|

市場調查報告書

商品編碼

1693682

託管數位工作場所服務:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Managed Digital Workplace Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

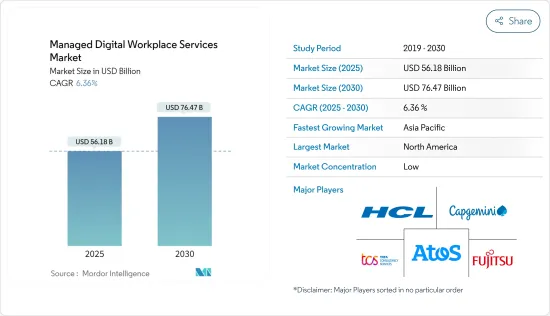

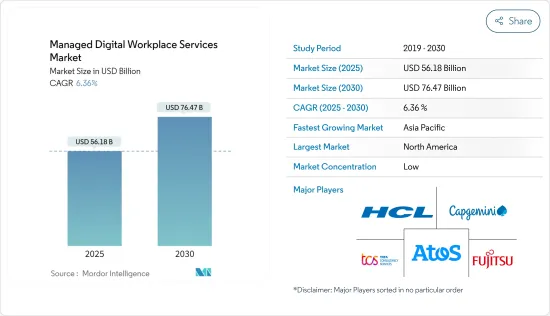

託管數位工作場所服務市場規模預計在 2025 年為 561.8 億美元,預計到 2030 年將達到 764.7 億美元,預測期內(2025-2030 年)的複合年成長率為 6.36%。

託管數位化工作場所服務的促進因素包括技術進步、勞動力人口結構的變化、新技術和工具的可用性、員工對更多靈活性的渴望以及強大而富有愛心的經營團隊培育的積極的公司文化。此外,成功的數位轉型取決於有效的變革管理、員工參與度以及對轉型目標和目的的清晰理解等因素。

主要亮點

- 在預測期內,各組織擴大採用數位化工作場所可能會推動對託管數位化工作場所服務的需求。例如,beautiful.ai 在 2022 年對 3,000 名管理人員進行的一項調查中探討了數位化工作場所如何影響他們的業務以及遠端工作者的未來發展,78% 的受訪者同意投入大量財力資源來確保數位化工作場所的成功,80% 的受訪者表示他們致力於在數位化財力和工具方面致力於管理人員的企業企業。 81%的人樂觀地認為數位化工作將取代辦公室工作。即使在數位化職場,66% 的人也感覺聯繫更加緊密。

- 此外,IT 技術對託管數位工作場所服務產生了重大影響。隨著數位平台和自動化的使用日益增多,工作場所變得更有效率和精簡。例如,雲端基礎的設施管理軟體可以讓企業領導者保持井然有序和最新狀態,從而提高業務績效。此外,數位化工作場所技術提供更好的工作流程和資料管理,並專注於通訊、資訊管理和網路安全。

- 此外,人工智慧在管理數位化工作場所營運方面變得越來越重要。透過自動化任務和提供智慧洞察,人工智慧使組織能夠簡化工作流程、提高生產力並改善員工體驗。數位化工作場所中的人工智慧應用範例包括知識管理、資料管治、資訊管理、最終使用者體驗管理和文件管理。此外,人工智慧可以幫助組織制定有效的工作場所自動化策略並提高員工的工作效率。隨著人工智慧技術的不斷發展,預計它將在塑造數位化工作場所的未來方面發揮更重要的作用。

- 此外,BFSI 領域的技術和客戶格局的變化可能會在預測期內推動對託管數位工作場所服務的需求。許多 BFSI 行業的公司,例如保險公司瑞士再保險公司,已經與市場供應商合作,實現雲端基礎的數位化工作場所,預計這一趨勢將在未來幾年加劇,從而增加 BFSI 行業的需求。此外,全球銀行和保險公司日益成長的數位轉型正在推動數位化工作場所轉型的需求,以提高效率和生產力,進一步增強研究市場的成長前景。

