|

市場調查報告書

商品編碼

1693701

教育安全:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Education Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

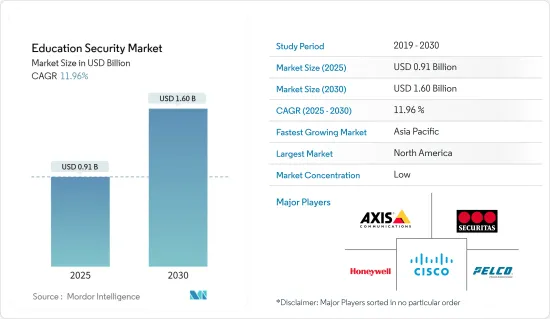

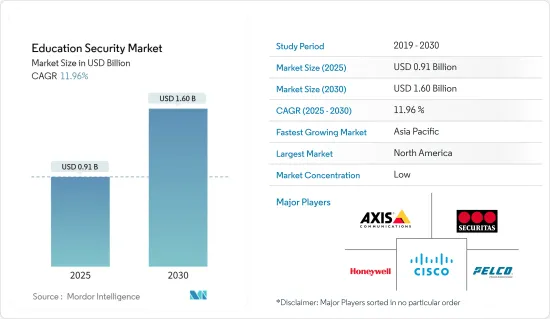

預計2025年教育安全市場規模為9.1億美元,2030年將達16億美元,預測期間(2025-2030年)的複合年成長率為11.96%。

安全系統旨在保護學生和教師免受疾病、火災、騷擾、盜竊、攻擊以及內部和外部攻擊。需要更多的安全支出來發展教育設施的技術創新。視訊監控系統以實惠的價格提供即時資訊。如果發生重大安全事件,這些解決方案將向最近的警察部門發出警報,以保護學生和教職員工並處理日常紀律問題。

各國教育設施結構有顯著差異,影響預防和介入暴力的方法和支持。在開發中國家、貧窮低度開發國家之間,學生和教師的學習程度、教育品質、教師支援和基礎設施也存在顯著差異。此外,各種安全系統和服務推動教育安全市場的擴張。

此外,近年來,隨著人們越來越意識到學校、學院和大學採取強力的安全措施的必要性,教育產業也經歷了重大轉型。隨著安全成為重中之重,教育機構擴大採用先進的安全解決方案來保護學生、教職員工和財產。此外,政府支持力度的加強推動了教育安全的發展,基礎設施的不斷擴張可能會加強安全系統,並在預測期內為市場成長做出重大貢獻。

例如,2024年2月,喬治亞大學宣布了價值730萬美元的新校園安全措施。該計劃包括為警察局增加 20% 的預算,並提供更具競爭力的薪酬,以促進警員的招募和保留。該計劃還包括安裝更多的安全攝影機、照明設備、更多的盤式分析儀和藍光呼叫系統。

與公共監控相關的採購成本和隱私問題嚴格限制了教育安全市場的成長。市場只有採取平衡的措施才能克服這些挑戰。

疫情對市場產生了不利影響,全球多所教育機構關閉。然而,教育安全將在復甦時期發揮新的作用,後疫情時代對教育安全自動化解決方案的需求將會增加。分析認為,為擺脫 COVID-19 的影響,全球範圍內教育設施建設的增加將對預測期內的市場成長率產生正面影響。

教育安全市場趨勢

高等教育設施預計將大幅成長

身分存取管理和訪客管理系統的需求在高等教育園區日益成長,為市場成長創造了機會。

Identisys、Honeywell 和 Pelco Products Inc. 等供應商提供針對大專院校獨特需求的解決方案,加速了教育安全解決方案的市場採用。例如,教育安全解決方案供應商Identisys 為大學校園提供客製化的安全系統、簡化的識別流程、先進的存取控制、整合的訪客管理和行動憑證。

此外,市場供應商正在推出先進技術,例如行動憑證解決方案,使學生和教職員工能夠將他們的智慧型手機用作虛擬ID卡和存取金鑰,從而無需實體卡,並透過多因素身分驗證來增強安全性。

例如,阿米蒂大學已經實施了智慧卡、生物識別閱讀器、IP攝影機和火災警報系統的安全解決方案,顯示校園對教育安全解決方案的需求。此外,學生攜帶晶片智慧卡進入校園,並可以在咖啡簡餐店、書店等處將其用作電子錢包,從而減輕了校園、學生和教職員工的安全需求,從而推動了市場成長。

由於需要整合安全解決方案和開放原始碼平台來同時管理和更好地管理大學園區內安裝的所有物聯網設備,系統整合和管理服務正在推動高等教育領域的教育安全市場的發展。該服務為使用者提供單一儀表板解決方案來控制、監控和管理他們的安全需求,並且可以作為客戶管理或供應商管理。

高等教育領域的教育安全解決方案市場正在取得重大技術進步,透過整合人工智慧 (AI) 解決方案來管理和檢測安全風險,以支援市場的成長。

預計北美將佔據較大的市場佔有率

北美教育安全市場主要受到以下因素的推動:由於過去幾年校園槍擊事件增加、新的中小學和高等教育設施的建設、教育預算的增加以及該地區供應商推出的創新解決方案,安全需求不斷增加。此外,思科系統公司和霍尼韋爾安全集團等大公司已在該地區開展業務,進一步擴大了該地區的教育安全市場。

美國和加拿大是該地區校園和學校安全市場成長最快的國家。主要原因是教育設施建設成本飆升以及監視錄影機需求不斷成長,導致教育安全支出增加。全國各學校和高等教育機構正在投入巨額資金升級安全措施。這推動了該地區教育安全市場的成長。

例如,2024年1月,賓州的學校有資格獲得1.55億美元的安全保障資金,其中9,000萬美元專門用於對心理健康顧問和資源的新投資。學校安全資金是州長喬許夏皮羅 (Josh Shapiro) 的首要任務,並被納入 2023-24 學年的州預算。學校安全和保障資金由賓州 CDD 委員會 (PCCD) 透過學校安全和保障 (SS&S) 委員會提供。 PCCD核准了一項資金籌措框架,該框架將允許學校利用超過 1.55 億美元的聯邦和州資金進行各種投資。

此外,該地區正在進行的基礎設施開發和建設活動預計將為採用安全解決方案保護新建教育設施創造成長機會。例如,2024 年 2 月,AUCSO 宣布與 ISARR(客製化風險、彈性和安全管理解決方案)合作,為成員學校收集關鍵基準數據。此次夥伴關係建立在 ISARR 和 AUCSO 現有關係的基礎上(ISARR 在過去四年中一直是 AUCSO 的主要支持者)。

此外,隨著對實體安全系統的日益關注,教育機構必須實施學校和大學校園安全解決方案,以阻止授權人員進入校園,並將未經授權的個人拒之門外。該國教育部門正在大力投資升級教育機構的視訊監控、門禁和門鎖系統。

因此,分析認為,由於產品推出量不斷增加、政府和教育部門對學校安全津貼不斷增加以及全部區域教育設施建設不斷增加,北美市場在教育安全市場中佔據了很大佔有率。

教育安防市場概況

教育安全市場的主要企業包括思科系統公司、霍尼韋爾國際公司、安訊士公司和 Genetec 公司。這些市場領導透過實施各種策略來增強功能,成功地在競爭中脫穎而出。這些策略包括提供遠端存取、無線功能、策略夥伴關係(提供額外服務、福利、產品捆綁和分銷)以及更大的折扣。因此,這些供應商在市場上的產品有顯著的差異化。

您的品牌形象的強度與您在市場上的影響力密切相關。由於成熟品牌是高性能的代名詞,預計老牌公司將能夠保持其競爭優勢。憑藉廣泛的市場覆蓋範圍和提供先進產品的能力,該領域的競爭對手之間的競爭預計將持續激烈。

2024年2月,OmnilERT推出第三代AI視覺槍枝檢測系統。此尖端系統採用了尖端創新技術,旨在透過 Omnilert 的視覺槍支檢測解決方案將行業提升到新的水平。 Omnilert Gun Detect 作為唯一提供檢測、檢驗、啟動和通知組合的解決方案,目前為數十萬所學校、大學、醫院園區、零售和商業機構以及其他機構設施和園區提供安全保障。

2024 年 4 月博世槍支檢測系統採用結合視訊和音訊 AI 的多層方法來檢測學校入口處的槍支。如果有人攜帶槍支進入學校入口,該系統的兩個配備 IVA PRO 可視槍支檢測功能的 Flexidome 攝影機會立即通知學校官員。如果看不到槍,第二台 Flexidome Panoramic 5100i 攝影機配備智慧音訊分析功能,可偵測和分類槍聲並準確預測其方向。基於近紅外線攝影機的系統提高了安全性,同時提供了支援學習的順暢流程和舒適的環境。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 疫情對市場的影響

第5章市場動態

- 市場促進因素

- 即時監控需求日益成長

- 對經濟高效的安全解決方案和關鍵基礎設施維護的需求不斷增加

- 市場限制

- 安全解決方案的採購成本和與公共監控相關的隱私問題將影響市場成長

第6章市場區隔

- 按服務

- 安全

- 就業前篩檢

- 安全諮詢

- 系統整合與管理

- 警報監控服務

- 其他私人保全服務

- 按設施

- 中小學教育設施

- 高等教育設施

- 其他教育設施

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Cisco Systems Inc.

- Honeywell International Inc

- Pelco Inc.(Motorola Solutions Inc.)

- Securitas Technology(Securitas AB)

- Axis Communications AB

- Genetec Inc.

- Verkada Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd

- Silverseal Corporation

- Bosch Sicherheitssysteme GmbH(Robert Bosch GMBH)

- SEICO Inc.

- AV Costar

- Kisi Incorporated

- Siemens AG

第8章投資分析

第9章:未來市場展望

The Education Security Market size is estimated at USD 0.91 billion in 2025, and is expected to reach USD 1.60 billion by 2030, at a CAGR of 11.96% during the forecast period (2025-2030).

Security systems are designed to protect students and teachers from diseases, fires, harassment, theft, aggression, and attacks from internal and external forces. More security spending is needed to develop technology innovation in education facilities. Video surveillance systems are affordable and provide real-time information. In case of significant security incidents, these solutions alert the nearer law enforcement offices to protect students and staff and handle routine discipline issues.

Significant differences in the structure of educational establishments in different countries affect the approach and support for violence prevention and intervention. Substantial differences also exist in the level of student and teacher learning standards, quality of teaching, support for teachers, and infrastructure across countries with development, poverty, or underdeveloped status. Moreover, the increase in the market for education safety is driven by a variety of security systems and services.

Moreover, the education sector has witnessed a significant transformation in recent years, driven by the increased awareness of the need for robust security measures in schools, colleges, and universities. With safety becoming a top priority, educational institutions increasingly use advanced security solutions to protect students, staff, and property. In addition, the growing government aid to boost education security growth and the increasing expansion of infrastructure are set to strengthen the security systems and significantly contribute to the market's growth during the forecast period.

For instance, in February 2024, the University of Georgia announced new campus security measures worth USD 7.3 million. The package includes a 20% budget increase for the police department to increase officer recruitment and retention through more competitive salaries. The package also includes additional security cameras and lighting, additional license plate readers, and the implementation of a Blue Light Call System.

Procurement costs and privacy concerns related to public surveillance significantly restrain the growth of the Education Security Market. The market is expected to overcome these challenges only by implementing a well-balanced approach.

The pandemic had a negative impact on the market, with several education institutions shut down globally. However, in the recovery, education security served additional purposes, and in the post-COVID-19 environment, the demand for automated solutions in education security has risen. The growing construction of education facilities globally to recover from the impact of COVID-19 is analyzed to positively impact the market growth rate during the forecast period.

Education Security Market Trends

Higher Education Facilities are Expected to Witness Major Growth

The need for identity access management and visitor management systems, among others, is gaining traction in higher education campuses, creating market growth opportunities.

Market vendors, such as Identisys, Honeywell, and Pelco Products Inc., provide customized solutions to universities and colleges designed for their unique needs, driving the market adoption of education security solutions. For instance, IdentiSys, an education security solution provider, offers customized security systems, streamlined identification processes, advanced access control, integrated visitor management, and mobile credentials for university campuses.

Additionally, market vendors are introducing advanced technologies, such as mobile credential solutions to allow students and staff to use their smartphones for virtual ID cards and access keys, eliminating the need for physical cards and enhancing security through multi-factor authentication, driving the market growth of educational security solutions in higher educational institutions due to its ease in providing digital access control system.

For instance, Amity University implemented security solutions through smart cards, biometric readers, IP cameras, and fire warning systems, which shows the need for education security solutions on campuses. Additionally, students carry a chip-enabled smart card to access the campus, which can be used as an e-wallet in the cafeteria, book shops, etc., easing the security needs of the campus, students, and staff and fueling the market growth.

System integration and management services are driving the educational security market in higher education departments due to the need for integrated security solutions and an open-source platform to simultaneously manage all the IoTs installed on university premises for better management. This service offers a single dashboard solution to the user to control, monitor, and manage their security needs, which can be customer-managed and vendor-managed.

The higher education sector's market for education security solutions has been registering significant technological advancement and integrating artificial intelligence (AI)-enabled solutions to manage and detect security risks, supporting market growth.

North America is Expected to Hold Significant Market Share

The education security market in North America is primarily driven by the increased demand for security owing to the increased shooting attacks in schools in the past few years, construction of new primary and higher education facilities, growth in the education budget coupled with innovative solutions launches by the market vendors operating in the region. Additionally, the region is home to some of the major players, such as Cisco Systems Inc. and Honeywell Security Group, which further expand the education security market in the region.

The United States and Canada have experienced the highest growth in the region's campus and school security market, primarily because of rising education security spending caused by high construction costs for educational facilities and increased demand for surveillance cameras. Various schools and higher education institutions in the country are upgrading their security measures by investing substantial funding. This, in turn, drives the growth of the education security market in the region.

For instance, in January 2024, Pennsylvania schools were entitled to USD 155 million in safety and security funds - USD 90 million of which is earmarked for new investments in mental health counselors and resources. School safety funding is a top priority for Governor Josh Shapiro and was included in the state budget for the 23-24 school year. The School Safety and Security funding is made available through the Pennsylvania Commission (PCCD) through the School Safety and Security (SS&S) Committee. PCCD has approved a funding framework that allows schools to leverage over USD 155 million dollars in federal and state funding for a variety of investments.

Furthermore, the region's ongoing infrastructure development and construction activities are expected to create growth opportunities for adopting security solutions for the security of newly constructed educational facilities. For instance, in February 2024, AUCSO announced a partnership with ISARR, A Customized Risk, Resilience and Security Management Solution, to collect critical benchmarking data for its members. This partnership builds on the existing relationship between ISARR and AUCSO (ISARR has been a major supporter of AUCSO over the past four years).

Further, with a greater focus on physical security systems, it's becoming vital that educational facilities implement school and college campus security solutions that can allow authorized individuals onto their sites and keep unauthorized individuals out. Education authorities in the country are investing heavily to expand educational institutions' video surveillance systems, access control systems, and door-locking systems.

Therefore, the North American market is analyzed to hold a significant share in the education security market owing to the growing product launches, increasing school security funding by the government and educational authorities, and growth in educational facilities construction across the region.

Education Security Market Overview

The Education Security market features key players such as Cisco Systems Inc., Honeywell International Inc., Axis Communications AB, and Genetec Inc. These market leaders have successfully set themselves apart by implementing various strategies to enhance functionality. These strategies include remote access, wireless capabilities, strategic partnerships (offering additional services, benefits, product bundling, and distribution), and providing deeper discounts. As a result, these vendors have significantly differentiated their offerings in the market.

The strength of their brand identity is closely tied to their influence in the market. Established brands are synonymous with high performance, so long-standing players are anticipated to maintain a competitive advantage. Due to their extensive market reach and capacity to offer advanced products, the competitive rivalry in this sector is expected to remain intense.

February 2024: OmnilERT launched its 3rd generation AI Visual Gun Detection System. This state-of-the-art system is packed with cutting-edge innovations designed to take the industry to the next level with Omnilert's visual gun detection solution. As the only solution to deliver the combination of Detection, Verification, Activation and Notification Omnilert Gun Detect now secures hundreds of thousands of school, college, and hospital campuses, as well as retail and commercial properties and other organizational facilities and campuses.

April 2024: Bosch's gun detection system combines video and audio AI with a multi-tiered approach to detect guns at school entrances. When someone brandishing a gun walks into a school's entrance, the system's two Flexidome cameras, equipped with IVA PRO visual gun detection, immediately notify school staff. If a gun isn't visible, the second layer, the Flexidome panorama 5100i camera, with intelligent audio analytics, detects and classifies the shot while accurately predicting the direction from which it came. The near-infrared camera-based system enhances safety while providing a smooth flow and welcoming environment to support learning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Real-time Surveillance

- 5.1.2 Growing Demand for Cost-effective security solutions and significant Infrastructure Developments

- 5.2 Market Restraints

- 5.2.1 The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Guarding

- 6.1.2 Pre-Employment Screening

- 6.1.3 Security Consulting

- 6.1.4 Systems Integration & Management

- 6.1.5 Alarm Monitoring Services

- 6.1.6 Other Private Security Services

- 6.2 By Facilities

- 6.2.1 Primary & Secondary Facilities

- 6.2.2 Higher Education Facilities

- 6.2.3 Other Educational Facilities

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Honeywell International Inc

- 7.1.3 Pelco Inc. (Motorola Solutions Inc.)

- 7.1.4 Securitas Technology (Securitas AB)

- 7.1.5 Axis Communications AB

- 7.1.6 Genetec Inc.

- 7.1.7 Verkada Inc.

- 7.1.8 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.9 Silverseal Corporation

- 7.1.10 Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- 7.1.11 SEICO Inc.

- 7.1.12 AV Costar

- 7.1.13 Kisi Incorporated

- 7.1.14 Siemens AG