|

市場調查報告書

商品編碼

1692538

無線連接晶片組:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Wireless Connectivity Chipset - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

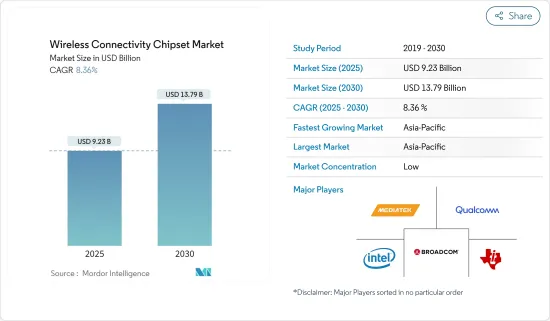

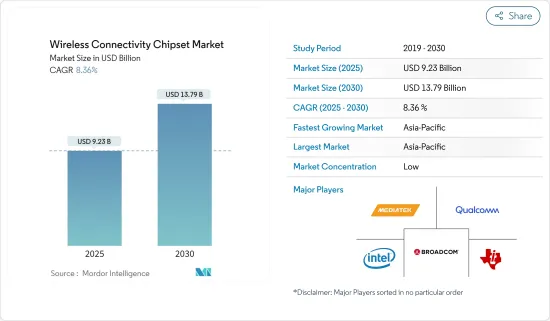

預計到 2025 年無線連接晶片組市場規模將達到 92.3 億美元,到 2030 年將達到 137.9 億美元,預測期內(2025-2030 年)的複合年成長率為 8.36%。

關鍵亮點

- 隨著高速網路的普及,連網型設備和智慧家庭應用的採用率正在增加,尤其是在歐洲、北美和亞太等地區。主要解決方案包括語音助理、智慧恆溫器、智慧照明、安全攝影機和智慧家用電子電器。

- 此外,2024 年 5 月,聯發科宣布推出兩款新晶片組,它們將提供強大的性能並支援多個垂直領域的最新 AI 增強功能。其中包括用於高階 Chromebook 的 Kompanio 838 SoC 和用於 4K 高階智慧型電視和顯示器的 Pentonic 800 SoC。該公司重點介紹了人工智慧、汽車、物聯網、電視、Chromebook 和無線連接等產品類型的重大發展。

- 例如,中國成立了IMT-2030(6G)推進組,加速6G技術研發。預計2030年左右全球將實現6G商用,中國率先支持5G商用,將為6G發展奠定堅實基礎。

- 增加多個設備(例如在物聯網中)會增加網路的表面積,並在此過程中增加潛在的攻擊媒介。即使連接到網路的單一不安全設備也可能成為針對網路的主動攻擊的入口點。

- 根據經濟合作暨發展組織(OECD)的研究,到2025年,擁有電腦的家庭數量預計將增加到1,262,470,000個。擁有至少一台電腦的家庭稱為電腦家庭。電腦普及率的顯著提高為市場參與企業創造了機會,使他們能夠拓寬 Wi-Fi 晶片組產品系列、擴大在不同地區的影響力並增加市場佔有率。

- 市場上的各種參與企業都在開發新產品以保持競爭力,這可能會進一步促進市場成長。例如,Wi-Fi 7 技術的早期先驅聯發科於 2023 年 11 月推出最新產品 Filogic 860 和 Filogic 360,鞏固了其市場領導地位。這些新增產品大大擴展了聯發科的尖端產品線,專注於提供卓越性能和堅如磐石的可靠性的最新連接技術。

- Filogic 860 晶片組具有雙頻網路基地台和先進的網路處理器,專為企業網路基地台、服務供應商閘道器、網狀節點以及各種零售和物聯網路由器量身定做。同時,Filogic 360 將 Wi-Fi 7 2x2 功能和雙藍牙 5.4 無線電整合到單一晶片中。該設計經過專門設計,旨在為邊緣和串流媒體設備以及各種家用電子電器產品帶來下一代 Wi-Fi 7 連接。

- 開發和製造先進 Wi-Fi 晶片組的高成本對市場構成了重大挑戰。製造這些晶片組所需的複雜且昂貴的技術可能會增加最終產品的成本並阻礙其採用,尤其是對於對價格敏感的消費者而言。

- 新冠疫情過後,人們更加重視採用協作工具,同時選擇採用數位模式進行相關會議與討論。此外,新興的 5G使用案例(例如支援增加上學和在家工作的需求)預計將推動 5G 投資。此外,許多職場正在採用混合工作模式,透過部署 5G 連線可以增強這種模式。儘管供應鏈短缺造成中斷,但此類情況仍對市場產生積極推動作用。

無線連接晶片組市場趨勢

Wi-Fi 獨立組網佔據最大市場佔有率

- Wi-Fi網路技術的進步使用戶體驗到更快的速度和更低的通訊。這鼓勵了數據密集型服務和應用程式的使用。透過 Wi-Fi 網路傳輸的資料量大幅增加,主要原因是客戶對視訊的需求以及企業和消費者向雲端服務的轉變。預計此因素將推動對高速、大容量網路的無線 5G 連線的需求。

- 網路在現代世界的普及率正在不斷提高。根據通訊預測,到 2023 年,全球網路用戶數將由去年的 51 億增加到 54 億。這佔世界人口的67%。

- 根據 Snapchat 的報告,到 2025 年,全球約 75% 的人口和幾乎所有智慧型手機用戶都將成為 AR 技術的頻繁用戶,其中超過 15 億是千禧世代。根據GSMA《中國移動經濟》預測,到2025年,中國大陸將新增約3.4億個智慧型手機連接,佔全球連接數的90%,其中中國當地的普及率將達到15億,香港為1230萬,澳門為190萬,台灣為2570萬。

- 2024年2月,韓國Stage X公司宣布取得頻譜,成為韓國第四大行動營運商,並計畫在2025年上半年推出全國性行動網路服務。該公司計劃投資4.62億美元(6,128億韓元)興建6,000個基地台,在韓國全國推出28GHz的5G網路。

- 根據愛立信行動報告,到 2026 年,北美智慧型手機的平均每月行動數據使用量預計將達到 49GB。智慧型手機的消費者群體、豐富的影片使用和大資料方案正在推動流量成長。雖然每部智慧型手機的流量在短期內可能會強勁成長,但預計採用由 AR 和 VR 驅動的身臨其境型5G 消費者連線將在長期內推動更高的成長率。

- 此外,低延遲為高速虛擬和擴增實境影像奠定了基礎,不會故障或延遲。小型基地台基礎設施將增強行動連線,它可以增強 5G 無線訊號並改善穿過混凝土建築物和牆壁的移動。小型基地台天線還可以加強無線連接,支援在同一網路上同時連接更多設備。預計此類發展將推動市場發展。

亞太地區可望成為成長最快的市場

- 5G在亞太地區的出現加速了用於高速網路連接的無線連接晶片組的部署。日本政府已批准在全國20.8萬個交通號誌上安裝5G基地台。地方政府和通訊業者共同承擔5G部署使用交通號誌的成本。這將允許在更短的時間內部署更多的解決方案,並更快地將5G連線帶到全國各地。

- 像 Biju 這樣的印度跨國教育科技公司正在向學生提供平板電腦作為其教育課程的一部分,並透過數位方法和傳統教學方法對他們進行教育。預計市場公司的這些舉措將進一步推動對平板電腦、智慧型手機和其他家用電子電器產品的需求,從而在預測期內推動該地區平板電腦無線連接晶片組市場的發展。

- 此外,亞太地區對網路服務的需求不斷成長也有望推動該地區無線連接晶片組的採用。總理表示,印度推出5G網路服務預計將為該國釋放新的經濟潛力和社會效益。

- 此外,中國正引領全球5G的發展。全國已建成超過254萬個5G基地台,超過5.75億人擁有5G智慧型手機。中國也計劃在2025年投資1.2兆元人民幣(1742億美元)建設5G網路。對穩定的5G網路日益成長的需求正在加速中國小型基地台解決方案的部署。

- 隨著 5G 智慧型手機的普及和價格的不斷下降,以及大都會圈和農村地區智慧型手機的快速普及,預計 5G 用戶數量將快速成長,到 2023 年底該地區將達到約 5,000 萬。

- 2023年2月,新加坡網路營運商M1與StarHub組成名為Antina的聯盟。兩家公司已延長與諾基亞的協議,以改善全國範圍內的室內和室外 5G 覆蓋範圍。為了提供具有高頻寬、極快速度和最小延遲的更好的 5G 用戶體驗,諾基亞將安裝小型基地台解決方案,以使用 MIMO(多輸入、多輸出)自適應天線覆蓋新建築。

無線連接晶片組產業概覽

無線連接晶片組市場較為分散,參與的公司眾多,包括博通公司、高通公司、聯發科公司、英特爾公司和德州儀器公司。此外,公司還透過推出新產品、業務擴張、策略合併、聯盟和收購來擴大其市場影響力。

- 2023 年 6 月:博通推出第二代 Wi-Fi 7 晶片組。 BCM47722 是一款住宅Wi-Fi 7網路基地台晶片,具有雙物聯網無線電,支援低功耗藍牙 (BLE)、Zigbee、 網路基地台和 Matter通訊協定操作;BCM4390是一款專為行動裝置設計的低功耗Wi-Fi 7、藍牙和802.15.4複合晶片。 BCM47722 企業 Wi-Fi 7網路基地台SoC 規格支援無線連線。

- 2023 年 4 月:德州儀器推出其最新的 SimpleLink 系列,這是一系列 Wi-Fi 6伴同性積體電路 (IC)。這些 IC 旨在幫助設計人員創建強大、安全且高效的 Wi-Fi 連接,特別適合高密度或高達 105 度C的高溫環境中的應用。 TI CC33xx 系列的首批成員在單一 IC 上同時支援 Wi-Fi 6 和低功耗藍牙 5.3。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 評估宏觀經濟趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 透過家庭自動化實現連網家庭的需求不斷增加

- 家庭和企業的網路普及率不斷提高

- 市場問題

- 與資料安全和隱私、設備連接和互通性相關的問題

- 部分行動裝置需求低迷

第6章市場區隔

- 按類型

- Wi-Fi 獨立

- 藍牙獨立

- Wifi 和藍牙組合

- 低功耗無線IC

- 按最終用戶應用程式

- 消費者

- 企業

- 行動裝置

- 車

- 工業的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Broadcom Inc.

- Qualcomm Incorporated

- Mediatek Inc.

- Intel Corporation

- Texas Instruments Incorporated

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Qorvo Inc.

- Skyworks Solutions Inc.

- Hisilicon Technologies Co. Ltd

- Tsinghua Unigroup Co. Ltd(unisoc(Shanghai)Technologies Co. Ltd)

8.供應商市場佔有率分析

第9章投資分析

第10章:投資分析市場的未來

The Wireless Connectivity Chipset Market size is estimated at USD 9.23 billion in 2025, and is expected to reach USD 13.79 billion by 2030, at a CAGR of 8.36% during the forecast period (2025-2030).

Key Highlights

- With the growing penetration of high-speed internet, the adoption of connected devices and smart home applications is increasing, especially in regions such as Europe, North America, and Asia-Pacific. Some major solutions include voice assistants, smart thermostats, smart lighting, security cameras, and smart appliances.

- Further, in May 2024, MediaTek announced the debut of two new chipsets with powerful performance and support for the latest AI enhancements across multiple verticals. These included the Kompanio 838 SoC for premium Chromebooks and the Pentonic 800 SoC for 4K premium smart TVs and displays. The company highlighted major developments in product categories such as AI, automotive, IoT, TVs, Chromebooks, and wireless connectivity.

- For instance, the IMT-2030 (6G) Promotion Group was formed in China to speed up the R&D of 6G technology. Around 2030, the world is anticipated to witness the commercialization of 6G. China is leading the charge in supporting the commercialization of 5G, which will provide a solid basis for developing 6G.

- Adding several devices, such as in IoT, increases the surface area of a network, creating more potential attack vectors in the process. Even a single unsecured device connected to a network may serve as a point of entry for an active attack on the network.

- According to the Organisation for Economic Co-operation and Development survey, by 2025, the number of households with computers is anticipated to increase to 1,262.47 million. Homes with at least one computer are referred to as computer households. Such a massive boost in computer adoption will create an opportunity for the market players to expand their Wi-Fi chipset product portfolio, expand their presence in different regions, and advance their market share.

- Various players in the market are developing new products to stay competitive, which may further propel market growth. For instance, in November 2023, MediaTek, an early pioneer in Wi-Fi 7 technology, solidified its position as a market leader with the launch of its latest offerings, the Filogic 860 and Filogic 360. These additions significantly expanded MediaTek's cutting-edge product line, emphasizing the latest connectivity technologies for superior performance and unwavering reliability.

- The Filogic 860 chipsets, featuring a dual-band access point and an advanced network processor, are tailored for enterprise access points, service provider gateways, mesh nodes, and various retail and IoT router applications. On the other hand, the Filogic 360 facilitates Wi-Fi 7 2x2 capabilities and dual Bluetooth 5.4 radios in a single chip. This design is specifically crafted to bring next-gen Wi-Fi 7 connectivity to edge and streaming devices, as well as a wide range of consumer electronics.

- High costs associated with developing and producing advanced Wi-Fi chipsets pose a significant challenge in the market. The sophisticated and expensive technology needed for manufacturing these chipsets inflates the final product's cost, potentially hindering adoption, especially among price-sensitive consumers.

- Post-COVID-19, there was a shift to opting for digital modes for relevant meetings and discussions while focusing more on adopting collaborative tools. Furthermore, emerging use cases for 5G, including the need to support increasing numbers of individuals schooling and working from home, are expected to drive 5G investment. In addition, many workplaces have adopted a hybrid model of working, for which 5G connections can be deployed for better connectivity. Such cases have positively driven the market despite the disruptions caused due to shortages in the supply chain.

Wireless Connectivity Chipset Market Trends

Wi-Fi Standalone Holds the Maximum Share of the Market

- The evolution of Wi-Fi network technology allows users to experience faster speeds and lower latency. It boosted the use of data-heavy services and applications. The significant rise in the volume of data carried by Wi-Fi networks has been primarily driven by customer demand for video and business and consumer moves to cloud services. This factor is expected to drive the need for a wireless 5G connection with fast and high-capacity networks.

- Internet penetration has scaled up in the modern world. According to the International Telecommunication Union, as of 2023, the estimated number of internet users worldwide was 5.4 billion, up from 5.1 billion in the previous year. This share represented 67% of the global population.

- According to a report from Snapchat, by 2025, around 75% of the global population and almost all smartphone users will be frequent AR technology users, out of which more than 1.5 billion are anticipated to be millennials. According to GSMA's Mobile Economy China, China will add around 340 million smartphone connections by 2025, with adoption rising to 9 in 10 connections, 1.5 billion in Mainland China, 12.3 million in Hong Kong, 1.9 million in Macao, and 25.7 million in Taiwan.

- In February 2024, Stage X, a South Korean company, announced that it was awarded a spectrum that will enable it to be the nation's fourth mobile carrier and planned to launch nationwide mobile network services in the first half of 2025. The company invested USD 462 million (KRW 612.8 billion) to deploy its 28 GHz 5G network across South Korea with a plan to build 6,000 base stations; it also involved the mandated installation standard for the 28 GHz frequency network.

- According to Ericsson's Mobility Report, the monthly average usage of mobile data in North America is expected to reach 49 GB per month for smartphones in 2026. A smartphone-savvy consumer base, video-rich applications, and large data plans will drive traffic growth. While there may be robust growth in traffic per smartphone in the near term, the adoption of immersive consumer 5G connections utilizing AR and VR is expected to lead to an even better growth rate in the long term.

- Lower latency is also poised to enable high-speed virtual and augmented reality video without glitches or delays. Mobile connectivity can be strengthened with small cell infrastructure, densifying 5G wireless signals and improving their movement through concrete buildings and walls. Small-cell antennas will also enhance wireless connection, supporting more devices on the same network simultaneously. Such developments are expected to drive the market.

Asia-Pacific is Expected to be the Fastest-growing Market

- The advent of 5G in the Asia-Pacific region accelerated wireless connectivity chipset deployment for high-speed network connectivity. Japan's government granted permission to install 5G base stations on 208,000 traffic lights across the country. Local administrations and operators shared the costs of using the traffic lights for 5G deployments. This will help with more solution deployment in less time, thereby circulating 5G connectivity faster throughout the country.

- Various Indian multinational educational technology companies, such as Byju's, provide their students with a tablet as a part of their educational curriculum to educate the students via digital methods along with the traditional methods of teaching. Such initiatives by the companies in the market are expected to promote further the demand for tablets, smartphones, and other consumer electronics in the market, thereby driving the market for wireless connectivity chipsets for tablets in the region during the forecast period.

- The increasing demand for internet services in the Asia-Pacific region is also expected to promote the adoption of wireless connectivity chipsets in the region. As per the prime minister of India, the launch of 5G internet services in India is expected to bring new economic possibilities and societal benefits to the nation.

- In addition, China is leading 5G development on a worldwide scale. More than 2.54 million 5G base stations have been built nationwide, and more than 575 million people now own 5G smartphones. The country further plans to invest CNY 1.2 trillion (USD 174.2 billion) in 5G network construction by 2025. This growing demand for a 5G stable network is accelerating the deployment of small-cell solutions in the country.

- Due to the increasing availability and affordability of 5G smartphones and the rapid adoption of smartphones in metropolitan and rural areas, 5G subscriptions are expected to rapidly increase to reach approximately 50 million in the region by the end of 2023.

- In February 2023, Network operators M1 and StarHub in Singapore formed an alliance named Antina. They extended their contract with Nokia to improve indoor and outdoor 5G coverage nationwide. To provide a better 5G user experience with high bandwidth, breakneck speeds, and minimal latency, Nokia will install its small cell solution called airscale indoor radio (ASiR), covering new buildings with multiple input, multiple outputs (MIMO) adaptive antennas.

Wireless Connectivity Chipset Industry Overview

The wireless connectivity chipset market is fragmented, with many players like Broadcom Inc., Qualcomm Incorporated, Mediatek Inc., Intel Corporation, and Texas Instruments Incorporated. The companies are also increasing their market presence by introducing new products, expanding their operations, and entering strategic mergers, partnerships, and acquisitions.

- June 2023: Broadcom unveiled its second-generation Wi-Fi 7 chipsets: the BCM6765 residential Wi-Fi 7 access point chip, the BCM47722 enterprise Wi-Fi 7 access point chip with dual IoT radios that support operation for Bluetooth Low Energy (BLE), Zigbee, Thread, and Matter protocols, and the BCM4390 low-power Wi-Fi 7, Bluetooth, and 802.15.4 combo chip designed for use in mobile devices. BCM47722 enterprise Wi-Fi 7 access point SoC specifications allow wireless connectivity.

- April 2023: Texas Instruments unveiled its latest SimpleLink family, a line of Wi-Fi 6 companion integrated circuits (ICs). These ICs are designed to empower designers to create robust, secure, and efficient Wi-Fi connections, particularly for applications in high-density or high-temperature settings, reaching up to 105 °C. The initial offerings from TI's CC33xx family cater to both Wi-Fi 6 and Bluetooth Low Energy 5.3, all within a single IC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Connected Homes Through Home Automation

- 5.1.2 Increasing Internet Penetration into Homes and Enterprises

- 5.2 Market Challenges

- 5.2.1 Issues Related to Security and Privacy of Data and Connectivity of Devices and Interoperability

- 5.2.2 Slow Demand for Some Mobile Handset Types

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wi-Fi Standalone

- 6.1.2 Bluetooth Standalone

- 6.1.3 Wifi and Bluetooth Combo

- 6.1.4 Low-power Wireless IC

- 6.2 By End-user Application

- 6.2.1 Consumer

- 6.2.2 Enterprise

- 6.2.3 Mobile Handsets

- 6.2.4 Automotive

- 6.2.5 Industrial

- 6.2.6 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Qualcomm Incorporated

- 7.1.3 Mediatek Inc.

- 7.1.4 Intel Corporation

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 STMicroelectronics NV

- 7.1.7 NXP Semiconductors NV

- 7.1.8 On Semiconductor Corporation

- 7.1.9 Infineon Technologies AG

- 7.1.10 Microchip Technology Inc.

- 7.1.11 Qorvo Inc.

- 7.1.12 Skyworks Solutions Inc.

- 7.1.13 Hisilicon Technologies Co. Ltd

- 7.1.14 Tsinghua Unigroup Co. Ltd (unisoc (Shanghai) Technologies Co. Ltd