|

市場調查報告書

商品編碼

1693756

北美農業生技藥品:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Agricultural Biologicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

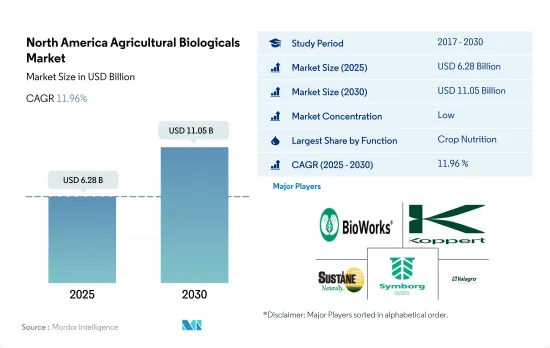

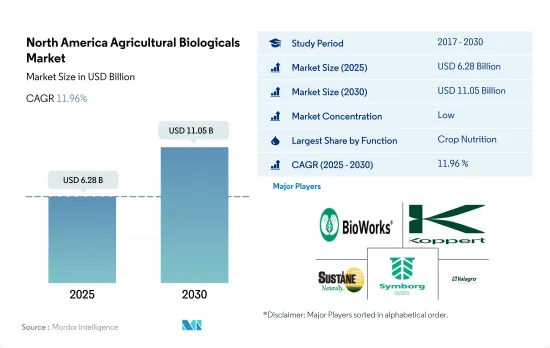

北美農業生技藥品市場規模預計在 2025 年為 62.8 億美元,預計到 2030 年將達到 110.5 億美元,預測期內(2025-2030 年)的複合年成長率為 11.96%。

- 農業生技藥品在北美永續農業中扮演重要角色。透過提供必需的營養物質和控制作物害蟲和昆蟲,這些產品減少了化學肥料和殺蟲劑的使用。 2017年至2022年,該地區的農業生技藥品市場成長了63.1%。

- 作物營養生技藥品在生技藥品市場佔據主導地位,而在作物營養物質中,生物肥料將在 2022 年佔據作物營養物質市場的主導地位。生物肥料是含有幫助植物生長的活微生物的有機物質。 2017-2021年期間,生物肥料市場規模成長約49.3%。以根瘤菌為基礎的生物肥料將引領北美生物肥料產業,到2022年將佔生物肥料市場規模的約36.5%。這主要是因為基於根瘤菌的生物肥料有潛力減少對無機氮肥的整體依賴。

- 作物保護以生物農藥為主,佔作物保護類別的94.1%。北美生物殺菌劑市場規模預計在2022年達到8.912億美元,佔同年市場佔有率的46.9%,成為最受歡迎的生物農藥類型。生物殺菌劑是噴灑在植物上以防止病原體真菌引起的疾病的物質。芽孢桿菌、木黴菌和假單胞菌是市面上使用最廣泛的生物殺菌劑。

- 隨著消費者越來越意識到合成化學肥料的不利影響,國內外對有機產品的需求都在成長。市場成長了 95.1%,2023 年至 2029 年的複合年成長率為 11.8%。

- 美國在北美生技藥品市場佔據主導地位,2022 年市場佔有率為 55.5%。在美國,作物保護產品引領農業生技藥品市場,價值 13.5 億美元。生物農藥是美國消費量最大的生物作物保護產品,到2022年將佔作物保護產品的83.5%。

- 生物農藥在生物農藥領域占主導地位,用於控制病原真菌引起的植物疾病。生物殺菌劑要么來自微生物,要么植物來源。預計2022年這些生物殺菌劑的市場規模將達到6.509億美元,成為同年消費量最大的生物農藥類型,市場佔有率為49.5%。

- 2022年加拿大佔北美農業生技藥品市場的28.8%,市場規模為12.7億美元。 2022 年,該國作物保護領域的市場規模估計約為 4.751 億美元。該國作物保護領域以生物農藥為主,佔當年作物保護市值的 95.2%。

- 就有機作物種植面積而言,墨西哥是北美第二大國。該國有機作物總面積預計將從 2017 年的 512,700 公頃增加到 2022 年的 541,500 公頃,到 2029 年底將增加 10.9%。有機作物種植面積增加的趨勢將直接增加預測期內對生技藥品的需求。

