|

市場調查報告書

商品編碼

1693761

中國農業生技藥品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030年)China Agricultural Biologicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

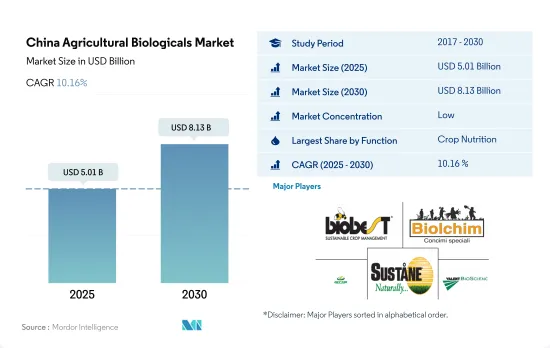

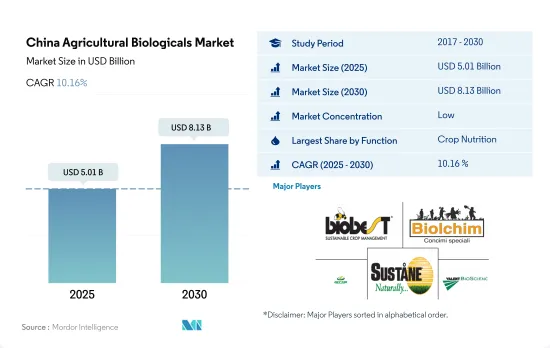

預計2025年中國農業生技藥品市場規模將達50.1億美元,2030年預計將達到81.3億美元,預測期內(2025-2030年)的複合年成長率為10.16%。

- 2022年,作物營養投入品約佔中國農業生技藥品市場的87.1%。在作物營養領域,有機肥料是全國消耗最多的生物投入品。有機肥料的優越性主要歸功於其在有機農業和傳統農業中的廣泛應用。

- 堆肥在該國的有機肥料市場中佔據主導地位,預計 2022 年市場價值將達到 14.2 億美元。堆肥傳統上用作有機和非有機農業的基礎肥料,並且可以增加土壤中的有機質和碳含量。堆肥類別之後是其他有機肥料類別,包括魚糞、蝙蝠糞、魚乳劑、蚯蚓堆肥、糖蜜和其他堆肥等肥料。 2022 年其他有機肥料部門的價值約為 8.322 億美元。

- 2022 年,作物劑佔據作物保護領域的主導地位,佔有 52.8% 的佔有率。大型生物防治劑將主導中國的生物防治劑市場,預計 2022 年市場規模約 2.792 億美元。大型生物防治劑的主導地位主要歸因於其能夠控制多種害蟲。

- 捕食性害蟲在中國生物防治劑市場中佔據大型生物製劑領域的主導地位,主要是因為它們能夠攻擊不同生命階段的害蟲,甚至攻擊不同種類的害蟲。它們也比其他生物防治劑更貪婪。 2022 年,捕食者子區隔約佔中國生物防治劑市場大型生物細分市場的 47.4%。

中國農業生物防治劑市場趨勢

農藥使用零成長和有機產品出口增加促進有機農業

- 根據FiBL和IFOAM的最新報告,中國有機食品市場正以每年25.0%的速度成長。鑑於中國每年出口29.1億美元的農產品,從傳統農業向有機農業的轉變意味著中國轉向更永續的食品體系的轉變。

- 隨著收入的增加和食品安全日益重要,越來越多的人開始購買有機產品,中國的有機農場面積迅速成長。過去三年,中國有機種植面積增加了10%,2020年達到240萬公頃。此外,國家推出了推動有機生產的政策,並提出了「綠水青山就是金山銀山」和「綠色發展」的口號。

- 中國的有機農業主要以出口為導向。出口和進口商品包括穀物、大豆、水果和蔬菜。中國東北三省(遼寧、吉林、黑龍江)是全國有機農產品生產總量、數量、面積最大的省區。中國北方(如山東省和遼寧省)的大多數有機農場都向周邊城市供應有機蔬菜和水果。另外部分產品也出口到日本、韓國、歐美等美國。

- 由於過度使用合成肥料和殺蟲劑導致土壤污染,人們越來越擔心土壤毒性,中國對永續農業實踐和有機食品生產的需求正在成長。農業實踐的這種變化是一個緩慢但不斷成長的趨勢,並且它正在增加對作物營養和保護產品的需求。

由於對有機產品的需求不斷成長,約73%的中國消費者希望購買有機食品。

- 中國有機食品市場發展迅速,中國消費者對有機食品的潛在需求龐大。更富裕的中階的崛起和對健康影響的認知不斷提高是這一現象背後的驅動力。 2021年,中國有機食品銷售額約達775.4億美元。

