|

市場調查報告書

商品編碼

1693720

瓶蓋機械:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Bottle-Capping Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

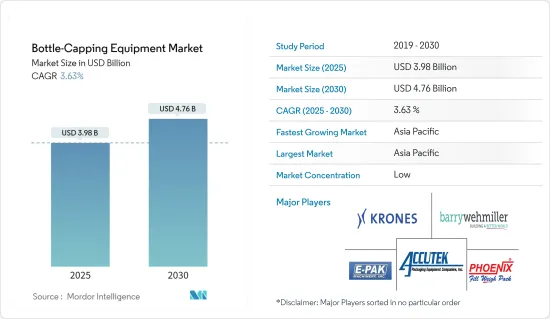

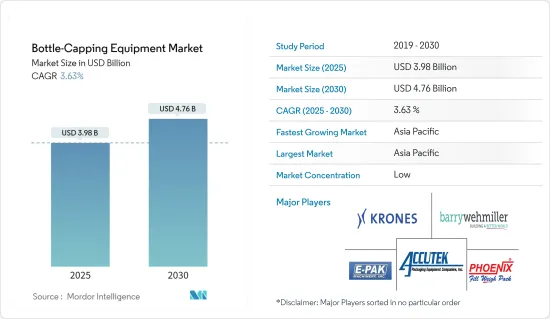

預計 2025 年瓶蓋設備市場規模為 39.8 億美元,到 2030 年將達到 47.6 億美元,預測期內(2025-2030 年)的複合年成長率為 3.63%。

關鍵亮點

- 瓶蓋封蓋機在裝瓶自動化中起著至關重要的作用,確保瓶蓋準確可靠地封蓋。各個終端產業對安全瓶蓋的需求推動了對這種設備的需求。

- 適用於各種瓶子尺寸和類型的封蓋設備現在通常採用就地清洗 (CIP) 技術。此功能在食品加工和製藥領域很受歡迎,可以對機器進行消毒以防止污染。全自動 CIP 技術顯著減少了人為接觸,這是主要的污染風險。此類技術創新將在未來幾年增強市場。

- 瓶蓋機主要用於製藥、食品飲料和化學工業,可確保包裝過程中瓶子可靠密封。這些機器不僅增強了製造程序,而且還優先考慮品質和衛生,從而刺激了需求。

- 隨著快速消費品飲料和藥品需求的增加,製造商正在提高其生產線的速度。因此,人們越來越需要能夠快速封瓶且不影響容量和重量準確性的封蓋機。

- 可以處理各種瓶子(包括塑膠瓶、玻璃瓶和金屬瓶)的封蓋機。近年來,由於可支配收入的增加和消費者健康意識的增強,對加工食品的需求激增。這一趨勢正在刺激食品和飲料行業的成長,進一步增加對瓶蓋設備的需求。

- 建立包裝產業需要大量的資本投入,主要是因為設備成本高。因此,高昂的維護成本是一項挑戰,阻礙了瓶蓋設備市場的成長。

瓶蓋設備市場趨勢

製藥和化學工業推動對先進瓶蓋解決方案的需求

- 製藥和化學領域對防竄改瓶蓋的需求正在迅速成長。越來越多的公司開始尋求能夠延長保存期限的產品。隨著製造商運送的產品越來越多,迫切需要能夠承受運輸挑戰並在各種環境條件下保持完整性的包裝。

- 瓶蓋不僅可以防止污染,還符合藥品包裝的嚴格國際安全標準。瓶蓋設備能力的不斷發展推動了市場的成長。

- Adinath International 2023 年的一項研究強調了瓶蓋在藥品安全中的重要性。蓋子起到屏蔽的作用,保護元素的純度免受環境污染物的侵害。現代封蓋設備的市場接受度凸顯了該產業對安全包裝的承諾。

- 製藥公司考慮到成分的敏感性,更喜歡使用正確封蓋的無菌瓶。為了確保產品安全,這些公司正在採用先進的瓶蓋工藝,許多市場參與企業提供特殊機制來提高產品品質。

- 2024年6月,Shemesh Automation慶祝了其旗艦產品Attilus連續封蓋機上市兩週年。 Attilus 擁有整合的機器人技術和尖端的視覺系統,確保自動瓶蓋、幫浦和扳機分類具有無與倫比的靈活性、更快的速度和卓越的準確性。只需按一下按鈕即可切換瓶蓋類型,無需額外的格式部件,大大減少停機時間並節省大量成本。

- 根據歐洲化學工業理事會(Cefic)的數據,2024年上半年全球化學品產量與2023年相比成長了6.1%(載於2024年10月《化學月報》(CMR))。亞洲在化學品銷售方面領先世界,其次是歐洲和北美。在美國,化學工業正處於變革時期期,在產品組合重組、供應鏈重組和材料創新方面處於領先地位。這項重大變化主要是為了滿足不斷變化的客戶需求,影響從產品供應到原料選擇等各個方面。由於這些技術進步,製造商已經開始安裝更快、更有效率的瓶蓋機。

重點產業需求成長推動亞太瓶蓋設備市場成長

- 隨著終端用戶產業擴大其製造設施以及製藥公司增加其需求,亞太瓶蓋設備市場預計將在預測期內實現成長。

- 印度是全球牛奶生產大國,隨著消費者興趣的不斷成長,該國瓶裝乳製品供應量正在激增。這一趨勢促使乳製品供應商在全國各地投資瓶子製造廠,增加了對瓶蓋設備的需求。

- 隨著生產能力的提高,瓶蓋設備市場的供應商擴大迎合化學和化肥領域的需求。例如,2024年11月,國營企業國家化肥有限公司(NFL)宣布計劃在其Nangal工廠生產奈米尿素,該工廠將使用先進的奈米技術每天生產1.5公升500毫升的奈米尿素。這些舉措加上化學、製藥和乳製品產業不斷成長的需求,預計將推動印度市場的成長。

- 受食品、飲料和製藥業對創新解決方案的需求激增的推動,日本的瓶蓋設備市場呈現穩定成長的趨勢。自動化程度的提高、主要供應商的存在以及對技術創新的持續追求進一步激發了日本市場的活力。

- 隨著當地永續性措施的實施,終端用戶產業正在推出創新的飲料包裝。再加上人們對瓶裝飲料(從水、果汁到碳酸飲料)的日益偏好,刺激了該地區的市場擴張。

瓶蓋機產業概況

瓶蓋設備市場由 Barry-Wehmiller Group, Inc.、E-PAK Machinery Inc.、Tetra Pak International SA(利樂拉伐集團)、Accutek Packaging Equipment Companies Inc.、Phoenix Dison Tec LLC 和 Krones AG 等公司主導,這些公司提供各種類型的機器,為客戶提供最佳體驗,並在廣告上投入巨資。

- 2024 年 9 月,Barry Wehmiller 集團推出了BW Filling & Closing。新部門整合了其現有灌裝和封口業務、Pneumatic Scale Angelus 和 Synerlink 的優勢。新成立的營業單位旨在無縫整合其前身組織的產品和服務。此外,該公司還將加強對客戶的全球支援和服務,確保他們能夠繼續提供他們期望的高品質產品。

- 2024 年 7 月,ProMach Inc. 在歐洲市場邁出了重要一步,擴建了其專門生產瓶蓋和瓶蓋加工設備的 Zalkin 製造工廠。此次擴張旨在提高生產能力、縮短前置作業時間並進一步促進公司的成長軌跡。 ProMach 對歐洲包裝市場的承諾是明確的,此次擴張是一系列投資中的最新一次。過去三年來,該公司收購了西班牙和義大利的多家公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業生態系統分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 地緣政治情境對產業的影響評估

- 定價分析

- 進出口分析

第5章市場動態

- 市場促進因素

- 製藥和化工產業的需求不斷成長

- 技術創新推動自動封蓋機需求

- 市場限制

- 存在替代解決方案且初始投資較高

第6章市場區隔

- 依技術

- 自動的

- 半自動

- 按瓶蓋類型

- ROPP帽

- 螺旋蓋

- 卡扣式蓋

- 軟木塞

- 按最終用戶

- 製藥

- 個人護理和化妝品

- 飲食

- 化學品

- 車

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 墨西哥

- 巴西

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章競爭格局

- 公司簡介

- E-PAK Machinery Inc.

- Accutek Packaging Equipment Companies Inc.

- Barry-Wehmiller Group, Inc.

- Phoenix Dison Tec LLC

- Krones AG

- LPE(Levapack)

- Closure Systems International Inc(CSI)

- Ronchi Mario SpA

- Likai Technology Co., Ltd.

- ProMach Inc.

- Marchesini Group SpA

第8章投資分析

第9章:市場的未來

The Bottle-Capping Equipment Market size is estimated at USD 3.98 billion in 2025, and is expected to reach USD 4.76 billion by 2030, at a CAGR of 3.63% during the forecast period (2025-2030).

Key Highlights

- Bottle-capping equipment plays a pivotal role in bottling automation, ensuring caps are applied accurately and securely. Various end-use industries' demand for secure bottle closures drives the need for this equipment.

- Capping machines, tailored for diverse bottle sizes and types, now often incorporate Clean-in-Place (CIP) technology. This feature, prevalent in food processing and pharmaceuticals, sanitizes the machine to prevent contamination. Fully automated, CIP technology significantly reduces human contact, a major contamination risk. Such innovations are poised to bolster the market in the coming years.

- Primarily utilized in the pharmaceutical, food & beverage, and chemical sectors, bottle-capping machines ensure bottles are securely sealed during packaging. These machines not only enhance the manufacturing process but also prioritize quality and sanitization, fueling their demand.

- As the need for fast-moving beverages and pharmaceuticals grows, manufacturers are ramping up production line speeds. This surge amplifies the need for bottle-capping equipment, ensuring swift sealing without compromising volumetric and weight accuracy.

- Whether for plastic, glass, or metal, bottle-capping machines cater to a variety of bottles. Recent years have seen a surge in demand for processed foods, driven by rising disposable incomes and health-conscious consumers. This trend has spurred growth in the food and beverage sector, further amplifying the demand for bottle-capping equipment.

- Establishing a packaging industry demands hefty capital investments, primarily due to high equipment costs. Consequently, the substantial maintenance expenses of the setup pose a challenge, hindering the growth of the bottle-capping equipment market.

Bottle-Capping Equipment Market Trends

Pharmaceutical and Chemical Industries Drive Demand for Advanced Bottle-Capping Solutions

- Demand for tamper-evident caps is surging in the pharmaceutical and chemical sectors, driven by the need for child-resistant and contamination-free packaging. Companies are increasingly seeking products that promise an extended shelf life. As manufacturers ramp up product shipments, there's a pressing need for packaging designed to endure transport challenges and maintain integrity across varied environmental conditions.

- Bottle capping not only prevents contamination but also aligns with the stringent international safety standards governing pharmaceutical packaging. The evolving features of bottle-capping equipment are set to propel market growth.

- A 2023 survey by Adinath International highlighted the paramount importance of bottle caps in pharmaceutical product safety. Acting as a shield, the cap safeguards elemental purity from environmental contaminants. The market's embrace of modern capping machines underscores the industry's commitment to safe packaging.

- Given the sensitivity of their ingredients, pharmaceutical companies prioritize properly capped sterilized bottles. To uphold product safety, these companies are turning to advanced bottle capping processes, with many market players offering specialized mechanisms to enhance product quality.

- In June 2024, Shemesh Automation celebrated the second anniversary of Attilus, its flagship continuous motion capping machine. Attilus boasts integrated robotics and a cutting-edge vision system, promising unparalleled flexibility, heightened speeds, and superior accuracy in sorting automatic caps, pumps, and triggers. With a simple button press, users can switch cap types, eliminating the need for additional format parts and significantly cutting down downtime, translating to substantial cost savings.

- According to data from Cefic, the European Chemical Industry Council, global chemical production rose by 6.1% in the first half of 2024 compared to 2023, as reported in the October 2024 edition of their Chemical Monthly Report (CMR). Asia leads the world in chemical sales, trailed by Europe and North America. In the United States, the chemical industry is undergoing a transformation, reshaping portfolios, reimagining supply chains, and pioneering material innovations. This significant shift is largely a response to evolving customer demands, influencing everything from product offerings to raw material selection. As a result of these innovations, manufacturers have commenced the deployment of faster and more efficient bottle-capping machines.

Rising Demand Across Key Industries Drives Growth in Asia Pacific Bottle-Capping Equipment Market

- As end-user industries expand their manufacturing facilities and pharmaceutical companies ramp up demand, the bottle-capping equipment market in the Asia Pacific is poised for growth during the forecast period.

- India, a global leader in milk production, is witnessing a surge in bottled dairy offerings, due to heightened consumer interest. This trend has prompted dairy vendors to invest in bottle-making plants across the country, bolstering the demand for bottle-capping equipment.

- With a boost in production capacity, vendors in the bottle-capping equipment market are increasingly catering to the chemical and fertilizer sectors. For instance, in November 2024, National Fertilizers Limited (NFL), a government enterprise, unveiled plans to produce nano urea at its Nangal plant, churning out 1.5 lakh bottles of 500 ml nano urea daily, leveraging advanced nanotechnology. Such initiatives, coupled with rising demand from the chemical, pharmaceutical, and dairy industries, are set to propel market growth in India.

- Japan's bottle-capping equipment market is on a steady growth trajectory, driven by a surge in demand for innovative solutions in the food, beverage, and pharmaceutical sectors. The country's market is further buoyed by increasing automation, a strong presence of leading vendors, and their relentless pursuit of innovation.

- In line with regional sustainability initiatives, end-user industries are rolling out innovative beverage packaging. This, combined with a rising appetite for bottled beverages-ranging from water and juices to carbonated drinks-is fueling the market's expansion in the region.

Bottle-Capping Equipment Industry Overview

The bottle-capping equipment market is fragemented with companies such as Barry-Wehmiller Group, Inc., E-PAK Machinery Inc., Tetra Pak International SA (Tetra Laval Group), Accutek Packaging Equipment Companies Inc., Phoenix Dison Tec LLC, and Krones AG offer the various types of machines, delivering the best experience to their customers and spending high on advertising.

- September 2024: Barry-Wehmiller Group, Inc. has launched BW Filling & Closing, a new division that consolidates the strengths of its legacy filling and closing businesses, Pneumatic Scale Angelus and Synerlink. This newly formed entity aims to seamlessly integrate the products and services of its predecessor organizations. Additionally, it is committed to enhancing global support and services for its customers, ensuring they continue to receive the high-quality products they've come to expect.

- July 2024: ProMach Inc. has made a significant move in the European market by expanding Zalkin's manufacturing facility, which specializes in capping and cap handling equipment. This expansion aims to boost production capacity, shorten lead times, and propel the company's growth trajectory. ProMach's commitment to the European packaging market is evident, with this facility expansion being the latest in a series of investments. Over the past three years, the company has also acquired several firms across Spain and Italy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Eco-system Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of Geopolitical Scenario on the Industry

- 4.5 Pricing Analysis

- 4.6 Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand from Pharmaceutical and Chemical Industries

- 5.1.2 Innovations in Technology Driving the Demand for Automated Capping Machines

- 5.2 Market Restraints

- 5.2.1 Presence of Alternative Solutions and High Initial Investments

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic

- 6.1.2 Semi-automatic

- 6.2 By Cap Type

- 6.2.1 ROPP Caps

- 6.2.2 Screw Caps

- 6.2.3 Snap-on-Caps

- 6.2.4 Corks

- 6.3 By End User

- 6.3.1 Pharmaceuticals

- 6.3.2 Personal Care and Cosmetics

- 6.3.3 Food and Beverage

- 6.3.4 Chemicals

- 6.3.5 Automotive

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.4 Australia & New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Mexico

- 6.4.5.2 Brazil

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 E-PAK Machinery Inc.

- 7.1.2 Accutek Packaging Equipment Companies Inc.

- 7.1.3 Barry-Wehmiller Group, Inc.

- 7.1.4 Phoenix Dison Tec LLC

- 7.1.5 Krones AG

- 7.1.6 LPE(Levapack)

- 7.1.7 Closure Systems International Inc (CSI)

- 7.1.8 Ronchi Mario S.p.A.

- 7.1.9 Likai Technology Co., Ltd.

- 7.1.10 ProMach Inc.

- 7.1.11 Marchesini Group S.p.A.