|

市場調查報告書

商品編碼

1693668

泰國金屬包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Thailand Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

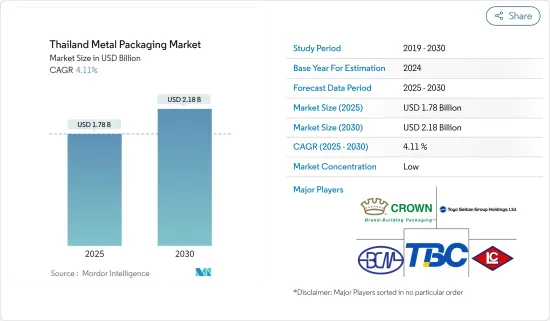

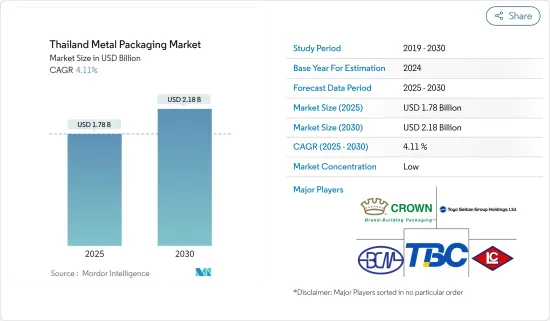

泰國金屬包裝市場規模預計在 2025 年為 17.8 億美元,預計到 2030 年將達到 21.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.11%。

關鍵亮點

- 金屬包裝市場對泰國的包裝產業至關重要,為各個領域提供強大且可靠的解決方案。該研究深入研究了金屬包裝市場的複雜動態,並將其分為兩個主要部分:工業市場和金屬罐市場。

- 受工業活動增加、食品和飲料消費成長以及環保意識增強等多種因素的影響,泰國金屬包裝市場表現出韌性和成長。工業金屬包裝,包括中型散裝容器、散裝容器、桶和封蓋,由於其耐用性和保護性,在化學品、潤滑劑、農產品等領域受到穩定的需求。

- 該地區的金屬罐市場正在經歷強勁成長,這得益於化妝品、汽車和工業、油漆和清漆以及藥品等各種終端用戶對包裝食品和飲料儲存罐以及氣霧罐的需求不斷成長。永續包裝解決方案的採用正在推動可回收和環保金屬包裝的需求。消費者偏好正在發生變化,監管措施也有利於環保包裝。

- 泰國金屬包裝市場持續成長,為世界各地的產業參與企業提供了新的創新和合作機會。例如,特種化學品公司東洋油墨集團的日本母公司東洋SC控股於2023年3月宣布,已與其合併子公司東洋油墨泰國公司簽署了一項股份購買協議,以收購泰國罐頭市場無印刷罐外牆塗料製造商泰國Eurocoat的100%股權。

- 鋁是一種可回收材料。廢物被控制在最低限度,幾乎 100% 可回收。鋁製汽水罐可以回收成大小大致相同的新罐。據泰國飲料罐有限公司稱,多年來生產的鋁中有近75%仍在使用。在泰國,90%以上的鋁罐都是可回收的。

- 金屬包裝面臨其他包裝解決方案的競爭。塑膠包裝解決方案等材料是該行業的替代包裝選擇之一。塑膠包裝已成為許多行業大規模倉儲和運輸中金屬包裝的主要競爭對手。食品和飲料行業是金屬罐的主要用戶,現在開始採用可回收塑膠包裝解決方案。塑膠罐是透明的,這有助於品牌表明食品的品質。此外,政府推廣環保儲存材料的措施也限制了市場的成長。

泰式金屬包裝市場趨勢

罐裝食品佔據很大市場佔有率

- 罐裝飲料非常適合盛裝啤酒等酒精飲料,尤其是那些略帶氣泡的飲料。罐子是密封的,非常適合盛裝酸性強且可在壓力下儲存的軟性飲料。二氧化碳不像穿過其他材料那樣容易穿過金屬,因此氣體濃度會隨著時間的推移而增加,從而給消費者帶來更「發泡」的體驗。

- 各公司逐漸意識到罐裝優質飲料包裝的巨大潛力,這一趨勢有望推動市場成長。例如,飲料業主要企業卡拉寶集團憑藉其首款產品拉格啤酒(酒精濃度為4.9%)進入啤酒市場。 2023年11月,該公司在泰國推出了兩個金屬罐裝的新啤酒品牌:Carabao Beer和Tawan Daeng Beer。

- 此外,根據泰國工業經濟辦公室的數據,泰國的啤酒總銷售額從2023年7月的2.867億美元逐漸增加到2023年12月的4.356億美元。隨著消費量的增加,啤酒銷售也呈現出巨大的需求,這直接影響了對用於包裝啤酒的金屬罐的需求,因為金屬罐具有其特性。總體而言,這些趨勢正在促進市場充滿活力和不斷擴大,為該地區的老牌參與企業和新興品牌提供機會。

- 隨著泰國個人護理和化妝品行業的發展,對環保包裝的需求也顯著成長。這是因為個人護理和化妝品含有可與陽光和空氣反應的化學物質,並且採用氣霧金屬罐包裝。因此,各大公司開始推出鋁製氣霧罐,特別是用於髮膠和除臭劑等產品。此外,具有環保意識的消費者選擇可自然分解的可回收包裝,促進了氣霧罐的銷售。

飲料業預計將佔據主要市場佔有率

- 飲料業包括蘇打水、果汁、咖啡、茶等多種飲料。它回應了消費者對清爽、偏好飲料不斷變化的偏好。對健康和保健的關注促使消費者尋求更健康的飲料。功能性飲料、運動飲料、維生素和礦物質強化飲料、益生菌等機能飲料正在興起。

- 此外,消費者越來越關注糖的消費量以及它對他們的健康和福祉的影響。在此背景下,人們對不含添加糖的天然有機飲料的需求日益增加。飲料產業的變化是罐裝飲料包裝市場擴大的驅動力之一。

- 即飲飲料(RTD)是成熟品牌和新興品牌機能飲料的最新趨勢之一。隨著越來越多的人尋求新穎、創新的方式來享受他們最喜歡的飲料,RTD 已成為一種流行的選擇。對於經常出門的人來說,罐裝飲料是理想的選擇,因為它們易於攜帶,可以讓飲料更長時間地保持冷鮮,而且不易破碎。

- 飲料罐的目的是為了保持果汁成分的新鮮度。它也很方便,因為您可以在旅途中飲用。罐頭保存期限長,可保留風味,方便消費者儲存、堆疊和維護。 2024 年 2 月,泰國的果汁銷售額大幅成長,從 2023 年 10 月的 44,200 美元成長至 57,700 美元,表明該地區的果汁需求增加,從而塑造了一系列金屬罐的市場。

- 罐子光滑、纖薄的風格易於抓握,而且外觀也很漂亮。它還可以作為光線和空氣的屏障,幫助能量飲料保持更長的新鮮並更快冷卻。這些環保罐與其他飲料罐一樣,光滑、纖薄、可堆疊、重量輕且可 100% 無限回收。因此,罐裝能量飲料的需求很高,尤其是年輕一代,這為製造商創造了良好的機會。例如,2023年6月,TCP集團新成立的「Refreshment Booster」部門將在該地區推出罐裝「紅牛能量汽水」。

泰國金屬包裝產業概況

泰國金屬包裝市場的競爭格局分為東洋制管集團控股公司、昭和電工株式會社等參與企業。 (SDK)、Crown Holdings, Inc.、Lohakij Rung Charoen Sub 和 Thai Beverage Can Ltd. 隨著市場參與企業對研發的投資,他們的產品變得更加差異化,並在競爭中佔據上風。

- 2023 年 9 月 - 泰國飲料罐有限公司在 WHA工業區的泰國飲料罐 2 號工廠開設第五條鋁罐生產線。新的生產設施將能夠根據客戶需求生產鋁罐和鋁瓶。最初,該公司計劃生產常規的 500 毫升罐和 DWI(拉深和壁厚)鋁瓶。 DWI 鋁瓶纖薄而堅固且輕便,採用現代設計,有 310 毫升和 510 毫升兩種尺寸。

- 2023 年 7 月 - 皇冠控股已將其鋁業管理舉措(ASI) 認證擴展到亞太地區,強調其 Twentyby30 永續發展舉措,以促進道德供應鏈。泰國的 Nong Khae 工廠和 Crown TCP 飲料包裝工廠最近獲得了 ASI 性能標準認證。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場動態

- 市場促進因素

- 都市化加速,經濟持續成長

- 罐頭需求推動市場成長

- 市場問題

- 替代產品成本下降可能抑制市場成長

- 全球金屬包裝市場概覽

第6章市場區隔

- 依材料類型

- 鋁

- 鋼

- 依產品類型

- 能

- 食品罐

- 飲料罐

- 氣霧罐

- 散裝容器

- 運輸桶和鼓

- 瓶蓋和瓶塞

- 能

- 按行業

- 飲料

- 食物

- 油漆和化學品

- 工業的

第7章競爭格局

- 公司簡介

- Toyo Seikan Group Holdings, Ltd.

- ALUCON Public Company Limited(TAKEUCHI PRESS INDUSTRIES CO., LTD.)

- Crown Holdings, Inc.

- Lohakij Rung Charoen Sub Co., Ltd.

- SWAN實業(泰國)有限公司

- Thai Beverage Can Ltd.

- Bangkok Can Manufacturing Co., Ltd.

- Next Can Innovation Co., Ltd.

- Asian-Pacific Can Co., Ltd(Thai Union Group PCL)

- 標準罐頭有限公司(泰國)

- Royal Can Industries Company Limited

第8章投資分析

第9章:市場的未來

The Thailand Metal Packaging Market size is estimated at USD 1.78 billion in 2025, and is expected to reach USD 2.18 billion by 2030, at a CAGR of 4.11% during the forecast period (2025-2030).

Key Highlights

- The metal packaging market is vital to the Thailand packaging industry, offering robust and reliable solutions across various sectors. The study delves into the intricate dynamics of the metal packaging market, categorizing it into two primary segments: the industrial and metal cans markets.

- The Thai metal packaging market demonstrates resilience and growth, driven by diverse factors such as increasing industrial activities, expanding food and beverage consumption, and growing environmental awareness. Industrial metal packaging, including IBCs, bulk containers, drums, and closures, witnesses steady demand from sectors like chemicals, lubricants, and agricultural products due to their durability and protective qualities.

- The metal cans segment is experiencing strong growth in the region, driven by the growing demand for storage cans for packaged food and beverages and aerosol cans for various end-users, including cosmetics, automotive and industrial, paints and varnishes, pharmaceuticals, etc. Adopting sustainable packaging solutions increases the demand for metal packaging, which is recyclable and eco-friendly. Consumer preferences are changing, and regulatory measures favor eco-friendly packaging.

- The Thai metal packaging market will continue to grow, providing new opportunities for innovation and cooperation between industry players worldwide. For instance, Toyo SC Holdings, the Japanese parent company of the specialty chemicals company Toyo Ink Group, announced that, on March 2023, it and its consolidated subsidiary, Toyo Ink Thailand, entered into a share purchase agreement to acquire 100% of Thai Eurocoat, a manufacturer of external paints for nonprinted cans in the Thai canned food market.

- Aluminium is a highly recyclable material. It is almost 100% recyclable with minimal loss. Ann aluminum soda can can can be recycled into a new can of nearly the exact same size. According to Thai Beverage Can Ltd.,nearly 75% of all aluminium produced over the years is still in use. In Thailand, aluminium cans can be recycled more than 90%.

- Metal packaging is facing a lot of competition from other packaging solutions. Materials like plastic packaging solutions are among the alternative packaging options in the industry. Plastic packaging is the main competitor of metal packaging in many industries for large-scale storage and transportation. The food and beverage industry, the primary user of metal cans, has started adopting recyclable plastic packaging solutions. Plastic cans are transparent, which helps brands to show their food's quality. Further, the government's efforts to promote environmentally friendly storage materials limit market growth.

Thailand Metal Packaging Market Trends

Can segment to Hold Significant Market Share

- Cans are perfect for alcoholic beverages like beer, especially those with a hint of foam. The airtight nature of the can makes it ideal for soft drinks, which have a higher acidity level and are pressurized. Carbon dioxide cannot pass through metal than other materials, so the gas concentration can increase over time, providing consumers with a much more "fizzy" experience.

- Companies recognize the immense potential of premium beverage packaging in cans, a trend poised to drive market growth. For instance, the Carabao Group, a significant player in the beverage industry, has entered the beer market with its first product, "Lager," with 4.9 percent alcohol content. In November 2023, it launched Carabao Beer and Tawan Daeng Beer, two new beer brands in Thailand, in metal cans.

- Further, per the Office of Industrial Economics (Thailand) data, total beer sales in Thailand increased gradually in December 2023 to USD 435.6 million, up from USD 286.7 million in July 2023. With the growing consumption, beer sales also show significant demand, directly impacting the demand for metal cans for packing beer due to its characteristics. These trends collectively contribute to a dynamic and expanding market, offering opportunities for established players and emerging brands in the region.

- As Thailand's personal care and cosmetics sector grows, the need for environmentally friendly packaging has significantly increased. This is because personal care and cosmetic items contain chemicals that can react to sunlight and air, leading to the use of aerosol metal cans for their packaging. As a result, major companies are now launching aerosol cans made from aluminum, particularly for items like hair sprays and deodorants. Moreover, consumers who care about the environment are choosing recyclable packaging that can break down naturally, which is helping to boost the sales of aerosol cans.

Beverage Segment is Expected to Hold a Significant Market Share

- The beverage industry encompasses many drinks, including carbonated soft drinks and juices, coffee and tea, and more. It caters to consumers with changing preferences for refreshing and indulgent beverages. Health and wellness concerns have prompted consumers to look for healthier beverages. Functional drinks such as functional water, sports drinks, vitamins and minerals-fortified drinks, probiotics, and more are rising.

- Further, consumers are becoming more conscious of their sugar consumption and how it affects their health and well-being. With this in mind, there is an increasing demand for sugar-free, natural, organic drinks. The changing landscape of the beverage industry has been one of the driving forces behind the expansion of the can market in beverage packaging.

- Ready-to-drink beverages (RTDs) are one of the latest trends in functional drinks for both established and up-and-coming brands. As more people seek new and innovative ways to enjoy their favorite beverages, RTDs have become the go-to choice for many. Cans are easy to transport, keep drinks cold and fresh longer, and are unbreakable, making them ideal for constantly moving people.

- The purpose of the beverage can is to maintain the freshness of the juice's ingredients. It is also convenient and easy to consume on the go. Cans provide a long shelf life, keep the flavor, and allow consumers to store, stack, and maintain their supply. The fruit juices' sales value increased significantly in Thailand in February 2024. It was USD 57.7 thousand, which increased from USD 44.2 thousand in October 2023, showing the increasing demand for Juice in the region, creating a market for different metal cans.

- Sleek and slim-style cans are more accessible to grip and look good. They also act as a barrier to light and air, which helps keep your energy drinks fresh longer and allows them to cool down faster. These eco-friendly cans are sleek, slim, stackable, lightweight, and 100% infinitely recyclable like all beverage cans. Thus, there is a high demand for energy de=rink cans in the young generation, creating an opportunity for the manufacturers. For instance, in June 2023, TCP Group's new "refreshment booster" segment launches "Red Bull Energy soda" in can packaging in the region.

Thailand Metal Packaging Industry Overview

The competitive landscape of the Thailand Metal Packaging Market is fragmented, with several players, such as Toyo Seikan Group Holdings, Ltd., Showa Denko K.K. (SDK), Crown Holdings, Inc., Lohakij Rung Charoen Sub Co., Ltd., Thai Beverage Can Ltd., and more. As the market participants spend on R&D, their products become more distinct, and the idea of product differentiation is to gain a competitive edge.

- September 2023-Thai Beverage Can Ltd. opened the fifth aluminum can production line at the Thai Beverage Can two plant in the WHA Industrial Area. This new production facility can produce aluminum cans and bottles to meet customer demand. Initially, the production will include 500 ml regular cans and DWI (Drawn and wall-ironed) aluminum bottles, which are thinner yet solid and lightweight, available in modern designs of 310 ml and 510 ml sizes.

- July 2023-With its Twentyby30 sustainability initiative to promote ethical supply chains, Crown Holdings, Inc. has broadened its Aluminium Stewardship Initiative (ASI) certifications across the Asia Pacific. The Thailand Nong Khae and Crown TCP beverage packaging facilities recently received the ASI Performance Standard certification.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Urbanization and Consistent Economic Growth in the Country

- 5.1.2 Demand for Canned Food Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 Lower Cost of Substitute Products may Restrain the Market Growth

- 5.3 Overview of Global Metal Packaging Market

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.1.1 Food Cans

- 6.2.1.2 Beverage Cans

- 6.2.1.3 Aerosol Cans

- 6.2.2 Bulk Containers

- 6.2.3 Shipping Barrels and Drums

- 6.2.4 Caps and Closures

- 6.2.1 Cans

- 6.3 By End-User Vertical

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Paints and Chemicals

- 6.3.4 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toyo Seikan Group Holdings, Ltd.

- 7.1.2 ALUCON Public Company Limited (TAKEUCHI PRESS INDUSTRIES CO., LTD.)

- 7.1.3 Crown Holdings, Inc.

- 7.1.4 Lohakij Rung Charoen Sub Co., Ltd.

- 7.1.5 SWAN Industries (Thailand) Company Limited

- 7.1.6 Thai Beverage Can Ltd.

- 7.1.7 Bangkok Can Manufacturing Co., Ltd.

- 7.1.8 Next Can Innovation Co., Ltd.

- 7.1.9 Asian-Pacific Can Co., Ltd (Thai Union Group PCL)

- 7.1.10 Standard Can Co,. Ltd. (Thailand)

- 7.1.11 Royal Can Industries Company Limited