|

市場調查報告書

商品編碼

1693762

印度農業生技藥品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Agricultural Biologicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

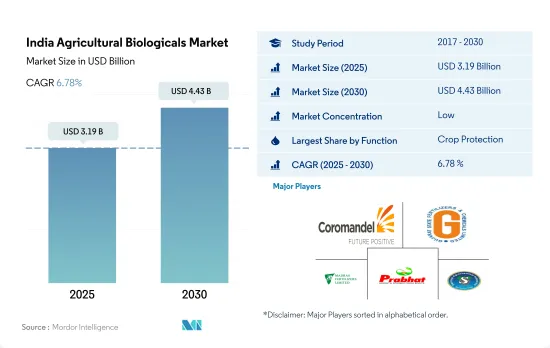

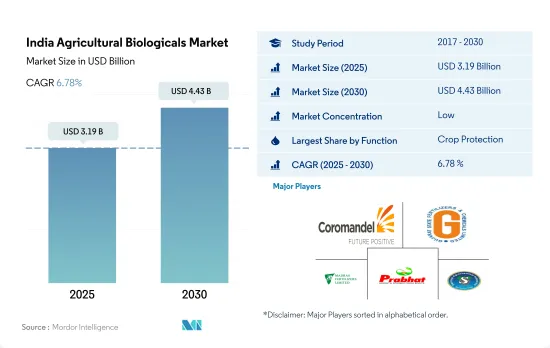

印度農業生技藥品市場規模預計在 2025 年將達到 31.9 億美元,預計到 2030 年將達到 44.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.78%。

- 過度使用化學肥料和農藥是該國面臨的嚴峻挑戰之一。在固定位置持續使用氮肥對土壤健康和作物產量產生了負面影響,顯示缺乏多種大分子和微量營養素。即使 NPK 的用量超過建議量,微量和中量營養素的缺乏仍是產量的限制因素。

- 採用永續和有機的耕作方法可以減少化學肥料對環境的影響。印度農業研究理事會 (ICAR) 建議採用綜合營養管理,使用無機和有機植物營養源,以減少化肥的使用並防止土壤健康、環境惡化和地下水污染。

- 這些因素以及有機農業面積的增加正在推動印度農業生技藥品市場的發展。作物保護領域佔據市場主導地位。 2022年市場規模約18.5億美元。同年,作物營養領域的市場規模為 7.593 億美元。

- 連續作物種植是該國的主流,2022 年佔印度農業生技藥品產品市場的約 87.7%。該國正在透過 Parampragat Krishi Vikas Yojana (PKVY) 和東北地區有機價值鏈發展計畫 (MOVCD-NER) 推廣有機農業。預計國內和國際市場對有機產品的需求也將在 2023 年至 2029 年期間推動印度農業生技藥品市場的發展。

印度農業生技藥品市場趨勢

有機生產者的增加推動了有機種植面積的增加,主要用於連續作物。

- 印度是世界上經過認證的有機生產者總數最多的國家,2019年擁有130萬名有機生產者。儘管有機生產者數量眾多,但該國有機種植面積僅佔全國農業總面積的2.0%左右。 2021年,該國有機種植面積達70萬公頃,比2017年成長約3.4%。

- 全國排名前 10 名的有機作物州約佔有機作物總面積的 80.0%。包括有機農業排名靠前的中央邦、拉賈斯坦邦和馬哈拉斯特拉邦在內的多個邦正在帶頭改善有機農業,其中中央邦在 2019 年佔比為 27.0%。

- 該國以連續作物有機種植為主,2021 年約佔有機作物總面積的 59.7%。糧食生產以稻米、小麥、小米和玉米為主。大多數穀類作物在雨季(六月至九月)種植。此季節生長的作物主要依賴雨水或需要大量水,例如水稻、玉米、棉花和大豆。

- 有機經濟作物的總種植面積將從 2017 年的 27 萬公頃增加到 2021 年的 28 萬公頃。該國主要生產的經濟作物為棉花、甘蔗、茶葉和香辛料。目前,該國有機園藝作物的生長有限。由於對有機產品的需求不斷成長以及印度政府的有機農業計劃,預計2023-2029年期間有機作物面積將會增加。

透過電子商務管道不斷成長的需求和供應將推動人均有機食品支出的增加

- 印度人均有機產品支出為0.23美元,與亞太地區人均有機產品支出平均值相比相對較低。然而,近年來,消費者需求正在轉向有機產品,因為越來越多的消費者認為有機產品具有更強的免疫力、更好的品質並且更容易透過電子商務管道獲得。印度是有機食品和飲料的一個有前景的市場。預計到 2024 年,印度有機食品和飲料產業規模將達到 1.38 億美元,2019 年至 2024 年期間的複合年成長率為 13%。

- 2022 年該國消費的有機食品和飲料總合為 1.08 億美元。該國有機產品消費額從 2016 年的 4,500 萬美元成長至 2021 年的 9,600 萬美元。有機食品銷售趨勢呈上升趨勢,主要原因是消費者意識不斷增強,高所得消費者鼓勵消費有機食品和飲料。需求最大的類別包括有機雞蛋、乳製品、水果和蔬菜等必需食品。

- 有機飲料消費佔據市場主導地位,佔 2022 年有機食品和有機飲料總合市場價值的約 85.2%。有機飲料部分包括經核准認證機構認證的有機包裝食品和飲料產品。 2020 年至 2022 年,有機飲料消費量的複合年成長率為 14%。有機產品的價格溢價限制了低收入消費者的購買能力,是有機食品消費的主要限制因素。然而,積極的推廣和有機產品的優勢將在預測期內推動有機食品市場的發展。

印度農業生技藥品產業概況

印度農業生技藥品市場細分,前五大公司佔20.64%。市場的主要企業有 Coromandel International Ltd、Gujarat State Fertilizers & Chemicals Limited、Madras Fertilizers Limited、Prabhat Fertilizer、Chemical Works、Swaroop Agrochemical Industries 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 有機種植區

- 有機產品人均支出

- 法律規範

- 印度

- 價值鍊和通路分析

第5章市場區隔

- 功能

- 作物營養

- 生物肥料

- 固氮螺菌

- 固氮菌

- 菌根真菌

- 解磷細菌

- 根瘤菌

- 其他生物肥料

- 生物肥料

- 胺基酸

- 富裡酸

- 腐植酸

- 蛋白質水解物

- 海藻萃取物

- 其他生物刺激素

- 有機肥

- 肥料

- 餐食基肥料

- 油餅

- 其他有機肥料

- 作物保護

- 生物防治劑

- 大型微生物

- 微生物

- 生物防治劑

- 生物真菌劑

- 生物除草劑

- 生物殺蟲劑

- 其他生物防治劑

- 作物營養

- 作物類型

- 經濟作物

- 園藝作物

- 耕地作物

第6章競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Coromandel International Ltd

- Gujarat State Fertilizers & Chemicals Limited

- Indian Farmers Fertiliser Cooperative Limited

- Koppert Biological Systems Inc.

- Madras Fertilizers Limited

- Prabhat Fertilizer and Chemical Works

- Rallis India Ltd

- Samriddhi Crops India Pvt. Ltd

- Swaroop Agrochemical Industries

- Valagro

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

The India Agricultural Biologicals Market size is estimated at 3.19 billion USD in 2025, and is expected to reach 4.43 billion USD by 2030, growing at a CAGR of 6.78% during the forecast period (2025-2030).

- The overuse of chemical fertilizers and pesticides is one of the serious challenges in the country. The continuous use of nitrogen at fixed sites had a negative impact on the health of the soil and crop yield, indicating deficiencies in several macro and micronutrients. Even with recommended doses of NPK and more, deficiency of micro and secondary nutrients has become a yield-limiting factor.

- The adoption of sustainable agricultural practices or organic farming can decrease the effect of chemical fertilizers on the environment. The Indian Council of Agricultural Research (ICAR) recommends integrated nutrient management through conjunctive use of both inorganic and organic sources of plant nutrients to reduce the use of chemical fertilizers, preventing deterioration of soil health and environment and contamination of groundwater.

- These factors and the growing organic agricultural cultivation area are driving the Indian agricultural biologicals market. The crop protection segment is dominating the market. It was valued at about USD 1.85 billion in 2022. The crop nutrition segment was valued at USD 759.3 million in the same year.

- Row crop cultivation is dominant in the country, accounting for about 87.7% of the Indian agricultural biologicals market in 2022. The country is promoting organic farming under the Parampragat Krishi Vikas Yojana (PKVY) and the Mission Organic Value Chain Development for North East Region (MOVCD-NER). The demand for organic products in domestic and international markets is also expected to drive the Indian agricultural biologicals market between 2023 and 2029.

India Agricultural Biologicals Market Trends

Growing number of organic producers helping the increase in area under organic cultivation, primarily in row crops

- India is the largest country, in terms of the total number of certified organic producers in the world, with 1.3 million organic producers in 2019. Despite having a large number of organic producers, organic cultivation areas in the country account for around 2.0% of the total agriculture area in the country. In 2021, the organic area in the country was recorded as 0.7 million hectares, which increased by about 3.4% compared to 2017.

- The top ten organic farming states in the country account for about 80.0% of the total organic crop area. A few states have taken the lead in improving organic farming including Madhya Pradesh, Rajasthan, and Maharashtra, the top organic farming states, with Madhya Pradesh accounting for 27.0% in 2019.

- Organic cultivation of row crops is dominant in the country, which accounted for about 59.7% of the total organic crop area in 2021. Cereal crop production is dominant rice, wheat, millet, and maize are the major cereals produced. Most cereal crops are grown in the kharif season (June - September). The crops grown in this season are mainly rain-dependent or require more water, like rice, maize, cotton, and soybean.

- The overall organic cash crop cultivation area increased from 0.27 million hectares in 2017 to 0.28 million hectares in 2021. The major cash crops produced in the country are cotton, sugarcane, tea, and spices. There is a limited growth of organic horticultural crops currently in the country. The increasing demand for organic products and Indian government initiatives to go organic are anticipated to increase organic crop area between 2023 and 2029.

Growing demand and their easy accessibility through e-commerce channels, rising the per capita spending on organic food

- India's per capita spending on organic products is relatively low at USD 0.23 compared to the average per capita spending on organic products in Asia-Pacific. However, in recent years, shifting consumer demand has increased toward organic products as more customers perceive these items offer better immunity, higher quality, and more accessibility through e-commerce channels. India is a promising and developing market for organic foods and beverages. India's domestic organic food and beverage industry is expected to be worth USD 138.0 million by 2024, rising at a compound annual growth rate of 13% between 2019 to 2024.

- In 2022, the total combined organic food and beverages worth USD 108.0 million consumed in the country. The consumption value of organic products in the country increased from USD 45 million in 2016 to USD 96.0 million in 2021. Organic food sales have seen an increasing trend mainly due to increasing consumer awareness, and high-income consumers are propelling organic food and beverage consumption. Categories that gained the most demand included essential foods, such as organic eggs, dairy, and fruits and vegetables.

- Organic beverage consumption dominated the market and accounted for about 85.2% of the total combined organic food and beverages market value in 2022. The organic beverages segment includes organic packaged food and beverages that are certified by the approved certification body. Organic beverage consumption value increased at a CAGR of 14% between 2020 to 2022. The price premium associated with organic products hampers lower-income consumer access and is the major limiting factor for organic food consumption. However, organic products' active promotion and advantages drive the organic food market during the forecast period.

India Agricultural Biologicals Industry Overview

The India Agricultural Biologicals Market is fragmented, with the top five companies occupying 20.64%. The major players in this market are Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Limited, Madras Fertilizers Limited, Prabhat Fertilizer and Chemical Works and Swaroop Agrochemical Industries (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Crop Nutrition

- 5.1.1.1 Biofertilizer

- 5.1.1.1.1 Azospirillum

- 5.1.1.1.2 Azotobacter

- 5.1.1.1.3 Mycorrhiza

- 5.1.1.1.4 Phosphate Solubilizing Bacteria

- 5.1.1.1.5 Rhizobium

- 5.1.1.1.6 Other Biofertilizers

- 5.1.1.2 Biostimulants

- 5.1.1.2.1 Amino Acids

- 5.1.1.2.2 Fulvic Acid

- 5.1.1.2.3 Humic Acid

- 5.1.1.2.4 Protein Hydrolysates

- 5.1.1.2.5 Seaweed Extracts

- 5.1.1.2.6 Other Biostimulants

- 5.1.1.3 Organic Fertilizer

- 5.1.1.3.1 Manure

- 5.1.1.3.2 Meal Based Fertilizers

- 5.1.1.3.3 Oilcakes

- 5.1.1.3.4 Other Organic Fertilizers

- 5.1.2 Crop Protection

- 5.1.2.1 Biocontrol Agents

- 5.1.2.1.1 Macrobials

- 5.1.2.1.2 Microbials

- 5.1.2.2 Biopesticides

- 5.1.2.2.1 Biofungicides

- 5.1.2.2.2 Bioherbicides

- 5.1.2.2.3 Bioinsecticides

- 5.1.2.2.4 Other Biopesticides

- 5.1.1 Crop Nutrition

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Coromandel International Ltd

- 6.4.2 Gujarat State Fertilizers & Chemicals Limited

- 6.4.3 Indian Farmers Fertiliser Cooperative Limited

- 6.4.4 Koppert Biological Systems Inc.

- 6.4.5 Madras Fertilizers Limited

- 6.4.6 Prabhat Fertilizer and Chemical Works

- 6.4.7 Rallis India Ltd

- 6.4.8 Samriddhi Crops India Pvt. Ltd

- 6.4.9 Swaroop Agrochemical Industries

- 6.4.10 Valagro

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms