|

市場調查報告書

商品編碼

1693670

北美電池管理系統:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)North America Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

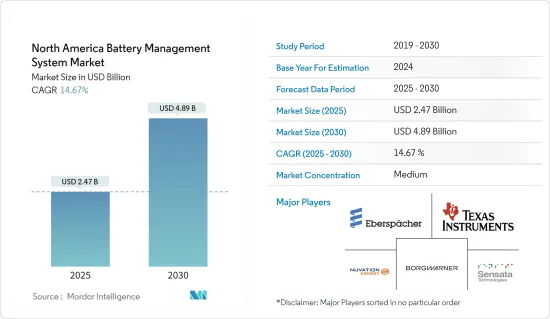

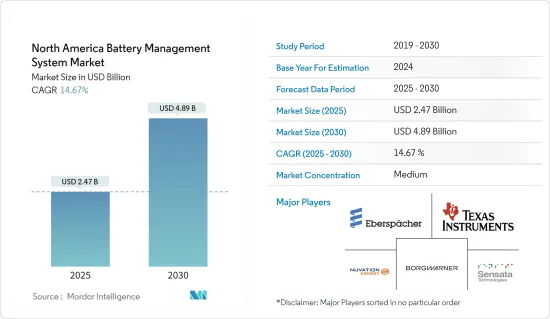

北美電池管理系統市場規模預計在 2025 年為 24.7 億美元,預計到 2030 年將達到 48.9 億美元,預測期內(2025-2030 年)的複合年成長率為 14.67%。

主要亮點

- 從中期來看,人們對 ESS 中使用鋰離子電池的安全問題的日益擔憂以及電動汽車的廣泛採用預計將在預測期內推動對創新高效電池管理系統 (BMS) 的需求。

- 然而,現成電池管理系統的限制使得目前的設計過時,預計這將影響預測期內的市場研究。

- 然而,整合人工智慧的電池管理系統技術進步預計將帶來降低複雜性、提高效率和提高可靠性等好處,從而提供未來的成長機會。

- 由於兩個行業(能源儲存系統和電動車)的需求旺盛,預計美國將在預測期內佔據市場主導地位。

北美電池管理系統市場趨勢

預計運輸領域將主導市場

- 以前,只使用內燃機車輛(ICE)。然而,隨著人們對環境問題的日益關注,科技正在轉向電動車(EV)。因此,電池管理系統在內燃機中並不佔有很大的市場佔有率。

- 鋰離子電池主要用於電動車,因為它們具有能量密度高、自放電低、重量輕和維護成本低等特性。鉛基電池廣泛用於內燃機汽車,預計在可預見的未來仍將是唯一的大眾市場電池系統。對於 SLI 應用,鋰離子電池仍需要大幅降低成本,才能被視為可行的大規模生產鉛電池替代品。

- 鋰離子電池系統為插混合動力汽車汽車和電動車提供動力。鋰離子電池具有高能量密度、快速充電能力和高放電功率,是唯一能夠滿足目標商標產品製造商對車輛行駛里程和充電時間要求的技術。鉛基牽引電池由於比能量低、重量大,在全混合動力車或電動車中使用不具競爭力。

- 墨西哥的電動車製造市場蓬勃發展。 2023 年 3 月,墨西哥政府宣布計劃到 2030 年使該國銷售的所有汽車中有一半都是電動車。墨西哥預計將成為電動車的生產中心,尤其是特斯拉計劃在該國開設一座價值 50 億美元的超級工廠。在預測期內,此類措施可能會促進墨西哥各地電動車的銷量,從而刺激電動車鋰離子電池的需求。

- 此外,2024 年 2 月,中國著名電動車 (EV) 製造商比亞迪宣布將在墨西哥建立新的製造工廠。該公司已開始對該合資企業進行可行性研究,並正在積極與墨西哥政府相關人員進行討論,特別是關於工廠的具體位置。

- 與美國一樣,加拿大的汽車產業也正在經歷轉型,大多數汽車製造商將重點轉向電氣化,透過建造新工廠或改造舊工廠來生產電動車。

- 例如,本田汽車工業於2024年4月宣布,將投資110億美元在安大略省建立電動車和電池生產廠,以擴大目前的生產能力。這是該公司迄今為止在加拿大最大的一項投資。該計畫計劃於 2028 年投入營運,預計年產能高達 24 萬輛電動車。

- 根據加拿大能源資訊署 (EIA) 的數據,截至 2023 年,加拿大的電動車庫存約為 38,000 輛,比 2022 年記錄的庫存增加近 35.71%。

- 因此,由於上述因素,預測期內運輸業可能會主導北美電池管理系統市場。

預計美國將主導市場

- 預計到 2023 年,美國將成為全球最大的能源儲存系統和電動車市場之一。這兩個終端使用者群體都依賴電池管理系統 (BMS) 來確保電池系統的正常運作。由於這兩個龐大的終端用戶行業的高需求,預計美國將在預測期內成為電池管理系統最突出和成長最快的區域市場之一。

- 美國是世界上汽車工業最發達的國家之一。隨著氣候和環境問題日益嚴重,該國大多數汽車製造商都優先考慮生產電動車。此外,美國政府致力於增加電動車持有,以減少石化燃料的依賴和排放。

- 根據美國能源資訊署(EIA)的數據,截至2023年,美國電動車庫存量將達到約350萬輛,較2022年的庫存量成長近66.67%,成為僅次於中國的全球第二大電動車市場。

- 截至2023年,該國可再生能源裝置容量約為387.54吉瓦,與前一年同期比較成長約8.7%。未來幾年,該國的可再生能源發電產能可能會增加,例如到2030年實現80%的新增清潔能源產能。此外,政府也計畫在2030年安裝30吉瓦的離岸風力發電,到2050年安裝110吉瓦的離岸風電。

- 可再生能源發電的快速成長使得電網穩定性成為可再生能源高度融入電網的國家面臨的主要問題。美國已安裝的可再生能源容量中近 66% 來自風能和太陽能,它們本質上是一種可變的能源來源。需要能源儲存系統在發電高峰期儲存可再生能源發電,並在需求高峰期釋放再生能源,而電池管理系統決定了這些系統的效率和運作。

- 在美國,大規模電池農場正在開發中,預計將實現公用事業規模的能源儲存。這些公用事業規模的系統預計將由複雜的電池管理系統監控和操作,實現雙向能量流和電池最佳化,以最大限度地提高效率並最大限度地減少事故,同時提高電池壽命。

- 2024 年 4 月,致力於再生能源高價值成長並渴望引領能源轉型的 Equinor 公司批准了美國首個電池儲存專案。這兩個計劃的總合容量為 110 兆瓦,預計將增強德克薩斯州電網的能源安全。位於德克薩斯州州弗里奧縣的日落嶺能源中心已在建設中,位於德克薩斯州州卡梅倫縣的柑橘平原計劃也正在籌備中。 Sunset Ridge 的 10MW/20MWh 電池儲存旨在提高可靠性,尤其是在高峰需求期間,並更好地服務 Equinor 客戶。 Sunset Ridge 預計將於 2024 年底開始商業營運。同時,規模更大的 100MW/200MWh計劃Citrus Flats 將與美國電力公司的輸電網連接,並計劃於 2026 年初開始商業營運。

- 上述因素正在推動美國電池管理系統市場的發展,預計該市場在預測期內將進一步成長。

北美電池管理系統產業概況

北美電池管理系統市場處於半分散狀態。市場上主要企業(不分先後順序)包括 Eberspaecher Vecture Inc.、BorgWarner Inc.、Texas Instruments Incorporated、Nuvation Energy 和 Sensata Technologies Inc.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2029 年市場規模與需求預測(美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 電動車的普及

- 鋰離子電池系統的安全問題

- 限制因素

- 現成電池管理系統的技術限制

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 投資分析

第5章市場區隔

- 應用

- 固定式

- 可攜式的

- 運輸

- 區域市場分析

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- Strategies Adopted & SWOT Analyses for Leading Players

- 公司簡介

- Eberspaecher Vecture Inc.

- BorgWarner Inc.

- Texas Instruments Incorporated

- Nuvation Energy

- Sensata Technologies Inc.

- BorgWarner Inc.

- Romeo Power Inc.

- ION Energy

- Ewert Energy Systems Inc.

- Schneider Electric SE

- List of Other Prominent Companies(Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- Market Ranking/Share(%)Analysis

第7章 市場機會與未來趨勢

- 技術進步:電池管理系統與人工智慧和機器學習的融合

The North America Battery Management System Market size is estimated at USD 2.47 billion in 2025, and is expected to reach USD 4.89 billion by 2030, at a CAGR of 14.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing safety concerns regarding the use of lithium-ion batteries in ESS and the widespread adoption of electric vehicles are expected to drive the demand for an innovative and efficient battery management system (BMS) during the forecast period.

- On the other hand, limitations in off-the-shelf battery management systems are expected to make the current design outdated and impact the market studied during the forecast period.

- Nevertheless, technological advancements in battery management systems with the integration of artificial intelligence, which offer advantages such as reduced complexity, better efficiency, and improved reliability, are expected to provide growth opportunities in the future.

- The United States is expected to dominate the market during the forecast period due to high demand from two industries: energy storage systems and electric vehicles.

North America Battery Management System Market Trends

Transportation Segment Expected to Dominate the Market

- Vehicles with internal combustion engines (ICE) were the only types used earlier. However, technology has been shifting toward electric vehicles (EVs) in line with growing environmental concerns. Therefore, due to these reasons, battery management systems do not hold any share in the internal combustion engine market.

- Lithium-ion batteries are primarily used in electric vehicles as they provide high energy density, low self-discharge, less weight, and low maintenance. For internal combustion engine vehicles, the lead-based battery is being widely used and is expected to continue to be the only viable mass-market battery system for the foreseeable future. For use in SLI applications, lithium-ion batteries still require higher cost reductions to be considered a viable mass-market alternative to lead-based batteries.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Owing to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology capable of meeting the requirements of original equipment manufacturers for the vehicle's driving range and charging time. Lead-based traction batteries are not competitive for use in full hybrid electric vehicles or electric vehicles because of their lower specific energy and higher weight.

- Mexico is witnessing rapid growth in its electric vehicle manufacturing market. In March 2023, the Mexican government announced its intention for EVs to account for half of all cars sold domestically by 2030. Particularly, with Tesla Inc.'s plan to open a USD 5 billion Gigafactory in Mexico, the country is expected to become a production hub of electric vehicles. Such initiatives are likely to raise the sales of electric vehicles across the country and boost the demand for lithium-ion batteries for electric vehicles during the forecast period.

- In addition, in February 2024, BYD Co. Ltd, a prominent Chinese electric vehicle (EV) manufacturer, announced that it was in the process of establishing a new manufacturing plant in Mexico. The company has initiated a feasibility study for this venture and is actively engaged in discussions with Mexican officials, particularly focusing on finalizing the factory's precise location.

- Similar to the United States, the Canadian automobile industry is also undergoing a transition, with most auto producers pivoting toward electrification by setting up new plants or repurposing older plants to produce EVs.

- For instance, in April 2024, Honda Motor announced that it was set to inject a substantial USD 11 billion into new electric vehicle and battery production plants in Ontario, augmenting its current setup. This would mark the company's most significant investment in Canada to date. The initiative aims to kick off operations by 2028, boasting an anticipated annual production capacity of up to 240,000 electric vehicles.

- According to the Energy Information Agency (EIA), as of 2023, Canada's electric vehicle stock was recorded at approximately 38 thousand units, up by nearly 35.71% from stock volumes recorded in 2022.

- Thus, based on the abovementioned factors, the transportation segment is likely to dominate the North American battery management systems market during the forecast period.

The United States Expected to Dominate the Market

- The United States was projected to be one of the largest global markets for energy storage systems and electric vehicles in 2023. Both the end-user segments utilize battery management systems (BMS) to ensure the battery system's adequate performance. Due to the high demand from these two massive end-user industries, the country is expected to be one of the most prominent and fastest-growing regional markets for battery management systems during the forecast period.

- The United States has one of the world's most well-developed automotive industries. As climate and environmental concerns are rising, most automakers in the country have prioritized the production of electric vehicles. Additionally, the US government has focused on increasing its electric vehicle fleet to reduce fossil fuel dependence and emissions.

- According to the Energy Information Agency (EIA), as of 2023, EV stock in the United States was approximately 3.5 million, up by nearly 66.67% from 2022 stock volumes, making it the second largest global EV market after China.

- As of 2023, the country had a renewable energy capacity of around 387.54 GW, an increase of around 8.7% compared to the previous year. In the upcoming years, renewable capacity in the country is likely to increase through targets that include having 80% new power generation capacity of clean energy by 2030. Further, the country aims to have 30 GW of offshore wind by 2030 and 110 GW by 2050.

- Due to this rapid rise in renewable generation, grid stability has become a major issue in countries with a high level of renewable integration in their grids. Nearly 66% of the installed renewable energy capacity in the United States is from wind and solar, which are inherently variable energy sources. Energy storage systems are needed to store renewable energy generation during high generation periods and release it during peak demand, while battery management systems dictate the efficiency and operation of these systems.

- The United States is expected to witness the development of massive battery farms, which are expected to provide utility-scale energy storage. These utility-scale systems are to be monitored and operated via a sophisticated battery management system, which is expected to allow bi-directional energy flow and battery optimization to improve battery life while maximizing efficiency and minimizing accidents.

- In April 2024, Equinor, a company dedicated to high-value growth in renewables and aspiring to lead the energy transition, greenlit its inaugural US battery storage ventures. These two projects, collectively boasting a 110 MW capacity, are poised to enhance energy security for the Texas grid. The Sunset Ridge Energy Center, located in Frio County, Texas, is already under construction, while preparations are underway for the Citrus Flatts project in Cameron County, Texas. The 10 MW/20 MWh battery storage at Sunset Ridge aims to bolster reliability, especially during peak demand, ensuring better service for Equinor's customers. Sunset Ridge is slated for commercial operation in the latter half of 2024. On the other hand, Citrus Flatts, a more substantial 100 MW/200 MWh project, will link up with American Electric Power's transmission network and is anticipated to commence commercial operations in early 2026.

- The abovementioned factors are driving the US battery management systems market, which is expected to grow further during the forecast period.

North America Battery Management System Industry Overview

The North American battery management systems market is semi-fragmented. Some of the major players in the market (in no particular order) include Eberspaecher Vecture Inc., BorgWarner Inc., Texas Instruments Incorporated, Nuvation Energy, and Sensata Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Widespread Adoption of Electric Vehicles

- 4.5.1.2 Safety Concerns Regarding Lithium-ion Battery Systems

- 4.5.2 Restraints

- 4.5.2.1 Technical Limitations in Off-the-Shelf Battery Management Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Stationary

- 5.1.2 Portable

- 5.1.3 Transportation

- 5.2 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (For Regions Only)}

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analyses for Leading Players

- 6.3 Company Profiles

- 6.3.1 Eberspaecher Vecture Inc.

- 6.3.2 BorgWarner Inc.

- 6.3.3 Texas Instruments Incorporated

- 6.3.4 Nuvation Energy

- 6.3.5 Sensata Technologies Inc.

- 6.3.6 BorgWarner Inc.

- 6.3.7 Romeo Power Inc.

- 6.3.8 ION Energy

- 6.3.9 Ewert Energy Systems Inc.

- 6.3.10 Schneider Electric SE

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements: Integration of Battery Management Systems With Artificial Intelligence and Machine Learning