|

市場調查報告書

商品編碼

1693635

中國電動車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030年)China Electric Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

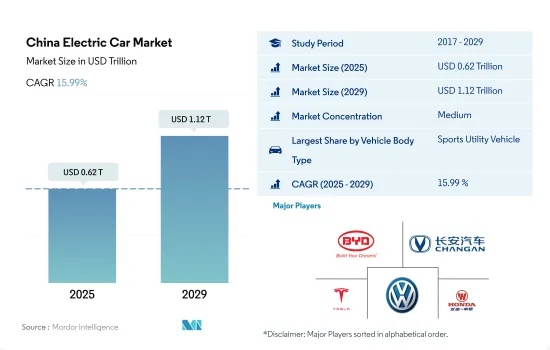

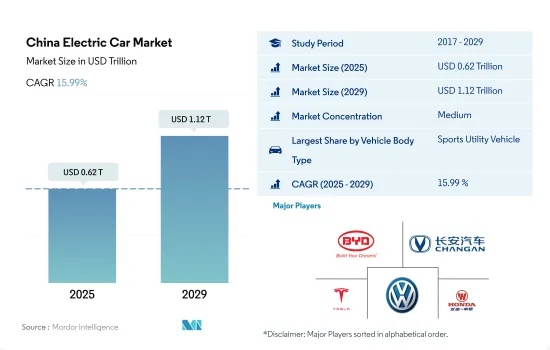

預計 2025 年中國電動車市場規模將達到 6,200 億美元,到 2029 年預計將達到 1.12 兆美元,預測期內(2025-2029 年)的複合年成長率為 15.99%。

對多樣化汽車組合的關注反映了中國引領電動車創新和滿足廣泛消費者偏好。

- 在中國充滿活力的汽車市場中,電動車的興起反映了消費者偏好和政策方向的更廣泛轉變,旨在培育更永續的交通生態系統,重塑不同汽車領域的市場動態。預計掀背車混合動力車市場將略有下滑,這表明市場正在向全面電氣化進行調整,而轎車、SUV 和 MPV 市場預計將繼續成長,這主要得益於綠色需求、技術進步和強力的政府獎勵。

- 混合動力汽車市場,尤其是轎車市場,經歷了急劇的成長,並且由於中國積極的二氧化碳減排政策和補貼,混合動力汽車對消費者更具吸引力,預計還會進一步擴大。同樣,SUV HEV 領域也正在經歷指數級成長,顯示人們明顯偏好將 SUV 的實用性、多功能性與環境效益相結合的車輛。預計這一趨勢將持續下去,混合動力技術的持續進步預計將在本世紀末帶來可觀的銷售。

- MPV市場雖然規模較小,但卻反映了這一上升趨勢,並體現了中國消費者對寬敞、多功能和環保的交通解決方案的多樣化需求。政府推行永續交通的政策以及充電基礎設施和車輛技術的發展是推動這一成長的關鍵因素。隨著中國繼續推動電氣化進程,這些汽車領域的不同發展軌跡揭示了一個複雜且快速發展的市場。

中國電動車市場趨勢

政府措施和強勁的OEM投資推動中國電動車銷售快速成長

- 政府減少汽車燃料排放的計畫正在鼓勵消費者轉向更環保的汽車。 2020年11月,中國政府宣布將在2035年前禁止石化燃料汽車,並承諾在新能源計畫下銷售100%新能源汽車。這導致對電動車的需求增加。透過採取此類法規,中國近年來加強了電動車及其所用各種電池組的銷售。

- 政府為消費者和製造商推出了各種計劃和獎勵,以促進和加強該國對電動車的需求。 2022年5月,政府宣布重新引入補貼計劃,以增加電動車的銷售量。此外,政府還將為選擇電動車的客戶提供1,500美元的補貼。這些因素正在鼓勵消費者投資電動車,2022 年電動車銷量將比 2021 年成長 2.90%。

- 電動車需求的不斷成長迫使OEM計劃擴大電動車類別的開發和生產。 2021年,通用汽車宣布計劃在2025年將電動和自動駕駛汽車方面的支出增加到200億美元。該公司計劃在2023年推出20款新型電動車,並計劃在中國每年銷售超過100萬輛電動車。因此,預計這些因素將在 2024 年至 2030 年期間推動中國電動車市場的發展。

中國電動汽車產業概況

中國電動車市場格局適度整合,前五大企業市佔率達53.91%。市場的主要企業有:比亞迪汽車、重慶長安汽車股份有限公司、特斯拉公司、福斯汽車股份公司和五菱汽車控股有限公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 二手車銷售

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 車輛配置

- 搭乘用車

- 掀背車

- 多用途車輛

- 轎車

- SUV

- 搭乘用車

- 燃料類別

- BEV

- FCEV

- HEV

- PHEV

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BYD Auto Co. Ltd.

