|

市場調查報告書

商品編碼

1693595

可膨脹石墨:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Expandable Graphite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

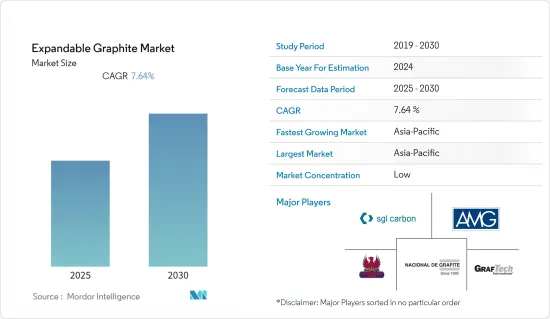

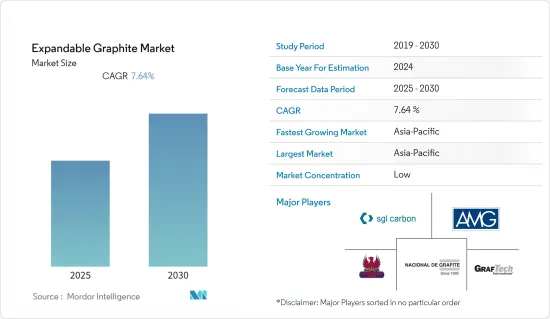

預計預測期內可膨脹石墨市場複合年成長率為 7.64%。

主要亮點

- 從中期來看,由於建築業擴大採用可膨脹石墨作為阻燃劑、對非鹵阻燃劑的需求不斷成長以及家電市場的成長等因素,全球可膨脹石墨消費量預計將增加。

- 但由於石墨供應有限,估計可膨脹石墨的需求可能很快就會下降。此外,供應有限和價格上漲預計也會阻礙市場發展。

- 然而,隨著建築和墊片中耐火材料和石棉基耐火材料等危險耐火材料的使用禁令日益嚴格,預計將為擴大的石墨市場帶來新的機會。

- 在收益和預測方面,預計亞太地區將在預測期內主導全球市場。

可膨脹石墨市場趨勢

阻燃劑領域預計將佔據很大佔有率

- 可膨脹石墨是層狀石墨,每層之間都含有酸。加熱時,酸會產生氣體,導致層狀石墨膨脹並透過切斷空氣供應來滅火。

- 阻燃劑的目的是減少火勢的發生或減緩或防止火勢的蔓延。阻燃劑用於軟墊家具、汽車座椅、地毯和其他可能成為火源的區域。可膨脹石墨特別適合作為阻燃添加劑。

- 可膨脹石墨具有受熱膨脹的特性,因此被廣泛應用於各行各業作為阻燃劑。例如建築、電子、汽車、紡織品等。

- 在北美,美國在建設產業中佔有重要佔有率。除美國外,加拿大和墨西哥是建築業投資的主要貢獻者。根據美國人口普查局的數據,2022年新的私人倉儲建設將達到615.3億美元,比2021年的12,795億美元成長24.6%。

- 德國聯邦統計局的數據顯示,2022 年德國服飾收益約 68 億歐元,而 2021 年為 57 億歐元。此外,2022年德國紡織業的收益將達到約127.9億歐元,而2021年為118億歐元。

- 預計所有上述因素將在預測期內推動全球可膨脹石墨市場的發展。

亞太地區佔市場主導地位

- 在亞太地區,中國是GDP最大的經濟體。國際貨幣基金組織數據顯示,2021年該國實際GDP折合成率成長8.4%,主要得益於工業活動和進出口貿易的逐步恢復。然而,到2022年,這一比例下降至3.0%。預計2023年GDP成長率為5.2%。

- 中國是該地區的主要國家之一,也是各種用途可膨脹石墨的主要消費國。

- 2022年,諾德曼與ADT合作在北京西南部建立了新的生產工廠。新的生產設施擁有未來30至40年的營運許可,並配備了現代化的集中水處理系統。原料石墨配送中心也位於同一化工園區內,確保快速供應這種生產可膨脹石墨的最重要原料。

- 可膨脹石墨對於各種行業使用的電池來說是一種特別有價值且眾所周知的元素。 2022 年,科萊恩宣布將在該國未來的 Dayabey 工廠生產第二條受專利保護的無鹵素 Exolit OP 阻燃劑生產線。該公司已投資約 4,000 萬瑞士法郎(約 4,560 萬美元)用於擴大創新和永續防火解決方案及相關技術專長的取得管道,並支持電動車和電氣電子領域工程塑膠應用的顯著成長。

- 印度是全球多個產業最大的新興市場之一。該國認為可膨脹石墨有多種用途,包括電動車電池、阻燃劑、軟性線圈和石墨烯。

- 2022年,澳洲石墨礦開發商Evion Group(前身為Blackearth)和印度石墨生產商Metachem在普納收購了一塊佔地5英畝的土地,以建立合資下游石墨加工廠。

- 該合資企業名為 Panthera Graphite Technologies,初始階段(前三年)每年將可生產 2,000-2,500 噸可膨脹石墨。此後,從第四年開始,產能將擴大至每年4000-5000噸。該工廠計劃於2023年11月開始運作。

- 預計所有上述因素將在預測期內刺激該國所研究市場的需求。

可膨脹石墨產業概況

可膨脹石墨市場較為分散。市場上的主要石墨製造商包括(不分先後順序)SGL Carbon、AMG Mining AG、Durrans Group、Nacional de Grafite 和 GrafTech International Ltd。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 可膨脹石墨作為阻燃劑的應用日益廣泛

- 無鹵阻燃劑需求不斷成長

- 限制因素

- 擴大石墨供應限制

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 阻燃劑

- 軟性箔

- 導電添加劑

- 冶金

- 石墨烯

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- GrafTech International Ltd.

- Nacional de Grafite

- NeoGraf Solution

- Northern Graphite

- Qingdao Black Dragon Graphite Group

- Qingdao Jinhui Graphite Co. Ltd

- Qingdao YanXin Graphite Products Co., LTD.

- Sanyo Corporation

- SGL Carbon

- Shijiazhuang ADT Carbonic Material Factory

- Yichang Xincheng Graphite Co., Ltd.

第7章 市場機會與未來趨勢

- 加強對危險防火材料的禁令

簡介目錄

Product Code: 92746

The Expandable Graphite Market is expected to register a CAGR of 7.64% during the forecast period.

Key Highlights

- Over the medium term, factors such as the increasing adoption of expandable graphite as a flame retardant in the construction industry, increasing demand for non-halogenated flame retardants, and growth in the consumer electronics market are expected to increase the global consumption of expandable graphite.

- However, it is estimated that the demand for expandable graphite may decrease shortly due to the limited supply of graphite. Furthermore, limited supply and rising prices are also expected to hamper the market.

- Nevertheless, increasing bans on hazardous refractories such as brominated or asbestos refractories in buildings and gaskets are expected to provide new opportunities for the expanded graphite market.

- In terms of revenue, Asia-Pacific is expected to dominate the global market during the forecast period.

Expandable Graphite Market Trends

The Flame Retardant Segment is Anticipated to Hold a Significant Share

- Expandable graphite is a stratiform graphite and contains acids between each stratum. When heated, an acid generates gas, and these stratiforms are expanded, which enables to put off a fire by cutting off the supply of air.

- Flame retardants are intended to limit, slow, or prevent the spread of fires. Whether in upholstered furniture, car seats, or carpets, flame retardants are used wherever there are potential sources of fire. Expandable graphite is particularly suitable as a flame-retardant additive.

- Expandable graphite is widely used as a flame retardant in different industries due to its ability to expand during heating. A few industries include building and construction, electronics, automotive, and textiles.