- 由於政府的各項法律都傾向於有機食品而非食品安全,且消費者偏好有機食品而非傳統食品,因此對有機食品的需求大幅增加。中國的有機蔬菜價格是傳統蔬菜的3至15倍,而有機蔬菜的價格一般是傳統蔬菜的5至10倍。然而,儘管價格因素是一個障礙,富裕家庭和有健康問題的個人仍願意擴大預算,約 73% 的中國消費者願意為有機食品支付額外費用。

- 中國政府正逐步實現有機食品領域的自給自足。例如,透過鼓勵農民減少使用化學肥料並改用生物替代品,經濟正逐步轉向綠色農業實踐。中國連鎖專利權協會2020年的調查顯示,中國已開發城市民眾了解永續食品生產概念的有機意識已達83%。儘管中國的有機食品產業仍規模較小,遠未滿足國內外消費者的需求,但考慮到2021年國內銷售額預計將成長4.01%,可以說中國有機食品在國內外市場都具有巨大的潛力。

中國農業生技藥品產業概況

中國農業生技藥品市場細分化,前五大企業市佔率合計為1.05%。市場的主要企業包括 Biobest Group NV、Biolchim SPA、Genliduo Bio-tech Corporation Ltd、Sustane Natural Fertilizer Inc.、Valent Biosciences LLC 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 有機種植區

- 有機產品人均支出

- 法律規範

- 中國

- 價值鍊和通路分析

第5章市場區隔

- 功能

- 作物營養

- 生物肥料

- 固氮螺菌

- 固氮菌

- 菌根真菌

- 解磷細菌

- 根瘤菌

- 其他生物肥料

- 生物肥料

- 胺基酸

- 富裡酸

- 腐植酸

- 蛋白質水解物

- 海藻萃取物

- 其他生物刺激素

- 有機肥

- 肥料

- 餐食基肥料

- 油餅

- 其他有機肥料

- 作物保護

- 生物防治劑

- 大型微生物

- 微生物

- 生物防治劑

- 生物真菌劑

- 生物除草劑

- 生物殺蟲劑

- 其他生物防治劑

- 作物營養

- 作物類型

- 經濟作物

- 園藝作物

- 耕地作物

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Biobest Group NV

- Biolchim SPA

- Genliduo Bio-tech Corporation Ltd

- Haifa Group

- Henan Jiyuan Baiyun Industry Co. Ltd

- Novozymes

- Shandong Sukahan Bio-Technology Co. Ltd

- Sustane Natural Fertilizer Inc.

- Trade Corporation International

- Valent Biosciences LLC

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

The China Agricultural Biologicals Market size is estimated at 5.01 billion USD in 2025, and is expected to reach 8.13 billion USD by 2030, growing at a CAGR of 10.16% during the forecast period (2025-2030).

- Crop nutrition inputs accounted for about 87.1% of the Chinese agricultural biologicals market in 2022. In the crop nutrition segment, organic fertilizers are the most consumed biological inputs in the country. The dominance of organic fertilizers is mainly due to their application in bulk quantities both in organic and conventional farming.

- Manure dominates the country's organic fertilizers market, valued at USD 1.42 billion in 2022. Manure is conventionally used as a primary fertilizer both in organic and non-organic cultivation and is known to increase organic matter and carbon content in the soil, which would increase the nutrient uptake of the crop and, thus, the grain yield. The manure segment is followed by the other organic fertilizers segment, which includes fertilizers like fish guano, bat guano, fish emulsion, vermicompost, molasses, and other composted fertilizers. The other organic fertilizers segment was valued at about USD 832.2 million in 2022.

- Biocontrol agents dominated the crop protection segment, with a share of 52.8% in 2022. Macrobial biocontrol agents dominated the Chinese biocontrol agents market, valued at about USD 279.2 million in 2022. The domination of macrobial biocontrol agents is mainly due to their ability to control various pests.

- Predators dominate the macrobials segment of the Chinese biocontrol agents market mainly due to their ability to attack different life stages of pests and even different pest species. They are also voracious feeders compared to other biocontrol agents. The predators sub-segment accounted for about 47.4% of the macrobials segment of the Chinese biocontrol agents market in 2022.

China Agricultural Biologicals Market Trends

Country's zero growth in pesticides use and increasing exports under organic products driving the organic cultivation.

- According to the latest reports by FiBL and the IFOAM, the market for organic food in China is growing at an annual rate of 25.0%. The shift from conventional to organic is a transformation toward a more sustainable food system within China, given the USD 2.91 billion of agri-food commodities exported from China each year.

- The size of organic farmland increased rapidly in China because more people started buying organic products due to increased incomes and the increasing importance of food safety. In the last three years, China's organic planting area increased by 10%, reaching 2.4 million ha in 2020. In addition, national policies have been adopted to promote organic production, advocating the slogans that state, "lucid waters and lush mountains are invaluable assets" and "green development".

- Organic farming in China is majorly export-oriented. The products that are both exported and imported include cereals, soybeans, fruits, and vegetables. China's three northeastern provinces (Liaoning, Jilin, and Heilongjiang) support the largest organic production nationally in terms of output, volume, and area. Most organic farms located in the northern part of China (e.g., Shandong and Liaoning) supply organic vegetables and fruits to nearby cities. In addition, they export some products to Japan, South Korea, Europe, and the United States.

- With the increasing concerns of soil toxicity due to the overuse of synthetic fertilizers and pesticides that lead to soil contamination, the demand for sustainable agriculture practices and organic food production is on the rise in China. This moderately slow yet increasing shift in cultivation practices has also subsequently increased the demand for crop nutrition and protection products.

The growing demand for organic products, approximately 73% of Chinese consumers are willing to have organic food

- China's organic food market is developing rapidly, and the potential demand for organic food among Chinese consumers is enormous. This is due to the growth of the wealthier middle classes and a greater awareness of the health implications. In 2021, organic food sales in China amounted to about USD 77.54 billion.

- Due to various government laws that favor organic food over food safety and customer preferences for organic food over conventional food, the demand for organic food items has considerably expanded. While prices of organic vegetables in China range from 3 to 15 times the cost of conventional produce, prices for organic vegetables are generally between 5 and 10 times that of their conventional counterparts. However, despite the price factor being a barrier, wealthy families and individuals with health problems are eager to increase their budget, with approximately 73% of Chinese consumers willing to pay extra for organic foods.

- The Chinese government is slowly aiming to become self-reliant in the organic food sector. For instance, the economy is slowly moving toward a green agriculture practice by encouraging farmers to scale back the use of chemical fertilizers and switch to bio-based alternatives. The China Chain Store and Franchise Association (CCFA) research in 2020 declared that organic awareness among the Chinese population in developed cities was at 83% when it came to an understanding of the concept of sustainable food production. Although China's organic food sector is still quite small and falls far short of satisfying domestic and international consumer demand, it can be stated that organic food in China has enormous potential in both the domestic and foreign markets, considering the rise in domestic sales by 4.01% in 2021.

China Agricultural Biologicals Industry Overview

The China Agricultural Biologicals Market is fragmented, with the top five companies occupying 1.05%. The major players in this market are Biobest Group NV, Biolchim SPA, Genliduo Bio-tech Corporation Ltd, Sustane Natural Fertilizer Inc. and Valent Biosciences LLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Crop Nutrition

- 5.1.1.1 Biofertilizer

- 5.1.1.1.1 Azospirillum

- 5.1.1.1.2 Azotobacter

- 5.1.1.1.3 Mycorrhiza

- 5.1.1.1.4 Phosphate Solubilizing Bacteria

- 5.1.1.1.5 Rhizobium

- 5.1.1.1.6 Other Biofertilizers

- 5.1.1.2 Biostimulants

- 5.1.1.2.1 Amino Acids

- 5.1.1.2.2 Fulvic Acid

- 5.1.1.2.3 Humic Acid

- 5.1.1.2.4 Protein Hydrolysates

- 5.1.1.2.5 Seaweed Extracts

- 5.1.1.2.6 Other Biostimulants

- 5.1.1.3 Organic Fertilizer

- 5.1.1.3.1 Manure

- 5.1.1.3.2 Meal Based Fertilizers

- 5.1.1.3.3 Oilcakes

- 5.1.1.3.4 Other Organic Fertilizers

- 5.1.2 Crop Protection

- 5.1.2.1 Biocontrol Agents

- 5.1.2.1.1 Macrobials

- 5.1.2.1.2 Microbials

- 5.1.2.2 Biopesticides

- 5.1.2.2.1 Biofungicides

- 5.1.2.2.2 Bioherbicides

- 5.1.2.2.3 Bioinsecticides

- 5.1.2.2.4 Other Biopesticides

- 5.1.1 Crop Nutrition

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Biobest Group NV

- 6.4.2 Biolchim SPA

- 6.4.3 Genliduo Bio-tech Corporation Ltd

- 6.4.4 Haifa Group

- 6.4.5 Henan Jiyuan Baiyun Industry Co. Ltd

- 6.4.6 Novozymes

- 6.4.7 Shandong Sukahan Bio-Technology Co. Ltd

- 6.4.8 Sustane Natural Fertilizer Inc.

- 6.4.9 Trade Corporation International

- 6.4.10 Valent Biosciences LLC

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms