|

市場調查報告書

商品編碼

1693695

全球鋼骨市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Steel Sections - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

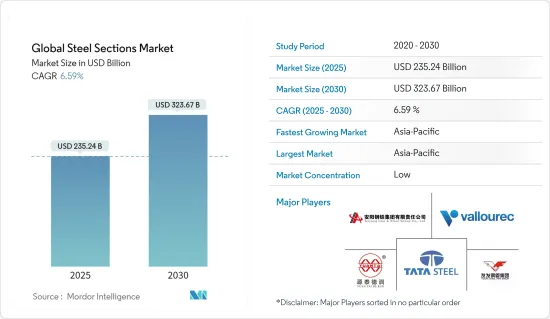

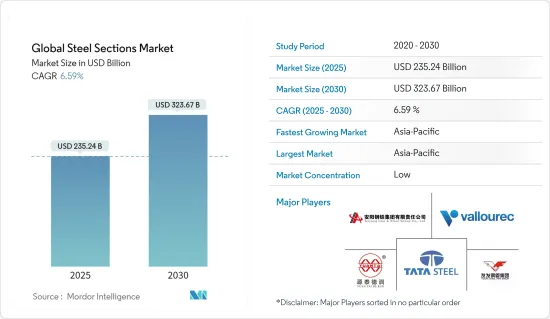

2025年全球鋼骨市場規模預估為2,352.4億美元,預估至2030年將達3,236.7億美元,預測期內(2025-2030年)的複合年成長率為6.59%。

主要亮點

- 代表所有鋼鐵生產國的世界鋼鐵協會表示,預計2024年全球鋼鐵需求將增加1.9%。根據世界鋼鐵協會的短期預測,2024年需求將增加至1,849.1噸。該協會預測2022年粗鋼需求量為1,831.5噸,較2021年下降4.3%。

- 推動市場發展的因素主要包括建設產業需求的增加、基礎建設的進步、工業化程度的提高。鋼骨是計劃中不可或缺的組成部分,建設產業的成長預計將推動鋼骨的需求。

- 世界各國政府都在大力投資道路、橋樑、鐵路等基礎建設計劃,可能會增加對鋼骨的需求。截至2023年6月,亞太地區道路建設計劃投資超過2.3兆美元。歐洲則位居第二,此類計劃投資額約 7 億美元。

- 預計2023年全球粗鋼產量將與去年與前一年同期比較持平,為18.882億噸,高於2022年的18.887億噸。不過,2023年12月全球粗鋼產量估計為1.357億噸,較去年同期的1.433億噸下降5.3%。

- 市場面臨的挑戰包括原物料價格波動、貿易保護主義和環境法規。環境法規增加了鋼鐵生產成本,而這可以透過提高鋼鐵價格轉嫁給消費者。

全球鋼鐵市場趨勢

從地區來看,亞太地區可望引領市場,帶來更多機會

- 由於多種因素,亞太地區是最大的鋼骨市場。該地區是全球成長最快的經濟體之一,導致建築、基礎設施和製造業對鋼鐵的需求飆升。據一些資訊來源稱,預計2024年該地區市場將成長3.5%至4.0%。

- 中國已成為世界主要鋼鐵生產國之一。 2021年鋼鐵產量將達9.43億噸,佔全球鋼鐵總產量17.5億噸的54%。

- 中國大部分鋼鐵產量(約85%)採用高爐煉鋼製程在高爐中生產。電弧爐(EAF)僅佔約15%,是一種使用廢鋼的「更清潔」的製程。

- 未來幾年,中國廢鋼供應和國內電價可能成為全球電弧爐生產的重要催化劑。除中國以外,電弧爐產量佔總產量的很大一部分,其中北美佔約 70%,歐洲佔 40%。為了滿足氣候變遷目標,世界各地都在努力提高電弧爐產量並開發更清潔的製程。

- 2022年9月,中國政府公佈了最新的發展規劃,將加速本土製造業的數位化和非合法化進程。此舉將有利於智慧製造,特別是汽車、石化、家電、醫療設備等重點產業。智慧製造裝備產業規模已近3兆元,滿足了50%以上的市場需求。

- 從2026年起,BMW在中國的汽車工廠將開始使用河鋼綠色鋼材。河鋼綠色鋼鐵採用電弧爐煉鋼,利用可再生電力生產,可減少二氧化碳排放約 95%。透過這種方式,BMW每年將能夠減少其供應鏈的二氧化碳排放量約 23 萬噸。 2022年3月,河鋼發布了《低碳發展技術藍圖》,此前一年,該公司宣布了2050年實現碳中和的目標。河鋼表示,將“探索六大技術路徑,搭建兩大管理平台”,力爭2025年碳排放比尖峰時段下降10%,到2030年下降30%,到2050年實現碳中和。

預計未來幾年住宅市場將獲得成長動力

- 由於可支配收入的增加和計劃技術的進步,鋼骨市場預計在未來幾年將穩步成長。推動市場發展的主要因素之一是製定建築指標,旨在鼓勵採用預製組件的先進建築方法。

- 鋼骨為跨越遠距提供了一種優雅且經濟有效的方式。透過擴大鋼跨度,我們可以創造出寬敞、開放、無柱的室內空間,現在許多客戶要求柱網間距為 15 公尺或更大。在單層建築中,軋延樑的淨跨距超過 50 公尺。

- 鋼材為建築師在顏色、紋理和形狀方面提供了更多的設計自由。它的強度、耐用性、美觀性、精確性和可塑性為建築師探索想法和開發創新解決方案提供了廣泛的參數。鋼材的跨度大,無需中間柱或承重牆即可創造出很大的開放空間。

全球鋼骨業概況

鋼骨鋼市場較為分散,包括多家全球性、本地性和地區性企業。主要參與者包括塔塔鋼鐵、瓦盧瑞克、元泰德潤集團、安陽鋼鐵集團和友發鋼管集團。由於供應鏈限制和消費者需求的變化,市場正在經歷許多變化。各公司都在努力透過技術進步來提高生產能力和改善產品品質。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態

- 當前市場狀況

- 市場概覽

- 市場動態

- 驅動程式

- 限制因素

- 機會

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 鋼骨技術進步

- 深入了解每種鋼鐵產品的生產與需求

- 鋼骨鋼材市場價格分析

- COVID-19 市場影響

第5章市場區隔

- 依產品類型

- 重型結構鋼

- 輕型結構鋼

- 加強

- 按最終用戶產業

- 住宅

- 製造業

- 航太和汽車

- 電力和公共產業

- 建造

- 石油和天然氣

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 公司簡介

- Tata Steel

- Vallourec

- Yuantai Derun Group

- Anyang Steel Group

- Youfa Steel Pipe Group

- ArcelorMittal SA

- POSCO Holdings Inc.

- Baoshan Iron & Steel Co. Ltd

- Nippon Steel Corp.

- Nucor Corp.

- Ansteel Group

- Hyundai Steel*

第7章:市場的未來

第 8 章 附錄

The Global Steel Sections Market size is estimated at USD 235.24 billion in 2025, and is expected to reach USD 323.67 billion by 2030, at a CAGR of 6.59% during the forecast period (2025-2030).

Key Highlights

- According to the World Steel Association, a body with membership in every steel-producing country, the demand for steel worldwide is expected to grow by 1.9% in 2024. Based on its short-range forecast, the World Steel Association reported that demand will rise to 1,849.1 mt by 2024. It had projected that the demand for crude steel would reach 1,831.5 mt in 2022, down by 4.3% compared to 2021.

- Some of the key factors driving the market's growth include increasing demand from the construction industry, rising infrastructure development, and growing industrialization. Steel sections are an essential component of construction projects, and the growth of the construction industry is expected to drive the demand for steel sections.

- Governments worldwide are investing heavily in infrastructure development projects, such as roads, bridges, and railways, which will likely boost the demand for steel sections. As of June 2023, Asia-Pacific accounted for more than USD 2.3 trillion of investments in road construction projects. In such projects, Europe ranked second, with investments amounting to around USD 700 million.

- Compared to the previous year, crude steel production worldwide remained unchanged in 2023, with an output of 1,888.2 million ton over 1,888.7 million ton in 2022. However, in December 2023, crude steel production worldwide decreased by 5.3% to 135.7 million ton compared to 143.3 million ton in the same period of the previous year.

- The market is facing some challenges, such as volatility in raw material prices, trade protectionism, and environmental regulations. Environmental regulations are increasing the cost of steel production, which can be passed on to consumers through higher prices for steel sections.

Global Steel Sections Market Trends

By Region, Asia-Pacific is Expected to Lead the Market with More Opportunities

- Asia-Pacific is the largest market for steel sections due to several factors. The region has some of the fastest-growing economies globally, leading to a surge in demand for steel in the construction, infrastructure, and manufacturing industries. According to some sources, the regional market is projected to grow between 3.5% and 4.0% in 2024.

- China has become the world's dominant steel manufacturer. The country produced 943 million metric ton of steel in 2021, 54% of the global total of 1.75 billion metric ton.

- Most (about 85%) of China's steel production is done in blast furnaces using the BOF process. Only about 15% is electric-arc furnace (EAF), the far "cleaner" process that uses scrap steel.

- The country's scrap steel supply and domestic power pricing will likely become key catalysts of EAF production worldwide in the coming years. Outside of China, EAF production accounts for a far greater proportion of the overall output, with North America at about 70% and Europe at 40%. There is a push to build more EAF and develop even cleaner processes to meet climate goals across the world.

- In September 2022, the Chinese government announced its latest development plan to accelerate the digitalization and antilegalization of the local manufacturing industry. This move benefits the smart manufacturing industry, especially key industries like automobiles, petrochemicals, home appliances, and medical devices. The scale of the intelligent manufacturing equipment industry has reached almost CNY 3 trillion, satisfying more than 50% of market demand.

- From 2026, BMW's car plants in China will begin to use HBIS green steel, which is produced via EAF with renewable-source electricity, with CO2 emissions cut by about 95%. This method will allow BMW to remove about 230,000 ton of CO2 emissions per year from the supply chain side. HBIS launched its Low Carbon Development Technology Roadmap in March 2022, a year after it announced the goal of achieving carbon neutrality by 2050. It said it would "explore six technology paths and build two management platforms" to cut carbon emissions by 10% from the peak in 2025 and by 30% in 2030 and achieve carbon neutrality in 2050.

The Residential Segment is Expected to Gain Momentum in the Coming Years

- The steel sections market is expected to grow steadily in the coming years due to rising disposable incomes and technological advancements in building and construction projects. One of the major factors driving the market is the development of a construction index that aims to encourage the adoption of advanced construction methods using prefabricated components.

- Steel sections provide an elegant, cost-effective method of spanning long distances. Extended steel spans can create large, open-plan, column-free internal spaces, with many clients now demanding column grid spacing over 15 meters. In single-story buildings, rolled beams provide clear spans of over 50 meters.

- Steel offers architects more design freedom in terms of color, texture, and shape. Its strength, durability, beauty, precision, and malleability give architects broader parameters to explore ideas and develop innovative solutions. Steel's long-spanning ability gives rise to large open spaces free of intermediate columns or load-bearing walls.

Global Steel Sections Industry Overview

The steel sections market is fragmented, with the presence of several local and regional players, as well as global players. Some of the major players include Tata Steel, Vallourec, Yuantai Derun Group, Anyang Steel Group, and Youfa Steel Pipe Group. The market is going through many changes due to supply chain constraints and a shift in demand among consumers. Companies are working on increasing their production capacities and improving the quality of products through technological advancements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.2 Restraints

- 4.3.3 Opportunities

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Advancements in Steel Sections

- 4.7 Insights on Production and Demand for Different Steel Sections

- 4.8 Pricing Analysis of the Steel Sections Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Heavy Structural Steel

- 5.1.2 Light Structural Steel

- 5.1.3 Rebar

- 5.2 By End-user Industry

- 5.2.1 Residential

- 5.2.2 Manufacturing

- 5.2.3 Aerospace and Automotive

- 5.2.4 Power and Utilities

- 5.2.5 Construction

- 5.2.6 Oil and Gas

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Overview

- 6.2 Company Profiles

- 6.2.1 Tata Steel

- 6.2.2 Vallourec

- 6.2.3 Yuantai Derun Group

- 6.2.4 Anyang Steel Group

- 6.2.5 Youfa Steel Pipe Group

- 6.2.6 ArcelorMittal SA

- 6.2.7 POSCO Holdings Inc.

- 6.2.8 Baoshan Iron & Steel Co. Ltd

- 6.2.9 Nippon Steel Corp.

- 6.2.10 Nucor Corp.

- 6.2.11 Ansteel Group

- 6.2.12 Hyundai Steel*