|

市場調查報告書

商品編碼

1693723

印度鋼鐵 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

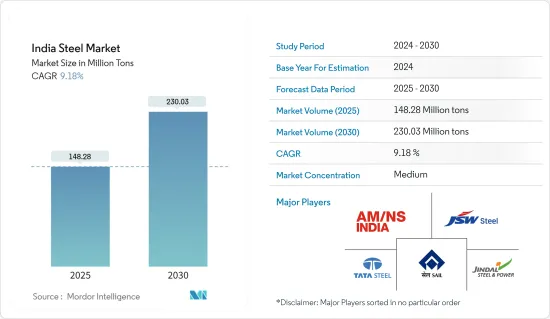

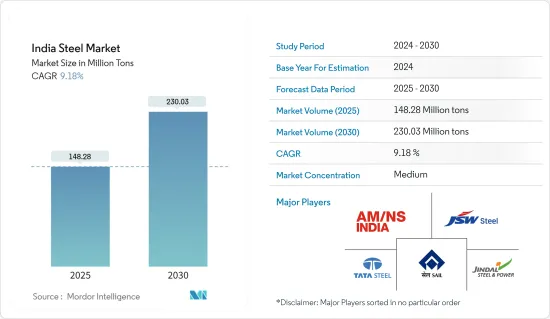

預計 2025 年印度鋼鐵市場規模為 1.4828 億噸,2030 年將達到 2.3003 億噸,預測期內(2025-2030 年)的複合年成長率為 9.18%。

關鍵亮點

- 在印度,由於新冠疫情爆發,汽車和運輸、建築和施工等所有行業的鋼鐵消費都受到限制。不過,由於終端用戶產業平穩運轉,遏制了病毒的傳播,印度鋼鐵市場出現強勁復甦。目前,鋼鐵市場正從疫情中復甦,並經歷強勁成長。

- 短期內,印度政府的強力政策支持、鋼鐵業的強勁投資流入、都市化的加快以及建築基礎設施計劃支出的增加預計將在預測期內推動市場發展。

- 然而,人均鋼鐵消費量低、生產成本高,大幅降低了印度鋼鐵製造商的利潤率。價格波動給進口商造成了巨大損失,阻礙了印度鋼鐵市場的成長。

- 由於鋼鐵生產中使用氫代替碳,並且預計未來貿易和投資機會將增加,所研究的市場在預測期內可能會出現良好的成長。

印度鋼鐵市場趨勢

高爐-鹼性氧氣轉爐(BF-BOF)技術佔市場主導地位

- BF-BOF 製程路線分為兩步驟。煉鋼:煉鐵:將鐵礦石、焦炭、石灰石裝入高爐。鐵礦石經過冶煉可生成熔融生鐵。接下來是煉鋼。將熔融生鐵裝入鹼性氧氣轉爐(BOF)。煤炭是煉鋼的主要含碳原料。它產生提煉鐵礦石並將其轉化為液態鐵所需的高溫。液態鐵進入轉爐,氧氣吹過熔融的鐵水以去除碳和其他雜質。

- 將鋼鑄造成鋼錠或鋼坯,再經過幾道軋延工序加工成鋼筋、線材、扁鋼等長條類產品。如有必要,對鋼材進行回火和塗層處理,以增強其性能和功能。

- 該高爐每天可生產高達10,000噸鐵水。 ,一座高爐一次加熱可生產高達300噸鋼。

- 鹼性氧氣轉爐(BOF)一直是印度生產粗鋼最受歡迎的製程路線。其鋼鐵產量佔全國的90%以上。截至2022年底,BOF技術將佔產量的46%。

- 在印度,68%的鋼鐵是透過高爐煉鋼生產的,焦煤是主要的還原劑。同時,也可採用粉煤(PCI)或天然氣作為輔助還原劑。在 BF-BOF 路線上,綠色氫氣正在被開發為 PCI 的替代品。

- 根據印度鋼鐵部的數據,截至 2022 年底,BOF 是印度粗鋼生產最受歡迎的製程路線,產量約 5,743 萬噸(佔粗鋼總量的 46%),比 2021 年成長 8.35%。

- 在預測期內,大多數 BOF 工廠將安裝在印度。例如,塔塔鋼鐵 BSL 有限公司計劃在 2024 會計年度在其位於奧裡薩邦的 Meramandali 工廠增加 607 萬噸的 BOF 產能,在其位於 Kalinganagar 工廠增加 300 萬噸的 BOF 產能。此外,印度還有另外5,000萬噸的潛在總生產量。

- 因此,考慮到印度高爐-鹼性氧氣轉爐 (BF-BOF) 技術的成長趨勢,BF-BOF 技術很可能會佔據市場主導地位。因此,預計預測期內鋼鐵需求將會成長。

建築和建築業佔據市場主導地位

- 鋼是一種人造合金,屬於鐵基金屬。它含有鐵(地球上天然存在的金屬元素)、碳和其他成分。建築業是鋼材廣泛應用的領域,因為鋼材具有很高的耐用性和強度,因此建築結構都是用鋼材製造的。鋼骨可以抵禦自然災害,並可根據特定計劃的需要進行客製化。

- 屋頂、檁條、內牆、天花板、覆層和外部隔熱板等產品均由鋼製成。鋼材也用於建築的許多非結構應用,例如暖氣和冷氣系統以及室內管道。

- 從住宅到停車場、高層建築,各種建築都依賴鋼材來確保強度。鋼材也用於屋頂和外牆覆層。扶手、架子和樓梯等內部固定裝置也由鋼製成。鋼骨為建築物提供了堅固、剛性的框架。

- 根據國家投資促進與便利局預測,2022-23年建築業將佔GDP的9%左右。該行業就業人數接近5,100萬人。受住宅和非住宅領域成長的推動,預計到 2025 年該數字還將達到 1.4 兆美元。

- 據印度工業聯合會 (CII) 稱,預計 2022 年印度的住宅需求將強勁,其中前七大城市為:德里國家首都轄區、班加羅爾、海得拉巴、孟買、普納、清奈和加爾各答。新增住宅約 402,000 套,比 2021 年成長 44%。 2023 年第一季(Q1)排名前七位的城市的住宅銷售量為 114,000 套,比 2022 年增加了 99,500 多套。

- 政府社會部門計劃,例如旨在促進全民住宅的Pradhan Mantri Awas Yojna、薩達爾·帕特爾城市住宅計劃、100 個智慧城市任務以及中小城市的基礎設施建設,正在促進印度鋼鐵行業的發展。

- 印度政府正致力於基礎建設以促進經濟成長。 2022-23 年,政府已撥款約 6,4573 億印度盧比(77.7356 億美元)用於新道路和橋樑的基礎設施建設。該部已撥款 260 億印度盧比(3.13 億美元)用於中央維斯塔計劃下非住宅辦公大樓的建設。此外,國家基礎設施管道(NIP)擁有價值 108 兆印度盧比(1.3 兆美元)的基礎設施計劃,處於不同的實施階段。

- 因此,考慮到印度建築業的成長趨勢,建築業很可能佔據市場主導地位。因此,預計預測期內鋼鐵需求將會上升。

印度鋼鐵業概況

印度鋼鐵市場部分分散。主要企業(不分先後順序)包括 JSW STEEL LIMITED、TATA STEEL、印度鋼鐵管理局有限公司 (SAIL)、AM/NS INDIA 和 JINDAL STEEL & POWER LIMITED。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 印度政府強而有力的政策支持

- 鋼鐵業大力投資

- 都市化加快,基礎計劃支出增加

- 限制因素

- 人均鋼鐵消費量低

- 生產成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 基本形式

- 粗鋼

- 最終形態

- 成品鋼

- 製造技術

- 高爐-氧氣頂吹轉爐(BF-BOF)

- 電弧爐(EAF)

- 其他

- 最終用戶產業

- 汽車和運輸

- 建築與施工

- 工具和機械

- 能源

- 消費品

- 其他終端用戶產業(石油和天然氣開採設備、家具、管道、桶、鼓、包裝、半導體)

第6章競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- AM/NS India

- Jindal Stainless LIMITED

- JINDAL STEEL & POWER LIMITED

- JSW STEEL LIMITED

- NMDC Steel Limited

- RASHTRIYA ISPAT NIGAM LIMITED

- Steel Authority of India Limited(SAIL)

- TATA STEEL

- Vedanta Limited

第7章 市場機會與未來趨勢

- 循環經濟的成長趨勢

簡介目錄

Product Code: 93661

The India Steel Market size is estimated at 148.28 million tons in 2025, and is expected to reach 230.03 million tons by 2030, at a CAGR of 9.18% during the forecast period (2025-2030).

Key Highlights

- Steel consumption across industries in India, including automotive and transportation, building and construction, and others, was restricted owing to the COVID-19 pandemic. However, the Indian steel market witnessed a strong recovery with the smooth functioning of the end-user industries in curbing the spread of the virus. Currently, the steel market recovered from the pandemic and is expanding significantly.

- Over the short term, strong policy support by the Indian Government, the strong influx of investments in the steel sector, increasing urbanization, and increased spending on construction and infrastructure projects are projected to drive the market during the forecast period.

- However, due to low per capita steel consumption and high production costs, the profit margin significantly decreased for steel manufacturers in India. The price fluctuation caused huge losses to importers, which hampered the growth of the Indian steel market.

- Nevertheless, using hydrogen instead of carbon in steel manufacturing and increasing trade and investment opportunities in the future for the market studied are likely to create lucrative growth over the forecast period.

India Steel Market Trends

Blast Furnace-Basic Oxygen Furnace (BF-BOF) Technology to Dominate the Market

- The BF-BOF route is a two-stage process: Ironmaking: Iron ore, coke, and limestone are charged into a blast furnace. The iron ore is smelted to produce molten pig iron. Second, it is Steelmaking: Molten pig iron is charged into a basic oxygen furnace (BOF). Coal is used as the primary carbon-bearing material for steelmaking. It generates high temperatures necessary to smelt the iron ore and convert it into liquid iron. This liquid iron enters the converter, where oxygen is blown through the molten iron to remove carbon and other impurities.

- The resulting steel is cast into ingots or slabs and processed into long products like bars, wire, or flat steel strips in several rolling operations. To enhance the characteristics and functions of steel, tempering or coating applications are also done when required.

- Blast furnaces can produce up to 10,000 tons of molten pig iron daily. Then, BOFs can produce up to 300 tons of steel per heat.

- A basic oxygen furnace (BOF) was the most preferred process route for the production of crude steel in India. It accounts for over 90% of the country's steel output. At the end of 2022, BOF technology accounted for 46% of the production.

- In India, 68% of steel is made through the Blast Furnace route in which coking coal is the primary reductant. At the same time, Pulverised Coal Injection (PCI) or Natural Gas can be used as an auxiliary reductant. Green Hydrogen to replace PCI in the BF-BOF route is under development.

- According to the Ministry of Steel of India, BOF was the most preferred process route to produce crude steel in India at the end of 2022, with around 57.43 million tons (46% of total crude steel) produced, which was 8.35% higher than in 2021.

- Most BOF plant installations will occur in India in the forecast period. For instance, Tata Steel BSL Ltd. plans to add 6.07 MMT of BOF capacity at the Meramandali works and 3.0 MMT of BOF capacity at the Kalinganagar works in Odisha state by FY 2024. Moreover, India holds an additional 50.0 MMT potential gross capacity.

- Therefore, considering the growth trends of blast furnace-basic oxygen furnace (BF-BOF) technology in India, the BF-BOF technology is likely to dominate the market. It, in turn, is expected to enhance the demand for steel during the forecast period.

Building and Construction Industry to Dominate the Market

- Steel is a man-made alloy that falls within the ferrous metal classification. It contains iron (a naturally occurring metal element on earth), carbon, and other components. Construction is a sector where steel is widely used since structures are created using it due to its high durability and strength. Steel structures can also withstand natural calamities and be tailored to the needs of a specific project.

- Products, such as roofing, purlins, internal walls, ceilings, cladding, and insulating panels for exterior walls, are made of steel. Steel is also found in many non-structural applications in buildings, such as heating and cooling equipment and interior ducting.

- Buildings from houses to car parks, schools, and skyscrapers all rely on steel for strength. Steel is also used on roofs and as cladding for exterior walls. Internal fixtures and fittings, such as rails, shelving, and stairs, are also made of steel. It provides a robust and stiff frame to the building.

- According to the National Investment Promotion and Facilitation Agency, the building and construction industry accounted for nearly 9% of the GDP in FY 2022-23. Nearly 51 million people are employed in the industry. Moreover, The industry is expected to reach USD 1.4 trillion by 2025 owing to rising residential and non-residential sectors in the country.

- According to the Confederation of Indian Industry (CII), housing construction in the country witnessed strong demand in 2022, with the top seven cities (Delhi NCR, Bangalore, Hyderabad, Mumbai, Pune, Chennai, and Kolkata). It added around 402 thousand units of new home construction, which was 44% higher than in 2021. In the first quarter (Q1) of 2023, housing sales in the top seven cities stood at 1.14 lakh units, an increase of over 99,500 units compared to 2022.

- Government social sector programs such as the Pradhan Mantri Awas Yojna, which promotes housing for all, the Sardar Patel Urban Housing Project, the 100 Smart Cities Mission, and the construction of infrastructure in medium and small towns are promoting the growth of the Indian steel industry.

- The Government of India strongly focuses on infrastructure development to boost economic growth. In 2022-23, the government allocated around INR 64,573 crore (USD 7,773.56 Million) for developing new roads and bridge infrastructure. The ministry issued INR 2,600 crore (USD 313 Million) to construct non-residential office buildings under the Central Vista Project. Moreover, under the National Infrastructure Pipeline (NIP), infrastructure projects worth INR 108 trillion (USD 1.3 trillion) are at different stages of implementation.

- Therefore, considering the growth trends of building and construction in India, the building and construction industry is likely to dominate the market. It, in turn, is expected to enhance the demand for steel during the forecast period.

India Steel Industry Overview

The Indian steel market is partially fragmented in nature. The major players (not in any particular order) include JSW STEEL LIMITED, TATA STEEL, Steel Authority of India Limited (SAIL), AM/NS INDIA, and JINDAL STEEL & POWER LIMITED, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Policy Support by the Indian Government

- 4.1.2 Strong Influx of Investments in the Steel Sector

- 4.1.3 Increasing Urbanization and Increased Spending on Construction and Infrastructure Projects

- 4.2 Restraints

- 4.2.1 Low Percapita Steel Consumption

- 4.2.2 High Production Costs

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Basic Form

- 5.1.1 Crude Steel

- 5.2 Final Form

- 5.2.1 Finished Steel

- 5.3 Technology

- 5.3.1 Blast Furnace-basic Oxygen Furnace (BF-BOF)

- 5.3.2 Electric Arc Furnace (EAF)

- 5.3.3 Other Technologies

- 5.4 End User Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Building and Construction

- 5.4.3 Tools and Machinery

- 5.4.4 Energy

- 5.4.5 Consumer Goods

- 5.4.6 Other End-user Industries (Oil and Gas Extraction Equipment, Furniture, Pipes, Barrels, Drums, Packaging, Semiconductors)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AM/NS India

- 6.4.2 Jindal Stainless LIMITED

- 6.4.3 JINDAL STEEL & POWER LIMITED

- 6.4.4 JSW STEEL LIMITED

- 6.4.5 NMDC Steel Limited

- 6.4.6 RASHTRIYA ISPAT NIGAM LIMITED

- 6.4.7 Steel Authority of India Limited (SAIL)

- 6.4.8 TATA STEEL

- 6.4.9 Vedanta Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trend of Circular Economy

02-2729-4219

+886-2-2729-4219