|

市場調查報告書

商品編碼

1693699

北美包裝膠帶:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Packaging Tapes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

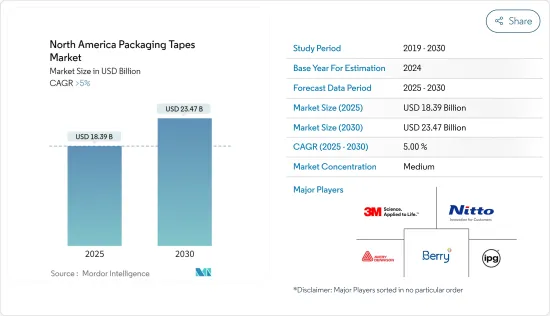

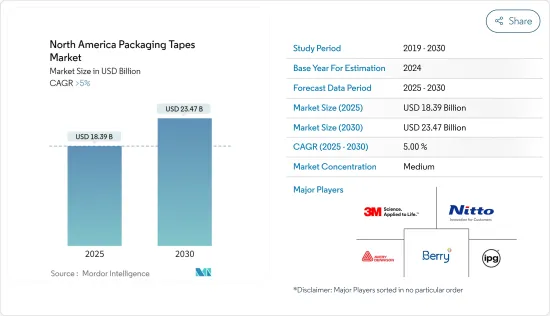

北美包裝膠帶市場規模預計在 2025 年為 183.9 億美元,預計到 2030 年將達到 234.7 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5%。

關鍵亮點

- 短期內,食品飲料和電子商務產業對包裝膠帶的需求不斷增加,以及製造業和工業領域對生產和分銷過程中捆綁、密封和固定各種產品的需求不斷增加,預計將在預測期內推動市場發展。

- 然而,政府關於塑膠使用的法規可能會對包裝膠帶市場的成長造成限制。

- 紙質和生物分解性包裝膠帶的需求正在成長,永續和可回收的包裝膠帶代表著未來的成長機會。

- 預計預測期內美國將主導北美包裝膠帶市場。

北美包裝膠帶市場趨勢

食品和飲料行業的需求不斷成長

- 根據與食品的直接和間接接觸,食品和飲料行業使用各種各樣的包裝膠帶。經 FDA 批准的食品包裝膠帶用於食品加工、製造和運輸。

- 在北美,隨著消費者尋求更快速的食物準備方式,包裝和保存食品的需求正在增加。網上購物的出現極大地推動了美國對包裝食品的需求。此外,人們對快餐和已調理食品的日益成長的偏好可能會進一步推動食品和飲料行業對包裝膠帶的需求。

- 世界各地營運的主要食品和飲料包裝製造商均遵循美國FDA 177.2600標準。此外,從事食品出口的跨國公司必須遵守歐盟(VO)1935/2004或中國GB 4806和GB 9685的規定,生產供全球消費的食品和飲料產品必須採用符合EHEDG(歐洲衛生工程與設計集團)衛生設計標準核准的優選包裝。

- 根據美國人口普查局的數據,2023 年美國零售食品和飲料機構的年銷售額將達到 9,853 億美元,與 2022 年的 9,615 億美元相比有所成長。

- 同樣,根據加拿大農業信貸銀行的數據,2023 年上半年食品和飲料銷售額保持穩定,與 2022 年同期相比,食品製造業成長 8.4%,飲料製造業成長 7.3%。

- 根據農業和農村發展部 (SADER) 的報告,到 2023 年,墨西哥的農產品貿易順差達到 9.55 億美元。 2023年1-2月,農業及農產品加工業出口達83億美元,較去年同期成長5.16%。到2023年7月,這數字將達到314億美元。

- 總體而言,預計預測期內北美食品和飲料市場的成長將推動包裝膠帶市場的發展。

美國主導市場

- 美國包裝膠帶產業在食品、零售、消費品和製藥等各行業都面臨積極的需求。

- 帶有公司標誌的防篡改和個人化包裝膠帶的需求量很大。製藥、電子商務和紡織公司擴大使用防篡改包裝來幫助減少仿冒品並確保產品的真實性。

- 2023年,美國食品和飲料零售額將達到每年約9,850億美元,較前一年穩定成長,是20年前的兩倍多。

- 根據美國全國紡織組織委員會(NCTO)的數據,2023年美國紡織品服裝出貨收益將達648億美元,美國在紡織研發方面居世界領先地位。該國的紡織品集團正在創造下一代紡織材料,如導電紡織品、防靜電紡織品、監測心率和生命徵象的電子紡織品、抗菌紡織品和救生衣。

- 支援紡織業生產的各種產品的銷售和分銷的電子商務平台的迅猛成長主要推動了對紡織相關產品的需求,從而促進了市場的成長。

- 此外,包裝膠帶對於零售業至關重要,可以在運輸過程中保護產品、密封和固定紙箱、透過印刷訊息增強品牌形象、協助庫存管理、透過防篡改選項提供安全性、促進線上零售包裝並有助於銷售點展示。

- 例如,根據美國人口普查局的數據,2023年美國零售總額價值為72,425.6億美元,與2022年的79,503億美元相比有所成長。

- 由於這些因素,預計該地區的包裝膠帶市場在預測期內將穩定成長。

北美包裝膠帶產業概況

北美包裝膠帶市場較為分散。市場的主要企業包括(不分先後順序)Intertape Polymer Group Inc.、3M Company、Berry Global Inc.、Avery Dennison Corporation、Nitto Denko、Mactac LLC 和 CCT Tapes。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 食品、飲料和電子商務產業的需求

- 其他促進因素

- 限制因素

- 政府關於塑膠使用的法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 材料類型

- 塑膠

- 紙

- 黏合劑類型

- 丙烯酸纖維

- 熱熔膠

- 橡膠底座

- 其他黏合劑類型

- 最終用戶產業

- 電子商務

- 食品飲料業

- 零售業

- 其他

- 地區

- 美國

- 加拿大

- 墨西哥

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M Company

- Avery Dennison Corporation

- Berry Global Inc.

- CCT Tapes

- Intertape Polymer Group

- Mactac, LLC

- Nitto Denko

- *List not Exhaustive

第7章 市場機會與未來趨勢

- 對紙質和生物分解性包裝類型的需求不斷增加

The North America Packaging Tapes Market size is estimated at USD 18.39 billion in 2025, and is expected to reach USD 23.47 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

Key Highlights

- In the short term, the demand for packaging tapes from the food, beverage, and e-commerce industries, along with the growing demand from the manufacturing and industrial sectors for bundling, sealing, and securing various products during production and distribution, is expected to drive the market during the forecast period.

- However, government regulations on plastic usage will act as a growth constraint for the packaging tapes market.

- Nevertheless, paper and biodegradable packaging tapes are growing in demand, and sustainable and recyclable packaging tapes will act as an opportunity for future growth.

- The United States is expected to dominate the North American packaging tapes market during the forecast period.

North America Packaging Tapes Market Trends

Growing Demand from the Food and Beverage Industry

- The food and beverage industry uses a wide range of packaging tapes depending upon direct and indirect contact with food. FDA-approved food-grade packaging tapes are used in food processing, production, and shipping.

- In North America, the demand for packaged and preserved food is upscaling as consumers across the region aim for fast ways to cook food. This emergence of e-shopping has dramatically fueled the demand for packaged foods in the United States. Moreover, a high preference for fast foods and ready-to-eat meals is further likely to increase the demand for packaging tapes used in the food and beverage industry.

- Primary food and beverage packaging manufacturers operating across the globe follow the American FDA 177.2600 standards. Moreover, multinational players engaged in exporting food products must comply with regulations set by the European Union (V.O.) 1935/2004 or the Chinese GB 4806 and GB 9685. Food and beverage products manufactured for global consumption must have preferred packaging approved by the Hygienic Design Standards of the EHEDG (European Hygienic Engineering and Design Group).

- According to the US Census Bureau, the annual sales of retail food and beverage stores in the United States amounted to USD 985.3 billion in 2023 and registered growth when compared to USD 961.5 billion in 2022.

- Similarly, according to Farm Credit Canada (agricultural term lender), the food and beverage sales figures for the initial half of 2023 remained stable, indicating an 8.4% growth in food manufacturing and a 7.3% increase in beverage manufacturing when compared to the corresponding period in 2022.

- At the turn of 2023, Mexico's agri-food merchandise trade balance recorded a surplus of USD 955 million, as reported by SADER (The Secretariat of Agriculture and Rural Development). From January to February 2023, the volume of agricultural and agri-industrial exports reached USD 8.3 billion, increasing by 5.16% Y-o-Y. By July 2023, the volume reached USD 31.4 billion.

- Overall, the growing food and beverage market in North America is expected to drive the packaging tapes market during the forecast period.

United States to Dominate the Market

- The United States packaging tapes industry has been experiencing a positive demand across various industries such as food, retail, consumer goods, and pharmaceuticals.

- Tamper-proof and personalized company-logo packaging tapes are in high demand. Pharmaceutical, e-commerce, and textile companies are increasingly using tamper-proof packaging, which helps reduce counterfeit goods and ensure the authenticity of the products.

- In 2023, the United States retail food and beverage sales totaled nearly USD 985 billion a year, a steady increase from the previous year and more than double the amount of two decades ago.

- According to data by NCTO (National Council of Textile Organization), the country's textile and apparel shipments accounted for USD 64.8 billion in 2023. The United States leads the world in textile R&D. The country's textile complex creates next-generation textile materials like conductive fabric, antistatic textiles, electronic textiles that monitor heart rate and vital signs, antimicrobial fibers, and life-saving body armor.

- The exorbitant growth of e-commerce platforms that support sales and distribution of different types of products manufactured by the textile industry has primarily propelled the demand for textile-related products, thereby augmenting the market's growth.

- Furthermore, packaging tapes are integral to the retail industry, serving to protect products during transit, seal and secure cartons, enhance branding through printed messages, aid in inventory management, provide security measures with tamper-evident options, facilitate online retail packaging, and contribute to point-of-sale displays.

- For instance, according to the US Census Bureau, the total retail sales in the United States were valued at USD 7,242.56 in 2023 and registered growth when compared to USD 7,095.03 billion in 2022.

- Due to all such factors, the market for packaging tapes in the region is expected to register steady growth during the forecast period.

North America Packaging Tapes Industry Overview

The packaging tapes market in North America is fragmented in nature. Some of the major players in the market include (not in any particular order) Intertape Polymer Group Inc., 3M Company, Berry Global Inc., Avery Dennison Corporation, Nitto Denko, Mactac LLC, and CCT Tapes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand from food, beverage, and e-commerce industries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Government Regulations on Plastic Usage

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.2 Adhesive Type

- 5.2.1 Acrylic

- 5.2.2 Hot Melt

- 5.2.3 Ruber-Based

- 5.2.4 Other Adhesive Types

- 5.3 End-User Industry

- 5.3.1 E-Commerce

- 5.3.2 Food and Beverage Industry

- 5.3.3 Retail Industry

- 5.3.4 Other End-User Industries

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M Company

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Berry Global Inc.

- 6.4.4 CCT Tapes

- 6.4.5 Intertape Polymer Group

- 6.4.6 Mactac, LLC

- 6.4.7 Nitto Denko

- 6.4.8 *List not Exhaustive

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Paper and Biodegradable Pakcaging Types