|

市場調查報告書

商品編碼

1692525

電池-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Battery Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

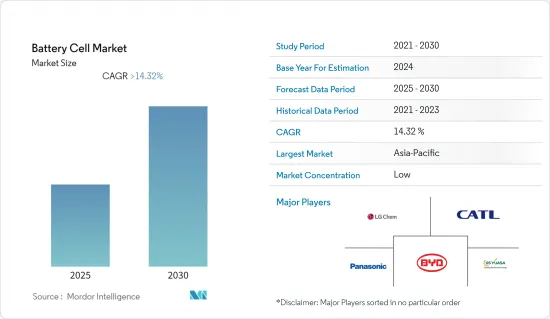

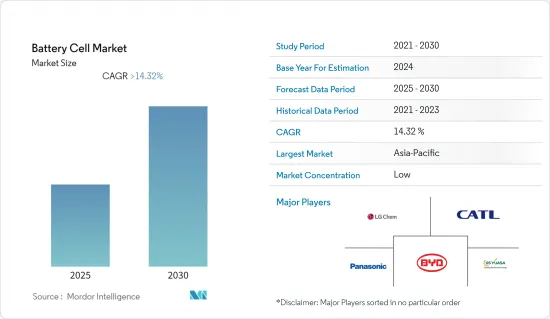

預計預測期內電池市場複合年成長率將超過 14.32%。

2020年,該國受到了新冠疫情的影響,但目前已恢復並達到疫情前的水平。預計預測期內電池需求的成長將推動市場成長。受鋰離子電池價格下跌的影響,電動車的快速普及也有望推動市場的成長。然而,缺乏直接獲取電池金屬的管道正在抑制市場的成長。隨著技術的進步,智慧型設備的價格預計將下降,使普通消費者能夠更負擔得起,這有望在預測期內提供成長機會。

亞太地區佔據市場主導地位,預計在預測期內將出現最高的複合年成長率。大部分需求來自中國和印度等國家。

電池市場趨勢

方形電池片預計將佔據市場主導地位

方形電池是 20 世紀 90 年代初引入電池行業的一種電池。現代方形電池滿足了對更薄尺寸的需求,並採用像口香糖盒或小巧克力棒一樣的精美包裝。矩形單元透過分層方法實現了空間的最佳利用。其他設計則被捲起並壓平成偽棱柱形果凍捲。這些電池主要用於行動電話、平板電腦和薄型筆記型電腦,容量從 800 mAh 到 4,000 mAh 不等。

方形電池尺寸較大,封裝在焊接鋁外殼中,容量從 20 到 50 Ah。它們主要用於能源儲存系統以及混合動力汽車和電動汽車的電動動力傳動系統。因此,方形電池的尺寸較大,不適合電動自行車和行動電話等小型設備。鋰方形電池是物料輸送設備 (MHE) 的首選技術。因此,這些電池類型更適合能源密集型應用。

這些電池類型因其大容量和棱柱形外形而廣受歡迎,可以輕鬆連接四個電池以創建 12V 電池組,從而提高空間利用率並實現設計靈活性。它具有最高的標稱容量(以 Ah 為單位)和能量(以 kWh 為單位),並且整體電池能量密度高於其他電池。這些電池單元不會受到膨脹的影響。與其他電池相比,這些優勢使其受到最終用戶的歡迎。然而,與圓柱形設計相比,它們的製造成本更高,溫度控管效率更低,循環壽命更短。

2022 年 1 月,韓國電池巨頭 LG Energy Solution 透露,計劃在其鋰離子電池產品線中增加方形電池類型。該公司表示,可能會在其產品組合中增加矩形格式,以擴大客戶群。該公司的本土競爭對手,如三星 SDI 和 SK On,正在向磷酸鐵鋰 (LFP) 方形電池過渡,目前這項舉措由中國 CATL主導,頂級電動車製造商特斯拉和大眾汽車是 2021 年最早採用方形電池的公司之一。

