|

市場調查報告書

商品編碼

1693517

磷肥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Phosphatic Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

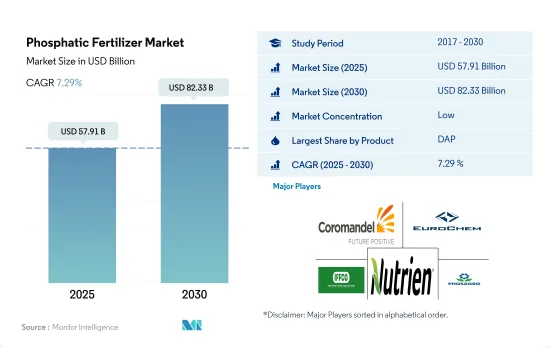

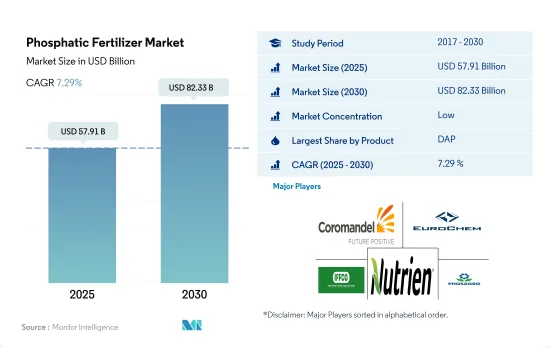

預計 2025 年磷肥市場規模為 579.1 億美元,到 2030 年將達到 823.3 億美元,預測期內(2025-2030 年)的複合年成長率為 7.29%。

土壤中磷含量的降低和作物生長對元素磷的需求可能會推動市場

- 2022 年,磷酸二銨(DAP)佔據磷肥市場的主導地位,佔全球消費佔有率的 41.3%,相當於 3,090 萬噸。 DAP 之所以受歡迎,是因為它含有 46.0% 的磷酸鹽和 18.0% 的銨,銨可作為氮源。這使得 DAP 成為全球農民的最佳選擇。 2022年,DAP的市值達到233億美元。

- 磷酸一銨(MAP)已成為 DAP 之後第二大最受歡迎的磷肥。 2022年全球MAP市場價值為113億美元,消費量1530萬噸。值得注意的是,MAP含有約90%的水溶性磷酸鹽,超過了作物的生長需求。

- 重過磷酸鈣(TSP)是含磷量最高的純磷酸鹽基肥料,為46.0%,佔2022年全球磷肥消費量的21.1%。 TSP市場預計將成長,尤其是隨著豆類作物種植面積的擴大。

- 2022 年,單過磷酸鈣 (SSP) 佔全球磷肥消費量的 16.7%。 SSP 因其為食用油提供重要的硫微量元素和在酸性土壤中提供鈣營養的作用,在作物中具有重要應用。這些因素表明未來幾年 SSP 的使用量可能會增加。

- 磷肥市場預計將經歷強勁成長,預計 2023 年至 2030 年的複合年成長率為 7.0%。這一成長主要得益於全球對磷肥的需求不斷成長,因為越來越多的農民希望提高作物產量。

提高生產力的需求和解決磷酸鹽缺乏症的不斷成長的需求預計將推動市場成長。

- 亞太地區佔據全球磷肥市場的主導地位,約佔整個市場的 58.6%,2022 年累計約 328 億美元。 2022 年,DAP 在亞太磷肥市場佔有 49.8% 的市場佔有率。該地區對 DAP 的需求很高,因為它比 TSP 和 SSP 等其他磷肥效率更高。

- 中國是全球領先的磷肥生產國之一,2022年佔全球磷肥市場價值佔有率約10.3%。其出口量約佔世界出口量的25.3%。中國最大的進口國是印尼、澳洲和伊朗。

- 北美佔第二大市場佔有率,為10.6%。磷肥是作物繼氮肥之後第二重要的營養源。在北美,磷酸一銨(MAP)佔據66.3%的市場佔有率,磷酸二銨(DAP)佔據30.9%的市場佔有率。 MAP 的高磷酸鹽含量推動了需求。

- 2022年,南美磷肥市場將佔全球市場的20.3%,預計2023年至2030年的複合年成長率為6.9%。

- 全球磷肥市場的價值和數量一直呈上升趨勢,除了 2020 年因 COVID-19 疫情造成的干擾而下降。然而,由於全球種植面積減少,預計市場規模將在 2023 年至 2030 年間恢復。