- Chery Automobile Co. Ltd.

- Chongqing Changan Automobile Company Limited

- Gac Aion New Energy Automobile Co.Ltd

- Hozon New Energy Automobile Co. Ltd.

- Li Xiang(Li Auto Inc.)

- Nio(Anhui)Co. Ltd.

- Tesla Inc.

- Volkswagen AG

- Wuling Motors Holdings Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93023

The China Electric Car Market size is estimated at 0.62 trillion USD in 2025, and is expected to reach 1.12 trillion USD by 2029, growing at a CAGR of 15.99% during the forecast period (2025-2029).

The focus on diverse vehicle configurations mirrors China's ambition to lead in electric car innovation, catering to a broad spectrum of consumer preferences

- In China's vibrant automotive landscape, the push toward EVs is reshaping the market dynamics across different vehicle segments, reflecting broader shifts in consumer preferences and policy directives aimed at fostering a more sustainable transportation ecosystem. While the hatchback HEV segment anticipates a slight decline, signaling a market adjustment toward full electrification, the sedan, SUV, and MPV segments are poised for continued growth, propelled by a combination of eco-friendly demand, technological advancements, and strong governmental incentives.

- The sedan HEV market, in particular, has experienced dramatic increases, with projections indicating further expansion, underscored by China's aggressive carbon reduction policies and subsidies that make HEVs more appealing to consumers. Similarly, the SUV HEV sector has shown exponential growth, highlighting a clear preference for vehicles that merge environmental benefits with the practicality and versatility of SUVs. This trend is expected to continue, with sales projected to reach significant numbers by the end of the decade, driven by ongoing advancements in hybrid technology.

- The MPV segment, while smaller, mirrors this upward trajectory, showcasing the diverse needs of Chinese consumers for spacious, versatile, and eco-friendly transportation solutions. Government policies promoting sustainable transportation, alongside developments in charging infrastructure and vehicle technology, are key factors fueling this growth. As China continues to navigate its path toward electrification, the varying trajectories of these vehicle segments reveal a complex and rapidly evolving market.

China Electric Car Market Trends

Government initiatives and strong OEM investments drive rapid drowth in electric vehicle sales in China

- The programs launched by the government to reduce gas emissions caused by vehicle fuels are encouraging consumers to shift to green vehicles. In November 2020, the government of China announced a ban on fossil fuel vehicles by 2035, clearly stating the selling of 100% new energy vehicles under the new energy program. As a result, the demand for electric cars increased. Adopting such regulations enhanced the sales of electric cars and various types of battery packs used in them in China in recent years.

- The government is introducing various schemes and incentives for customers and manufacturers to promote and enhance the demand for electric vehicles in the country. In May 2022, the government announced the reintroduction of the subsidy program to increase the sales of electric vehicles. Moreover, the government will allocate a subsidy of USD 1500 to customers opting for an electric car. Such factors have encouraged customers to invest in electric mobility, which further has increased the sales of electric cars by 2.90% in 2022 over 2021 in China.

- The growing demand for electric vehicles has forced OEMs to plan to increase development and production in the electric vehicle category. In 2021, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company is expected to launch 20 new electric models by 2023 and aims to sell more than 1 million electric cars a year in China. As a result, these factors are expected to drive the electric vehicle market in China during the 2024-2030 period.

China Electric Car Industry Overview

The China Electric Car Market is moderately consolidated, with the top five companies occupying 53.91%. The major players in this market are BYD Auto Co. Ltd., Chongqing Changan Automobile Company Limited, Tesla Inc., Volkswagen AG and Wuling Motors Holdings Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Chery Automobile Co. Ltd.

- 6.4.3 Chongqing Changan Automobile Company Limited

- 6.4.4 Gac Aion New Energy Automobile Co.Ltd

- 6.4.5 Hozon New Energy Automobile Co. Ltd.

- 6.4.6 Li Xiang (Li Auto Inc.)

- 6.4.7 Nio (Anhui) Co. Ltd.

- 6.4.8 Tesla Inc.

- 6.4.9 Volkswagen AG

- 6.4.10 Wuling Motors Holdings Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219