|

市場調查報告書

商品編碼

1692492

印度電子商務物流 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

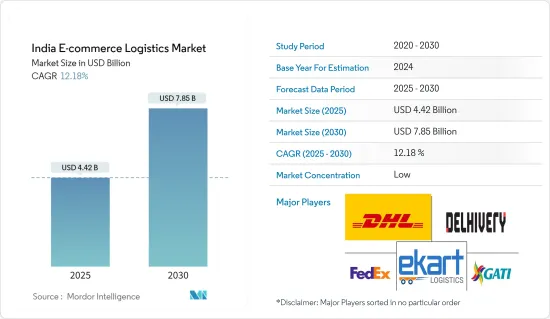

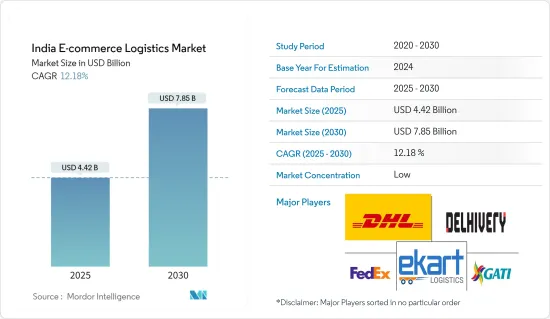

印度電子商務物流市場規模預計在 2025 年為 44.2 億美元,預計到 2030 年將達到 78.5 億美元,預測期內(2025-2030 年)的複合年成長率為 12.18%。

在第一波新冠疫情期間,許多零售商由於收益立即受到打擊而關閉了商店。但慢慢地我開始適應了。據印度政府出口促進機構印度品牌資產基金會稱,到2024年,線上零售滲透率預計將達到10.7%,而2019年為4.7%。隨著送貨上門需求的增加,零售商正在與物流公司合作,為訂單配送提供便利,為企業和零售商提供便利。

據印度非政府行業協會和倡導組織印度工商聯合會(FICCI)稱,預計印度零售市場將以每年10%的速度成長,到2026年達到1.6兆美元。印度零售市場佔國內生產總值)的10%,約佔就業人數的8%。印度是全球第五大零售目的地,吸引了許多新參與者。未來五年,網路商店預計將呈指數級成長,並與實體店相提並論。

由於線上零售商高度依賴第三方物流服務供應商,預計這將對印度的電子商務物流行業產生積極影響。

印度電商物流市場趨勢

電子商務銷售成長推動市場擴張

印度的電子商務市場正在大幅成長,印度品牌資產基金會預測,到2034年,印度將超過美國,成為全球第二大電子商務市場。預計到2027年,印度的電子商務市場規模將達到1,970億美元,高於2023年的1,027.5億美元。

該電子商務業務幫助商家在全球範圍內銷售,並透過行銷工具擴展業務,幫助他們在 Facebook 和 Google 上建立、執行和分析宣傳活動。商家可以從單一儀表板管理訂單、交付和付款,從而獲得極大的靈活性。透過當日配送流程和靈活的選擇,電子商務商店的消費者體驗得到了明顯改善。這些效率正在推動電子商務銷售的當前成長,並且可能持續成長。

隨著網際網路和智慧型手機用戶數量的預期成長,越來越多的公司進入電子商務行業。線上零售商與第三方物流 (3PL) 供應商合作管理庫存、包裝、交付、倉儲和追蹤等運輸問題。這直接促進了物流業的收益。

印度網路使用者數量不斷增加

Statista 預測,到 2027 年,網路用戶數量將達到 1,232,330,000。預計都市區和農村地區的網路使用者數量都將增加,這表明網路存取將呈現動態成長。根據印度網際網路和行動協會(IAMAI)的報告,印度是僅次於中國的全球第二大網路市場。由於行動連線的增強、女性購買行為的增加以及農村地區的廣泛採用,用戶數量正在逐漸增加。

根據印度品牌股權基金會的數據,「數位印度」計畫將協助印度網路使用者數量在2023年達到6.92億。在所有網路連線中,55%位於都市區,97%為無線網路。預計到2030年印度智慧型手機用戶數將達到8.874億,且數量將持續增加。印度是全球數據消費量最高的國家,每人每月消耗 14.1GB。

印度電商物流業概況

印度電商物流市場競爭格局分散。隨著全部區域對物流和服務的需求迅速成長,企業正在加強競爭力,以利用巨大的機會。印度政府的支持性政策允許 B2B 電子商務領域 100% 的外國直接投資,近年來數位素養的提高吸引了新的國際公司在印度開設商店。因此,國際物流公司正在透過建立區域物流網路進行策略性投資,包括開設新的配送中心和智慧倉庫。代表公司包括聯邦快遞公司、DHL、Aramex等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 產業技術趨勢

- 政府措施和法規

- 電子商務洞察

- 價值鏈/供應鏈分析

- 需求和供應分析

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 網路和智慧型手機的普及率不斷提高

- 都市化和生活方式的改變

- 政府舉措

- 市場限制

- 基礎設施薄弱,最後一英里交付

- 機會

- 投資物流基礎設施

- 跨境電子商務與逆向物流

- 與電子商務公司合作

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章市場區隔

- 按服務

- 運輸

- 倉庫和庫存管理

- 附加價值服務(標籤、包裝)

- 按業務

- B2B

- B2C

- 目的地

- 國內的

- 國際/跨境

- 按產品

- 服裝與時尚

- 家電

- 家電

- 家具

- 美容和個人保健產品

- 其他產品(玩具、食品等)

第7章競爭格局

- 市場集中度概覽

- 公司簡介

- FedEx Corporation

- Delhivery Pvt. Ltd

- Ekart Logistics

- Blue Dart Express Ltd

- Shadowfax

- Xpress Bees

- DTDC

- Ecom Express Logistics

- Gati-Kintetsu Express Private Limited

- DHL

- Mahindra Logistics Ltd*

- 其他公司

第8章:市場的未來

第9章 附錄

- 宏觀經濟指標(按活動分類的 GDP 分佈、運輸和倉儲業對經濟的貢獻)

- 資本流動洞察(運輸和倉儲領域的投資)

- 電子商務與消費者支出統計

- 對外貿易統計 - 出口和進口,按產品、目的地/原產國

The India E-commerce Logistics Market size is estimated at USD 4.42 billion in 2025, and is expected to reach USD 7.85 billion by 2030, at a CAGR of 12.18% during the forecast period (2025-2030).

During the first wave of COVID-19, many retailers shut down their stores as their revenue was hit instantly. However, it started to adapt gradually. As per the India Brand Equity Foundation, an Indian government export promotion agency, online penetration of retail is expected to reach 10.7% by 2024 compared to 4.7% in 2019, due to which many retailers started working on click-and-collect services and started partnering with logistics companies to keep their business moving forward. As the demand for door deliveries has increased, retailers are facilitating order deliveries with logistics companies to comfort companies and retailers.

India's retail market is expected to witness an annual growth rate of 10% with USD 1.6 trillion by 2026, as per the Federation of Indian Chambers of Commerce & Industry (FICCI), a non-governmental trade association and advocacy group based in India. The Indian retail market accounts for 10% of the country's gross domestic product (GDP) and around 8% of employment. India is the world's fifth-largest global destination in retail, leading to several new players' entries. In the next five years, online stores are expected to grow drastically and become equal to physical stores.

Since online retailers depend more on 3PL service providers, it is expected to influence the Indian e-commerce logistics sector positively.

India E-commerce Logistics Market Trends

The Growth of E-commerce Sales is Driving the Expansion of the Market

The Indian e-commerce market is growing predominantly and is expected to surpass the United States to become the second-largest e-commerce market in the world by 2034, as per the India Brand Equity Foundation. The Indian e-commerce market is expected to reach USD 197 billion by 2027 from USD 102.75 billion in 2023.

The e-commerce business helps the sellers sell globally and market the business using marketing tools that help create, execute, and analyze campaigns on Facebook and Google. The sellers can use a single dashboard to manage orders, shipping, and payments, which is highly flexible. The improvement of consumer experiences in e-commerce stores is evident through the same-day delivery process and flexible options. Due to these efficiencies, there is continuous growth in e-commerce sales across the existing and upcoming years.

The number of players entering the e-commerce industry is gradually increasing due to the expectation of increased penetration on the internet and smartphone users. Online retailers are partnering with third-party logistics (3PL) providers to manage issues related to delivery, such as inventory, packaging, shipping, warehousing, and tracking. This is directly contributing to the revenue of the logistics industry.

The Number of Internet Users in India is Increasing

Statista expects the number of internet users to reach 1,232.33 million by 2027. It is estimated to increase in urban and rural regions, indicating dynamic growth in access to the Internet. India is the second largest online market globally, ranking only behind China, according to a report by the Internet and Mobile Association of India (IAMAI). Due to the increase in mobile connectivity, growth in the purchasing behavior of women, and penetration in rural areas, the number of users has increased gradually.

The Digital India program drove the number of internet users to 692 million in 2023, per the India Brand Equity Foundation data. Of the total internet connections, 55% were in urban areas, 97% were wireless. The number of smartphone users in India is expected to reach 887.4 million by 2030, which shows an increase in users. India has the highest data consumption rate worldwide, at 14.1 GB of data per person a month.

India E-commerce Logistics Industry Overview

The competitive landscape of the Indian e-commerce logistics market is fragmented; as the demand for logistics services is growing rapidly across the region, companies are becoming more competitive to capture the huge opportunity. Policy support from the Indian government has allowed 100% FDI in B2B e-commerce, and the recent rise in digital literacy has led to new international players setting up their bases in India. This has, in turn, led the international logistics players to make strategic investments by establishing a regional logistics network, such as opening new distribution centers and smart warehouses. Some of the leading players include FedEx Corporation, DHL, and Aramex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends in the Industry

- 4.3 Government Initiatives and Regulations

- 4.4 Insights into the E-commerce

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Demand and Supply Analysis

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Internet and Smart Phone Penetration

- 5.1.2 Urbanization and Lifestyle Changes

- 5.1.3 Government Initiatives

- 5.2 Market Restraints

- 5.2.1 Poor Infrastructure and Last Mile Delivery

- 5.3 Opportunities

- 5.3.1 Investments in the Logistic Infrastructure

- 5.3.2 Cross-Border E-commerce and Reverse Logistics

- 5.3.3 Collaborations with E-commerce Companies

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services (Labeling, Packaging )

- 6.2 By Business

- 6.2.1 By B2B

- 6.2.2 By B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross Border

- 6.4 By Product

- 6.4.1 Fashion and Appareal

- 6.4.2 Consumer Electronics

- 6.4.3 Home Appliances

- 6.4.4 Furniture

- 6.4.5 Beauty and Personal Care Products

- 6.4.6 Other Products (Toys, Food Products, Etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 FedEx Corporation

- 7.2.2 Delhivery Pvt. Ltd

- 7.2.3 Ekart Logistics

- 7.2.4 Blue Dart Express Ltd

- 7.2.5 Shadowfax

- 7.2.6 Xpress Bees

- 7.2.7 DTDC

- 7.2.8 Ecom Express Logistics

- 7.2.9 Gati-Kintetsu Express Private Limited

- 7.2.10 DHL

- 7.2.11 Mahindra Logistics Ltd *

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport and Storage Sector to Economy)?

- 9.2 Insights on Capital Flows (Investments in the Transport and Storage Sector)

- 9.3 E-commerce and Consumer Spending-related Statistics

- 9.4 External Trade Statistics - Exports and Imports, by Product and by Country of Destination/Origin