在大眾決定到2030年在其高達80%的電動車中使用方形電池後,韓國企業三星SDI和SK On也將注意力轉向了方形封裝。 2022年7月,大眾集團宣布將在德國薩爾茲吉特建立首座電池電芯工廠。該公司宣布將在高達80%的車型中採用棱鏡型統一電池。該工廠計劃於 2025 年開始生產,新電池工廠(暱稱 Salzgiga)的年生產能力將達到 40 GWh,足以滿足約 50 萬輛電動車的需求。

因此,由於上述因素,預計方形電池部分在預測期內將顯著成長。

亞太地區預計將經歷強勁成長

亞太地區是最大的消費性電子設備製造地和出口地,其中主要以中國為主,因為中國擁有較高的生產能力。預計該地區將在預測期內主導消費性電子製造業。因此,亞太電池市場預計將受益於家用電子電器領域的成長。

中國是世界領先的電池生產國和使用國之一,其電池用途廣泛。 2020年,中國生產了全球76%的鋰離子電池和44%的電動車。中國是電子產業的中心,2021 年,行動電話出口總額的近 48.4% 來自中國,這使得中國成為電池產業的重要市場參與企業。

韓國是圓柱形和方形電池的主要消費國,這些電池主要用於家用電子電器產品、家用電器和電動車電池。隨著近年來韓國半導體出口預計將放緩,電動車電池已成為未來幾年有望推動韓國經濟發展的新支柱。

2022年7月,GODI成為印度首家獲得印度標準局(BIS)認證的21,700個圓柱形NMC811 3.65V-4.5Ah鋰離子電池的公司。該公司計劃在 2024 年成立一座鋰離子電池製造廠。新認證的電池預計將滿足印度電動車和儲能系統產業的需求。因此,預計此類即將到來的投資將在預測期內推動印度電池市場的成長。

因此,由於上述因素,預計亞太地區在預測期內將顯著成長。

電池產業概況

全球電池市場呈現細分化趨勢。該市場的主要企業(不分先後順序)包括 LG 化學有限公司、寧德時代新能源科技股份有限公司、比亞迪股份有限公司、GS 湯淺株式會社和松下株式會社。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2027 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 按類型

- 棱鏡類型

- 圓柱形

- 小袋

- 按應用

- 汽車電池(HEV、PHEV、EV)

- 工業電池(動力、固定(電信、UPS、能源儲存系統(ESS) 等))

- 可攜式電池(家用電子電器產品等)

- 電動工具電池

- SLI 電池

- 其他

- 按地區

- 北美洲

- 亞太地區

- 歐洲

- 中東和非洲

- 南美洲

第6章競爭格局

- 併購、合作與合資

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc.

- EnerSys

- GS Yuasa Corporation

- Shenzhen ACE Battery Co. Ltd

- LG Energy Solution Ltd

- Panasonic Corporation

第7章 市場機會與未來趨勢

The Battery Cell Market is expected to register a CAGR of greater than 14.32% during the forecast period.

Although the market studied was affected by the COVID-19 pandemic in 2020, it recovered and reached pre-pandemic levels. The growing demand for battery cells is expected to boost the market's growth during the forecast period. The rapid adoption of electric vehicles, mainly fostered by the declining price of lithium-ion batteries, is also expected to drive the growth of the market studied. However, the lack of direct access to battery metals is restraining the market's growth. With technological advancements, the price of smart gadgets is expected to decline, making them more affordable to the public, which is expected to provide growth opportunities during the forecast period.

Asia-Pacific dominates the market and is expected to witness the highest CAGR during the forecast period. The majority of the demand comes from countries like China and India.

Battery Cell Market Trends

Prismatic Cell Segment is Expected to Dominate the Market

Prismatic cells are a type of battery cell in the battery industry that were introduced in the early 1990s. The modern prismatic cell fulfills the demand for thinner sizes and comes wrapped in elegant packages like a box of chewing gum or a small chocolate bar. The prismatic cells make optimal use of space by using the layered approach. Other designs are wound and flattened into a pseudo-prismatic jelly roll. These cells are mostly found in cell phones, tablets, and low-profile laptops ranging from 800 mAh to 4,000 mAh.

