|

市場調查報告書

商品編碼

1693554

歐洲保固管理系統:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Europe Warranty Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

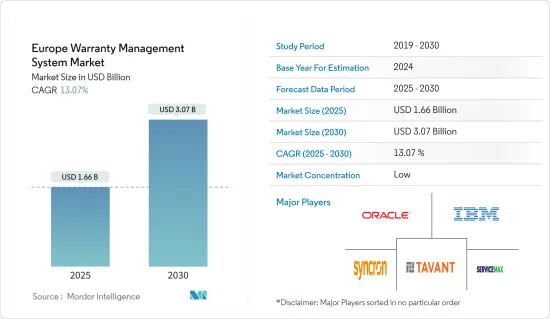

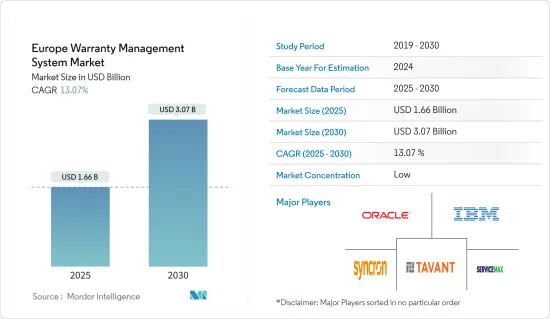

歐洲保固管理系統市場規模預計在 2025 年為 16.6 億美元,預計到 2030 年將達到 30.7 億美元,預測期內(2025-2030 年)的複合年成長率為 13.07%。

主要亮點

- 任何服務業務的關鍵方面是保固管理。查看、存取和自動追蹤客戶資產覆蓋範圍和資料的能力至關重要。保固管理可幫助企業避免銷售損失和客戶不滿。

- 保固管理系統透過自動化保固索賠處理和裝置量資產追蹤,使服務提供者能夠設計、管理、追蹤和處理保固、索賠和資產。創新的保固管理系統 (WMS) 透過結合人工智慧和機器學習功能來確保客戶滿意度,引領歐洲市場。

- 汽車產業的保固管理非常複雜,因為從供應商到經銷商再到最終消費者的整個過程中的大量資料增加了多個層面出現錯誤的可能性。每個經銷商和製造商都有自己的處理保固索賠和資料的程序,但傳統系統通常無法產生可靠或一致的結果,從而刺激了歐洲保固管理系統的引入。

- 保固管理系統透過使用廣泛的業務規則檢驗所有福利功能,並立即將來自診斷和行動裝置的資訊流合併到保固索賠表中,從而提高保固資訊的準確性和品質。此應用程式處理退貨核准、退貨追蹤、RGA/RMA 創建和物料輸送的退貨核准。透過管理零件的供應商保修,保固追蹤器使供應商和製造商能夠共同努力降低保固成本,從而刺激市場採用。

- 然而,歐洲保固管理系統市場競爭日益激烈,價格敏感度不斷上升,導致供應商限制市場成長,因為最終用戶在選擇保固管理系統時可能會在服務功能和價格之間做出妥協。此外,由於診斷不準確、過度維護、詐欺以及對保固和維修程序缺乏了解而導致的收費過高正在阻礙預測期內的市場成長率。

- 在新冠疫情爆發後,全部區域明顯出現了向自動化技術的轉變。生產力提高、資料可靠性提高、索賠資料的有效性和品質提高等顯著優勢正在吸引客戶採用使用 AI 和 ML 的自動化保固管理系統,從而促進市場成長率。

歐洲保固管理系統市場趨勢

雲端部署領域佔據主要市場佔有率

- 企業越來越意識到將資料遷移到雲端而不是建置和維護新的資料儲存可以節省成本和資源的重要性,這推動了對雲端基礎的解決方案的需求,因此也推動了該地區按需保固管理系統的採用。此外,雲端平台和生態系統提供了多種優勢,有望成為未來幾年數位創新速度和規模指數級成長的發射台。

- 此外,公共雲端服務的採用將信任的界限擴展到組織界限之外,使安全性成為雲端基礎設施的重要組成部分。然而,雲端基礎的解決方案的使用增加極大地簡化了公司保固管理實踐的實施。隨著 Google Drive、Dropbox 和 Microsoft Azure 等雲端服務的日益普及,以及這些工具成為業務流程不可或缺的一部分,企業必須透過採用隨選保證管理解決方案來解決諸如失去對敏感資料的控制等安全問題。

- 雲端運算是該國成長最快的市場之一,該領域的投資不斷增加,擴大了受調查的行業範圍。大型服務供應商擴大管理全國範圍內的大量公共和混合雲端公共雲端環境以及超大規模服務。例如,Oracle於2022年7月宣布,將於2023年在歐盟推出新的主權雲區,以便更好地服務整個歐盟的客戶。德國和西班牙將成為歐盟首批兩個主權雲區域,這兩個區域在邏輯和物理上與該地區目前的公共 OCI 區域有區別。新的主權雲端區域將使私人公司和政府機構能夠在敏感、受監管或具有戰略重要性的地區託管資料和應用程式。

- 雲端基礎的解決方案還具有降低資本支出要求的優勢,使其成為更強大的商業說服選擇。透過採用雲端基礎的服務,企業可以大幅減少資本支出需求,因為他們不需要投資硬體元件。雲端解決方案還允許公司更準確地預測應用程式的成本,因此他們不必承擔太多的前期成本來採用該技術。硬體和 IT 支援方面的節省也使得雲端基礎的解決方案更加經濟實惠。

- 此外,雲端基礎的系統的日益普及也促進了市場的成長。例如,歐盟去年宣布,41%的歐盟公司已經採用了雲端運算。歐盟對雲端運算的使用正在成長,尤其是在零售領域。雲端運算涉及兩個組成部分:雲端基礎設施和軟體應用程式。預計保固管理系統中軟體應用的需求不斷成長將促進預測期內的市場成長。

德國有望創下最快成長

- 由於政府對各行業進行監管並加強軟體開發以滿足客戶的多樣化需求,德國是該地區發展最快的國家之一。重型機械、汽車和許多其他行業的產量不斷成長,推動了該地區保固管理系統的生產,以追蹤銷售給客戶的產品的保固期和索賠。

- 德國律師最近通過了一項新的銷售法,加強了有利於客戶的保固規定。兩年保固期自購買或交付產品和服務之日起生效。如果在保固期結束時發現缺陷,條款將會略有修改。此限制自購買日起 4 個月後生效。如果在保固期到期之前出現問題,買家將有更多時間提出保固索賠。

- 汽車製造商和保固公司之間日益加強的夥伴關係預計將推動市場研究。這些發展鼓勵他們在產品系列中推出新的解決方案,以簡化工作流程和追蹤索賠。例如,Europe Assistance Germany 已將其車輛保固組合委託給其長期合作夥伴和保固保險公司 Real Garant VersicherungAG,該公司專門處理整個歐洲的行動服務,這是汽車行業的關鍵業務。

- 據德國貿易投資署稱,機械設備是德國最具活力的產業,價值鏈上約有6,600家企業,其中近90%是中小企業。德國機械設備(M&E)產業仍然是德國最大的工業雇主,擁有超過一百萬名工人。機電產業是該國最具創新性的產業之一,去年在研發上總合花費約 170 億歐元。工具機、驅動技術和物料輸送設備部門是年營業額最大的機械工程部門之一。因此,在設備製造業,許多公司必須管理其購買的每個組裝的保固。保固管理系統可以透過提供先進的工具來輕鬆監控和管理保固、索賠和盈利,從而幫助減輕這項繁瑣的工作。

- 在德國,人口成長和老化、慢性病增加、基礎設施發展和技術進步正在促進該行業的擴張。保固管理系統有效管理心律調節器和心臟去顫器等植入式設備的保固流程。簡化保固期內設備的退貨流程,並在召回時產生必要的文件。在德國,醫療保健由公共和私人提供者提供。政府在醫療保健行業投入了大量資金,從而帶來了雙心室心律調節器、植入式心臟整流去顫器、植入式心臟環記錄器和心律調節器等創新手術器械的出現。

歐洲保固管理系統產業概況

- 歐洲保固管理系統市場由 Oracle Corporation、IBM Corporation、Syncron AB 和 Servicemax Inc. 等主要參與者主導。這些公司正在大力投資,為客戶提供客製化解決方案。此外,市場上的新興企業正在從投資者那裡籌集資金。市場的主要企業正在進行聯盟、合併、收購和投資,以保持其在市場中的地位。

- 2022年11月,數位產品和解決方案公司、服務生命週期管理全球領導者之一的Tavant Technologies Inc.宣布與全球領先的商用汽車製造商之一戴姆勒卡車股份公司(DTAG)合作,為DTAG的歐洲品牌提供保固和索賠管理解決方案,標誌著歐洲汽車製造業引入保固管理系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 製造業和汽車業擴大採用保固管理系統

- 在下一代保固管理系統中擴大採用人工智慧和機器學習功能,以確保客戶滿意度

- 市場限制

- 價格敏感型市場中獨立服務供應商之間的激烈競爭

第6章市場區隔

- 按部署

- 本地

- 雲

- 按最終用戶產業

- 工業設備

- 汽車和運輸設備

- 耐久財

- 其他終端用戶產業(醫療設備、航太和國防等)

- 按國家

- 英國

- 德國

- 法國

- 其他歐洲國家

第7章競爭格局

- 公司簡介

- Syncron AB

- IFS AB

- Tavant Technologies Inc.

- ServiceMax Inc.

- SKYLYZE

- Pegasystems Inc.

- PTC Inc.

- Oracle Corporation

- IBM Corporation

- Wipro Limited

第8章投資分析

第9章 市場機會與未來趨勢

簡介目錄

Product Code: 92648

The Europe Warranty Management System Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 3.07 billion by 2030, at a CAGR of 13.07% during the forecast period (2025-2030).

Key Highlights

- A crucial part of every service business is warranty management. The capacity to view, access, and automatically track client asset warranty coverage and data is critical. With warranty management, companies may be protected by loss of sales and customer displeasure.

- The warranty management system enables service businesses to design, administer, track, and process warranties, claims, and assets by automating warranty claim handling and installed base asset tracking. Innovative warranty management systems (WMS) are linked with AI and machine learning capabilities to guarantee customer satisfaction, driving the European market.

- The automobile sector's management of warranties is complex because the abundance of data, which spans the entire process from suppliers to dealers to final consumers, increases the probability of errors at different levels. Although each dealer and manufacturer has unique procedures for handling warranty claims and data, the traditional systems frequently do not produce reliable or consistent results, fuelling the adoption of warranty management systems in Europe, supported by the region's industrial development in automating.

- The warranty management system improves the accuracy and quality of warranty information by validating all privilege features using broad business rules and immediately incorporating information streams from diagnostic and mobile devices into warranty claim forms. The application handles the authorization of returns, tracking of returns, and creation of RGA/RMA or approvals for returns of material. By managing supplier warranties for parts and components, the warranty tracker enables suppliers and manufacturers to work together to cut warranty costs, fueling market adoption.

- However, due to the increasing competition and the increase in the Price sensitivity in the European warranty management system, providers are limiting the market growth because end users could compromise service features over price while choosing the warranty management system for their business due to the high price sensitivity in the market. Additionally, inaccurate diagnosis, excessive maintenance, fraud, and overcharging resulting from a lack of understanding of the warranty and repair procedure hamper the market growth rate during the forecast period.

- With the COVID-19 pandemic, the shift toward automated technologies has been significant across the region. Considerable advantages like enhanced productivity, data reliability, enhanced claim data validity, quality, etc., are luring customers into adopting automated warranty management systems with AI and ML, contributing to the market's growth rate.

Europe Warranty Management System Market Trends

Cloud Deployment Segment Holds Major Market Share

- The increasing realization among enterprises about the importance of saving money and resources by moving their data to the cloud instead of building and maintaining new data storage drives the demand for cloud-based solutions and, hence, the adoption of on-demand warranty management systems in the region. Moreover, owing to multiple benefits and over the next few years, cloud platforms and ecosystems are anticipated to serve as a launchpad for an explosion in the pace and scale of digital innovation.

- Furthermore, deploying public cloud services extends the boundary of trust beyond the organization, making security a vital part of the cloud infrastructure. However, the increasing usage of cloud-based solutions has significantly simplified enterprises' adoption of warranty management practices. With the increased adoption of cloud services, such as Google Drive, Dropbox, and Microsoft Azure, among others, and with these tools emerging as an integral part of business processes, enterprises must deal with security issues, such as losing control over sensitive data, raises the incorporation of on-demand warranty management solutions.

- One of the country's fastest-growing markets is the cloud, and rising investment in the sector is broadening the area of the industry under study. Large service providers increasingly manage the country's extensive public and hybrid cloud environments and hyper-scale services. For instance, in July 2022, Oracle announced it would introduce new sovereign cloud zones for the European Union in 2023 to serve its clients across the European Union better. Germany and Spain will host the first two EU sovereign cloud regions, which will be logically and physically distinct from the region's current public OCI regions. The new sovereign cloud regions will allow private businesses and government agencies to host sensitive, regulated, or strategically significant regional data and applications.

- Cloud-based solutions also benefit from lower capital expenditure requirements, making the business more compelling. Deploying cloud-based services can significantly reduce the Capex requirement as companies do not need to invest in hardware components. Cloud solutions also enable better prediction of the cost of an application, and companies don't need to incur as much upfront cost to incorporate the technology. Also, hardware and IT support savings make cloud-based solutions much more affordable.

- Furthermore, the growing adoption of cloud-based systems contributes to market growth. For instance, the European Union states that 41% of EU businesses adopted cloud computing last year. In the European Union, cloud computing usage grew, especially in retail. Cloud computing involves two components, which are cloud infrastructure and software applications. The growing demand for software applications in warranty management systems is expected to contribute to the market's growth during the forecast period.

Germany is Expected to Register the Fastest Growth

- Germany is one the fastest-growing countries in the region due to government regulations in different industries and the increasing development of software to satisfy customers' diverse needs. The demand for heavy equipment, automotive, and many more industries is increasing their production, driving the output of warranty management systems in the region so that the sectors may track the warranty periods and claims made on the products sold to customers.

- Recently, German lawmakers passed a new sales law that tightens warranty regulations in favor of customers. The two-year warranty period will be applicable for goods and services from the date of purchase or delivery. If a flaw is discovered near the conclusion of the warranty period, some modifications will be made to the conditions. The limitations are applicable only after the completion of four months after the purchase. This scenario gives the buyer extra time to make warranty claims if the issue materializes just before the expiration of the warranty period.

- The rise in partnerships between the automotive and warranty issuer firms is expected to drive the market studied. Such developments will push them to deploy new solutions in their product portfolio to streamline the workflow and track the claims. For instance, Europe Assistance Germany outsourced its portfolio of vehicle warranties to its long-time partner and warranty insurance Real Garant VersicherungAG to concentrate on its main business in the automotive industry, the processing of mobility services across Europe.

- According to German Trade and Invest, with almost 6,600 enterprises along the value chain, nearly 90% of which are SMEs, machinery and equipment are Germany's most active sector. The German Machinery and Equipment (M&E) sector continues to be the largest industrial employer in Germany, with a workforce of more than one million workers. The M&E sector is one of the most innovative in the nation, which spent about EUR 17 billion on research and development in total in the last year. The machine tools, drive technology, and material handling equipment sectors are some of the most significant in yearly turnover within the mechanical engineering sector. Such a high number of firms in the industry of equipment production have to maintain warranty documents for each assembled part they buy. Such hectic work can be reduced by deploying warranty management systems because they provide advanced tools to easily monitor and manage warranties, claims, and profitability.

- In Germany, population growth and aging, an increase in chronic disease prevalence, infrastructure improvements, and technological advancements have contributed to the sector's expansion. The warranty management systems efficiently manage the warranty processes for implanted devices like pacemakers and defibrillators. They streamline the return of the equipment under warranty and fill out the necessary paperwork in the event of a recall. In Germany, healthcare is made available through public and private healthcare. The government is making significant investments in the healthcare industry, which has led to the availability of innovative surgical tools such as biventricular pacemakers, implantable cardioverter defibrillators, implantable cardiac loop recorders, and pacemakers.

Europe Warranty Management System Industry Overview

- The European warranty management system market is highly fragmented due to various market players like Oracle Corporation, IBM Corporation, Syncron AB, Servicemax Inc., Tavant Technologies Inc., etc. These companies are extensively investing in offering customized solutions to customers. Moreover, the startups in the market are attracting funding from investors. The key players in the market are making partnerships, mergers, acquisitions, and investments to retain their market position.

- In November 2022, Tavant Technologies Inc., a digital products and solutions company, one of the global leaders in service lifecycle management, announced a partnership with Daimler Truck AG (DTAG), one of the global leaders in commercial manufacturers, to offer warranty and claim management solutions for the DTAG European brands, which shows the market adoption of warranty management systems in the European automotive manufacturing industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Warranty Management Systems in the Manufacturing and Automotive Industries

- 5.1.2 Increasing Adoption of AI and ML Capabilities in Next-generation Warranty Management Systems to Ensure Customer Satisfaction

- 5.2 Market Restraints

- 5.2.1 Intense Competition Between Independent Service Providers in Price-sensitive Markets

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By End-user Industry

- 6.2.1 Industrial Equipment

- 6.2.2 Automotive and Transportation

- 6.2.3 Consumer Durable

- 6.2.4 Other End-user Industries (Medical Devices, Aerospace, Defense, Etc.)

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Syncron AB

- 7.1.2 IFS AB

- 7.1.3 Tavant Technologies Inc.

- 7.1.4 ServiceMax Inc.

- 7.1.5 SKYLYZE

- 7.1.6 Pegasystems Inc.

- 7.1.7 PTC Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 IBM Corporation

- 7.1.10 Wipro Limited

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219