- 日益猖獗的網路犯罪為全球託管數位工作場所服務市場帶來了重大挑戰和限制。保護數位資產、防禦網路威脅以及遵守資料保護條例對於組織來說都是具有挑戰性的任務。由於網路犯罪對客戶信任的影響以及對增加網路安全投資的呼籲,強力的安全措施和主動的安全管理對於提供託管數位工作場所服務至關重要。

- 疫情過後,混合型和現場工作越來越受歡迎。世界各地的組織必須適應不同實體職場環境中的這種新常態,並改善其企業數位化工作場所。預計這種工作轉變將影響對託管數位工作場所服務的需求,以改善工作實踐,確保持續的生產力、營運和業務成功。疫情爆發後,各家公司紛紛聯合起來,利用數位化工作場所的優勢。這種加強的合作可能會促進疫情期間研究市場的成長。

託管數位工作場所服務市場趨勢

醫療保健產業預計將出現強勁成長

- 在醫療保健行業,採用新技術已經變得很普遍,以改善患者護理和體驗以及職場管理。醫療保健行業的人員配置安排多種多樣且複雜,包括大型團隊、兼職、全職、隨叫隨到、季節性、遠端和現場工作人員以及具有多種角色和專業的工作人員。這個行業涉及許多協調和特殊性,這就是為什麼實施管理解決方案如此重要。

- 此外,降低醫院和其他醫療機構的人事費用、提高業務效率和整合部門的需求日益成長,是推動採用此類解決方案的主要因素。此外,預測期內,醫療保健專業人員日益成長的需求以及職場管理解決方案帶來的好處(例如職場透明度和靈活排班)也有望增加這些解決方案在醫療保健領域的採用。

- 此外,對醫療服務的需求不斷成長,導致對醫療設施建設的投資增加。醫療保健設施市場的成長是由於世界各地人口的成長和老化。這可能會導致醫療保健領域更多地採用託管數位工作場所服務。例如,根據經合組織和世界衛生組織的研究,預計未來五年全球醫院數量將穩定成長。數據顯示,預計五年內醫院數量將達到166,235家。

- 許多醫療保健提供者正在投資擴大和建造新的醫療設施。例如,2022 年 6 月,南卡羅來納州衛生和環境控制部核准羅珀聖弗朗西斯醫療保健中心在其伯克利縣院區增建一座塔樓。預計醫療設施的擴張將增加對數位管理服務的需求,以追蹤數據和整體工作場所管理,這反過來又將產生對託管數位工作場所服務的需求。

- 醫療機構需要各種職場管理服務,如廢棄物管理、保全服務、餐飲服務、清潔服務、技術支援服務等,而且需求可能很快就會增加。單獨管理這些服務很困難。工作場所管理服務提供的雲端處理、行動性、實體和知識自動化等協作工具使得同時完成所有工作變得更加容易。快速擴張數位化趨勢正在推動對託管數位工作場所服務的需求。

亞太地區將迎來顯著成長

- 亞太地區最近經歷了快速的技術進步和數位轉型。這場數位革命正在大幅改變企業的業務方式,推動對高效、安全的數位化工作場所解決方案的需求。託管數位化工作場所服務對於企業提高生產力、協作能力和員工滿意度至關重要。

- 亞太地區的政府和公共部門組織正在經歷快速的數位轉型,以滿足改善公民服務、簡化業務和提高效率的需求。許多政府機構正在轉向託管數位工作場所服務 (MDWS) 作為實現這些目標的策略解決方案。此外,亞太地區的政府也擴大採用數位管道來提供高效率的、以公民為中心的服務。

- 此外,託管數位服務使政府能夠創建一個職場環境,讓員工能夠無縫協作、存取相關資訊並快速回應公民的詢問和服務請求。例如,新加坡的智慧國家計畫專注於利用服務台透過 MyInfo 服務和 Moments of Life 應用程式等平台提供綜合數位服務和個人化公民體驗。

- 此外,亞太地區的託管數位工作場所服務 (MDWS) 市場正在經歷強勁成長並具有巨大的潛力。隨著數位化進程、遠距辦公採用和業務效率的提高,亞太地區的企業逐漸意識到 MDWS 解決方案的價值。市場對無縫遠端協作、改善員工體驗和強大資料安全的需求不斷成長。

- 此外,隨著政府和企業對數位轉型計畫的投資,MDWS 供應商擁有獨特的機會提供滿足亞太市場獨特需求的客製化解決方案。隨著新興技術的整合和對創新的關注,亞太地區的 MDWS 市場預計將進一步擴大,並在塑造該地區未來工作和數位賦能方面發揮關鍵作用。

託管數位工作場所服務產業概覽

總體而言,競爭對手之間的競爭強度很高,預計在預測期內將保持不變。 Atos Se、富士通有限公司、HCL 和凱捷等市場主要企業不斷提供更多、更強大的服務。此外,企業紛紛採取強而有力的競爭策略來維持市場地位和留住客戶,這導致競爭對手之間的敵意日益加劇。此外,供應商專注於提供整合服務,使他們能夠為客戶提供一體化託管數位工作場所服務。

2023 年 4 月,Stefanini 和菲利普莫里斯國際公司 (PMI) 宣佈建立工作場所解決方案合作夥伴關係。 Stefanini 提供託管服務,例如服務台支援、服務管理、現場支援和 Workplace Core 服務,例如端點管理、ITAM、M365 等。菲利普莫里斯國際公司的約 79,800 名員工將在 80 個國家、140 個地點(包括辦公室、工廠和零售店)獲得服務,並使用 29 種語言。

2022 年 9 月,全球科技公司 HCL Technologies (HCL) 和英特爾推出了卓越中心,以加速開發和採用符合業界標準的數位化工作場所 (DWP) 產品。該卓越中心擁有創新技術和主題專家,將利用 HCL 的 DWP 解決方案和英特爾的技術組合共同創建解決方案,以實現無縫、互聯和安全的混合工作場所。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 生態系分析

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 服務台採用先進的數位化,解決聯絡問題

- 作為數位轉型舉措的一部分,數位解決方案的採用率不斷提高

- 在家工作增多,多家公司考慮將在家工作作為永久選擇

- 市場限制

- 網路犯罪的興起

第6章市場區隔

- 按服務

- 服務台

- 最終用戶設備支持

- 數位化工作場所

- 按行業

- BFSI

- 衛生保健

- 製造業

- 能源和公共產業

- 政府和公共機構

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭格局

- 公司簡介

- Atos SE

- Fujitsu Ltd

- HCL Technologies

- Capgemini Services SAS

- Tata Consultancy Services Limited

- Wipro Ltd

- IBM Corporation

- DXC Technology

- Cognizant Technology Solutions Corporation

- NTT Data Corporation

- Stefanini Group

第 8 章 供應商排名分析

第9章投資分析

第10章 市場機會與未來展望

The Managed Digital Workplace Services Market size is estimated at USD 56.18 billion in 2025, and is expected to reach USD 76.47 billion by 2030, at a CAGR of 6.36% during the forecast period (2025-2030).

The driving factors that can contribute to managed digital workplace services include technological advancements, changing workforce demographics, availability of new technologies and tools, employee demand for greater flexibility, and a positive company culture facilitated by strong and helpful management. Additionally, successful digital transformations are influenced by factors such as effective change management, employee engagement, and a clear understanding of the goals and objectives of the shift.

Key Highlights

- The rise in adopting digital workplaces by various organizations would drive the demand for managed digital workplace services over the forecasted period. For instance, According to a survey done by beautiful.ai in 2022, which polled 3,000 managers to find out how the digital workplace has affected their businesses and what the future holds for the remote worker, 78% agree that significant financial resources are being directed toward achieving a successful digital workplace, and 80% said their firm is committed to investing financial resources in technology and tools to assist managers in successfully leading and meeting goals in a digital workplace. 81% are optimistic about digital work replacing their in-office setting. In a digital working environment, 66% feel that there is still a strong sense of connection.

- Furthermore, information technology has significantly impacted managed digital workplace services. With the increasing use of digital platforms and automation, workplaces have become more efficient and streamlined. Cloud-based facilities management software, for example, has enabled business leaders to stay organized and up-to-date, resulting in improved business performance. Additionally, digital workplace technologies have focused on communication, information management, and cybersecurity, providing better workflows and data management.

- Furthermore, artificial intelligence is increasingly important in managing digital workplace operations. By automating tasks and providing intelligent insights, AI enables organizations to streamline workflows, increase productivity, and improve employee experience. Some examples of AI applications in the digital workplace include knowledge management, data governance, information management, end-user experience management, and document management. Additionally, AI can help organizations formulate effective workplace automation strategies and increase employee productivity. As AI technology continues to evolve, it is expected to play an even more significant role in shaping the future of the digital workplace.

- Further, the changing technology and customer experience landscape in the BFSI sector will drive the demand for managed digital workplace services over the forecast period. Many BFSI sector companies, such as Swiss Re, an insurance firm, have partnered with market vendors to enable a cloud-based digital workplace, and the trend is expected to strengthen in the coming years, with the demand expected to increase from the BFSI sector. Further, the growing digital transformation in banks and insurance firms worldwide necessitates the need for digital workplace transformation for enhanced efficiency and productivity, thus further providing growth prospects for the studied market.

- For the global market for managed digital workplace services, the rising incidences of cybercrime present significant challenges and constraints. Securing digital assets, defending against cyber threats, and adhering to data protection regulations are challenging for organizations. Strong security measures and proactive security management are crucial in delivering managed digital workplace services due to the impact of cybercrime on customer trust and the requirement for greater investments in cybersecurity.

- Post-pandemic, hybrid work, and on-site work are gaining traction. Organizations worldwide must adapt to this new normal in different physical workplace settings or improvements in the corporate digital workplace. This work shift is analyzed to influence the demand for managed digital workplace services to improve work practices to ensure that productivity, operations, and business success continue. Post-pandemic, various firms have collaborated to use the benefits of the digital workplace; such a rise in collaborations would push the growth of the studied market during the pandemic.

Managed Digital Workplace Services Market Trends

Healthcare Sector Expected to Witness Robust Growth

- Incorporating emerging technologies in the healthcare industry is prevailing, owing to enhanced patient treatment and experience and better workplace management. It has been understood that the healthcare industry presents various staffing complexities, including larger teams, a mix of part-time, full-time, on-call, seasonal, remote, and on-site workers, and workers of multiple roles and specializations. A great deal of coordination and specificity is involved in the industry, making deploying a management solution crucial.

- Moreover, the increasing need to reduce labor costs in hospitals and other health facilities, increased operational efficiency, and consolidation in the sector are some of the primary factors driving the adoption of these solutions. Further, the growing demand for healthcare professionals and benefits associated with workplace management solutions, such as transparency and flexible scheduling of workplaces in the industry, is also expected to increase the adoption of these solutions in the healthcare sector during the forecast period.

- Further, there is an increase in investment in the construction of healthcare facilities due to the increased need for healthcare services. This increase in the market for healthcare facilities is caused due to the rise in population and the growing aging population across various regions worldwide. This will likely expand the healthcare sector's adoption of managed digital workplace services. For instance, as per the survey by OECD and WHO, the number of hospitals worldwide is expected to rise steadily over the next five years. According to the data, the number of hospitals is expected to reach 1,66,235 in five years.

- Many healthcare providers are investing in expanding and constructing new healthcare facilities. For instance, in June 2022, the South Carolina Department of Health and Environmental Control approved Roper St. Francis Healthcare's Certificate of Need's additional tower on the hospital's Berkeley County campus. The expansion of healthcare facilities is anticipated to create augmented demand for digital management services to keep track of the data and overall workplace management, which in turn is projected to generate demand for managed digital workplace services.

- Healthcare establishments require various workplace management services, such as Waste Management, Security Services, Catering Services, Cleaning Services, Technical Support Services, and many more, whose demand will likely increase shortly. These services are difficult to manage individually. Collaboration tools such as cloud computing, mobility, and physical and knowledge automation provided by workplace management services make it easy to handle it all simultaneously. Rapid expansion and digitalization trends have crested demand for managed digital workplace services.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific region has experienced rapid technological advancements and digital transformation recently. This digital revolution has significantly changed businesses' operations, increasing demand for efficient and secure digital workplace solutions. Managed Digital Workplace Services have emerged as a critical enabler for organizations to enhance productivity, collaboration, and employee satisfaction.

- The Government and Public sector in the Asia-Pacific region are experiencing rapid digital transformation driven by the need to enhance citizen services, streamline operations, and improve efficiency. Many government organizations are turning to Managed Digital Workplace Services (MDWS) as a strategic solution to achieve these goals. Furthermore, governments across the Asia-Pacific are increasingly adopting digital channels to provide efficient and citizen-centric services.

- Moreover, managed digital services enable governments to create work environments that empower employees to collaborate seamlessly, access relevant information, and promptly respond to citizen inquiries and service requests. For instance, Singapore's Smart Nation initiative focuses on leveraging service desks to provide integrated digital services and personalized citizen experiences through platforms like the MyInfo service and the Moments of Life app.

- Furthermore, the managed digital workplace services (MDWS) market in the Asia-Pacific region is experiencing robust growth and holds immense potential. With increasing digitalization efforts, remote work adoption, and the drive for operational efficiency, organizations across the region recognize the value of MDWS solutions. The market is fueled by the growing demand for seamless remote collaboration, enhanced employee experiences, and robust data security.

- Further, as governments and enterprises invest in digital transformation initiatives, MDWS providers have a unique opportunity to offer tailored solutions that cater to the specific needs of the Asia-Pacific market. With the convergence of emerging technologies and a focus on innovation, the MDWS market in the region is poised for further expansion, playing a vital role in shaping the future of work and digital empowerment in the Asia-Pacific.

Managed Digital Workplace Services Industry Overview

Overall, the intensity of competitive rivalry is high and expected to remain the same throughout the forecasted period. Major players in the market, such as Atos Se, Fujitsu Ltd, HCL, and Capgemini, are constantly providing increased and enhanced offerings. Additionally, companies are employing powerful competitive strategies to sustain themselves in the market and retain their clients, thereby intensifying competitive rivalry. Further, the vendors are focusing on offering integrated services to the client where all-in-one managed digital workplace service can be provided to the client.

In April 2023, Stefanini, with workplace solution collaboration, Stefanini and Phillip Morris International (PMI) announced a partnership. Stefanini will provide managed services such as service desk support, service management, onsite support, and workplace core services such as End Point Management, ITAM, and M365. Phillip Morris International's approximately 79,800 employees will be served in 29 languages throughout 80 countries and 140 sites, including offices, factories, and retail stores.

In September 2022, HCL Technologies (HCL), a global technology company, and Intel launched a Center of Excellence to foster the creation and adoption of industry-tailored Digital Workplace (DWP) offerings. Equipped with innovative technologies and experts, the Center of Excellence will leverage HCL's DWP solutions and Intel's technology portfolio to co-create solutions enabling seamless, connected, secure hybrid workplaces.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Higher Levels of Digitization in the Service Desk for Contact Resolution

- 5.1.2 Increase in Adoption of Digital Solutions as part of Digital Transformation Initiatives

- 5.1.3 Rise of Work from Home Employees with Several Companies Considering it as a Permanent Alternative

- 5.2 Market Restraints

- 5.2.1 Increasing Incidents of Cybercrime

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Service Desk

- 6.1.2 End-user Device Support

- 6.1.3 Digital Workplace

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 Manufacturing

- 6.2.4 Energy and Utility

- 6.2.5 Government and Public Sector

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atos SE

- 7.1.2 Fujitsu Ltd

- 7.1.3 HCL Technologies

- 7.1.4 Capgemini Services SAS

- 7.1.5 Tata Consultancy Services Limited

- 7.1.6 Wipro Ltd

- 7.1.7 IBM Corporation

- 7.1.8 DXC Technology

- 7.1.9 Cognizant Technology Solutions Corporation

- 7.1.10 NTT Data Corporation

- 7.1.11 Stefanini Group