Prismatic cells are also available in large formats packaged in welded aluminum housings and deliver capacities of 20-50 Ah. These are primarily used in energy storage systems and for electric powertrains in hybrid and electric vehicles. Hence, the larger size of the prismatic cells makes them bad candidates for smaller devices like e-bikes and cellphones. Lithium prismatic cells are the preferred technology for material handling equipment (MHE), as the technology provides the best ratio of power and energy per volume unit. Therefore, these battery cell types are better suited for energy-intensive applications.

These battery cell types have gained popularity due to their large capacity and prismatic shape, making it easy to connect four cells and create a 12V battery pack, providing improved space utilization and allowing flexible design. It has the highest Ah nominal capacity and kWh energy and a higher overall battery energy density than other cells. These battery cells are not subject to swelling. Such advantages over other battery cell types make it preferable to the end users. However, it can be more expensive to manufacture, less efficient in thermal management, and have a shorter cycle life than the cylindrical design.

In January 2022, South Korean battery major LG Energy Solution Ltd planned to add a prismatic cell type to its lithium-ion battery lineup. The company revealed that it could add the prismatic form to its portfolio to broaden its customer base. The company's local competitors like Samsung SDI and SK On are moving onto prismatic cells with lithium-iron-phosphate (LFP), currently led by China's CATL, as top EV makers Tesla and Volkswagen adopted prismatic type earlier in 2021.

Korean players, both Samsung SDI and SK On, turned attention to rectangular packaging after Volkswagen decided that up to 80% of its electric vehicles would use prismatic batteries by 2030. In July 2022, Volkswagen Group announced the setup of its first battery cell factory in Salzgitter, Germany. It unveiled the prismatic unified cell would be used in up to 80% of its models. The plant is expected to start production by 2025, and the new cell plant, nicknamed SalzGiga, is expected to reach an annual capacity of 40 GWh, enough for about 500,000 electric vehicles.

Hence, due to the above-mentioned factors, the prismatic cell segment is expected to witness significant growth during the forecast period.

Asia Pacific is Expected to Witness Significant Growth

Asia-Pacific is the biggest manufacturer and exporter of consumer electronics, mainly dominated by China due to its large production capabilities. The region is expected to dominate the consumer electronics manufacturing sector during the forecast period. Hence, the Asia-Pacific battery market is expected to benefit from the growth of the consumer electronics sector.

China is one of the leading countries in the world that manufacture and utilizes batteries in a wide range of applications. In 2020, China manufactured 76% of the global lithium-ion battery and 44% of the global electric vehicles. The country is a hub of the electronic sector, i.e., nearly 48.4% of the total mobile phone export was from China in 2021, making China a significant market player in the battery cell industry.

South Korea is a major consumer of cylindrical and prismatic cells, primarily used in consumer electronics, household items, and electric vehicle batteries. Amid concerns about an anticipated slowdown in South Korean semiconductor exports in recent years, batteries for electric vehicles are emerging as a new pillar, which is expected to propel the country's economy in the coming years.

In July 2022, GODI became the first company in India to receive Bureau of Indian Standard (BIS) certification for its 21700 cylindrical NMC811 3.65V-4.5Ah lithium-ion cells. The company aims to set up a lithium-ion cell manufacturing factory by 2024. The newly certified cells are likely to cater to the needs of the EV and ESS sectors in India. Thus, such upcoming investments are expected to drive the battery cell market's growth in India during the forecast period.

Hence, due to the above-mentioned factors, the Asia-Pacific segment is expected to witness significant growth during the forecast period.

Battery Cell Industry Overview

The global battery cell market is fragmented. Some key players in this market (in no particular order) include LG Chem Ltd, Contemporary Amperex Technology Co. Limited, BYD Company Limited, GS Yuasa Corporation, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Prismatic

- 5.1.2 Cylindrical

- 5.1.3 Pouch

- 5.2 By Application

- 5.2.1 Automotive Batteries (HEV, PHEV, EV)

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics etc.)

- 5.2.4 Power Tools Batteries

- 5.2.5 SLI Batteries

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 Middle East and Africa

- 5.3.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Collaborations, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc.

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Shenzhen ACE Battery Co. Ltd

- 6.3.7 LG Energy Solution Ltd

- 6.3.8 Panasonic Corporation