|

市場調查報告書

商品編碼

1692498

菲律賓資料中心市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Philippines Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

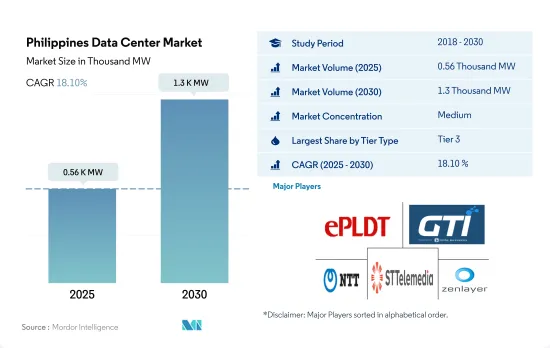

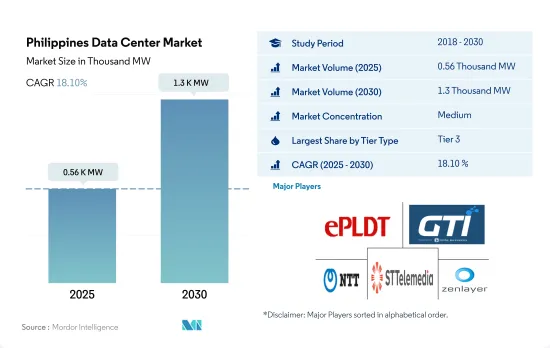

菲律賓資料中心市場規模預計在 2025 年達到 560kW,預計 2030 年達到 1,300kW,複合年成長率為 18.10%。

預計主機託管收益將在 2025 年達到 3.92 億美元,到 2030 年達到 11.62 億美元,預測期內(2025-2030 年)的複合年成長率為 24.27%。

到 2023 年,Tier 3 資料中心將佔據大部分佔有率,而 Tier 4 資料中心在整個預測期內將實現最快的成長。

- 由於設施不可靠且停機時間較長,一級市場的成長預計仍將保持低迷。 Tier 2 細分市場的 IT 負載容量預計將從 2021 年的 125.6 MW 成長到 2029 年的 172.6 MW,複合年成長率為 4.33%。這些資料中心因其以實惠的價格提供的性能而最受中小型企業的青睞。然而,由於每年有 22 小時的停機時間,企業可能不願意並且猶豫是否選擇資料中心。

- 菲律賓資料中心市場 Tier 3 部分的 IT 負載容量預計將從 2021 年的 78.3MW 成長到 2029 年的 489.3MW,複合年成長率為 25.75%。這些資料中心提供 99.98% 的執行時間,具有 N+1 冗餘,每年僅停機 1.6 小時。這些優勢使其備受大型企業的青睞。

- 目前,該地區的 Tier 3 資料中心非常普遍,一些設施已將其結構和服務升級到所需的標準。企業更希望新建的設施符合 Tier 3 或 Tier 4 標準。

- 菲律賓資料中心市場 Tier 4 部分的 IT 負載容量預計到 2029 年將達到 70MW。這些資料中心預計將於 2023 年開始運作,因其高可靠性和約 26.3 分鐘的低停機時間而受到青睞。菲律賓目前沒有經過 Tier 4 認證的主機託管設施。然而,ePLDT 宣布其位於聖羅莎的第 11 個資料中心將達到 Tier 4 級別,並將於 2023 年運作。

- 新的資料中心營運商更喜歡為其基礎設施配備 Tier 4 級認證,因為它具有很高的可靠性。

菲律賓資料中心市場趨勢

菲律賓消費者每天花在智慧型手機的時間達 10 小時,每天傳輸大量資料。

- 2022年菲律賓智慧型手機用戶數將達到約1.01億,預計2029年將達到1.81億,複合年成長率為8.79%。

- 疫情過後,智慧型手機的需求顯著成長,因為它們在瀏覽網頁、金融交易、網路購物等方面非常方便。人們正在適應城市生活方式,並使用這些設備實現家庭自動化功能、線上遊戲、串流內容、瀏覽新聞、網路購物等。能夠立即完成幾乎任何事情的便利性增加了用戶數量,預計隨著人口的成長,用戶數量還會增加。

- 菲律賓是世界上唯一用戶平均每天花在手機上10小時的國家。隨著通訊網路的發展和設施的改善,用戶能夠在智慧型手機上實現良好的行動資料通訊速度,從而提高功能和體驗。手機網路遊戲品質的提升、網路遊戲舉辦的活動等也進一步拉動了智慧型手機的需求。現在,配備更強大處理器、更好顯示器和電池的行動電話可以以廉價的價格購買。 74% 的用戶更喜歡手機遊戲而不是 PC 或主機遊戲。

DITO、Globe 和 Smart 等行動通訊業者的 5G 網路擴展將推動資料中心市場

- 菲律賓消費者目前擁有很大比例的4G和3G服務。 5G 網路服務預計將於 2021 年底推出,客戶將於 2022 年第一季開始採用。

- 菲律賓提供5G服務的設施包括DITO、Globe和Smart。這些公司正在擴大其業務範圍以加強其網路連接。

- 例如,Smart已計劃在2022年將5G變電站的數量增加到7,300個,以加強其5G網路。

菲律賓資料中心產業概況

菲律賓資料中心市場適度整合,前五大公司佔據54.17%的市場。該市場的主要企業有:ePLDT Inc.、GTI Corporation、NTT Ltd、STT GDC Pte Ltd 和 Zenlayer Inc.(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝的機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的數據流量

- 行動數據速度

- 寬頻數據速度

- 光纖連接網路

- 法律規範

- 菲律賓

- 價值鍊和通路分析

第6章市場區隔

- 熱點

- NCR(馬尼拉大都會)

- 其他地區

- 資料中心規模

- 大規模

- 大規模

- 中等規模

- 百萬

- 小規模

- 等級類型

- 1級和2級

- 第 3 層

- 第 4 層

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他最終用戶

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- Bitstop

- Dataone

- ePLDT Inc.

- GTI Corporation

- NTT Ltd

- Space DC Pte Ltd

- STT GDC Pte Ltd

- VSTECS Phils Inc.

- Zenlayer Inc.

- LIST OF COMPANIES STUDIED

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 數據包

- 詞彙表

The Philippines Data Center Market size is estimated at 0.56 thousand MW in 2025, and is expected to reach 1.3 thousand MW by 2030, growing at a CAGR of 18.10%. Further, the market is expected to generate colocation revenue of USD 392 Million in 2025 and is projected to reach USD 1,162 Million by 2030, growing at a CAGR of 24.27% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, Tier 4 is fastest growing through out the forecasted period

- Growth in the tier 1 segment is expected to be stagnant due to the unreliability and longer downtimes of facilities. The IT load capacity of the tier 2 segment is expected to increase from 125.6 MW in 2021 to 172.6 MW by 2029 at a CAGR of 4.33%. These data centers are preferred mainly by small businesses due to the performance they offer at an affordable cost. However, a downtime of 22 hours annually, at times, makes companies reluctant and hesitant to opt for them.

- The IT load capacity of the tier 3 segment of the data center market in the Philippines is anticipated to increase from 78.3 MW in 2021 to 489.3 MW by 2029 at a CAGR of 25.75%. These data centers offer an uptime of 99.98% with N+1 redundancies, and they only have around 1.6 hours of downtime in a year. These advantages have made them highly preferable by large businesses.

- Currently, tier 3 data centers are highly prevalent in the region, as some facilities have upgraded their structures and services to the required standards. Operators prefer newly constructed facilities to be tier 3 and tier 4 ready.

- The IT load capacity of the tier 4 segment of the data center market in the Philippines is expected to reach 70 MW by 2029. These data centers are expected to be operational in 2023 and are preferred due to their high reliability and lower downtime of around 26.3 minutes. Currently, the Philippines has no colocation facility with Tier 4 certification. However, ePLDT announced that its 11th data center in Santa Rosa would be tier 4 and would be launched by 2023.

- Operators of new data centers prefer Tier 4 grade certifications for their infrastructure facilities due to the high reliability offered.

Philippines Data Center Market Trends

Philippines consumers spends 10hr/day on smartphone, generating huge amount of data transfer daily, this would drive data center market

- The Philippines had around 101 million smartphone users in 2022, which is expected to reach 181 million by 2029 at a CAGR of 8.79%.

- Post-pandemic, the demand for smartphones has significantly increased as they turned out to be useful for browsing, financial transactions, online shopping, and others. People are adopting urban lifestyles and use these gadgets for automation functions in their homes, online gaming, streaming content, browsing news, and online shopping. The convenience of doing almost everything instantly has increased the number of users and is expected to increase with the increasing population.

- The Philippines is the only country in the world where users, on average, spend an average of 10 hours a day on the phone. As the telecom network developed and improved its facilities, users could attain good mobile data speeds on their smartphones which increased their functionality and experience. Online games on mobile have improved their quality, and the events organized by them have furthermore increased the demand for smartphones. As phones with higher processors, better displays, and batteries are available at a budget price. 74% of the users prefer mobile gaming over PC and console gaming.

Expansion of 5G network by mobile operators such as DITO, Globe, and Smart boost the data center market

- Consumers in the Philippines currently use 4G and 3G services in greater proportion. 5G network services were launched at the end of 2021 and were increasingly adopted by customers in the first quarter of 2022.

- Facilities offering 5G services in the Philippines are DITO, Globe, and Smart. These companies are expanding their bases to strengthen their network connectivity.

- For instance, Smart increased the count of its 5G substations to 7300 in 2022 to strengthen its 5G networks.

Philippines Data Center Industry Overview

The Philippines Data Center Market is moderately consolidated, with the top five companies occupying 54.17%. The major players in this market are ePLDT Inc., GTI Corporation, NTT Ltd, STT GDC Pte Ltd and Zenlayer Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Philippines

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 NCR (Metro Manila)

- 6.1.2 Rest of Philippines

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Bitstop

- 7.3.2 Dataone

- 7.3.3 ePLDT Inc.

- 7.3.4 GTI Corporation

- 7.3.5 NTT Ltd

- 7.3.6 Space DC Pte Ltd

- 7.3.7 STT GDC Pte Ltd

- 7.3.8 VSTECS Phils Inc.

- 7.3.9 Zenlayer Inc.

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms