|

市場調查報告書

商品編碼

1693573

車身套件:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Car Body Kit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

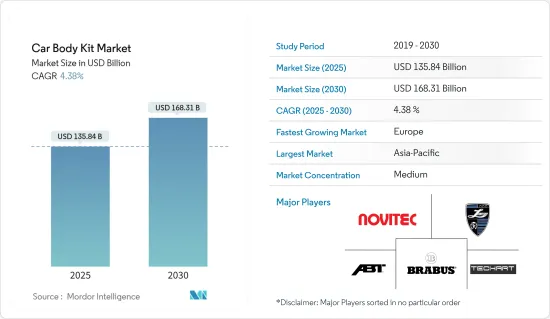

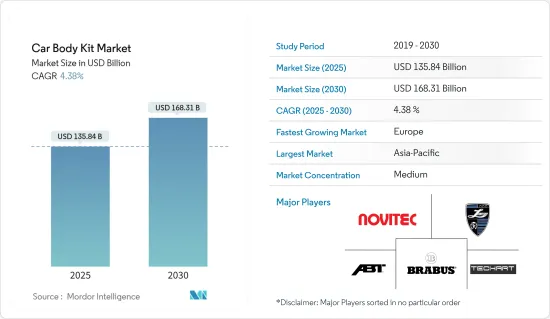

預計 2025 年車身套件市場規模為 1,358.4 億美元,到 2030 年將達到 1,683.1 億美元,預測期內(2025-2030 年)的複合年成長率為 4.38%。

預測期內市場成長的主要驅動力預計是消費者對娛樂性駕駛體驗的偏好不斷上升,以及年輕人對車輛客製化的偏好不斷上升。車主們透過汽車展現自己的個性,讓自己的汽車更加獨特、更加舒適、在眾多汽車中脫穎而出。

此外,汽車行業參與企業以及高檔跑車和賽車用戶的積極參與,透過空氣動力學套件、保險桿調校等方式提高市場的整體性能,預計將在未來幾年進一步增加市場需求。此外,由於擾流板和保險桿損壞而經常發生的事故也增加了市場對車身套件的需求。

電氣化趨勢和消費者在車身套件製造過程中越來越偏好使用輕質材料,預計將為在市場上營運的公司提供顯著的機會。碳纖維是一種有吸引力的選擇,因為它具有賽道般的特性。例如,2024 年 2 月,Pit+Paddock 將推出 Artisan Spirits Black Label,這是一款用於全輪驅動、渦輪增壓豐田 GR Corolla 的碳纖維空氣動力學套件。

Novitec Group、Maxton Design、TECHART Automobildesign GmbH 等是市場上一些知名的參與者。這有助於市場的成長。

車身套件市場趨勢

運動型多用途車佔大部分市場佔有率

從長遠來看,消費者對舒適性和自動安全功能的日益成長的傾向、更高的離地間隙、有尊嚴的駕駛員座位位置、堅固性和越野能力等因素預計將推動運動型多功能車市場的發展。

隨著對 SUV 的需求不斷成長,中型 SUV 的需求也很高,因為它們提供多種引擎型號,包括內燃和電動選項,以提高燃油效率。此外,這些車輛配備多種傳動選擇,對市場產生了積極影響。

電動運動型多功能車的普及率不斷提高以及快速發展等其他因素也在推動市場發展。

亞太地區的電動SUV擁有量正在快速成長,從而帶來了更廣泛的基本客群。考慮到這種情況,各公司正在透過提供緊湊型和豪華型等不同領域的電動 SUV 的各種選擇來滿足市場需求。例如,2023 年 12 月,現代汽車宣布將於 2024 年在印度推出熱門 SUV 現代 Creta 的電動版。

此外,考慮到運動型多用途車 (SUV) 的成長,車身套件製造商正專注於推出各種車型。例如,2023 年 8 月,Honda WR-V 將在印尼上市,配備賽車風格的車身套件,使其具有攻擊性的姿態。

從而促進該領域的成長。

亞太地區佔最大

預計未來幾年亞太地區將經歷顯著成長。該地區對車身套件的需求主要受到中國、印度和其他國家新車、二手和商用車銷售成長的推動。此外,各汽車製造商正在投資開發自動駕駛、混合動力汽車和電動車的電氣和數位技術,預計這將對市場產生積極影響。例如

2024年1月,比亞迪推出人工智慧智慧汽車系統,在自動泊車等先進技術上與競爭對手競爭。該公司計劃投資 50 億元人民幣(7.018 億美元),在中國各城市建設全球首個全地形專業試駕場地。

鑑於汽車銷量的成長,這些車身套件近年來越來越受歡迎,尤其是在汽車製造商和愛好者中。公司正專注於推出各種新產品來滿足日益成長的需求。例如,2023 年 12 月,日本改裝公司 DAMD 為鈴木吉姆尼發表了多款車身套件和造型零件。這些車身套件和零件可以讓小型 SUV 呈現出復古的外觀,或者讓它看起來更像其他越野車,例如豐田Land Cruiser或梅賽德斯-奔馳 G-Wagon。

此外,汽車性能套件不僅僅是添加設計元素,還可以提供一系列附加特性,而無需修改或安裝任何零件或組件。透過修改,使用者可以提高性能和美觀度,從而提高功率和扭矩。

從而促進市場的成長。

車身套件產業概況

車身套件市場由全球和地區的知名公司鞏固和主導。為了維持市場地位,公司正在採取新產品發布、合作和合併等策略。例如

2023 年 9 月,日本改裝商 DAMD 在 2024 年東京汽車沙龍上為鈴木吉姆尼推出了兩款全新車身套件。這家日本改裝廠的吉姆尼車身套件的主題是「歐洲傑作」。 DAMD 也與 OZ Racing 合作,為 Jimny 重新打造了經典的白色拉力賽車輪轂。

市場的主要企業包括 NovitecGroup、Maxton Design、TECHART Automobildesign GmbH 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 乘用車銷量成長

- 市場限制

- 政府對車輛改裝的嚴格規定

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 體型

- 掀背車

- 轎車

- SUV

- 多用途汽車(MPV)

- 車身套件材質

- 玻璃纖維

- ABS塑膠

- 聚氨酯

- 碳纖維

- 複合材料

- 車身套件零件

- 全身套件

- 前後保險桿套件

- 劇透

- 其他零件(唇形套件、前格柵、改裝罩等)

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Modsters Automotive

- Auto Starke Private Limited

- TECHART Automobildesign GmbH

- Maxton Design

- Novitec Group

- LARTE Design

- BRABUS GMBH

- Mansory Design & Holding GmbH

- ABT SportsLine GmBH

- Motoren Mayer Technik GmbH

- AC Schnitzer

第7章 市場機會與未來趨勢

The Car Body Kit Market size is estimated at USD 135.84 billion in 2025, and is expected to reach USD 168.31 billion by 2030, at a CAGR of 4.38% during the forecast period (2025-2030).

The increasing consumer inclination towards an entertaining driving experience and rising vehicle customization among the young population are considered primary driving factors for the market growth during the forecast period, i.e., nowadays, most people try to make themselves different from others. Car owners express their individuality using their vehicles, making them unique, more comfortable, and noticeable among other cars.

In addition, the active participation of car enthusiasts and users of premium sports and racing cars in enhancing the overall performance of the market through aerodynamic kits, bumper tuning, etc., is expected to further augment the demand in the market in the coming years. Furthermore, normal accidents with spoilers and bumper damages contribute to the demand for body kits in the market.

The trend of electrification and consumers' growing preference for using lightweight materials in the manufacturing process of body kits are expected to offer notable opportunities for the players operating in the market. Carbon fiber is one of the attractive options as it focuses on features like racetracks, such as extraordinary strength and durability against intense forces put upon it when traveling at speed for protracted periods. For example, in February 2024, Pit+Paddock debuts the Artisan Spirits Black Label carbon fiber aero kit for the all-wheel-drive and turbocharged Toyota GR Corolla.

Novitec Group, Maxton Design, TECHART Automobildesign GmbH, and Others are some of the prominent players in the market. Thus contributing to the market growth.

Car Body Kit Market Trends

Sports Utility Vehicles Hold Major Share

Over the long term, factors such as rising consumer inclination toward comfort and automatic safety features, higher ground clearance, commanding driver seating position, robustness, and off-road driving capabilities are projected to drive the sports utility vehicle market.

With the growth in demand for sports utility vehicles, mid-size SUVs are in high demand as they are offered in multiple engine variants with internal combustion engines and electric options for better fuel economy. Additionally, these vehicles are provided with various transmission options, positively impacting the market.

Other factors, such as the increasing adoption of electric sports utility vehicles coupled with rapid development, will drive the market growth.

Asia-Pacific has witnessed an exponential rise in electric SUV ownership, resulting in a larger customer base. Considering the scenario, the companies are providing various options for electric SUVs in various segments, such as compact and luxury, to cater to the market. For example, In December 2023, Hyundai announced the launch of an electric option for its popular SUV, the Hyundai Creta, in India in 2024.

In addition, considering the growth of sports utility vehicles, body kit companies are focusing on various launches. For instance, in August 2023, the Honda WR-V was launched in Indonesia with a racer edition body kit installed to give it an aggressive stance.

Thus, contributing to segment growth.

Asia-Pacific Holds the Highest Share

The Asia-Pacific region is expected to grow significantly over the coming years. The region's demand for car body kits is mainly supported by increasing sales of new and used cars and commercial vehicles across China, India, and other countries. Further, as various automakers are investing in the development of electric and digital technologies for autonomous, hybrid, and electric vehicles, such is expected to positively impact the market. For instance

In January 2024, BYD launched its AI-powered smart car system to better compete with rivals on advanced technologies such as automated parking, and the company plans to invest 5 billion Chinese yuan (USD 701.8 million) to build the world's first all-terrain professional test drive sites in cities across China.

Considering vehicle sales growth, these body kits have gained popularity in recent years, particularly among automakers and enthusiasts. Companies are focusing on various launches to cater to the increasing demand. For example, In December 2023, DAMD, a Japanese tuning company, released multiple body kits & styling parts for the Suzuki Jimny. These body kits and parts can be used to either give the small SUV a retro look or make it look like other off-roaders, such as a Toyota Land Cruiser and the Mercedes-Benz G-Wagon.

Furthermore, car performance kits can provide various additional characteristics without the need to modify or install any components or parts rather than just adding design elements. The modifications allow users to have enhanced performance and aesthetics, resulting in increased power and torque.

Thus, contributing to the market growth.

Car Body Kit Industry Overview

The Car Body Kit market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance

In September 2023, Japanese tuner DAMD revealed two new body kits for the Suzuki Jimny at the 2024 Tokyo Auto Salon. The theme for the Japanese tuner's Jimny body kits is "European masterpiece." DAMD also collaborated with OZ Racing to recreate a version of the classic white rally racing wheel for the Jimny, which features both new body kits.

Some of the major players in the market include NovitecGroup, Maxton Design, TECHART Automobildesign GmbH, and Others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increase in Sales of Passenger Cars

- 4.2 Market Restraints

- 4.2.1 Strict Regulations by Various Government on Vehicle Modifications

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION ( Market Size in USD Billion)

- 5.1 Body Style

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sports Utility Vehicles (SUVs)

- 5.1.4 Multi-Purpose Vehicles (MPVs)

- 5.2 Body Kit Material

- 5.2.1 Fiberglass

- 5.2.2 ABS Plastic

- 5.2.3 Polyurethane

- 5.2.4 Carbon Fibre

- 5.2.5 Composites

- 5.3 Body Kit Component

- 5.3.1 Full-body Kits

- 5.3.2 Front and Rear Bumper Kits

- 5.3.3 Spoilers

- 5.3.4 Other Components (Lip Kit, Front Grille, Tuning Hoods, etc.)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Modsters Automotive

- 6.2.2 Auto Starke Private Limited

- 6.2.3 TECHART Automobildesign GmbH

- 6.2.4 Maxton Design

- 6.2.5 Novitec Group

- 6.2.6 LARTE Design

- 6.2.7 BRABUS GMBH

- 6.2.8 Mansory Design & Holding GmbH

- 6.2.9 ABT SportsLine GmBH

- 6.2.10 Motoren Mayer Technik GmbH

- 6.2.11 AC Schnitzer