全球磷肥市場趨勢

為滿足日益成長的糧食需求,農業面臨的壓力日益增大,預計將導致田間作物種植面積增加

- 全球農業部門正面臨許多挑戰。聯合國預測,到 2050 年世界人口將超過 90 億,這可能會給農業帶來壓力,而農業已經面臨勞動力短缺和都市化導致的田地萎縮的困境。聯合國糧食及農業組織預測,2050年,全球70%的人口將居住在都市區。隨著全球可耕地面積減少,農民越來越依賴化肥來提高作物產量,以滿足日益成長的糧食需求。

- 亞太地區是世界主要農業生產地區之一,農業約佔該地區勞動力的20%。大田作物是常態,佔該地區耕地面積的95%以上。水稻、小麥和玉米是該地區的主要田間作物,佔2022年種植面積的24.3%。

- 北美洲是世界第二大可耕地,擁有以田間作物為主的多樣化作物組合。其中,玉米、棉花、米、大豆、小麥等產量居於首位,美國農業部對此予以強調。 2022年,美國佔北美作物種植面積的46.2%。然而,包括德克薩斯和休士頓等地區遭遇嚴重洪澇災害在內的不利條件,導致2017年至2019年期間該國作物面積大幅減少,凸顯了農業生產對氣候變遷的脆弱性。

菜籽是全世界施用鉀肥最多的作物,平均施用量為248.6公斤/公頃。

- 玉米、油菜籽、棉花、高粱、水稻、小麥和大豆是世界著名作物,以營養需求高而聞名。 2022 年這些作物的平均主要養分施用量為:玉米(230.57 公斤/公頃)、油菜籽(255.75 公斤/公頃)、棉花(172.70 公斤/公頃)、高粱(158.46 公斤/公頃)、水稻(154.49 公斤/公頃)(158.46 公斤/公頃?公斤/公頃)。主要營養素對作物至關重要,它們驅動代謝過程並有助於植物必需組織的形成,例如細胞、細胞膜和葉綠素。特別是磷對於種植優質作物至關重要,而鉀在激活植物生長所必需的酵素方面起著至關重要的作用。

- 全球田間作物氮、鉀、磷養分平均施用量為164.31公斤/公頃。氮是使用最廣泛的主要養分,施用率為224.6公斤/公頃,其次是鉀,施用率為150.3公斤/公頃。磷排在第三位,預計 2022 年的消費量為 117.9 公斤/公頃。

- 2022年,氮肥施用量最高的是油菜,為347.4公斤/公頃。玉米磷施用量最高,為156.3公斤/公頃,油菜鉀施用量菜籽, 248.6公斤/公頃。

- 全球田間作物種植面積正在擴大,其中南美洲和亞太地區的成長尤其顯著。這些地區正成為化肥的主要市場。歐洲和北美等已開發地區以及遭受營養缺乏的地區正在轉向使用特殊肥料,以提高其有效性。這些動態可能會在未來幾年推動主要營養肥料市場的發展。

磷肥業概況

磷肥市場分散,前五大企業佔13.55%的市佔率。該市場的主要企業有:Coromandel International Ltd.、EuroChem Group、Indian Farmers Fertiliser Cooperative Limited、Nutrien Ltd. 和 PhosAgro Group of Companies(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 主要作物種植面積

- 田間作物

- 園藝作物

- 平均養分施用量

- 主要營養素

- 田間作物

- 園藝作物

- 主要營養素

- 灌溉農田

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 類型

- 直的

- 磷

- DAP

- MAP

- SSP

- TSP

- 其他

- 直的

- 施肥方式

- 受精

- 葉面噴布

- 土壤

- 作物類型

- 田間作物

- 園藝作物

- 草坪和觀賞植物

- 地區

- 亞太地區

- 澳洲

- 孟加拉

- 中國

- 印度

- 印尼

- 日本

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

- 歐洲

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲國家

- 中東和非洲

- 奈及利亞

- 沙烏地阿拉伯

- 南非

- 土耳其

- 其他中東和非洲地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Coromandel International Ltd.

- EuroChem Group

- Indian Farmers Fertiliser Cooperative Limited

- K+S Aktiengesellschaft

- Koch Industries Inc.

- Nutrien Ltd.

- PhosAgro Group of Companies

- SABIC Agri-Nutrients Co.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Phosphatic Fertilizer Market size is estimated at 57.91 billion USD in 2025, and is expected to reach 82.33 billion USD by 2030, growing at a CAGR of 7.29% during the forecast period (2025-2030).

Reducing phosphorous content in the soils and the need for the element in crop growth may drive the market

- Diammonium phosphate (DAP) dominated the phosphatic fertilizer market in 2022, capturing a significant 41.3% global consumption share, equivalent to 30.9 million metric tons. Its popularity stems from its composition, with 46.0% phosphate and 18.0% ammonium, serving as a nitrogen source. This made DAP the top choice for farmers worldwide. The market value of DAP reached USD 23.3 billion in 2022.

- Monoammonium phosphate (MAP) emerged as the second most favored phosphatic fertilizer, trailing behind DAP. The global MAP market, valued at USD 11.3 billion in 2022, witnessed a consumption volume of 15.3 million metric tons. Notably, MAP boasts a water-soluble P content of around 90%, surpassing the crop growth requirements.

- Triple superphosphate (TSP), a pure phosphate-based fertilizer with the highest phosphate content of 46.0%, accounted for 21.1% of global phosphate fertilizer consumption in 2022. The TSP market is poised for growth, especially with the expansion of legume crop cultivation areas.

- Single superphosphate (SSP) constituted 16.7% of global phosphatic fertilizer consumption in 2022. SSP finds significant usage in oilseed crops, owing to its role in providing crucial sulfur trace elements for edible oils and calcium nutrients in acidic soils. These factors indicate a potential uptick in SSP usage in the coming years.

- The phosphatic fertilizer market is projected to witness robust growth, with an estimated CAGR of 7.0% from 2023 to 2030. This growth is primarily driven by the escalating global demand for phosphatic fertilizers as more farmers seek to enhance their crop yields.

The need to improve productivity and rising demand to address the phosphate deficiency are expected to fuel the growth of the market

- The Asia-Pacific region dominated the global phosphatic fertilizer market and accounted for about 58.6% of the total market value, accounting for about USD 32.8 billion in 2022. In 2022, DAP occupied a market share of 49.8% in the Asia-Pacific phosphatic fertilizers market. The greater demand for DAP in the region is due to its greater efficiency than other phosphatic fertilizers like TSP and SSP.

- China was the world's leading producer of phosphorus fertilizers, accounting for nearly 10.3% value share of the global phosphatic fertilizer market in 2022. Its exports represented approximately 25.3% of the world's exports. The top importers from China are Indonesia, Australia, and Iran.

- North America secured the second-largest market share at 10.6%. Phosphatic fertilizers, after nitrogen fertilizers, are the second most crucial nutrient source for crops. In North America, mono ammonium phosphate (MAP) and diammonium phosphate (DAP) dominated the market in 2022, with shares of 66.3% and 30.9%, respectively. The high phosphate content in MAP drove its demand.

- In 2022, the South American phosphatic fertilizer market held a 20.3% share of the global market, and it is projected to register a CAGR of 6.9% during 2023-2030.

- The global phosphatic fertilizer market has witnessed a consistent upward trajectory in both value and volume, barring a dip in 2020, primarily attributed to the disruptions caused by the COVID-19 pandemic. However, the market value is expected to rebound during 2023-2030, driven by a decline in global cultivation areas.

Global Phosphatic Fertilizer Market Trends

The rising pressure on the agriculture industry to meet the growing food demand is expected to increase the area under field crop cultivation

- The global agricultural sector grapples with numerous challenges. The United Nations projects a world population surpassing 9 billion by 2050, potentially straining an agricultural industry already struggling with labor shortages and shrinking fields due to urbanization. The Food and Agriculture Organization predicts that by 2050, 70% of the global population will reside in urban areas. With arable land dwindling worldwide, farmers are increasingly relying on fertilizers to bolster crop yields in an effort to meet the rising demand for food.

- The Asia-Pacific region stands as the leading global agricultural producer, with agriculture employing roughly 20% of its workforce. Field crop cultivation dominates, encompassing over 95% of the region's crop area. Rice, wheat, and corn, collectively occupying 24.3% of the crop area in 2022, are the primary field crops in the region, which is a testament to the region's agricultural diversity and productivity.

- North America ranks as the second-largest arable region globally, boasting a diverse crop portfolio with a focus on field crops. Notably, corn, cotton, rice, soybean, and wheat take center stage, as highlighted by the USDA. In 2022, the United States commanded 46.2% of North America's crop cultivation area. However, adverse environmental conditions, including severe flooding in regions like Texas and Houston, led to a significant drop in the country's crop acreage between 2017 and 2019, underscoring the vulnerability of agricultural production to climate change.

Canola has the highest application rate of potassic fertilizers globally, with an average application rate of 248.6 kg/ha

- Corn, rapeseed, cotton, sorghum, rice, wheat, and soybean are prominent crops globally, known for their high nutrient requirements. The average primary nutrient application rates for these crops in 2022 were as follows: corn (230.57 kg/ha), rapeseed (255.75 kg/ha), cotton (172.70 kg/ha), sorghum (158.46 kg/ha), rice (154.49 kg/ha), wheat (135.35 kg/ha), and soybean (120.97 kg/ha). Primary nutrients are vital for crops, facilitating metabolic processes and contributing to the formation of essential plant tissues, including cells, cell membranes, and chlorophyll. Notably, phosphorus is crucial for cultivating high-quality crops, while potassium plays a pivotal role in activating enzymes necessary for plant growth.

- On a global scale, field crops have an average nutrient application rate of 164.31 kg/ha for nitrogen, potassium, and phosphorus. Nitrogen takes the lead as the most widely used primary nutrient, with an application rate of 224.6 kg/ha, followed by potassium at 150.3 kg/ha. Phosphorus ranks third, with a consumption rate of 117.9 kg/ha in 2022.

- In 2022, rapeseed had the highest nitrogen application rate at 347.4 kg/ha. Corn led in phosphorus application at 156.3 kg/ha, and canola topped in potassium application at 248.6 kg/ha.

- Field crop cultivation is rising globally, with notable growth in South America and Asia-Pacific. These regions are emerging as key markets for fertilizers. Developed regions like Europe and North America, along with areas grappling with nutrient deficiencies, are increasingly turning to specialty fertilizers for their efficacy. These dynamics are poised to fuel the primary nutrient fertilizers market in the coming years.

Phosphatic Fertilizer Industry Overview

The Phosphatic Fertilizer Market is fragmented, with the top five companies occupying 13.55%. The major players in this market are Coromandel International Ltd., EuroChem Group, Indian Farmers Fertiliser Cooperative Limited, Nutrien Ltd. and PhosAgro Group of Companies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Primary Nutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Primary Nutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Type

- 5.1.1 Straight

- 5.1.1.1 Phosphatic

- 5.1.1.1.1 DAP

- 5.1.1.1.2 MAP

- 5.1.1.1.3 SSP

- 5.1.1.1.4 TSP

- 5.1.1.1.5 Others

- 5.1.1 Straight

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Region

- 5.4.1 Asia-Pacific

- 5.4.1.1 Australia

- 5.4.1.2 Bangladesh

- 5.4.1.3 China

- 5.4.1.4 India

- 5.4.1.5 Indonesia

- 5.4.1.6 Japan

- 5.4.1.7 Pakistan

- 5.4.1.8 Philippines

- 5.4.1.9 Thailand

- 5.4.1.10 Vietnam

- 5.4.1.11 Rest of Asia-Pacific

- 5.4.2 Europe

- 5.4.2.1 France

- 5.4.2.2 Germany

- 5.4.2.3 Italy

- 5.4.2.4 Netherlands

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Ukraine

- 5.4.2.8 United Kingdom

- 5.4.2.9 Rest of Europe

- 5.4.3 Middle East & Africa

- 5.4.3.1 Nigeria

- 5.4.3.2 Saudi Arabia

- 5.4.3.3 South Africa

- 5.4.3.4 Turkey

- 5.4.3.5 Rest of Middle East & Africa

- 5.4.4 North America

- 5.4.4.1 Canada

- 5.4.4.2 Mexico

- 5.4.4.3 United States

- 5.4.4.4 Rest of North America

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Brazil

- 5.4.5.3 Rest of South America

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Coromandel International Ltd.

- 6.4.2 EuroChem Group

- 6.4.3 Indian Farmers Fertiliser Cooperative Limited

- 6.4.4 K+S Aktiengesellschaft

- 6.4.5 Koch Industries Inc.

- 6.4.6 Nutrien Ltd.

- 6.4.7 PhosAgro Group of Companies

- 6.4.8 SABIC Agri-Nutrients Co.

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms