|

市場調查報告書

商品編碼

1692519

全球半導體設備-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Semiconductor Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

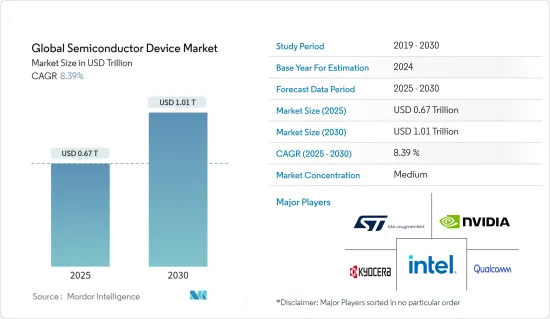

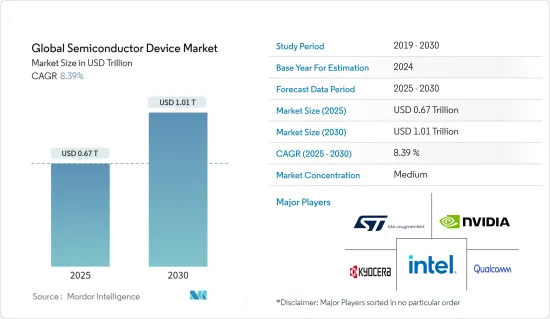

預計2025年全球半導體裝置市場規模為6,700億美元,到2030年將達到1,0100億美元,預測期內(2025-2030年)的複合年成長率為8.39%。

從出貨量來看,預計市場將從 2025 年的 8,800 億台成長到 2030 年的 1.23 兆台,預測期間(2025-2030 年)的複合年成長率為 7.02%。

半導體裝置通常透過稱為半導體製造或積體電路 (IC) 製造的複雜製程來製造。該過程涉及精確操縱半導體材料以創建具有特定電氣行為的組件。

半導體裝置是現代電子產品的支柱,為從智慧型手機和電腦到醫療設備和可再生能源系統等所有產品提供動力。半導體裝置的主要優點之一是體積小、結構緊湊。

與需要大型、笨重元件的舊真空管技術不同,半導體裝置可以製造成極小的尺寸。這種小型化促進了可攜式、穿戴式電子產品的發展,例如重量輕且易於攜帶的智慧型手機、健身追蹤器和智慧型手錶。

近年來,由於人工智慧和物聯網等尖端技術的日益普及,半導體裝置市場發生了重大轉變。這些先進技術為醫療、汽車等產業的革命性變革鋪平了道路,並為半導體裝置市場開闢了新的途徑。

數據消費的爆炸性成長是5G的主要市場驅動力之一。隨著連網型設備、智慧型手機和物聯網應用的激增,人們每天都會產生大量數據。 5G的高頻寬和容量將支援數據消費的激增,並為用戶實現無縫連接。

此外,半導體供應鏈是一個複雜的網路,由設計、製造、測試和分銷等相互關聯的階段組成。該過程從晶片設計開始,然後是晶圓製造、組裝和測試。最後,這些晶片被供應給目標商標產品製造商(OEM),用於各種電子設備。受遠端工作、電子商務和 5G 應用等趨勢的推動,電子產品需求激增,超出了半導體製造商的供給能力。需求的增加給整個供應鏈帶來壓力,導致供不應求。

COVID-19 疫情爆發的一個顯著後遺症是資料使用量的增加。此外,遠距工作環境的興起為增加資料產生帶來了新的機會。各種資料中心供應商都在不斷投資新的資料中心,以滿足對資料永不滿足的需求。據印度國家軟體和服務公司協會(NASSCOM)稱,到2025年,印度資料中心市場的投資預計將達到約46億美元。

半導體裝置市場趨勢

通訊業是最大的終端用戶

- 半導體在有線通訊中發揮著至關重要的作用,包括乙太網路控制器、適配器和交換器。這些半導體包括乙太網路供電 (PoE) 介面控制器和電力線收發器,對於支援網際網路協定語音 (VoIP) 至關重要。

- 在無線通訊,半導體用於微波、紅外線、衛星、廣播無線電和行動通訊系統,以及Wi-Fi、藍牙和Zigbee等技術。系統晶片(SoC) 和現場可程式閘陣列 (FPGA) 設備正在推動無線通訊系統,尤其是 5G 的發展。同時,低功耗微控制器(MCU)對於增強藍牙功能至關重要。無線感測器網路正在應用於從環境和結構監測到資產追蹤等各個領域。

- 隨著 5G 的加速推出,無線通訊半導體市場正在經歷重大轉型。根據GSMA預測,到2025年,5G行動連線預計將分別佔韓國和日本總連線數的73%和68%。此外,到2030年,海灣合作理事會國家95%的行動連線將為5G,而亞洲這一比例將達到93%。 5G智慧型手機和網路的日益普及將創造新的市場機會。

- 據 5Gamericas.org 稱,預計全球第五代 (5G) 用戶數量將在 2023 年達到 19 億,到 2028 年將躍升至 80 億。與前代技術相比,5G 技術擁有更快的下載速度和更低的延遲。

中國正在經歷快速成長

- 多年來,中國半導體產業迅速擴張,成為全球最大的晶片消費國之一。中國旨在透過發展強大的國內供應鏈來減少對半導體元件進口的依賴。

- 例如,2024年5月,中國啟動了政府支持的投資基金第三期,以擴大國內半導體產業。此舉凸顯了中國在美國制裁下實現自給自足的決心。

- 該基金註冊資本為3,440億元人民幣(475億美元)。中國積體電路產業投資基金為中國兩大晶片代工廠-中芯國際和華虹半導體以及少數幾家規模較小的公司提供融資。

- 其他因素包括消費性電子產業的快速成長、政府努力推動國內製造業並減少對外國技術的依賴(這導致對半導體生產能力的投資增加)、人工智慧和物聯網等新興技術的興起以及對電動車的需求不斷增加。

- 中國蓬勃發展的通訊業也是市場的主要動力。例如,根據中國國家統計局的數據,截至2023年3月,中國通訊業累積收入約為人民幣1,510億元(207.9億美元)。當月與前一年同期比較成長率約為4.8%。

半導體裝置產業概況

半導體裝置市場處於半靜態狀態。它隨著一體化程度的提高、技術進步和地緣政治情勢的變化而波動。除了代工廠和IDM之間的垂直整合不斷加強之外,市場競爭也在加劇。參與企業包括英特爾公司、英偉達公司、京瓷公司、高通公司和意法半導體公司。

2024 年 3 月—亞馬遜網路服務和 Nvidia 宣布擴大合作,以推動 Gen AI 創新。為了幫助客戶釋放先進的生成人工智慧的力量,Blackwell 將提供 NVIDIA GB200 Grace Blackwell 超級晶片和 B100 Tensor Core GPU,擴大兩家公司長期的策略合作,以提供最安全、最先進的基礎設施、軟體和服務。

2024 年 2 月-英特爾公司宣布推出英特爾代工廠,這是一個針對 AI 時代的永續系統代工廠。該公司還公佈了其擴張進程的藍圖,以鞏固其在 21 世紀 20 年代的領導地位。該公司強調了強大的客戶倡導和生態系統支持,其主要合作夥伴包括新思科技、Cadence、西門子和 Ansys,旨在透過先進的工具和設計流程加速英特爾代工客戶的晶片設計。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 科技趨勢

- 產業價值鏈/供應鏈分析

- 新冠疫情及其他宏觀經濟因素對市場的影響

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 物聯網和人工智慧等技術的採用日益增多

- 5G的普及和5G智慧型手機需求的成長

- 市場問題

- 供應鏈中斷導致半導體晶片短缺

第6章市場區隔

- 依設備類型

- 離散半導體

- 光電子

- 感應器

- 積體電路

- 模擬

- 邏輯

- 記憶

- 微

- 微處理器(MPU)

- 微控制器(MCU)

- 數位訊號處理器

- 按行業

- 汽車

- 通訊(有線和無線)

- 消費者

- 工業的

- 計算/數據存儲

- 政府(航太和國防)

- 按地區

- 美國

- 歐洲

- 日本

- 中國

- 韓國

- 台灣

- 其他

第7章 半導體代工展望

- 鑄造業務銷售額及鑄件製造商市場佔有率

- 半導體收入 – IDM 與 Fabless

- 截至 2021 年 12 月底各晶圓廠產能

- 五大半導體公司晶圓產能及各節點產能趨勢

第8章競爭格局

- 公司簡介

- Intel Corporation

- Nvidia Corporation

- Kyocera Corporation

- Qualcomm Incorporated

- STMicroelectronics NV

- Micron Technology Inc.

- Advanced Micro Devices Inc.

- NXP Semiconductors NV

- Toshiba Corporation

- Texas Instruments Inc

- Analog Devices Inc.

- SK Hynix Inc.

- Samsung Electronics Co. Ltd

- Fujitsu Semiconductor Ltd

- Rohm Co. Ltd

- Infineon Technologies AG

- Renesas Electronics Corporation

- Wolfspeed Inc.

- Broadcom Inc.

- ON Semiconductor Corporation

第9章:未來市場展望

The Global Semiconductor Device Market size is estimated at USD 0.67 trillion in 2025, and is expected to reach USD 1.01 trillion by 2030, at a CAGR of 8.39% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 0.88 trillion units in 2025 to 1.23 trillion units by 2030, at a CAGR of 7.02% during the forecast period (2025-2030).

Semiconductor devices are typically manufactured through a complex process called semiconductor fabrication or integrated circuit (IC) manufacturing. This process involves precise manipulation of the semiconductor material to create components with specific electrical behavior.

Semiconductor devices are the backbone of modern electronics, powering everything from smartphones & computers to medical devices and renewable energy systems. One of the primary advantages of semiconductor devices is their small size and compactness.

Unlike older vacuum tube technology, which requires large and bulky components, semiconductor devices can be manufactured in extremely small sizes. This miniaturization has allowed for the development of portable and wearable electronics that are lightweight and easy to carry, such as smartphones, fitness trackers, and smartwatches.

The semiconductor devices market has witnessed a significant transformation in recent years due to the increasing adoption of advanced technologies like AI and IoT. These advanced technologies have paved the way for revolutionary changes in various industries, ranging from healthcare to automotive, and have opened up new avenues for the semiconductor devices market.

The explosive growth of data consumption is one of the primary market drivers of 5G. With the proliferation of connected devices, smartphones, and IoT applications, people generate an enormous amount of data daily. 5G's higher bandwidth and capacity will support this surge in data consumption, enabling seamless connectivity for users.

Moreover, the semiconductor supply chain is a complex network of interconnected stages involving design, manufacturing, testing, and distribution. The process begins with chip design, followed by wafer fabrication, assembly, and testing. Finally, the chips are distributed to original equipment manufacturers (OEMs) who use them in various electronic devices. The surge in demand for electronic devices, driven by trends like remote working, e-commerce, and 5G adoption, has outpaced the supply capacity of semiconductor manufacturers. This increased demand has strained the entire supply chain, leading to shortages.

One of the significant aftereffects of the outbreak of COVID-19 is the increased usage of data. Moreover, it presented new opportunities for growing data generation due to increased remote working environments; various data center vendors consistently invest in new data centers in line with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is anticipated to reach approximately USD 4.6 billion in 2025.

Semiconductor Device Market Trends

Communication Industry to be the Largest End User

- Semiconductors play a pivotal role in wired communications, encompassing ethernet controllers, adapters, and switches. They feature Power over Ethernet (PoE) interface controllers, crucial for supporting Voice over Internet Protocol (VoIP), alongside powerline transceivers.

- In wireless communication, semiconductors are used in microwave, infrared, satellite, broadcast radio, mobile communications systems, Wi-Fi, and technologies such as Bluetooth and Zigbee. System-on-chip (SoC) and field-programmable gate array (FPGA) devices drive the evolution of wireless communication systems, notably 5G. Meanwhile, low-energy microcontrollers (MCUs) are pivotal in enhancing Bluetooth functionalities. Wireless sensor networks find applications in diverse fields, from environmental and structural monitoring to asset tracking.

- The market for semiconductors that power wireless communication is undergoing significant change with the increasing implementation of 5G. According to the GSMA, in 2025, the share of 5G mobile connections of total connections in South Korea and Japan are anticipated to account for 73% and 68%, respectively. Further, 95% of mobile connections will be 5G by 2030 in GCC states and 93% in Asia. The increasing adoption of 5G smartphones and networks creates new market opportunities.

- According to 5Gamericas.org, in 2023, the global count of fifth-generation (5G) subscriptions hit an estimated 1.9 billion, projected to soar to 8 billion by 2028. Compared to its predecessors, 5G technology boasts faster download speeds and significantly lower latency.

China to Witness Significant Growth

- Over the years, China's semiconductor industry has rapidly expanded and become one of the largest consumers of chips in the world. China aims to reduce its dependence on imported semiconductor components by developing a robust domestic supply chain.

- For instance, in May 2024, China established the third phase of a government-supported investment fund to expand its domestic semiconductor industry, which is the most significant phase to date. This move highlights China's determination to achieve self-sufficiency in light of US sanctions.

- The fund has a total registered capital of CNY 344 billion (USD 47.5 billion). The China Integrated Circuit Industry Investment Fund offers funding to the country's top two chip foundries, Semiconductor Manufacturing International Corporation and Hua Hong Semiconductor, and a few smaller companies.

- Moreover, the rapid growth of the consumer electronics industry, the government's efforts to promote domestic manufacturing and reduce reliance on foreign technology, which have led to increased investment in semiconductor production facilities, the rise of emerging technologies, such as artificial intelligence and internet of things, and the increasing demand for electric vehicles.

- The robust telecom industry in China is also a significant market driver. For instance, according to the National Bureau of Statistics of China, in March 2023, China generated a cumulative revenue of about CNY 151 billion (20.79 USD Billion) from its telecommunications industry. It had a year-on-year growth rate of approximately 4.8% that month.

Semiconductor Device Industry Overview

The semiconductor device market is semi-consolidated. It fluctuates with growing consolidation, technological advancement, and geopolitical scenarios. In addition to this increasing vertical integration of Foundries and IDMs, intense competition in the market studied is expected to rise, considering their ability to invest, which results from their revenues. Some players include Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Incorporated, and STMicroelectronics NV.

March 2024 - Amazon Web Services and Nvidia announced the extension of their collaboration to advance Gen AI innovation. To help customers unlock advanced generative artificial intelligence capabilities, Blackwell will offer the NVIDIA GB200 Grace Blackwell super chip and B100 Tensor core GPUs, which will extend the long-standing strategic collaboration between the two companies to deliver the most secure and advanced infrastructure, software, and services.

February 2024 - Intel Corporation unveiled Intel Foundry, a sustainable systems foundry tailored for the AI era. They also revealed an extended process roadmap to solidify their leadership well into the 2020s. The company emphasized strong customer backing and ecosystem support, with key partners like Synopsys, Cadence, Siemens, and Ansys, all geared to expedite chip design for Intel Foundry's clientele through advanced tools and design flows.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Technologies like IoT and AI

- 5.1.2 Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processors

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Communication (Wired and Wireless)

- 6.2.3 Consumer

- 6.2.4 Industrial

- 6.2.5 Computing/Data Storage

- 6.2.6 Government (Aerospace and Defense)

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Korea

- 6.3.6 Taiwan

- 6.3.7 Rest of the World

7 SEMICONDUCTOR FOUNDRY LANDSCAPE

- 7.1 Foundry Business Revenue and Market Shares by Foundries

- 7.2 Semiconductor Sales - IDM vs Fabless

- 7.3 Wafer Capacity By End of December 2021 Based on Fab Location

- 7.4 Wafer Capacity By Top 5 Semiconductor Companies and an Indication of Wafer Capacity by Node Technology

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intel Corporation

- 8.1.2 Nvidia Corporation

- 8.1.3 Kyocera Corporation

- 8.1.4 Qualcomm Incorporated

- 8.1.5 STMicroelectronics NV

- 8.1.6 Micron Technology Inc.

- 8.1.7 Advanced Micro Devices Inc.

- 8.1.8 NXP Semiconductors NV

- 8.1.9 Toshiba Corporation

- 8.1.10 Texas Instruments Inc

- 8.1.11 Analog Devices Inc.

- 8.1.12 SK Hynix Inc.

- 8.1.13 Samsung Electronics Co. Ltd

- 8.1.14 Fujitsu Semiconductor Ltd

- 8.1.15 Rohm Co. Ltd

- 8.1.16 Infineon Technologies AG

- 8.1.17 Renesas Electronics Corporation

- 8.1.18 Wolfspeed Inc.

- 8.1.19 Broadcom Inc.

- 8.1.20 ON Semiconductor Corporation