- 對永續和有機種植作物的需求不斷增加以及過度使用化學肥料的不利影響是生技藥品市場發展的促進因素。此外,生技藥品能夠降低整體生產成本,進一步促進市場成長。

北美農業生技藥品市場趨勢

美國等主要國家對有機農產品的需求正在成長,政府的支持也有助於增加有機農產品的種植面積。

- 根據FibL統計的數據,2021年北美有機種植農作物的面積達到了150萬公頃。該地區有機種植總面積在2017年至2021年間增加了13.5%。在北美國家中,美國佔據主導地位,擁有62.3萬公頃的有機農田,其中加州、緬因州和紐約州是實施有機種植的主要州。就國內生產而言,主要的有機農產品是蘋果(31.1%)、草莓(9.5%)、柳橙(6.9%)、長葉萵苣(6.7%)和馬鈴薯(6.2%)。貿易方面,2021年進口最多的水果是香蕉(53.1%)、酪梨(7.7%)、芒果(5.8%)、藍莓(5.0%)和南瓜(4.3%),出口最多的水果是蘋果(80.0%)、梨(14.4%)、櫻桃(4.0%)、乾乾(80.0%)、梨(14.4%)、櫻桃(4.0%)、乾洋蔥(1.5%)和馬鈴薯(1.2%)。

- 2021年墨西哥有機農業面積為531,100公頃。墨西哥是世界20大有機食品生產國之一。此外,全國主要的有機食品生產州包括恰帕斯州、瓦哈卡州、米卻肯州、奇瓦瓦州和格雷羅州,佔全國有機種植面積的80.0%。全國有機農業協會等組織正在該國推廣有機農業,預計將激勵更多農民從事有機農業。

- 加拿大作物種植面積將從2017年的40萬公頃增加到2021年的45萬公頃。 2021年,這一數字將達到42萬公頃,其中連作作物將佔據最大面積。加拿大政府宣布,將於2021年向有機發展基金提供297,330美元,用於支持有機農民。這些努力有望增加該地區有機種植的面積。

國內外市場對有機農產品的需求不斷增加,人均有機食品支出不斷增加

- 2021年北美人均有機食品支出為108美元。在北美國家中,美國的人均支出最高,2021年平均支出為158美元。

- 疫情是有機食品消費增加的一個主要因素。根據有機農產品網路和類別合作夥伴的報告,2020年美國有機產品銷售額成長了14.2%,相當於增加了10億美元,達到85億美元。

- 2021年,美國有機產品銷售額超過630億美元,與前一年同期比較成長2.0%。到 2021 年,有機水果和蔬菜將佔有機產品總銷售額的 15.0%,價值 210 億美元。

- 根據加拿大有機聯合會報告的數據,2020年加拿大有機食品銷售額達81億美元。加拿大是世界第六大有機產品市場,但其有機產品供應卻無法滿足需求。 2021年,人均有機食品支出為142.6美元。根據有機貿易協會數據顯示,2021年墨西哥有機產品市場規模為6,300萬美元,全球排名第35位,預計2021年至2026年複合年成長率為7.2%。然而,2021年墨西哥人均有機產品支出為0.49美元,低於該地區其他國家。隨著越來越多的公司進入墨西哥市場,預計該國對有機產品的需求將會增加。

北美農業生技藥品產業概況

北美農業生技藥品市場細分化,前五大公司佔0.75%的市佔率。市場的主要企業包括 Bioworks Inc.、Koppert Biological Systems Inc.、Sustane Natural Fertilizer Inc.、Symborg Inc.、Valagro USA 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 有機種植區

- 有機產品人均支出

- 法律規範

- 加拿大

- 墨西哥

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 功能

- 作物營養

- 生物肥料

- 固氮螺菌

- 固氮菌

- 菌根真菌

- 解磷細菌

- 根瘤菌

- 其他生物肥料

- 生物肥料

- 胺基酸

- 富裡酸

- 腐植酸

- 蛋白質水解物

- 海藻萃取物

- 其他生物刺激素

- 有機肥

- 肥料

- 餐食基肥料

- 油餅

- 其他有機肥料

- 作物保護

- 生物防治劑

- 大型微生物

- 微生物

- 生物防治劑

- 生物真菌劑

- 生物除草劑

- 生物殺蟲劑

- 其他生物防治劑

- 作物營養

- 作物類型

- 經濟作物

- 園藝作物

- 耕地作物

- 原產地

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Agriculture Solutions Inc.

