food and beverage market in the European Union. The food processing industry represents the third-largest industry in Germany. According to Statistisches Bundesamt, in 2008, German producers of food and animal feed generated revenues of roughly EUR 135.80 billion (USD 149.87 billion), and by 2021 this figure had increased to EUR 165.01 billion (USD 181.8 billion). All such factors are expected to boost the demand for barrier films in the region.

Europe Barrier Films Industry Overview

The European barrier films market is highly fragmented, with the presence of major players like Amcor, Mondi Group PLC, Berry Global, and Huhtamaki Oyj, among others, accompanied by several regional packaging firms. Players in the market adopt strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2023: Amcor and Nfinite Nanotechnology Inc. launched a collaborative research initiative to test the application of Nfinite's nanocoating technology to improve both recyclable and biodegradable packaging.

- December 2022: As part of its ongoing commitment to closing the loop on circular plastic recycling, Coveris launched a new business division called "ReCover," fully in line with its no-waste mission. ReCover will operate as a distinct business, providing Coveris locations with materials at an arms-length basis and supplying third-party customers looking for recycled materials of a caliber not already offered in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Replacement of Rigid Packaging Formats

- 5.1.2 Increasing Biodegradable Barrier Films

- 5.2 Market Restraints

- 5.2.1 Environmental Legislation for Recycling

6 MARKET SEGMENTATION

- 6.1 By Packaging Product

- 6.1.1 Bags and Pouches

- 6.1.2 Stretch and Shrink Wrap Films

- 6.1.3 Tray Lidding Films

- 6.1.4 Wrapping Films and Forming Webs

- 6.1.5 Blister Base Films

- 6.2 By Material

- 6.2.1 Polyethylene

- 6.2.2 BOPET

- 6.2.3 Polypropylene (CPP and BOPP)

- 6.2.4 Polyvinyl Chloride

- 6.2.5 Other Material (EVOH, Polystyrene (PS), and Nylon)

- 6.3 By End user Industry

- 6.3.1 Food and Pet Food

- 6.3.2 Beverages

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Personal and Home Care

- 6.3.5 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 France

- 6.4.3 Germany

- 6.4.4 Italy

- 6.4.5 Spain

- 6.4.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Coveris Holdings

- 7.1.3 Mondi Group PLC

- 7.1.4 Berry Global Group Inc.

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Sealed Air Corporation

- 7.1.7 Bak Ambalaj

- 7.1.8 Constantia Flexibles

- 7.1.9 Cellografica Gerosa SpA

- 7.1.10 Wipak Oy (Wihuri Oy)

- 7.1.11 Danaflex Group

- 7.1.12 UFLEX Limited

- 7.1.13 CDM Sp.z.o.o.

- 7.1.14 adapa Holding GsembH

- 7.1.15 Di Mauro Officine Grafiche SpA

- 7.1.16 Sudpack Verpackungen

- 7.1.17 Gualapack

- 7.1.18 Toppan Inc.