- In North America, the United States has a major share in the construction industry. Besides the United States, Canada and Mexico contribute significantly to the construction sector investments. According to the US Census Bureau, the value of new private warehouse construction in 2022 stood at USD 61.53 billion, 24.6% higher than the USD 1,279.5 billion in 2021.

- According to the German Federal Statistics Office, the German clothing industry recorded a revenue of around EUR 6.8 billion in 2022, compared to EUR 5.7 billion in 2021. Moreover, the revenue recorded from the German textile industry in 2022 was approximately EUR 12.79 billion, which was EUR 11.8 billion in 2021.

- All the above factors are expected to drive the global expandable graphite market during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China accounts for the largest economy in terms of GDP. According to the IMF, the country's real GDP grew 8.4% annually in 2021, primarily driven by the gradual resumption of industrial activities and import-export trade. However, it declined to 3.0% in 2022. The country's GDP is expected to grow 5.2% in 2023.

- China is one of the major countries in the region and has a major consumption of expandable graphite for various applications.

- In 2022, Nordmann, in partnership with ADT, set up a new production plant southwest of Beijing. The new production facility has an operating permit for the next 30-40 years and is installed with a modern and centralized water treatment system. The distribution center for raw graphite is located in the same chemical park, ensuring a faster supply of the most important raw material for producing the expandable graphite.

- The use of expandable graphite is an exceptionally valuable and especially well-known element for the batteries used in various industries. In 2022, Clariant announced the manufacturing of a second line of patent-protected halogen-free Exolit OP flame retardants at the future Daya Bay plant in the country. The company invested around CHF 40 million (~USD 45.6 million) to expand access to innovative and sustainable fire protection solutions and related technical expertise to support the significant growth of engineering plastics applications in e-mobility and electrical and electronic segments.

- India is one of the largest emerging markets in the world in various industries. The country has seen various applications of expandable graphite such as electric vehicle batteries, flame retardants, flexible coils, and graphene.

- In 2022, an Australian graphite mine developer Evion Group (Formerly known as Blackearth) and an Indian graphite producer Metachem acquired a 5-acre site in Pune to set up a downstream graphite processing plant under their joint venture.

- The JV, known as Panthera Graphite Technologies, can produce 2,000 - 2,500 tons per annum of expandable graphite in the initial stages (first three years). It will then expand production capacity to 4,000 - 5,000 tons per annum from the fourth year. The plant is expected to be commissioned in November 2023.

- All the abovementioned factors are expected to boost the demand for the market studied in the country during the forecast period.

Expandable Graphite Industry Overview

The expandable graphite market is fragmented in nature. Some major graphite manufacturers in the market include (in no particular order) SGL Carbon, AMG Mining AG, Durrans Group, Nacional de Grafite, and GrafTech International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption of Expandable Graphite as a Flame Retardant

- 4.1.2 Increasing Demand for Non-Halogenated Flame Retardants

- 4.2 Restraints

- 4.2.1 Limited Supply of Expanded Graphite

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Applications

- 5.1.1 Flame Retardant

- 5.1.2 Flexible Foils

- 5.1.3 Conductive Additives

- 5.1.4 Metallurgy

- 5.1.5 Graphene

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 GrafTech International Ltd.

- 6.4.2 Nacional de Grafite

- 6.4.3 NeoGraf Solution

- 6.4.4 Northern Graphite

- 6.4.5 Qingdao Black Dragon Graphite Group

- 6.4.6 Qingdao Jinhui Graphite Co. Ltd

- 6.4.7 Qingdao YanXin Graphite Products Co., LTD.

- 6.4.8 Sanyo Corporation

- 6.4.9 SGL Carbon

- 6.4.10 Shijiazhuang ADT Carbonic Material Factory

- 6.4.11 Yichang Xincheng Graphite Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Bans on Hazardous Fire-Resistance Materials

02-2729-4219

+886-2-2729-4219