- Andermatt Group AG

- BioFert Manufacturing Inc.

- BIOQUALITUM SA de CV

- Bioworks Inc.

- Koppert Biological Systems Inc.

- Lallemand Inc.

- Sustane Natural Fertilizer Inc.

- Symborg Inc.

- Valagro USA

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

The North America Agricultural Biologicals Market size is estimated at 6.28 billion USD in 2025, and is expected to reach 11.05 billion USD by 2030, growing at a CAGR of 11.96% during the forecast period (2025-2030).

- Agricultural biologicals play an important role in sustainable agriculture in North America. By delivering necessary nutrients and managing pests and insects in crops, these products decrease the usage of chemical fertilizers and pesticides. The regional agricultural biologicals market grew by 63.1% between 2017 and 2022.

- Crop nutrition biologicals dominate the biologicals market, and among crop nutrients, biofertilizers dominated the crop nutrient segment in 2022. Biofertilizers are organic substances containing live microorganisms that help plants thrive. From 2017 to 2021, the biofertilizer market value rose by approximately 49.3%. Rhizobium-based biofertilizers lead the North American biofertilizer industry, accounting for approximately 36.5% of the biofertilizer market value in 2022. This is mostly owing to the potential of rhizobium-based biofertilizers to reduce overall reliance on inorganic nitrogen fertilizers.

- Crop protection is dominated by biopesticides, which account for 94.1% of the crop protection category. The market for biofungicides in North America was valued at USD 891.2 million in 2022, making them the most popular biopesticide type with a 46.9% market share in the same year. Biofungicides are substances that are applied to plants to prevent diseases caused by pathogenic fungi. Bacillus, Trichoderma, and Pseudomonas are the most widely available biofungicides on the market.

- The demand for organic products has grown both domestically and internationally as a result of consumers' growing awareness of the negative effects of synthetic fertilizers. The market grew by 95.1%, with a CAGR of 11.8% between 2023 and 2029.

- The United States dominated the North American biologicals market with a market share of 55.5% in 2022. Crop protection led the agricultural biologicals market in the United States and accounted for USD 1.35 billion. Biopesticides are the most consumed biological crop protection segment in the United States and accounted for 83.5% of the crop protection segment in 2022.

- Biofungicides dominate the biopesticide segment and are used to control plant diseases caused by pathogenic fungi. Biofungicides may be of microbial or botanical origin. The market for these biofungicides was valued at USD 650.9 million in 2022 and was the most consumed type of biopesticide, with a market share of 49.5% in the same year.

- Canada accounted for 28.8% of the North American agricultural biologicals market in 2022, with a market value of USD 1.27 billion. The crop protection segment in the country was valued at about USD 475.1 million in 2022. Biopesticides dominated the crop protection segment in the country, accounting for 95.2% of the crop protection market value in the same year.

- Mexico is the second-largest country in terms of organic crop area in the North American region. The total organic crop area in the country increased from 512.7 thousand hectares in 2017 to 541.5 thousand hectares in 2022 and is anticipated to increase by 10.9% by the end of 2029. This increasing trend in organic crop areas directly increases the demand for biologicals in the forecast period.

- The increasing demand for sustainable or organically cultivated crops and the adverse effects of the overuse of chemical fertilizers are factors driving the market for biologicals. Additionally, biologicals have the ability to reduce the overall cost of production, further contributing to market growth.

North America Agricultural Biologicals Market Trends

Organic produce demand grows in major countries like the United States, increasing cultivation area with government support

- According to the data provided by FibL statistics, the area under organic cultivation of crops in North America was 1.5 million hectares in 2021. The total organic area in the region increased by 13.5% between 2017 and 2021. Among the North American countries, the United States is dominant, with 623.0 thousand hectares of agricultural land under organic farming, with California, Maine, and New York being the major states practicing agriculture. Regarding domestic production, the main organic produce was apples (31.1%), strawberries (9.5%), oranges (6.9%), romaine lettuce (6.7%), and potatoes (6.2%). In the case of trade, the most imported products were bananas (53.1%), avocados (7.7%), mangoes (5.8%), blueberries (5.0%), and squash (4.3%), while the most exported were apples (80.0%), pears (14.4%), cherries (4.0%), dried onions (1.5%), and potatoes (0.2%) in 2021.

- Mexico had 531.1 thousand hectares of area under organic farming in 2021. Mexico is among the top 20 organic food producers in the world. Moreover, the major organic food-producing states in the country include Chiapas, Oaxaca, Michoacan, Chihuahua, and Guerrero, which account for 80.0% of the total organic area in the country. Organizations such as the National Association for Organic Agriculture are promoting organic agriculture in the country, which is expected to motivate more farmers to take up organic agriculture.

- Canada's area under organic crop cultivation increased from 400,000 hectares in 2017 to 450,000 hectares in 2021. Row crops occupied the maximum area, with 420,000 hectares in 2021. The Canadian government announced a sum of USD 297,330 in 2021 as an Organic Development Fund to support organic farmers. These initiatives are expected to increase the organic area in the region.

Growing demand for organic produce in domestic and international markets, rise in per capita spending on organic food

- The average per capita spending on organic food products in North America was recorded as USD 108.0 in 2021. Among the North American countries, the United States had the highest per capita spending, with an average spending of USD 158.0 in 2021.

- The pandemic has been a major factor in the increase of organic food consumption. In 2020, sales of organic products in the United States grew by 14.2%, which represented an increase of USD 1.0 billion, reaching a value of USD 8.50 billion, according to a report by Organic Produce Network and Category Partners.

- In 2021, organic product sales in the United States crossed USD 63.00 billion with a 2.0% increase over the previous year. Organic fruits and vegetables accounted for 15.0% of the total organic product sales with a value of USD 21.0 billion in 2021.

- According to data reported by the Organic Federation of Canada, organic food sales in Canada reached a value of USD 8.10 billion in 2020. Canada is the 6th largest market in the world for organic products, with the supply of organic products failing to keep up with the demand in the country. In 2021, the average spending on organic food per person was USD 142.6. In 2021, Mexico registered a market size of USD 63.0 million for organic products with a global rank of 35, and it is estimated to record a CAGR of 7.2% between 2021 and 2026, according to the Organic Trade Association. However, the per capita spending on organic products in the country is less compared to other countries in the region with a value of USD 0.49 in 2021. It is expected that more players entering the market in Mexico will increase the demand for organic products in the country.

North America Agricultural Biologicals Industry Overview

The North America Agricultural Biologicals Market is fragmented, with the top five companies occupying 0.75%. The major players in this market are Bioworks Inc., Koppert Biological Systems Inc., Sustane Natural Fertilizer Inc., Symborg Inc. and Valagro USA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Crop Nutrition

- 5.1.1.1 Biofertilizer

- 5.1.1.1.1 Azospirillum

- 5.1.1.1.2 Azotobacter

- 5.1.1.1.3 Mycorrhiza

- 5.1.1.1.4 Phosphate Solubilizing Bacteria

- 5.1.1.1.5 Rhizobium

- 5.1.1.1.6 Other Biofertilizer

- 5.1.1.2 Biostimulants

- 5.1.1.2.1 Amino Acids

- 5.1.1.2.2 Fulvic Acid

- 5.1.1.2.3 Humic Acid

- 5.1.1.2.4 Protein Hydrolysates

- 5.1.1.2.5 Seaweed Extracts

- 5.1.1.2.6 Other Biostimulants

- 5.1.1.3 Organic Fertilizer

- 5.1.1.3.1 Manure

- 5.1.1.3.2 Meal Based Fertilizers

- 5.1.1.3.3 Oilcakes

- 5.1.1.3.4 Other Organic Fertilizer

- 5.1.2 Crop Protection

- 5.1.2.1 Biocontrol Agents

- 5.1.2.1.1 Macrobials

- 5.1.2.1.2 Microbials

- 5.1.2.2 Biopesticides

- 5.1.2.2.1 Biofungicides

- 5.1.2.2.2 Bioherbicides

- 5.1.2.2.3 Bioinsecticides

- 5.1.2.2.4 Other Biopesticides

- 5.1.1 Crop Nutrition

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Agriculture Solutions Inc.

- 6.4.2 Andermatt Group AG

- 6.4.3 BioFert Manufacturing Inc.

- 6.4.4 BIOQUALITUM SA de CV

- 6.4.5 Bioworks Inc.

- 6.4.6 Koppert Biological Systems Inc.

- 6.4.7 Lallemand Inc.

- 6.4.8 Sustane Natural Fertilizer Inc.

- 6.4.9 Symborg Inc.

- 6.4.10 Valagro USA

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms